Congrats loyal employees – Gratuity limit raised from 10 lacs to 20 lacs

Do you know anything about gratuity? It is one of the components of your salaried income which you will get at the time of your retirement. A lot of people are not even aware of the term gratuity and tax exemption on this amount.

In this article, I’m going to tell you what is a gratuity, how it is calculated and how much tax exemption you can get on this amount.

Recently limit of gratuity payment has been increased from Rs.10 lac to Rs.20 lac. This hike is a kind of good news for employees who are working in the non-government sector for more than 5 years in the same company.

First of all, let me tell you what is a gratuity.

Meaning of Gratuity

Gratuity is the reward given in the form of money by an employer to his employee for being loyal to the company and completing 5 or more than 5 years of service in the same company.

Various countries have different gratuity limit. In India, this limit was Rs.10 Lac earlier but after implementation of the 7th pay increment of salary this limit has been increased from Rs.10 lac to Rs.20 lac.

Mode of Gratuity payment:

Just like your provident fund gratuity is also paid totally by the employer only. It depends on the employer’s decision that either he will pay you this amount or he may take a group gratuity plan with an insurance company. The employee can also contribute to his gratuity if it is paid through insurance company whereas it is not mandatory.

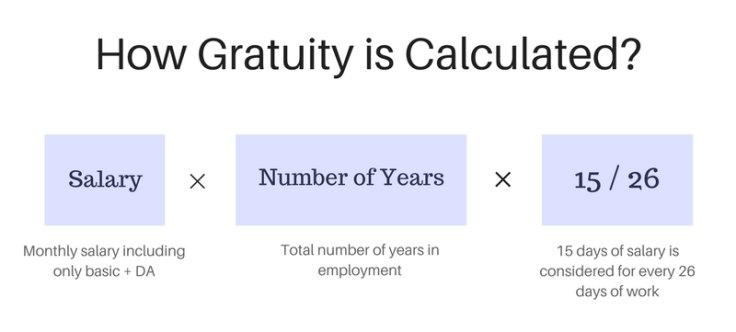

How gratuity is calculated?

Once you complete 5 years of your service, gratuity will be calculated for 15 days per year of your employment. The total working days considered are 26. It will calculated the number of years of your employment.

While considering years of service if the time period is more than 6 months then it will be considered as 1 year. For example, if your service period is 5 years and 7 months then for gratuity calculation it will be taken as 6 years.

Below are the terms taken into consideration while calculating gratuity:

- Last drawn salary including basic pay and dearness allowance.

- No. of years of your employment.

- Paid for 15 days per year of employment considering working days as 26.

The formula for calculating gratuity is given below.

Let’s take an example of gratuity calculation.

Suppose you are working with a company from the last 5 years and 7 months and your salary is Rs.50,000 including DA. Then your Gratuity will be –

= 50000*6*15/26

= Rs.1,73,076.9

At what time gratuity is given?

Gratuity is a kind of superannuation. When a person completes 5 or more years of his service in the same company then he is eligible to get gratuity.

The criteria for gratuity payment is given below.

- Retirement of employee

- When an employee resigns the job after completing 5 years.

- In case of death or permanent disability because of an accident.

The criteria of completing 5 years of employment will be relaxed in case of death or permanent disability caused due to an accident. In this case, the employer will pay gratuity for 15/26 days of every completed year of service.

Companies are supposed to pay Gratuity?

The gratuity act was originally passed in 1972. This act covers all the workers or employee’s in various companies, factories, mines, etc. As per this act, all the companies who have at least 10 employee’s have to pay gratuity.

If a company has 10 employee’s though for a single day in a period of 12 months then the company is eligible for paying gratuity.

Who is eligible to get Gratuity?

There are 3 criteria’s for an employee to become eligible for Gratuity which is as:

- The employee should retire after completing 5 years of service in the same company.

- Employee must resign after 5 years of service in the same company.

- In case the Employee passed away or suffers from any kind of deficiency while he was still working.

Whereas as per the rule under section 4(2), 5 years doesn’t mean 365 days/ year. As per this rule, an employee who satisfies the criteria given below is eligible for Gratuity, the criteria are as –

- The employee should work 240 days a year – if the company has 6 working days.

- The employee should work 190 days a year – if the company has 5 working days

This rule is will not be applicable if the employee dies or becomes disable while he is still working. In that case, the company will provide Gratuity to such employee or the nominee.

Is gratuity Amount Taxable?

In the current situation all the government employee has a tax benefit on their gratuity. There will be no tax on the amount received as gratuity for government employees for state government, central government or a local authority.

For non-government i.e. private sector or public sector employee’s tax exemption is depending upon either the employer company is covered under gratuity act or not.

1. Employer covered under payment of gratuity act:

When a person is working in a private sector and his employer company is covered under gratuity act then he can get tax exemption on his half months salary i.e 15 days salary of every year of his employment.

2. Employer not covered under the payment of gratuity act:

When your employer company is not covered under the gratuity act then you can get tax exemption on any one of the three options given below. Whichever is less will be considered for exemption –

- Rs.20,00,000

- Actual gratuity received by an employee.

- 15 days salary of every year of employment.

[CP_CALCULATED_FIELDS id=”6″]

Change in taxable income because of hike in gratuity limit:

Hike in gratuity limit is more beneficiary for employee’s working in private or public sectors. In any case, government employees are getting tax exemption on the entire amount of gratuity payment.Let’s see the difference in tax exemption after this hike in the gratuity limit.

I hope you got an idea of calculating gratuity and tax exemption on it. If you have any query let us know by leaving your reply in the comment section.

May 24, 2018

May 24, 2018

Great article Manish. You have mentioned it in the article. I felt it would be more appropriate to display basic +Da in the calculator than monthly salary to be very precise.

Hi Sri

Yes, its a good suggestion. Thanks.

Hi ,

I worked for one of IT company in Hyderabad for 4 years, 7 months, 11 days and the company says i am not eligible for gratuity.when i raised a query i got below reply. could you please let me know if am eligible or not.

Dear Vijay, Thank you for raising query with The HUB Re-connect Team. We already provided below as per the process we provide the Gratuity amount. As per Gratuity eligible criteria complete 4 years 10 months (or) 4years 190 working days, Your total tenure:4 years, 7 months, 11 days (or) 4 years 160 days not eligible for Gratuity amount. Regards, PFHelpdesk Team

So whats the issue ? As per law you have not qualified for gratuity, you can see that as per calculations.

Gratuity rules are fixed

Manish

Great Information..

Excellent and detailed article. Very informative! thanks for sharing ..

Thanks for your comment Future Finance .. Please keep sharing your views like this..

Manish

Excellent and detailed article. Very informative! thanks for sharing. ..

Thanks for your comment Future Finance .. Please keep sharing your views like this..

Manish

Nice Graphics and good information!

Thanks for the share.

Thanks Manisha