5 reasons why people avoid retirement planning and die poor?

From last 8 yrs, I have been talking and dealing with investors & I can see some progress on how people see their retirement these days. They have got more “serious” about retirement planning.

Almost all the clients we have, for them retirement is a big goal and their focus on it is worth appreciation. But that’s a very small number, few hundred may be.

If we talk at the mass level (All India level), there is almost no seriousness for retirement planning. At the mass level, people are very short sighted and plan for their short term goals, but not “long term goals”

5 reasons why investors don’t plan for their retirement?

What about you?

Have you started your retirement planning?

Is some money being invested for retirement goal each month?

By “Retirement planning”, I mean a well thought investment plan (it might not be written) for your future. Are you consciously thinking about create a big enough corpus at your 60, which will support you for next 30-40 yrs?

Please do not confuse “retirement planning” with buying some random policy for your 80C deduction, which had a word “retirement” in the name. It’s mostly a well marketed product sold to you on the name of retirement.

Now, let’s see some of the top most reasons why people don’t invest for their retirement seriously!

Reason #1 – It’s a “Selfish” Goal

I recently attended a session where the speaker asked this question – “Which is the most important financial goal of your life?”

To this, there were many answers like ..

- Retirement

- Children Education

- Buying a House

- Getting Debt free

- Stating own business

- Daughter Marriage

But the trend was clear… “Retirement” was not in majority.

The group age range was between 30 – 50 yrs. The speaker was silent for a moment, but then he said something which really hit me.

“Most of the people know deep down that Retirement is their biggest goal, but they refrain to accept it because it’s a SELFISH Goal”

Planning for Retirement is a “selfish goal”

Yes, retirement is about you and your requirement. Your retirement is the most costly financial goal and long duration goal, which will have to be provided for not just years, but DECADES.

It feels very odd to openly accept this and say this, especially in a society where we are always taught to first provide for others and think of others needs. We are taught from childhood that we should not think about yourself, we should not be self centered, we should think about others, we should think of others before thinking about yourself.

“Others” here can be our parents, children, friends, relatives, husband, wife or anyone else.

It’s a taboo to tell someone that “I want to first think about my own happiness and requirement at the cost of others”. You suddenly become “self-centered” and “rude”.

This is one major reason why a lot of people think of their own retirement at the end, only when other goals are planned for.

I think this is changing slowly and the way people are prioritizing things is slowly taking a new shape. I can now see a trend, where people have started giving importance to their own dreams and desires, compared to our parent’s generation.

While, you plan for important financial goals of your life, like buying a house, your kid’s education, children marriage etc, you need to give first priority to your own retirement.

It does not make sense to not plan for your own retirement, at the cost of other goals.

Reason #2 – Because it’s too early to plan

Imagine you are 30 yrs old.

It’s been just few years since you started your career. The top most thing in your mind right now is “how to buy the house?” and how to get the better pay package in the next job?

You are so engrossed into the hustles and bustles of life, and suddenly something says to you “Are you saving for your retirement?”

“Dude, I am just 30” – You feel !

Let’s be honest, it’s very tough to get serious about retirement at such a young age.

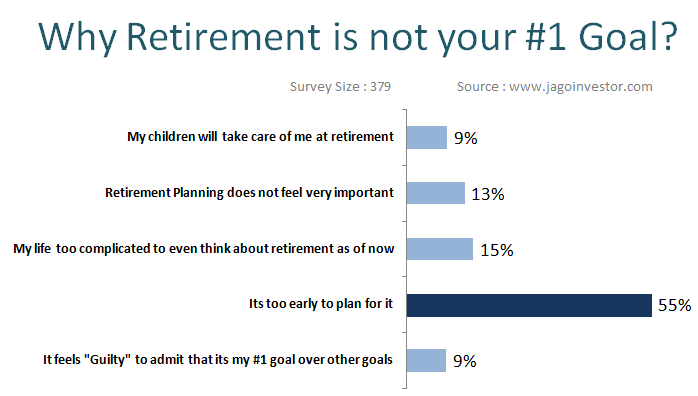

Some days back, we did a small survey with 379 people where we asked them what was the biggest reason why they did not consider retirement planning as their #1 goal in life, and the top most reason they choose was “It’s too early to plan for it”, the average age of this group was 30.4 yrs.

Which clearly shows that people are 30 are avoiding retirement planning because they feel it’s too far in future to even think about it.

But there is a problem…

Most of the youngsters never get out of that “I am still young” mode for decades. And one day when they hit 40-45, they feel they made a mistake of not starting early. Some people realize this at 50.

And then by that time, it’s very late.

So even though your retirement is very far away, you need to get this once and for all that you would need a big sum of money at the end, and early you start, better it is. You might not give high priority to retirement saving in the start, but start with something at least and increase the allocation later in life as you move from 30 to 40 .. and so on.

Reason #3 – They are not able to visualize the “Retirement” goal

We all are very bad at predicting how our lives will turn out to be after 10 or 20 yrs old. Just think about your past for a moment. 10 yrs back, did you have even a slight idea of how your life would have been today?

Not at all!

So it’s tough to predict how good or bad the future will be.

This is the reason, why most of the people do not plan for retirement. They are not able to visualize how serious it is to plan for retirement and how tough it will get if they do not have enough retirement corpus.

Most of the people who earn sufficient money right now never realize that one day the SMS – “Your salary XXXX amount has been credited in your account” will permanently stop and they will be left with another approx 40 yrs to be alive.

Your health will not be at the best level and your kids may not be in position to take care of you in the same way you imagine them to take care of you. They will be busy and struggling with their own life issues.

It’s not easy to look far ahead in future and visualize it especially when you have a very active income right now. Just like its very tough to image how it feels to be hungry, when you are easily getting 3 meals each day.

There are various examples of successful people who died poor and struggled in their retirement life. If you do not have enough money in your retirement, you do not have power with you. People do not treat you well, and that’s the harsh reality of life.

Don’t be that guy !

Subra has written a great piece called “Retirement Failure”, where he talks about how a retirement life looks like, if you do not have enough money at retirement. He is one of the best authors and writers on the topic of retirement, so you can trust him 🙂

So start getting serious about future and plan for the D-Day !

Reason #4 – Not able to save enough money

People also don’t save for retirement for the simple reason that they just don’t have any surplus left at the end of month. It’s fairly logical!

Incomes are not increasing, while expenses are growing like amoeba in all directions. It’s getting tough to save in today’s times especially if you are single earning member in family with 5-6 people in a big city.

It’s true that you are not able to save much, but that’s something to get altered to and act on it, rather than hide behind that fact and just let years pass by.

Just because you were not able to save enough for future, no one is going to give you money at your retirement.

So take charge of your future now, and act on it. Work on your income, work on your expenses and make a start. Start saving with Rs 1,000 a month first, then Rs 2,000 and eventually go up and up.

Even if you are able to save Rs 5,000 or Rs 10,000 a month at minimum, a good retirement corpus can be generated. You will not be a RICH guy, but you will have something to fall back on at least.

What can you do with Rs 10,000 per month?

Below is a graph which shows you the power of investing Rs 10,000 per month on a regular basis for next 30 yrs. You can create close to 4 crore at retirement if you are a 30 yr old person.

It can be a slow start, but that’s OK.

If you want to talk to our team for your retirement planning, just leave your details on this page and our team will call you to discuss about your retirement planning.

Reason #5 – They see their kids as retirement corpus

I am not giving my own comments on this point, it has to be written by you.

Yes, I do not want to give my comments on this point because it’s such a sensitive topic that various people will have very different style of thinking on this topic.

From my side, I can only say that I can see lots of people in big cities these days who are very clear that they do not want to depend on their children for anything. They want to give the best to their kids and raise them as amazing people, but then they do not expect anything back from them.

But from the small city I have come from (and many of you) , it’s almost a crime to think like that. Most of the people really see their children as “Budhape ka Sahara” and literally expect them to take care of them “because” they have also raised them and spend on them all their life, so it’s now their turn to return back.

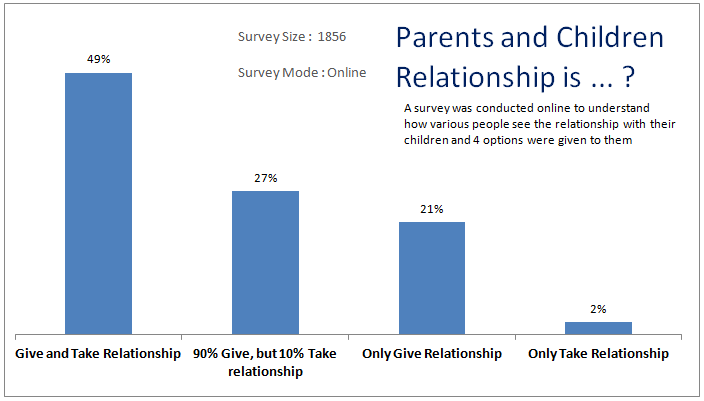

How do you see the relationship with your kids?

Few months back, we did one online survey on this website to understand how do people see their relationship with their children. 49% participants in that survey choose the option which said “Give and Take Relationship”, where as only 21% felt that it’s only a “Give Relationship”.

I can’t comment if it’s right or wrong, but would like to know from everyone, what they feel about this point? Please expand this 5th point in comment section and have some fruitful discussion.

December 19, 2017

December 19, 2017

What a great Article. I would like to appreciate your all efforts with this Article!!

Great Perspective I agree with your way of thinking on Retirement Planning.

Coming to the 5th point

I personally feel that we should never expect depending on our children for financial aid after retirement.

We never know what situation our children will be there when they are adult.Each and every person should save as much as they can and build a retirement Compilation that should cover basic living expense and medical needs.

Good point !

Thank you.Keep sharing your views..!!

reading this article of your was mind blowing and put me too in a state of shock as i am also going to be retiring in next 12 months. worried as i fall in give only situation.

Awesome post manish!!! The need for retirement planning has been important nowadays. As the time goes on, there’s been a priority of retirement planning for every individual. This article will act as a eye opener to the people who thinks it early for retirement planning. Thank you for the post, Keep Posting!!!!

Thanks for your comment Abhishek Sen .. Please keep sharing your views like this..

Manish

Hello There! Thank You For Sharing The Info. It’s Really Useful & Enlightening. Will Revisit Continuously To Check Up For New Updates. Keep Up The Good Work

Welcome !

Very Good article

Thanks for your comment jokes in urdu

well written article. i think we must hope for the best yet prepare forthe worst. my query what about people who are in btween jobs or does not hold a steady income? what about retirement plans for such category ?

In any case, you need to invest some money once in a while .. If its not possible to invest each month a fixed amount, then in that you can invest a lumpsum whenever you have the money

Manish

I have observed that people of our generation are taking care (or will be) of their parents while we dont trust that our children will do the same for us. We so distrust our own culture and genes. We are not Americans, I am sure future generation want be as Nalayak as we are painting them to be not only on this blog but everywhere.

Having said that retirement planning is a must we should prepare for the worst.

Thanks for your comment Umang

Well, even looking at it altruistically for the kids, you don’t want to depend on the kids. We have no idea what challenges they may face and what trade offs they will have to make to provide for the parents. IMO, it is very selfish to have to depend on the kids for retirement. While I raise my kids to care for the previous generation (like i do) and I know they will I don’t want to be a burden.

Thanks for your comment Ram

Manish, It is nice article put together and I am sure it is a reminder for a lot of people like me. For Point number 5, I think nowadays people are realizing (having a nuclear family and learning lot of things from western culture) not to depend on their kids. But this is true with the people who are upper middle class. But people who are below middle class, they cannot afford to think of this since they will not be able to make enough money for their retirement and they will end up staying with their kids even though it is a struggling life. And also as you said at the mass level, there is very less number of people who will plan for their retirement. Do you think is there a way, people can be educated including the middle class and below middle class.

Educating people to plan for retirement is a very large project and this will take decades to educate the mass about it. People dont get the fact that they plan to plan well for their retirement just because some blog wrote about it. SOme people do, but most of the people learn from their environment and situation and the next generation implements it.

This “retirement planning is important” fact will get into heads of people layer by layer .. Like in US now majority of people understand that retirement is extremely important and one has to not depend on others. This has happenened only because of the culture change and it will also happen in our country, but its a slow process.

My advice to present generation people who are in their 20s and 30s to not think of their children as retirement corpus. Times are changing and you cannot look at the social structure of the past to assume that your kids will take care of you in the same way you are taking care of your parents. Nuclear families are now the norm and most children from well off families look to fly abroad after completing their studies. Also mindset of people are changing. So expect to live all alone after retirement and fund all your expenses yourself. This is the reality and we should look at the social fabric of developed countries to get a glimpse of the future.

This is why it’s important to make Retirement planning as #1 goal right from the start. Plan to fund your children’s education till school only. For college, get him an education loan and let him learn the responsibility of grown up adult life on his own. With the pressure to pay off EMIs after getting job, he will automatically learn the value of money stop wasteful expenditure. You need to think about your future too and it’s definitely not selfish to do so.

Another thing is cost of living and lifestyle expenses of present times are vastly different from previous generation. Since more luxury and comfort in available at our fingertips, people are not willing to live frugally like our older generation ancestors. In previous generations, the working head of the family could feed 10 people with his income because people lived frugally and didn’t expect much luxury. Nowadays, that’s not the case. So, it’s becoming very important for men to marry working women who can also support the family financially. Girls should also wake up and realize that their honeymoon days of sitting at home while the husband slogs away all day long to feed 5-6 mouths in the family are over. I still see many girls of present generation who do not take education seriously because they know they will get married and some guy will take care of them. This mentality needs to change.

Wonderful detailed comment .. truly endorse what you said !

I want to give my son for Housing amount more than 25 lacs instages . Whether and what precausions I should take,please guide

You have not written your query in full context ?

Give it by cheque .. What is the the method ?

Coming to 5th Point, Seeing children as retirement corpus.

I feel our generation is inbetween . We are prone to feel guilty if we do not take care of our parents. But at the same time, we cannot expect our kids to take care of us. As time Changes, things change and do not remain the same, Hence, we need to plan our savings after taking care of our parents expenses, but not be dependent on our children. If we get from our children, it is a bonus.

Thanks for your comment Minu Amar

I absolutely agree what you said. We are actually in between 🙁 The people who are born on 80’s are really confused. But we will get used to it since we do not have options.

Very Nice Article Manish. I have one question, what if we invest in real estate instead of cash / bank/ mutual funds or stocks. Keep it long for 20-25 years and then sell it when we retire (As i have two flats – One with no liability and getting INR 7000 PM and one is mortgaged till 25 years, and paying mortgages through rent only). Would like to hear on the same from different perspective. And regarding 5th point – i do agree with to give the best to kids and raise them as amazing people, but then they do not expect anything back from them.

Any thing which can build your wealth is fine, but the question is for 20-25 yrs , if real estate is the best wealth creator compared to equities. FOr that answer is NO .Unless its a very very lucky investment, real estate has not beaten equities ..

And the returns from real estate is not going to be the same like it has delivered in last 20-25 yrs ..

So my suggestion is not to be very heavy weight in real estate and if you already have some good wealth, better divert it to equities

Thanks for another excellent article Manish!!

My perspective is that Retirement Planning and planning for children education should not be seen differently in order to get away with the guilt of seeing it as a SELFISH GOAL. Below is what I think, will happen in the event of saving for it or not:

1> If we don’t plan for retirement and put all the saving for children education and other things, then the odds are that we won’t have enough saving for the non-earning years. In that case we will have to depend financially on the children. Certainly we will not be helping our children at that point in time.

2> If we save for the retirement too apart from other goals, then certainly we will have a corpus to dig into during retirement years. This way, we will not be dependent at all or less dependent financially on our children. This will be a great relief for them in terms of their personal finance.

Ultimately planning for your retirement, you would be helping your children too.

Retirement planning mantra for me is “save more to save more”. Once you start saving irrespective of how small it is and you see it growing with time, then there is a temptation of saving more.

Very good points Priyank .. No matter what we need to save is the conclusion I think !

On the 5th point I personaly feel that one should never assume depending on children for financial assitance after retirement. We never know under what situation our children will line in when they are adult. The golden rule in financial planning is “Always plan for the worst”. If your children are able to take care of you it is a bonus but do not plan for it. Everyone should save as much as they can and build a retirement corpus that will atleast cover basic living expense and basic medical needs.

Thanks for adding your views on this Amogh .. very valid point !

Thanks Manish!!!

Think reason 3 is very pertinent. Most people do not appreciate the kind of effect inflation will have on their reitrement corpus. To put it another way, they are a bit complacent about how much they need for it. Their retirement requirement may be vastly underestimated.

Yes, very valid point !

Well written. 🙂

For 5th point, i think those who are being dependent on their children to take care of retirement haven’t probably thought through around what life can throw in terms of good and bad as surprise beyond one’s control .

I am 28, from Surat, living in Pune. Am sure, am gonna take care of my parents few years down the line! 🙂

But if i think about having kids and then being dependent on them to take care of me when i am old , sounds damn crazy. I don’t think, they will have any obligation to do, if they don’t want to. If they do, i will be happy. If not, i shall be in position to survive on my own. Otherwise, i would have a story for which people will offer sympathy and move on. I don’t think, sympathy can be converted in food and shelter. Correct me if am wrong.

I won’t call it even hedging. I have started saving considering, i and my partner will be on our own. If kids will be around, we all will have fun together, if not, atleast two of us will have! Fun is not going anywhere, not after 60, for sure. 🙂

Thats a very positive and great insight . Good to know that you have started to save for your retirement !

This is a very good article Manish. Thanks for the details you have put together.The 5th point is surely a sensitive topic. I am also from a small town but I am of the belief that the Parent Child relationship should be only a Give relationship. The decision to have kids is ours and and we take that decision to fulfill an inner desire to feel complete. So the only thing we should expect in return from our children should be love. Yes if they feel they want to take care of you its ok but if they see it as a burden then you are better off living on your own in retirement.

And you cannot plan for this scenario when you are retired or nearing it. So better to start as early as possible. I am 38 now and started planning for this goal since last 5 years. This article is again a welcome reminder and provides some good pointers

Great to know your thoughts on this topic !

Very Good article, Every Youngster who stars their earning must start Equity Mutual fund through SIP At lest 20% of their earning to keep aside for retirement planning to build a huge corpus and see the effect of power of Compounding

Equity is not Risk in long term planning

Thanks for your comment Chandrashekhar N

Dear Sir,

This is really a very nice and eye-opening article. One must save enough today, to secure their tomorrow. However small the amount of saving is today, but one should start. The power of compounding will do its duty.

I strongly believe that today’s saving is tomorrow’s income.

Under temporary temptation, people buy things beyond their budget (for example, mobile and car). If they actually evaluate the cost-benefit aspect, they can understand the situation. This happens almost in all the cases.

By not buying unnecessary things today, we can buy necessary things easily in retired life. This is not compromise, but this is financial shield.

Thanks for your views on this topic Viral !

Rightly said Manish. I appreciate your thoughts on Retirement Planning. In fact today’s generation -after getting Jobs will always thought for short term goal (naturally) since they freshly came out of college campus and need to fulfill their dreams.

The way you thrown light on the retirement planning, definitely people in 30’s will think and accordingly can plan for future.

Glad that you acknowledged it 🙂 . Would like to know your thoughts on the 5th point if you can take out 2 min for that?