Now get a short term loan in your Paytm account by ICICI Bank

Paytm, India’s largest mobile payment network has partnered with ICICI bank to provide short term small loans to its users. This is India’s first scheduled commercial bank tie-up with a mobile payment platform, and it is named as Paytm-ICICI bank postpaid.

The main motive behind this partnership is to provide 24/7 digital money support to millions of Paytm and ICICI banks common customers across all over India.

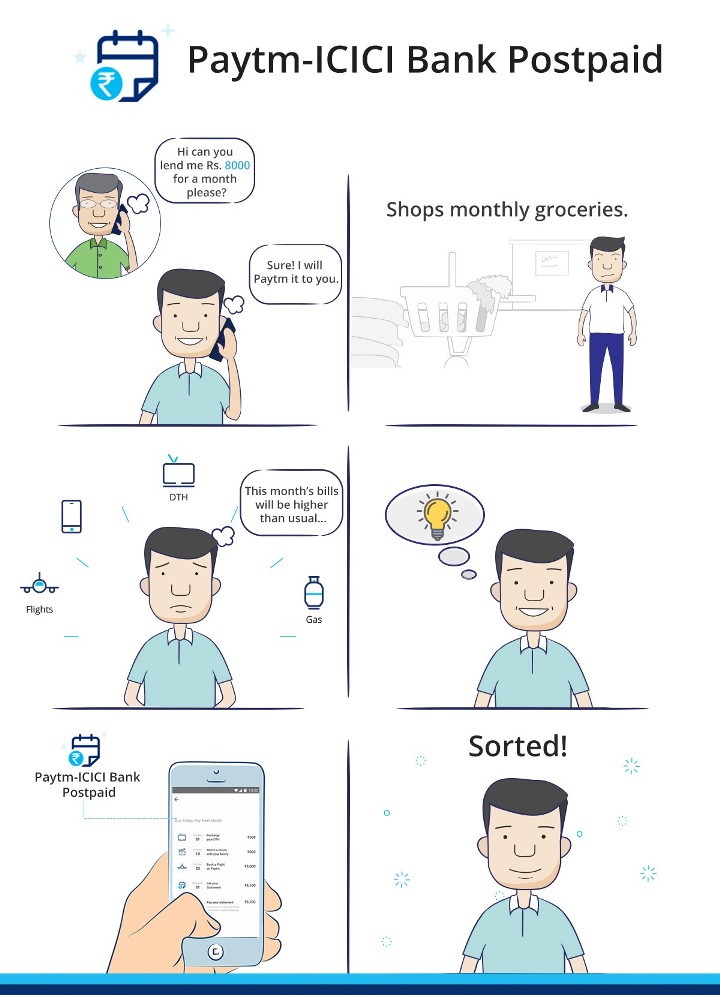

This feature is introduced to ease the daily expenses of all ICICI bank customers who are using Paytm, by providing them Digital credit. The below image shows you how it works

As per this tie-up, you can take digital credit in your Paytm account from ICICI bank, which you can use for your daily expenses like paying bills, booking flight or bus or even buying a movie ticket. You can use this credit anywhere where Paytm payment is accepted.

Please watch below video to know the details.

Type of loan and interest rate

This credit will be interest free for first 45 days. If you repay it within 45 days, then you will have to to pay only the principle amount and no interest will be charged. But if you delay the payment for more than 45 days, then you will have to pay a late fee of Rs.50 and 3% interest.

How much maximum credit can you take?

This credit limit ranges from Rs.3000 to Rs 10000. It means you can take digital credit of minimum Rs.3000 and maximum of Rs.10,000. And if you have a good repayment history which means you payed all your credit loan in time, then the limit can be extended for you upto Rs.20,000.

Which means that this is going to be useful mostly to students and those people who are left with no money by the end of the month or have severe cash crunch.

Right now this facility is available for the customers of ICICI bank who are using Paytm, but soon all the Paytm users also can get benefit of this newly introduced postpaid digital currency.

Who should use this?

If you are using Paytm heavily and if you are the type of person who has severe cash crunch and want to take short term credits, then this facility if for you.

We do not recommend this facility to be used unless you really need the money. Its better to always maintain liquidity in your bank account and not fall for this kind of service.

I hope this information is useful for you. If you have any query, leave your reply in the comment section.

December 7, 2017

December 7, 2017

Hi Manish,

Not to be a harsh critique here, The quality of articles has gone down for a while, Not sure if you are writing or doing someone to do ghost writing. The topics which is coming up are so called fillers. I know you might be busy with your business etc, please try and write on some burning topics like retirement, index funds, 4% swr related to retirement. Lot of people have no idea how bad a retirement can be if its not planned.

Thanks for all your efforts.

You dont have to publish this if you dont want to 🙂

Cheers

Hi Suresh

Thanks for your comment. You are actually right. We are quite busy and have been writing these fillers articles .. But we are also working on some other good articles which will surely come very soon. But better to put something rather than keep it empty, hence these kind of posts.

Thanks for your comment, I appreciate honest feedback !

Manish

Can we transfer that money to bank account and withdraw

Hi Srinivas

The money can not be transferred to bank account you have to use it through Paytm only.

So finally, there is someone who would be giving loans to students as well without asking for ITR. Good initiative

Thanks Karan

But the decision to issue the loan or not rests with Paytm or ICICI, depending on the spending pattern of the user.

Manish

Thanks for the post!!!

The feature will have utility for those who do not yet have credit cards.

Those who have credit cards can still manage to take credit despite transaction through Paytm.

Thanks for your comment Deepesh .. Please keep sharing your views like this..

Manish

This is not accurate, the video is wrong.

Paytm postpaid can only be used to buy things on PayTm, we can’t use it for other things like bill payments.

I have it and you can choose to pay by Paytm PP only when you buy some item on Paytm.

Hi Prithvi

Thanks for update. And yes that’s true you can use only to by through Paytm.

I don’t see this different from loading your paytm wallet using credit card . There also you get interest free 45-50 days.

Thanks for your comment SACHIN JAIN .. Please keep sharing your views like this..

Manish

It seems like a small amount credit card as well as it has all ability to trap people like credit card.

Good facility in emergency but suggest not fall pray to over using and over purchasing

Hi Rajiv

Yes ofcourse, it’s a good initiative but only if you use it wisely.

That’s a good news thanks Jagoinvestor for the info

Thanks for your comment Lokeshwar khajuria .. Please keep sharing your views like this..

Manish