How is Rupay card different from Visa or Mastercard?

Have you heard about RUPAY cards? Today we will talk to them in detail and how they are different from Visa or MasterCard and if you should choose them or not. But before that, let’s understand the background first.

What is Visa or MasterCard?

You must be already having a debit card or credit card which must be having either VISA or MASTERCARD written on it. Visa and MasterCard are credit card networks with their own systems, rules, and processes for payments, benefits, etc.

However, Visa and MasterCard are both American companies globally accepted and widely used card networks across the world. There are some other card networks also like American Express, Amex, Citi etc, but you got the point. These are global card companies.

Now, these companies do not directly issue a debit or credit card, but various banks across the world offer their cards with payment network operators which can be VISA, MASTERCARD or others.

What is Rupay?

Rupay is just another payment network solution like VISA or MASTERCARD, but it’s our own desi version. It’s an Indian company and purely an indigenous product creates by us. Here is what Rupay website says

RuPay is India’s indigenous card scheme created by the National Payments Corporation of India. It was conceived to fulfill RBI’s vision to offer a domestic, open-loop, multilateral system which will allow all Indian banks and financial institutions in India to participate in electronic payments. It is made in India, for every Indian to take them towards a “less cash” society.

RuPay is the first-of-its-kind domestic Debit and Credit Card payment network of India, with wide acceptance at ATMs, POS devices and e-commerce websites across India. It is a highly secure network that protects against anti-phishing. The name, derived from the words ‘Rupee and ‘Payment’, emphasizes that it is India’s very own initiative for Debit and Credit Card payments. It is our answer to international payment networks, expressing pride over our nationality.

RuPay fulfils RBI’s vision of initiating a ‘less cash’ economy. This could be achieved only by encouraging every Indian bank and financial institution to become tech-savvy and engage in offering electronic payments.

Issuing Banks

Presently, RuPay has collaborated with almost 600 international, regional and local banks across the country. Its ten core promoter banks are State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank N. A. and HSBC. It expanded its shareholding in 2016 to 56 banks to bring more banks across sectors under its umbrella.

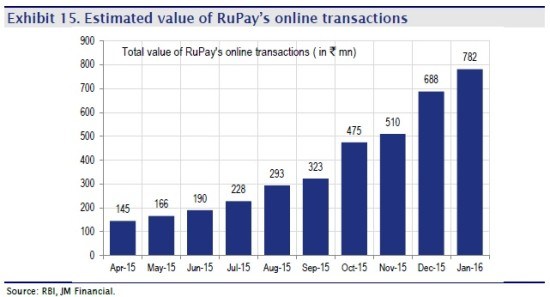

Rupay cards usage is increasing

Online transactions are increasing day by day in India as we are moving towards a cashless economy and the usage of Rupay cards is also increasing. Here is some data on Rupay online transactions.

Why Rupay was launched?

As we are moving towards becoming one of the major economies of the world, it was very important that we own our own payment solutions like Visa and MasterCard and hence govt started working on Rupay!.

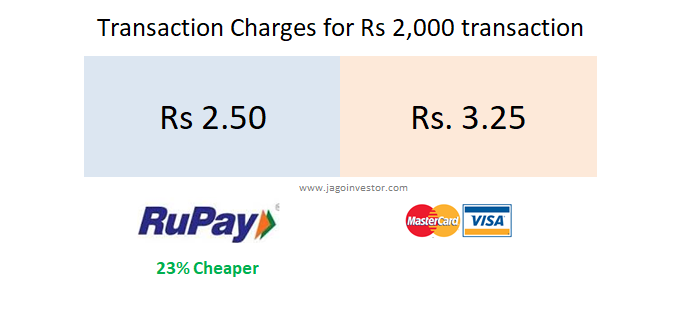

Two more benefits of the Rupay card network are that.

- The transaction history will not go out of the country if the transaction is within India.

- The charges that banks have to pay quarterly or monthly to the related companies to enter into the network is very low or NIL.

The image below shows you how a Rs 2,000 transaction charges will be lower in Rupay cards compared to a visa or MasterCard.

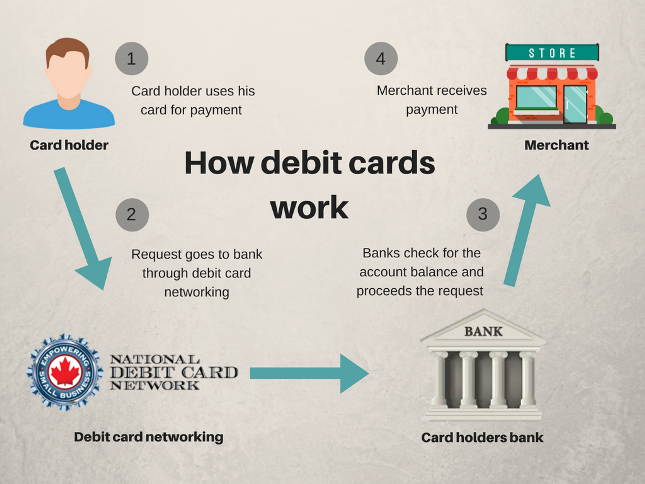

How does any card processing happens?

When you swipe your debit card or make an online payment, your request first goes to the debit card networking and then from there it goes to your bank. After that bank confirms your account balance and then completes the further procedure or transferring payment money to the merchant’s account.

See the image given below to know the procedure of your card.

Difference between Rupay card and Visa/Master card

Now let’s talk about some differences between Rupay and visa/MasterCard companies. This will give you a fair idea of how they are different from each other on various points.

[su_table]

Rupay |

Visa/MasterCard |

| Rupay is 100% Indian system | Visa/MasterCard are international systems |

| Lower transaction charges compared to Visa/MasterCard | It has higher transaction charges than Rupay Debit Card. |

| Banks don’t have to pay any fees to enter into the network | Banks have to pay fees to join the network |

| Transaction history remains within the country. | Transaction data is shared outside the country as it is an international card |

| All processing is done within the country so it has a high speed of transactions | Here the processing happens at an international level so sometimes it has low transaction speed or errors in server |

| Some banks shows Rupay credit card on their website but it is not launched officially yet by NPCI. | Visa/Master credit cards are available and have a strong network |

| The usage is very low and not widely accepted as of now | Widely Accepted and Used |

| Can’t be used outside India as of now | No restrictions like this |

[/su_table]

Transactions limits of Rupay debit card

Rupay cards like any other cards also have transaction limits and ATM withdrawal limits. Here is a quick list if you want to refer them.

[su_table]

Bank Name |

Limits (ATM transactions) |

| Central bank of India | Rs 40,000 and Rs 1,00,000 |

| Bank of India | Rs 25,000 each |

| Bank of Baroda | Rs 25,000 and Rs 50,000 |

| Vijaya bank | Rs.30,000 and Rs.25,000 |

| Punjab national bank | Ra.25,000 and Rs.60,000 |

| Oriental bank of commerce | Rs.25,000 each |

| Dena bank | Rs.20,000 and RS.25,000 |

| UCO bank | Rs.25,000 each |

[/su_table]

How to Apply for Rupay card?

If you want to apply for a Rupay debit card, then you must first check with your bank if they have them or not? All the bank accounts under Jan Dhan Yojana already provide you the Rupay card, you don’t need to mention separately in your debit card application if you open an account under this scheme.

Let us know if you need any more information about the Rupay card and we will be happy to answer them in the comments section.

October 31, 2017

October 31, 2017

Hi, I am using visa debit card, but some time there is lot of issue for withdrow the money, and lot of time canceled the process after all transaction processed. My card is not working properly, so I am intrested to take rupay card for non international using. Can I apply online?

Hello Yogesh,

You can take the rupay card if you wish, for that you can either apply it with the same bank you have your account with or any other bank. Very less options are there for online . one of them is KOTAK

Thank You

Anuradha

Useful information

Thanks

Excellent Information.

Thanks for your comment Brij Bhan Mishra

Very nice article …thanks. ..i will apply for rupay card

Thanks for your comment Anurag Sharma

According to my opinion, Master Card is better than Rupay, though I have not used a Rupay card yet. A nice and informative blog to read. Got to know more information about banking and Debit Cards.

Hi Aliv Dutta

Master card definitely has more benefits. Rupay card is a new initiative hopefully banks and government will add more feature in it soon to provide more benefits to its users. Thanks for your sharing.

Rupay card has arrangement with Discover card for international transactions

Hi vip

Yes NPCI has that arrangement of Discover card and Diners Club International cards which allows rupay card holders to use this network for any purchase or cashless transactions outside India.

What’s to be done to change existing card to rupay card?

Hi Vipul Mehta

As i know you have to submit your old debit card and apply for new one and mention that you want Rupay card in your application form. You can also contact your bank’s toll free number and ask them.

Excellent! Good Information.

Thanks for your comment U S Pandey

Thanks for your comment U S PandeyThanks for your comment U S Pandey

What you are trying to project? that we use Rupay & not use Visa & Master. Isnt is biased reporting ?

A Presstitute ?

No sir, its about telling you the difference between Rupay card and Visa/Mastercard.

Its just an article, not a gun point which can force you to do anything 🙂

Manish

what’s bad in promoting indigenous product?

@Tamal. Nowhere the author has tried to project one or the other as better or worse. The facts have been presented without any bias or tilt. There is complete absence of subtle manipulation in favour of either Rupay or Visa card. So it’s you who read it with a presumption of this informative article as being biased and reached at a wrong conclusion.

At least the Indian organization serving the public online tyoo –like donations to NGOs, hospitals & charitable Instittuions should have these on their transactions! Most POS still donot know about this!

Yes, the awareness about this is very low right now . But in coming times it will spread !

Can I withdraw as well as deposit money from this card. What is the charge in SBI rupay card?

Hi Ujjwal Howlader

Yes you can withdraw as well as deposit money from this card. Charges are different from bank to bank, you can just contact with SBI customer support and and get the exact details about its charges.