Which is the best critical illness policy in India?

Do you know that, as per Indian health statistics, every year 3 % of the population go below the poverty line due to the heavy spending on illnesses?

It means, because of large financial outgo for treatments, every year 3% of the population, drop down to one level below their present class i.e. high-class people become middle and middle transforms to lower class. So, Imagine how badly our financial life may get affected if we do not have a proper source of funding at the time of facing non-curable diseases.

The probability of getting affected by life-threatening diseases are getting higher day by day.

As per the growing modern trend in our society, our lifestyle has changed in a bit good way but a lot in a bad way (eating junk/overeating & drinking). There is a rapid rise in obesity in India, which leads to diabetes, stroke and many heart diseases.

As per the statistics on Indian health –

-

- Diabetes currently affects more than 62 million Indians, and India is projected to be home to 109 million individuals with diabetes by 2035.

- About 1.7 million Indian’s deaths caused by heart diseases every year, according to WHO.

- The incidence of cancer in India was 70-90 per 100000 population in the year 2014 which increased to 106.6 new cancer cases in 2016 per 100,000 people.

Along with bad lifestyle, pollution is also affecting our health. 7% of death in India is due to respiratory diseases. Before any of this life-threatening disease happens to us. We should be prepared financially so that we can utilize our energy fully on the treatment and not on the financial burden of that time. So, to meet those uncertain financial needs, having a critical illness policy cover will be the best resort.

If you are in a hurry so just watch the video below to get a brief idea.

What is critical illness cover?

Critical Illness insurance is an insurance product in which the insurer (insurance company) is promising to make a lump sum cash payment if the policyholder is diagnosed with one of the specific life-threatening illnesses on a predetermined list as part of an insurance policy. The policy may also be structured to pay out regular income and the payout may also be on the policyholder undergoing a surgical procedure, for example, having a heart bypass operation, etc.

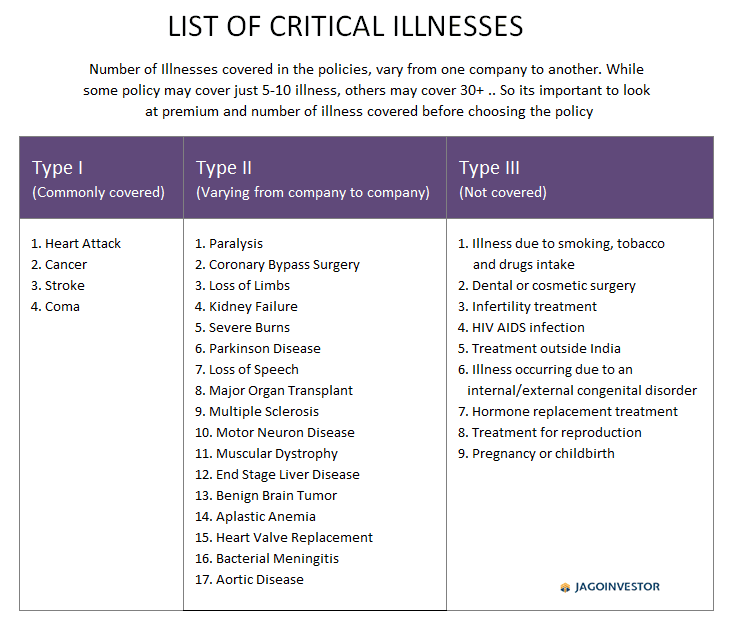

Every critical illness policy specifies the illnesses covered and not covered. The major illnesses like heart attack, cancer, stroke, and coma are commonly covered by all the critical illness policies. As the probability of occurring these is high and the payment on these illnesses (cancer or coma) are not one time task, it might be the life time operational costs. And the cover for other critical illnesses varies from company to company.

Below given table highlights the commonly covered illnesses with varying and uncovered illnesses.

There are some illnesses that are not covered by any critical illness policy, so make sure that you are not buying a critical illness specifically for getting covered from the following illnesses, as these are not going to be covered by any critical illness policy. Before buying any critical illness cover from any insurance company one should carefully read the policy terms and conditions to see which all illnesses are covered under a particular policy.

Benefits of Critical Illness Cover –

- Financial security for your loved ones– Critical Illness cover not only pays for protecting your life but makes your family feel secure financially.

- More than 30 Illnesses are covered -Not all but some companies cover more than 30 illnesses. Before

- A second opinion of the doctor – Almost all the companies provide second opinion. Second opinion gives us the chance to get a better review on diagnosed illness from a specialized doctor.

- 100% payout -If diagnosed with a critical illness then the company pays the entire sum assured of the policy.

- Tax benefit – All the policies of critical illness comes with a tax benefit u/s 80D of Income Tax Act,1961.

- Peace of mind – Once you have taken the critical illness policy you can be relieved because your financial state is now taken care off. If you encounter any critical illness disease then you can now focus more on the treatment rather than managing funds from here and there.

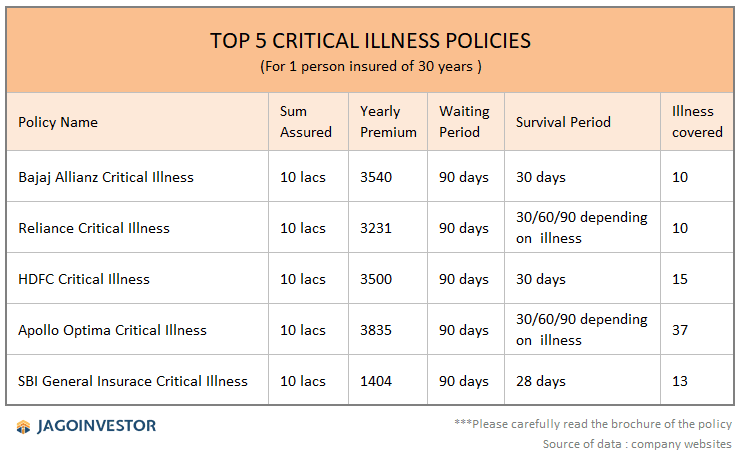

Top 5 CRITICAL ILLNESS COVER

For your reference, I have done an analysis of finding the top 5 critical illness cover policies in India. Below given is the list of top 5 critical illness cover policies.

****** The premium details are for a 1-year policy including GST.

6 points to get the best critical illness policy?

As now you know the top 5 critical illness policies, still it is not easy to select the best policy out of many. So, here are some of the points to evaluate the best critical illness policy.

#1 – The Premium amount

Comparing premium amount is as simple as, selecting a critical illness policy of that company which gives the best value for money at the same sum assured and illnesses cover you are looking for.

#2 – Sum Assured

Getting the highest sum assured should not be a criterion for policy buying. The standard cover suggested is of 10 lacs to 20 lacs, so that your financial life should not get affected due to any uncertain illness.

#3 – Waiting Period

A waiting period is a period up til which any of the illnesses specified under the policy are not covered. For example, if it’s 2 months, then if any of the critical illness happens to you before 2 months, your claim will not be taken. The insurance companies will consider your claim for paying the sum assured only after the period of waiting has ceased after buying a critical illness policy. So, before buying policy make sure that policy is having lesser waiting period. Almost all the companies have a waiting period of 90 days (not including existing illnesses).

***For existing illnesses waiting period is 48 months.

#4 – Survival Period

The survival period is the length of time, for which the insured must survive after being diagnosed with the illness, in order to get a claim. The insurance cover will be paid only after the survival period has passed. So, if a person’s death happens immediately after a heart attack, even if he has critical illness insurance, his or her family may not receive any payout from the insurer.

The length of survival period varies among different insurers, it can be 14 days or 30 days, etc. So, for buying a critical illness policy make sure that the policy has the least survival period.

The logic behind the survival period clause is that, critical illness insurance benefits are meant to be used by the insured as a living benefit to recover from illness, not a Death benefit. So, from this it is very clear that you should have a term insurance(life insurance) to provide the cover to your family, even if already having a critical illness cover.

#5 – Diseases covered

On selecting the best critical illness policy do not look for the maximum number of illnesses, it will be very illogical and will also lead you to pay a higher premium. Instead, go for a standard set of illnesses ( i.e. 28-32 illnesses covering major 4 critical illnesses) that might happen due to your life style habits and hereditary.

#6 – Entry Age

Check the entry age of policy before buying. Mostly the entry age for critical illness policy is of 18-64 years

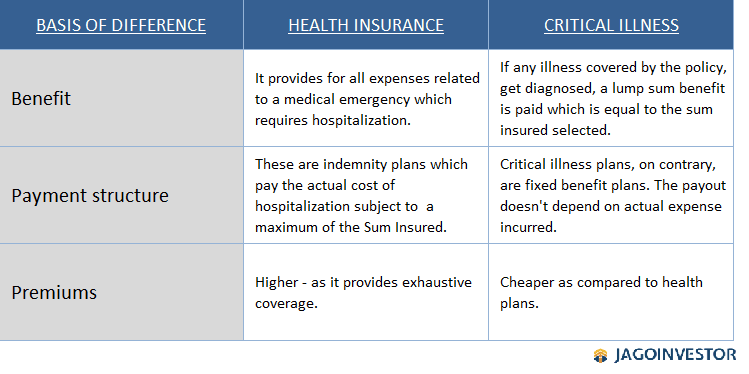

Why have a Critical Illness Cover if I already have Health Insurance?

One last thing to keep in mind is that health insurance and critical illness are two different products. Critical illness typically covers you from specified illnesses and not regular health-related issues.

Health Insurance provides exhaustive scope of coverage. Such as in-patient hospitalization, pre & post hospitalization, day care treatments, ambulance costs, organ donor expenses, etc. Where as Critical Illness plans provide coverage for a specified list of illnesses mentioned in the policy contract.

Below given table briefly represents the difference between health insurance and critical illness plans,

So, as you now know why and how to select the best critical illness policy, if you think any critical illness cover is best suitable for you, then go for it. Having one critical illness insurance policy is must in today’s era.

Let us know your views and queries about this article in the comment section.

January 26, 2019

January 26, 2019

Hello Sir,

I’m 43 years of age and planning to buy critical illness plan, only bread winner for family of 6 members.

I’m having medical insurance and personal accidental policy.

Please suggest which is the best critical illness policy at affordable premium.

With Best Regards,

Vijay

You need to make comparision at your end.. Check Max Bupa policy on this.

Hi

Please also provide information on below points.

1. Claim settlement ratio in case of Critical Illness policies, the claim process & typical time taken by Insurer to settle claim considering its a big outgo for insurer. Are there any additional checkups done by insurer?

2. Is there any floater option in Critical illness policy to cover all family members? This will help avoid managing too many policies in addition to Term, Health, Super Topup, Accident, Vehicle, Home insurance etc

Hi Abhijit Waghmode

Thanks for your comment.

1. Not much of the time is taken in settlement. Because the money is required in immediate medical expenses to be made to treat the disease.

A second opinion will be formed by an expert doctor provided by insurance company.

2. There is no family floater policy for critical illness policy.

Vandana

Hello, thanks for this article.Can critical illness policies typically cover parents who already have the disease? Or is there any policy which can cover for help like nurses and ayahs kept at home to take care of my physically-challenged parent?

Thanks for commenting Mr. Arin.

For covering any pre existing diseases there will be some higher waiting period for that. So, you need to ask the company regarding this.

Vandana

Dear mam,

critical illness policies in India are fraudulent policies.Stringent conditions are attached for payout. eg., Kidney failure- failure of both kidneys requiring regular dialyses. heart attack- Myocardial infraction with permanent damage of heart muscles,etc. Payout is made only for critical illness of “specified severity”. After going through these severity conditions, one can say that these are next only to Death. No data is available for payment statistics for critical illness policies. Hence , it is better to increase sum insured in Regular health policies instead of Critical Illness covers

Thanks R Satheesh for sharing your insights.

The cover is recommended just to provide additional financial security in case of big illnesses, and the sum assured is paid at the first diagnosis itself. Health insurance even after higher sum assured will not cover those big illnesses.

Vandana

What do you mean by health insurance will not cover big illness?

Hi Ramesh

Thanks for your comment.

Big illnesses like loss of limbs, paralysis, coma, cancer etc. On whose treatment the time taken is very long. Its like years of years to recover from those deceases. Health insurance covers hospitalization expenses for regular illnesses.

Vandana

Hi, very nice article, you missed mentioning that one just can’t go for highest possible cover as it is capped as per your annual income. Also, I am of the opinion that one should go for Cancer Insurance cover also as they are very cheap & cover all types of Cancer while Critical illness policies exclude many types of Cancer & for rest they cover them only at advance stages.

Thanks Shobhit for sharing your insight. I will update on that point.

Keep showing your views like this.

Vandana

Very educative and informative. Thank you for the article.

Hey Pradep

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

WHich is best plan according to you, lets forget premium

Thanks paresh for commenting.

I have added a table in article, listing top 5 policies. You can refer those to select best for you.

Vandana

Hi,

A very good and useful article.

Btw, I am wondering whether the “Critical illness policy” is better than the “Super Topup policies” that can increase the health cover at lower premiums?

Details about Super Topup policies were covered in a previous article:

http://jagoinvestor.dev.diginnovators.site/2015/10/super-topup-to-save-health-insurance-premium.html

Thanks, Vinod

Thanks for commenting Mr. Vinod,

As Super pop up is health insurance product, it will not cover you for critical illnesses.

Vandana

HI,

IF I INSURE FOR CRTICAL INSURANCE POLICY AND PAY FOR COUPLE OF PROBABLY 2-3 YEARS AND I AM DIGNOSED WITH SERIOUS ILLNESS AND I HAVE CHOSEN POLICY FOR 10 LAC. WHAT WILL BE MY PAYOUT

Thanks for commenting pavithra,

If the policy holder is diagnosed with any of the illnesses mentioned under critical illness policy will be paid full sum assured at that point itself. There will not be any proportionate payment.

Vandana

Thank you for a very informative article once again.

I was wondering about the effects on claim approval in case a person holds more than one health policy or a combination of health and critical illness plan.

It will be useful to know in what situations the insurance will prove uselss. ( Of course most people are aware of standard exclusions )

Thanks for commenting Mr. Satish,

The combination of health and critical illness can not work. You will either get the claim covered by health insurance or critical illness. However, if you hold more than 1 health insurance than the terms of the policies will come into picture for calculation of proportionate claim on the basis of sum assured of the health insurance policies.

Vandana

Excellent article that provides awareness on a much needed and necessary coverage for all individuals. It would help if you can provide additional details on the critical illnesses covered by the different policies listed above. Thanks very much for the article.

Hey Vivek Vijayaraghavan

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

But if I have a health insurance for 15 Lakh,Is it necessary to take critical illness plan for 10 Lakh ? Because the disease covered by critical illness plan will already been covered by health insurance? Kindly correct me if wrong.

Thanks for commenting Mr. Rajkumar,

If the illnesses are already covered by your health insurance or term insurance there is no need of getting a critical illness cover separately.

Vandana

I think it is still good to have critical illness insurance. Coz, if you are diagnosed with critical illness the sum assured is paid irrespective of treatment being taken or not. This provides financial backup against loss of income. While in case of health insurance, payment is made only if treatment is taken and limited to the minimum of cost of treatment or sum assured.

Hey Ankur

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Vandana

Are NRIs eligible for Critical illness claims in India if he/she undergoes the treatment in India and if he/she already has an Health Insurance policy in India.

Thanks for commenting Mr. Niraj,

Yes NRI’s can have a critical illness policy in india.

Vandana

Are there any such policies for senior citizens>70 ?

Thanks Mr. Nair for commenting,

The renewal in these policies are allowable for the people even above 70 years but, entry age of most of critical illness policy is up to 65 years.

Vandana

Very informative.Thank you

Hey Vijayakumar

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Good info

Hey Eswar

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Very good info. Can you also give information and options about the insurance for people already having critical illness

Hey Eswar

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish