How to check a fake GST number online in just 30 seconds

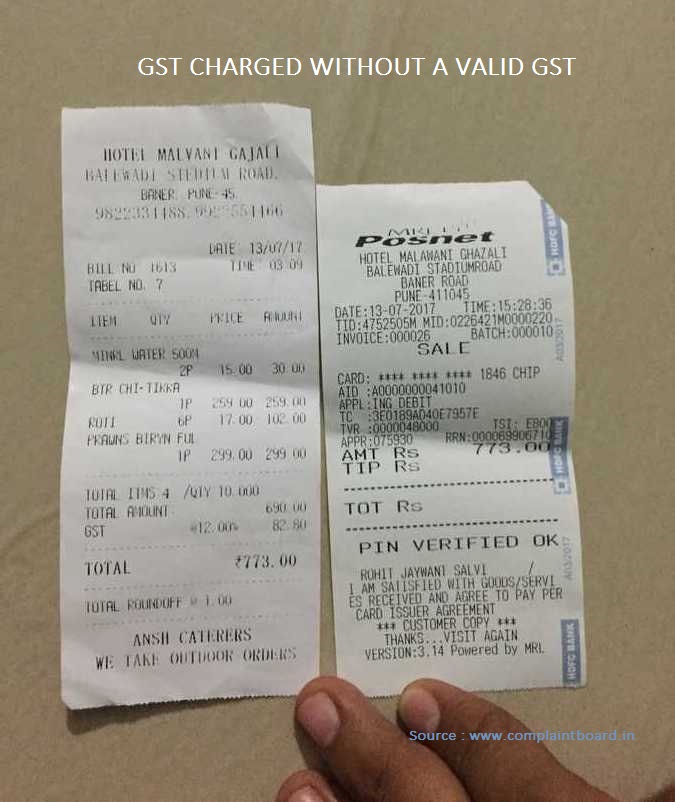

Now a days various restaurants and businesses are putting fake GST number on the bills and charging extra from the customers without registering with the GST department. In this article, we will teach you how you can check the validity of the GST number and its really valid of not in just 30 seconds. It’s a simple process that can be done with 2 clicks.

GST is now a reality and almost everywhere GST is charged. You can see that suddenly those restaurants who never mentioned any taxes in their bills have also started adding 18% more on the bill on the name of CGST and SGST (more on that later)

How fake GST number on bills is creating a hole in your pocket?

GST is a big reform in the country and while govt claims that it’s a simple tax, there are lots of inherent complications to this taxation system. A common man thinks that now everything has got costly by an extra 12% or 18% (especially in smaller cities)

One of my friend in Varanasi told me that a small shop near his place is charging extra Rs 2 on a packet of biscuits now telling the poor customers that its GST tax which is now to be paid.

While that’s an example of a mid-level city, many restaurants have also started putting fake GST number on the bill and have started charging extra taxes which they will never deposit to anyone.

How to verify the GST number?

Verifying the GST number online is a very simple procedure. First of all check the GST number on the receipt. It’s 100% mandatory to mention the GST number on the invoice or bill.

If someone is charging GST, without mentioning the GST number, then it’s illegal. Earlier it was service tax, now it’s GST number which is mandatory to put on the invoice.

Here is how to check if GST number is real or fake?

- Check the GST number on the bill and note it down

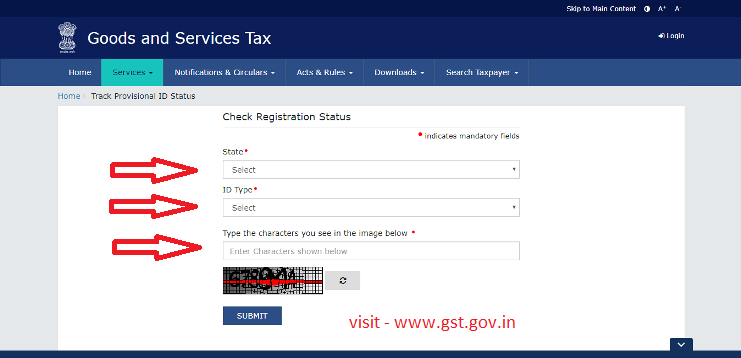

- Visit this page of GST website and enter the GST number as shown below

- Enter Captcha and press Submit.

- You will see the business name registered, match it with the name of the business on invoice

What if I don’t have a GST number?

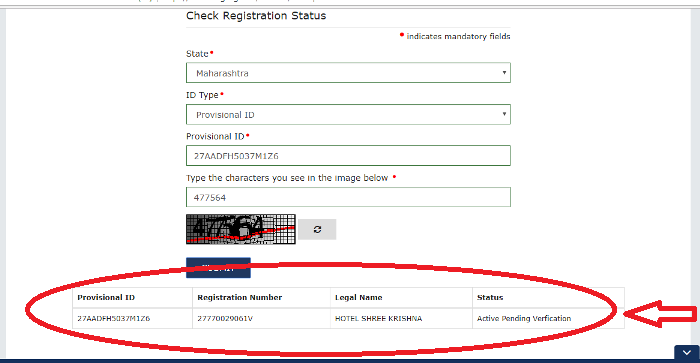

Some businesses still don’t have the registration number confirmed, but they have the provisional GST number with them, so you can also check the provisional GST number online and verify them. Even you can verify the business based on their PAN.

Here the steps to verify GST number in this case

Go to this link and you will be asked various details which you need to enter.

Here you need to fill the data required correctly i.e. state, ID type (PAN number, GST number or Provisional ID), ID number and verification code. At last click on submit and then scroll down to see the details of the registered business.

This is how you can verify if GST number is valid or not with the help of a provisional ID or PAN number. As of now, there is no way of finding or verifying the GST number just by entering the name of the business entity.

GST is a 15 character code

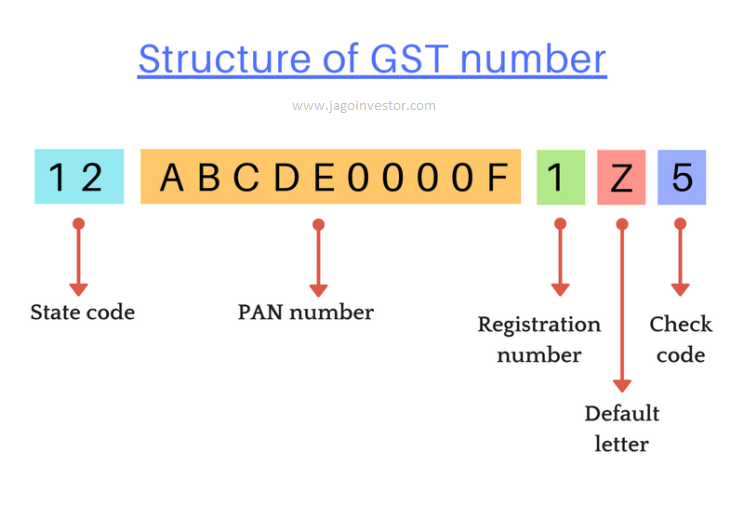

It’s an important point to know that GST number is 15 characters which are a combination of numbers and characters. These 15 digits are broken into 5 parts as follows

- First 2 digits are state code where the business is registered

- Next 10 digits are PAN number of the business

- 13th digit is registration number of that store or business with same PAN number

- 14th digit is Z by default for right now

- And the last i.e. 15th digit is a check code

What is someone says “I have applied for GST number”?

Some shopkeepers and business owners are playing the trick of “I have already applied for GST number, It’s not yet approved?”. This is to give a feeling to customers that they are rightfully charging GST. But this is again a fraud.

Because when they apply for GST number, they get a provisional GST number anyways and they need to either put a GST number or provisional GST number on the invoice/bill

Don’t fall for this trap and demand to see the GST number.

Where to complain about fake GST number?

GST department has dedicated the helplines for you to complain or ask any queries regarding GST. Here are the emails and phone numbers

- GST Complaint mail id: [email protected]

- GST Helpline Number: 0124-4688999 or 0120-4888999

Let us know if you have more questions on how to check if the GST number is valid or fake?

October 3, 2017

October 3, 2017

Hi there is company name GREEN LIFE AGROTECH with GSTIN number – 22JRKPS2938M1Z1. This company has taken a order and payment through cheque but now the company representative are not reachable. How can I find the details of this company through GSTIN number like company owner, phone number and registered office address?

You can search it here : https://services.gst.gov.in/services/searchtp

But you wont get any contact details

Nice information shared

Thanks

Nice Article , its very helpful to all

Thanks for your comment Nandram

Very nice blog on GST keep on sharing

thanks

Thanks

Very informative for our day to day life

Hi Ajay

Thanks for comment.

how to find HSN code. pl suggest website

For what purpose? Your CA will give it to you !

It is difficult to check every time we pay GST, weather the tax payer GST number is true or false.

I have got some idea

1. If GST team provides SMS service then immediately user will come to know the GST number true or false. Eg. send an sms GST number to XXXXXXXXXX. Immediately GST team will send registered merchant name.

I think this will work.

You dont have to check this everytime you go to any restaurant or buy something. Its only a measure to cross check GST number in 1 out of 100 situations when you really doubt the other party !

Thank you for this very useful information.

Welcome !

What is the guarantee that the businessmen actually credit the collected gst to govt. Can they get a valid gst number, print on the bill, collect from the customer but keep the money with them instead of crediting it to govt?

It will get caught while filing the tax return . Specially when the payment is happening online. The money will be coming to his account and he has to explain to govt on the GST payment for that particular transaction to govt if he is caught in scrutiny. Now its very tough for someone to collect GST and not pay it !

This is really very nice and informative article Thanks for sharing this type of article & keep posting amazing article. keep it up

Thanks for your comment Dilip panda

Valuable Information provided.

Where we have to complaint, If someone is doing business without GST number.

Hi Vipul Patel

Helpline number and mail ID of GST portal are given in the article you can contact them in such case.

Really very good information for us. keep it up

Thanks for your comment devendra

thank you very much for the valuable info.

Welcome

Thanks a lot for guidance its easy to understand each corner thanks again and keep it up…..

Glad to know that Jagdeep ..

How much GST is applicable for new house purchase?

Its 18%

GST Complaint mail id : [email protected]

GST Helpline Number : 0124-4688999 or 0120-4888999

the above email id and helpline number are for if you have any query related to GST but they are not taking complaint. I am also having one false bill of restaurant. when i called the helpline number for complaint they told be that they cannot register complaint over here you need to approach consumer forum.

Kindly help is there any online complaint forum available for this

Did you email them any complaint? Did they say they are not taking complaint ?

You are doing great help with such simple explanations. Thank you.

Could you please clarify if States are allowed to charge GST. For example, in Kerala most major shops are charging CGST and SGST same percentage each which means double tax whereas initially we heard in news that only one tax will be charged when GST is implemented. A friend from Hyderabad says he also noticed similar practice.

The GST is divided between two component, CSGT and SGST if the services taker and giver both are in same state. NOthing wrong in that !

You are doing very good work for educating the society. The points given in the article are very simple and easy to use.

Thanks for your comment Sourabh

Valuable information. Thanks for educating customers.

Thanks for your comment Dhaval