12 things about Budget 2018 which is related to middle class

This was the last budget of BJP govt before the next elections and it was expected that they would announce some very good changes in budget which will be for middle class. From last many years, the tax slab rates have not seen any major changes (except few small changes) . The 80C limit and housing loan interest deducted limits were revised few years back, but still the common man expected some really good news.

While the budget was very good for farmers and rural sectors in general and also for senior citizens, it was extremely disappointing for middle class who are mainly into jobs.

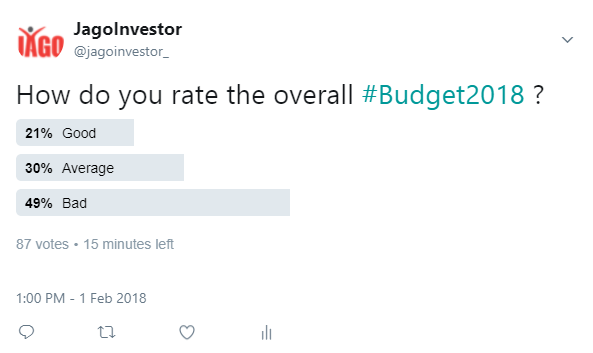

On twitter, I asked about people opinion on the budget and as expected, most of the people were not happy about it.

12 Things related to the middle class in 2018 BUDGET :

[su_table responsive=”yes” alternate=”no”]

| 1. No change in Tax Slabs | 2. Standard Deduction of Rs 40,000 |

| 3. Long Term Capital gain Tax on Equity Gains at 10% | 4. Dividend Distribution tax of 10% on Equity |

| 5. Increase in Health and Education Cess to 3% to 4% | 6. No tax on interest from Deposits up to Rs 50,000 for senior citizens |

| 7. No TDS for deposits for Senior Citizens up Rs 50,000 | 8. Health Insurance deduction increased from 30,000 to 50,000 for senior citizens |

| 9. Increase in limits for critical illness treatments | 10. Corporate tax @25% for companies with turnover of less than 250 crores |

| 11. EPF contribution of new women workers capped at 8% | 12. Health Insurance Scheme for 5 lacs sum assured for majority |

[/su_table]

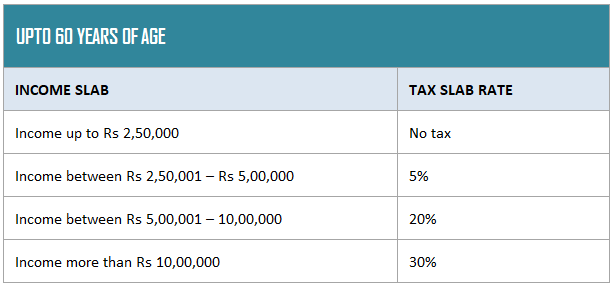

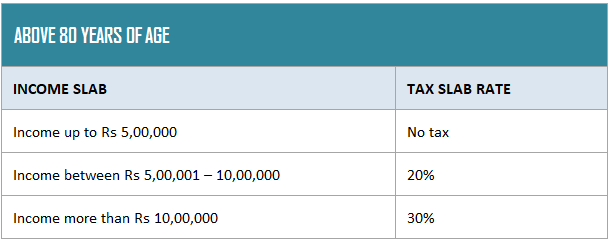

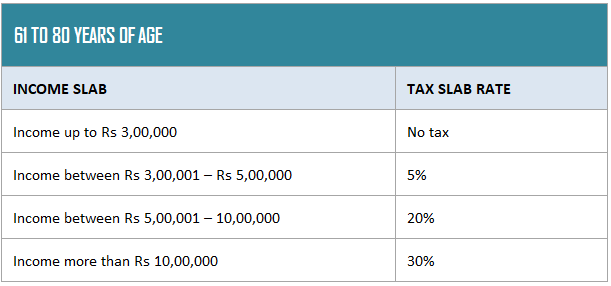

1. No change in Tax Slabs

One of the biggest disappointments for everyone in this budget was that the tax slabs were not changed at all. In media we keep hearing on how the minimum limit for taxation should be raised from 2.5 lacs to 5 lacs, but it was not even raised to 3 lacs.

Below are the slabs.

So you will still pay the taxes as per old slab rates only.

2. Standard Deduction of Rs 40,000

There is a standard deduction of Rs 40,000 allowed in this budget, which means that you can now reduce your taxable salary by Rs 40,000 directly along with other deductions and benefits. But this only looks great on paper, because the transport allowance of Rs 19,200 and medical reimbursement of Rs 15,000 are now removed as benefits.

So earlier anyways one was able to claim around Rs 34,200 ,so the added advantage is only for Rs 5,800 more.

You will only save a little headache of providing the medical bills which you used to do for claiming Rs 15,000 (a lot of people used to provide fake bills). So now the process will be simple

3. Long Term Capital gain Tax on Equity Gains at 10%

The biggest news in this budget was the reintroduction of 10% tax on long term capital gains on equity without Indexation benefits. Let me touch base on this a bit as this is very important to understand, however I will make another details article soon on this.

Till now, if you held equity stocks or equity mutual funds for more than 1 yr, then all the profits you made were tax free when you sold them. However now you will have to pay 10% tax on the profits on profits above Rs 1 lac.

However this will only apply on the profits made after 31st Jan 2018 and if you sell your holdings after 31st Mar 2018. All the gains you have made till 31st Jan 2018, are protected and now they will be considered as your cost price.

So if you had bought a stock or equity mutual funds for Rs 1 lacs in May 2017, and its value on 31st Jan 2018 was 1.2 lacs, then you do not pay any tax on this profit of Rs 20,000 . Now your cost price will become 1.2 lacs .

Now if you sell it in let’s say Dec 2018 for Rs 1.5 lacs , then your capital gains will be 1.5 lacs – 1.2 lacs = Rs 30,000 (not 50k).

[su_table url=”” responsive=”no” class=””]

| Particulars | Before Budget | After Budget |

| Buy Date : 1st June 2016 | Rs 5,00,000 | Rs 5,00,000 |

| Sell Date : 1st July 2019 | Rs 10,00,000 | Rs 10,00,000 |

| Price on 31st Jan 2018 | Rs 7,00,000 | Rs 7,00,000 |

| Purchase Price Considered | Rs 5,00,000 | Rs 7,00,000 |

| Capital Gains | Rs 5,00,000 | Rs 3,00,000 |

| Capital Gains Exempted | Rs 5,00,000 (100%) | Rs 1,00,000 (as per new rule) |

| Capital Gains which will be taxes | Rs 0 | Rs 2,00,000 |

| Tax Rate | NIL | 10% |

| Tax Payable | NIL | Rs 20,000 |

[/su_table]

Note that the capital tax gains will come into picture only when you sell your holdings and the tax will be applicable only on the profits above Rs 1 lac.

Capital gains on equity was already there before 2004, At that time it was 20% on profits with indexation or 10% without indexation. Now they are reintroduced.

Note that if you sell your holdings before 31st March 2018, the old rules still apply. This new rules are only going to be in picture if you sell after 1st April, 2018.

What should you do?

Nothing!

Dont get too emotional about the tax part. I know people hate paying tax in any form, and especially when it comes as a surprise. But the truth is that the capital gains tax was there before 2004. Its not reintroduced. You should feel happy that for 13 yrs, there was no taxes on equity gains and those of you who have made great returns in past decade enjoyed it tax free.

Also, the capital gains tax on equity is one of the lowest in India at 10% . Most of the other countries tax it at anywhere from 15-35% . So we are not in bad shape.

Equities are still one of the best asset classes, and now lets focus on your wealth creation over long term. The fundamentals are still strong and the equity is set to give great returns over long term. Even with this 10% tax, equities are the best thing to invest in (for long term)

4. Dividend Distribution tax of 10% on Equity

Before of the LTCG on equity , now the dividends from equity mutual funds and stocks will also be taxed at 10%. However this will at source. Which means that it will get deducted by the company itself and you will get the dividend post deduction of 10% . You will not be paying any tax at your end, so there is no headache of all that calculation and CA work

For example, if the company announces Rs 10 dividend per share/unit and you are suppose to get Rs 10,000 dividend , then you will get Rs 9,000 and Rs 1,000 will be paid to govt directly by the company.

This applies to both dividend and dividend reinvestment option in mutual funds.

The dividend distribution tax and treatment for debt mutual funds is still the same. No changes in that.

5. Increase in Health and Education Cess to 3% to 4%

The cess was increased from 3% to 4% in this budget.

Cess is something which you pay extra on the income tax. So if you are in 20% income tax bracket, then you will pay 4% more on 20% , which will make your income tax rate as 20.8% .

If your income tax amount comes to Rs 20,000 per year, then your cess will be 4% of Rs 20,000 = Rs 800.

With 1% increase in cess, you will pay Rs 200 more now (if your income tax is 20,000). This will increase your tax burden by a very marginal amount.

6. No tax on interest from Deposits up to Rs 50,000 for senior citizens

This budget has given a lot of benefits for senior citizens.

One big benefit is that now there won’t be any tax on interest on all the deposits and bank interest up to Rs 50,000 for senior citizens. This will include interest of saving bank account, fixed deposits and recurring deposits.

7. No TDS for deposits for Senior Citizens up Rs 50,000

Now there won’t be any TDS deductions for interest from deposits (fixed deposits and recurring deposits) upto Rs 50,000. Till now the TDS was deducted as per provisions of section 194A , if the interest was above Rs 10,000 , but now it will be Rs 50,000 limit.

8. Health Insurance deduction increased from 30,000 to 50,000 for senior citizens

Under section 80D, there was an exemption of up to 30,000 per year for health insurance premiums for senior citizens, but now it has been increased up to Rs 50,000 . It’s a major relief because for senior citizens the health insurance premiums are very high and in most cases, it’s more than 40-50k anyways.

9. Increase in limits for critical illness treatments

There is an increase in the deduction limit for medical expenditure for certain illness up to Rs 1 lac for all senior citizens under section 80DDB . So in a particular year, if a senior citizen spends money on treatment of these illness, they can claim deduction on up to Rs 1 lac.

Here is the list of all illness covered under Sec 80DDB

- Dementia

- Dystonia Musculorum Deformans

- Motor Neuron Disease

- Ataxia

- Chorea

- Hemiballismus

- Aphasia

- Parkinsons Disease

- Malignant Cancers

- Full Blown Acquired Immuno-Deficiency Syndrome (AIDS)

- Chronic Renal failure

- Hematological disorders

- Hemophilia

- Thalassaemia

Increase in deduction limit for medical expenditure for certain critical illness from Rs. 60,000 (in case of senior citizens) and from Rs. 80,000 (in case of very senior citizens) to Rs. 1 lakh for all senior citizens, under section 80DDB.

10. Corporate tax @25% for companies with turnover of less than 250 crores

Those of you who are running any companies, the good news is that the tax rate will be 25% now instead of 30%, provided your turnover is less than Rs 250 crores yearly.

11. EPF contribution of new women workers capped at 8%

Now all the new women how will join the workforce for the first time, their EPF will be deducted @8% only instead of 12% for the first 3 yrs, also the govt will now provide 12% from their side also. It’s still not clear if the employer contribution will also be extra other than govt contribution.

12. Health Insurance Scheme for 5 lacs sum assured for majority

Another big news was that now govt is bringing a health insurance scheme for masses, where each family will be entitled for Rs 5 lac sum assured each year. But this will be mostly for weaker section of society and I don’t think any of our readers will be eligible for this.

There are no details about this scheme right now in budget and no allocations is made for this. I would rather wait for more details before commenting on this more. However if successfully implemented it would be wonderful for our country.

Let us know what do you think about the budget? What is one major disappointment and one great thing about the budget for you?

February 2, 2018

February 2, 2018

Really Awesome post.. Hats off for your work.. Thanks !!!

Thanks for your comment Atellier .. Please keep sharing your views like this..

Manish

Before Budget and After budget column is Awesome.. Very nice work ,, Keep it up

Thanks for your comment Prajakta .. Please keep sharing your views like this..

Manish

Very informative.

Keep it up.

Thanks for your comment Salim .. Please keep sharing your views like this..

Manish

Nice Analysis…We are waiting for the budget which is middle class focused… lets see any govt. turn eye towards taxation reform of salaried class..

Thanks for your comment Super Multibaggers .. Please keep sharing your views like this..

Manish

Hello Manish,

Thanks for all above info, and I read all your articles and blogs, they really just awesome.

One thing want to share here is that you have mentioned in above for LTCG tax regards to India and other countries,

I agree may other countries are taking tax more however as a middle class man I am paying lot of taxes already to government even after this there is no developments happening and the changes that are happening are not reaching to actual people. This all because as every one know all politicians are corrupted and even many govt. officials as well.

So even after paying these many taxes i am not getting the basic and fundamental facilities.

In other countries the basic facilities are made reachable to common man but not in India.

Here am talking about.

1) Hospitals and medicines

2) Schools

3) Roads.

And want to confirm I am not anti Modiji Govt. too.

Yes Vish

More needs to be done from govt side .. and I think its happening .. The pace is slow and it will be. We can not see things changes in few months or even years. It takes decades !

Good you mentioned the last line…else you would have been branded as anti-nationlist !!!

Hi

Middle class peoples of this country do not have any objection if any tax is levied for instance LTCG .actually this class wants to grow India but taxes levied on this class should be used pro actively which. Is not in the case ….do following things

PM MODI JIIIII…

1.CANCEL CANTEEN SUBSIDY WHERE POOR MP MLA ARE SERVED AT RATE WHICH EVEN A REAL POOR CAN FIND FOOD….really THEY DESERVE ???????

2.WHY MP/MLA DO NOT PAY INCOME TAX . why income is exempted mp/MLA should be the first example as we are paying in nation. Building they why people should not …

But in India they deserve. All amenities …..tax free income .really they are poor..?????

3..FM speech at amritsar in 2013 there should be no income tax up to 5lakh…is it done when your gov have come…really again a jumla……

Why you say when you can’t do it even for nation

4. Petrol prices at 75 at 70 $barrell..in congress time petrol was 68 at 140$ …

Where the money is going ……..still middle man is affording the same …..petrol prices are left with market prices but why media do not criticise the move .

4.bjp always says Congress do not have right to say anything as they have not fine in past 55 years ….

BUT I REALLY CONDEM THIS SAYING ……MR MANMOHAN SINGH IS GREAT LEADER …HE IS THE OUR NATION BUILDER ….BJP IS EATING THE FRUITS OF MR MANMOHAN SINGH ………BUT PROBLEM WAS MR MANMOHAN SINGH Did EVERTHING BY KEEPING SILENT …AND OUT MODI JI DOES NOT DO NYTHING EVEN BY YELLING …..

BHAYIO MAIN 1 SIR KE BADLE 10 SIR LAUNGA WHERE IS THAT 56 INCH SEENA …..WHATS HE HAS DONE ABOUT PAKISTAN STILL WE ARE LOOSING OUR SAINIK….

NOTHING ON THAT FRONT ..

5 I PERSONALLY FEEL AND SALUTE MR MANMOHAN SINGH WAS BEST PRIME MINISTER AND BRILLIANT FINANCE MINISTER IN 1993 DUE TO THAT WE ARE NOT SELLING PAKORA AND DOING JOBS IN MULTINATIONAL COMPANIES ..

6 WHERE IS BLACK MONEY WHAT ABOUT THAT ….BABA RAMDEV WAS DAILY DELIVERING SPEECHES IN HIS SHIVIR EVEN I should SAY YOGA WAS LESS AND CONGRESS CRITICISM WAS ON UPPER RANK ….BUT NOW WHY HE IS SILENTTTT..HE DOES NOT SAY EVEN A SINGLE WORD …..EVEN MODI JI IS ALSO NOT SAYING ANYTHING …..ABT KALA DHAN WHICH WILL NEVER COME

7..LET THE PUBLIC DECIDE MP /MLA SALARIES THROUGH EVOTE THROUGH SMS

8LAST BUT NOT LEAST MEDIA SHOULD PUBLISH ANALYSIS GOVERMENT REPORT EVERY QAUTTER ……..WHAT YOU PROMISED AND WHATS DONE ..SO THAT PEOPLE COULD KNOW WHAT IS DOING AAAPNI GOVERMENT FOR US…..

Thanks for your comment Tarun kumatr .. Please keep sharing your views like this..

Manish

I do not know what system has been implemented to enable your blog, but is it possible for you to switch to a system which does not have too many indentation as on mobile it is impossible to write a reply to the third reply received by you.

There may be a system which use unindented reply system with a show and hide. That would be easy to interact.

Also could you have the Leave a Reply section directly underneath your blog, instead of having it at the end. Please take it as a constructive suggestion if thought deem fit.

Thanks for the feedback, Yes – its one of the issues which I am aware about. Will try to fix it asap. But it will take some time.

Manish

This budget seems to be very much inaccordance with growth

i am really not sure why there is so much about downfall -downfall is because of global issues not because of Budget

Thanks for your comment Shrenuj Jalan .. Please keep sharing your views like this..

Manish

This budget is more clear and beneficial for all categories. Govt. moves are perfect to create a solid base and stabilize the economy strongly. All earlier budgets or Govts had provided subsidies and wasted money. Neither able to control deficit nor manage the development. In this budget, though middle class has not received any thing, neither they are losing anything by any additional burden. Poor may get benefits. See Govt is trying to bring the poor in middle class segment sothat they shall cover under tax slab. In that case, deficit will be lowered and maximised tax collection. In current scenario, middle class is paying taxes honestly and benefits are given to all poors. Govt wants to improve this situation. Hence middle class public must control their feelings and support. So many years this class has faced only issues, few more may give long run benefits. The poor class currently, will also join middle class and burden will be shared. Then the power of this class can control higher class. That is the idealogy. Hence be cautious in 2019, else will have no option but to crawl life long. Keep eyes open, think how all oppositions are trying to form unity against this Govt to pull them down as their shops will close if poor class will join middle class. Best of luck.

Thanks for your comment B Prashant .. Please keep sharing your views like this..

Manish

Don’t you forget BJP has also got its fair chance in the past, whereby they have failed miserably only due to their ideology.

I am not too sure of economically backward class rising up to reach middle class but the fact is distinctly clear that middle class is merging to be economically backward from time to time, only it has not been recognised and publicised.

Only fools can fall prey to rosy pictures painted by the gift of the gab; as it has been for 70 years.

Very well writen article all who fantasise roses in thin air should read, be aware of, and sooner they accept realitu the better it is for India as a nation to keep its reapect intact. Only God can bless India from corrupt politicos.

http://www.newindianexpress.com/business/2018/feb/11/of-catchy-slogans-and-budget-targets-that-disappear-1771452.html

I really do not understand how economically backward class will move to middle class without creating earning opportunities for them, rather, just giving them freebies. While the petrol price, gas price increased which has a direct impact on all other commodities which will be priced higher, where do we see middle class going?

The very simple fact that every middle class has more issues and problems as they pay

income tax,

expenditure tax (GST / VAT, excise, octroi, service tax or what ever individually or now combined on restaurant, medicine, tel, mobile, electric and other expense bills – difference is only in how it is christened), and

savings tax ( Bank Charges for transfers and other services, SMS Charges, Minimum balance charges etc) with reducing interest on Savings account and now even PPF a/c,

STT and double it to now collect LTCG without indexation

is like saying, come here you are the “Bakra” and we wanna kill you; in a milder way. We are vegetarian man eating Indians.

Has any one realised that GST which was expected to reduce prices and should have, has in reality increased prices of the day to day items we use.

MEDICINE for one has become expensive by 10 to 15%, companies have increased MRP.

Hotel and Restaurant bills have gone up as the base / menu price have been jacked up. The list can continue and will keep adding up.

On the other hand business; startups, small, medium, and large establishments gets rebates and adjustments for taxes paid as expenses.

Injustice practiced since 70 years and no one thinks or speaks about it. We should have an effective organisation to represent middle class in a much stronger manner and get this rectified without second thought and immediately we should demand either have income tax or expenditure tax. Both oops sorry Triple taxation is not only unfair but a criminal offence. It is killing and it is high time, we raise our voice effectively.

It appears we live to work on calculating tax payable all year adhering to time limits to feed the paliamentarians as; as per tweet from financial secretary who claims GST revenue is used to pay military and defense of the country. Do you buy it?

Imagine all the time you would save and use it efficiently to do progressive work instead, if all taxes were done away with and a very simple and very low flat percentage of tax payable say 5% one time at year end is made applicable. The nation would progress at a much higher rate . This would have huge tax collection as a result, instead all farmers benefits going to scrupulous elements mis-reporting agriculture income as their earnings. most of the politicos have farm lands which ever way it is possible for them to hold and use this loophole.

Please ask him to elaborate and explain what are the other taxes, and as if that is not sufficient; surcharges and cess – education, swatch bharat cess etc which has achieved no purpose – the citys are not only dirty but filthier than before and gets worse day by day.

If Govt thinks they need 5L monthly salary for themselves, then that should be the exemption limit 5 x 12 = 60 L for middle class.

Ministers are in the field to “serve” the people. They want to get elected to serve you as they so say – they care for you. Then there is no question you ask for remuneration for that service and also make fast money with failed projects.

Every failed budget proposals should be scrutinised and the ministry and ministers past and present should be punished severely for lapse, loss due to delay and increase in cost to nation for those projects.

Budget is not only about proposal to spend (read make money) with future projects ( designed and crafted to pull the wool over people’s eyes) but also to account properly for the amount spent for the past projects; COMPLETED OR FAILED and explained.

There should be proper audit firm ( combination of 5 large audit firms ) to audit and fairly report govt accounts and their finding on a quarter to quarter basis, as is the normal practise / regulation for large companies to we the people.

JAGO GRAHAK JAGO. Kab?

Thanks for your comment Human being .. Please keep sharing your views like this..

Manish

Thank you for publishing it on your blog. I am honoured

Welcome !

Dear Manish , I have a doubt regarding the point 6) .It says NO TAX on interest UPTO Rs 50,000/- . Does that mean as a senior citizen money can be put in different banks with interest up to Rs 50,000 and will not be added up in the gross income ? I am confused as this was my understanding ,please correct me

Its Interest as a whole from all the bank deposits / saving banks . It will not help to distribute in various FD !

Manish

Interest income upto 50000 is tax free. Above that limit, it is taxable.

If one has deposits in same bank, the bank can track and deduct TDS if interest income crosses the limit. (This also I am doubtful, as normally savings bank income does not go for TDS). If one has deposits in various banks, each bank cannot track the total interest income and make TDS.

However, the responsibility lies with the individual who has to take these into accoutn and pay tax at the end of the year, as per calculation.

Yes, thats correct !

i agree with the spirit of the article and confirms that we never see big picture. This also reminds me of ‘Rich Dad Poor dad’ that an entrepreneur/ investor are at higher levels by virtue of structure.

I think only concern is that unlike developed countries where basics of health, infrastructure and education are far better than what we have in India. So it is matter of value we are getting form the price we pay.

However, things have been improving (irrespective of who is in power) in my personal experience and observation.

Responsibility remains collective and hence I feel fundamentals are still good for long term growth in India.

So LTCG should not be deterent for our investing.

Very True !

PITY! The MPs and MLAs salaries are going up and up with absolutely no meaningful contribution to the country. Their salary does not match the amount of contribution for country’s benefit. On the contrary many are a blot on India’s reputation. They definitely have several other sources of income. Whereas there are many people in the middle class who are just about surviving or managing their living on interest earned or dividend or stocks gathered with peanut money long back. With the current Government strategies middle class is finding it more and more difficult to fend reasonable standard of living. All their life they paid tax honestly and are paying even now. Business man has several methods to hide real income. Only marginal income earned by them is taxed. SO WHO ID SUFFERING?

Time to take a note of it as 2019 is approaching!

Thanks for sharing your views

Manish, You always keep it simple & clear :D. I was waiting for this post and I feel my wait is worth now. Thanks for penning down your thoughts. As told by you, I wont touch my portfolio and will wait for your detailed article on LTCG as well.

Thanks for your comment Keerthi .. Please keep sharing your views like this..

Manish

Each one of us have some different thinking directions but one thing is sure that neither any budget nor any government will change the situation of Middle class people though these people are paying some more tax from income, shopping and now from investments. Either poor can change their class from lower to higher or higher class will goes to highest. Middle class still remain at middle class only.How to change?

Thanks for your comment Vaibbhav .. Please keep sharing your views like this..

Manish

Though the anguish seems genuine, one has to live with it and it is a given.

Once this is accepted, one can think of ways in which one can reduce one’s tax incidence depending on one’s circumstances. I was in same boat for so many years. When I took charge of my wealth, on research many hither to unknown opportunities(unknown to me) opened up.

Also financial planning is not static and one can not copy paste from someone else. One needs to understand one’s circumstances fully and take appropriate action so that it can give best result.

Also, many books and articles freely available on net are written for newbies and are not tailor made for every body. But once this discovery journey starts, it becomes very interesting as one progresses.

Thanks for your comment Srinivas .. Please keep sharing your views like this..

Manish

If dividend distribution tax @10% is deducted on dividend payable by the MFs then is better to go for growth option instead of dividend option as the gains are distributed in both growth and dividend options? Is it so? pl confirm as growth option is not dividend and hence not deductible under DDT.

Hi S H Rao

No , its a myth . In dividend option its just taken out of same fund and given to you. In growth option, its not taken out and you will pay the tax when you redeem it.

Manish

Please re- check. There is no dividend collected so there is no DDT applicable. What one will have to pay is LTCG when u file ur return. DDT will not be deducted.

Yes, In growth option, there is no dividend … So no question of DDT. But when you redeem your funds, there will be 10% tax. So in both cases, you get deduction of 10% on the money you get. Both are same options !

Are you advocating u pay income tax and cap gain tax? Not possible Manish. Please please recheck. I am confident you are wiser than me.

No , in any case you end up paying only 10% tax . One can get money in two ways

Case 1 : Either by dividends, in which case they will get 90% of the dividend declared

Case 2 : When they redeem on choice: They get 90% even in this case

Manish

Have read your interpretation dated 11th Feb. As there is no reply button below it am starting a thread underneath the main reply.

I am terribly confused. If what you say is a learned opinion please explain how can one avail of 1 Lac LTCG exemption if MF will deduct tax @ 10% redeem, and pay the MF holder.

Mutual funds will redeem 10% only on the dividends payment, not on your redemption.

Incase you choose dividend option in mutual funds and some dividend is declared and paid, only and only in this case 10% will be deducted and rest will be paid to you. In this case the 1 lac limit does not come into picture.

Only when you sell your mutual funds on your own (called as REDEMPTION) , either in growth or dividend option, you will have to pay 10% tax on your own above Rs 1 lac

I hope its clear now. If not, please let me know with some example !

Manish

I do not agree , i have never gone to see movies in theater since so many years In India ,neither my family orders any dominos -fominos I am a real middle class person ,The vegetable venders ,what you call them in reality are not follwer of Mahatma Gandhi too , they will throw vegetables in dump but will not sell at a lower price even if it starts rotten. who are real farmers in this country politicians ,film actors , corporates , sugar lobbying dalals ,they are really enjoying backdoor agriculture not the grass root level farmers they are doing real work and do not get anything . The recent data shows that the disparity of money between big corporates and average indian is huge as corporates are holding 58% of wealth is this good economy or good indicator of country’s health ,you economists always look at finance and development ,never talk about health and education sector ,which has been neglected in this country and on the contrary its very much important for growth ,look at europe ,north americas , where do we stand and neglecting this the share of these two sectors has been decreased in the recent budget . Salaried middle class is ,has and always been neglected by all govts. whether it be congress or BJP. Housing projects are mosly for low income groups ( influencing vote politics) ,in the eye of govt. middle class have no problems they never strongly resists . Just give u an example how govt. are cheaters for salaried middle class people ,look at the lag between announcement of pay commission and actual implementation done it takes years for implementation ,untill either the next pay commission is knocking at your door or in many cases even beyond that , the benefit is received after 10 years of announcement. None of the govt. has focus towards restricting population of india , which will take over china , the resources of the mother earth are limited its not infinite , whatever you try to increase growth rate ,you will never achieve it until u control population .

Thanks for your comment gurudutt .. Please keep sharing your views like this..

Manish

I have gone through the points raised by Mr. Patil, who has tried to arouse the middle class salary earners. But, here I want to remind him, why did not he touched our Netas( MPs and MLAs), who have anonymously agreed to raise their salaries and perks beside the fact that around 90% of them are very wealthy and rich enough to sacrifice the subsidies( canteen, air and railway travel and so many other benefits). Of course, I also have respect for some of them, who have not amassed wealth during their tenure. If our politicians are always expecting more and more from the exchequer ( being extremely rich), where is the wrong, if a middle class salary earner expect something from the Govt. Serving for the entire life, he is hardly left with any savings and becomes dependent on his wards. I think this should be considered by every one.

Thanks for your comment Lalmohan Patnaik .. Please keep sharing your views like this..

Manish

budget is good ..but they should need to focus on ourbasic needs

Totally disappointed. LTCG tax exemption on equities played a major role in increasing retail investor participation in equity markets. Despite this, the proportion of retail investor segment remains dismally low when compared to advanced economies. With the reintroduction of this tax, equity investing will become less attractive to the retail investors, thereby slowing down the shift of household savings towards equities. Instead, increasing the holding period for claiming LTCG exemption from one year to threee years would have yielded better results. This would have promoted long term equity investing and generated higher revenues through short-term capital gains tax. Govt want to take away all tax free investment options. I would not be surprised if tomorrow Govt of India makes investment options like PPF and Sukanya Samriddhi Account maturity amount also taxable. I don’t understand what they want to prove, on one side they are hugely promoting investment in equities, on the other hand they are demotivating small middle class investors, by imposing taxes.

Thanks for sharing your views.

How are you going to change your strategy now ? I mean , Are you going to decrease your allocation in equity and move to debt?

Manish

This may not force me to come out of equity market, but surely it will be difficult for MF advisers or Brokers to attract new retail customers. Until now, their punch line “No tax on Income you earn by investing in equity” was very attractive for new to market. This may lead to less investment in market and overall low performance (May be small fraction). And this will lead to my less earning from stock market.

Yes some impact might be there. . but not major impact I think !

How will LTCG affect SWP (monthly) from Equity, Debt & liquid funds?

When you do SWP from equity, then its redeemption, so if its after 1 yr, the tax will be 10% on the amount you redeem.

For debt/liquid , the same .. the taxation applies as per debt fund laws !