Basic Services Demat Account – a no frills account for small investors

Do you hold a Demat account or planning to get one? Then you should know what is a Basic Service Demat Account because it can be helpful for you if you are planning to trade very less and want to save on yearly maintenance charges.

Basic Services Demat account as its name suggests is a basic version of a full-fledged Demat account that provides basic level services. It’s ideal for those whose portfolio size is quite small. We will look at the details in this article. But before that, do you know what is Demat account at the first place?

What is the Basic Services Demat Account?

Demat or Dematerialized Account means an electronic account that holds various financial securities (especially shares) in an electronic format securely. Demat account is a compulsory account for those who want to buy company stocks from the stock market.

Demat accounts are under the control of SEBI i.e. Security and Exchange Board of India. Now, from 27 August 2012, SEBI has brought a guideline that every Demat provider will have to provide “Basic Demat accounts” available to every beginner in the share market so that it can encourage the people to invest in trading. This will be helpful for achieving wide financial inclusion.

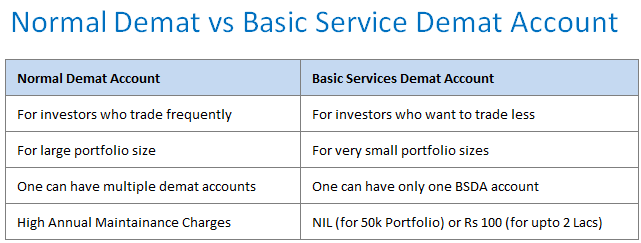

So all those investors, who want to trade less and have a portfolio size of small amounts can open a basic Services Demat Account (BSDA) and save on the annual maintenance charges.

Where to open a Demat account or BSDA account?

You can open your Demat account or BSDA at any bank like SBI, ICICI, HDFC, Kotak Mahindra and many other banks, or with a stock broking companies Angel broking, 5Paisa, Sherkhan, etc. directly. Opening both Demat Account and Basic Service Demat Account is free at both banks and broking companies, but again the AMC varies.

These banks and broking companies provide free services for the first year and from 2nd year onwards they may start to apply charges on the basis of transactions. So before applying for a BSDA or Demat account check for all the details on the website of that particular bank.

How are Basic Services Demat account different?

Basic services Demat Account is a Demat account which can be opened with any Demat Service provider of your choice when your holdings are expected to be below Rs.2,00,000/-.

If we are maintaining holdings of value less then Rs 50,000/- then no annual maintenance will be charged from our account. In case our holdings are between 50,000 to 2,00,000/- then the annual maintenance of Rs. 100 /- will be charged.

In case our holdings exceed 200000/- then our BSDA account will be converted into Regular Demat account. This initiative is to promote retail investment and to promote retail investors to hold securities in Demat form.

How is the value of holding determined?

The DP i.e. Depository Participants will keep calculating the daily closing prices of securities (stocks, mutual fundsetc.) to determine the portfolio size.

This will be calculated after every trading day and then it will be compared with the limits set for your BSDA account. The moment your portfolio value exceeds the limits, you will be charged the fees for the normal Demat account or the slab you fall into on a pro data basis.

Check the video below for more.

Services provided for Basic Service Demat account

Now you must be clear about normal Demat Account and BSDA. Generally, the Basic Service Demat Account provides all the major facilities covered in normal Demat Account. But other that those services, there are few services in BSDA which are a little bit different than normal Demat Account. These services are as given below:

1) Transaction statement:

When your BSDA account is active and balance is maintained then you will get the transaction statement of your account quarterly. But if you don’t have any transactions in a quarter and your no security balance then you will not get the transaction reports or statement.

The statements are available in two forms i.e. electronic and physical document or hard copy. Electronic statements are free of cost; you don’t need to pay any charges for that. But if you want the statement in hard copy then your first two statements will be provided for free of cost and for additional statements you will have to pay the charge which will not exceed Rs.25.

2) Annual holding statement:

One annual holding statement ho holding of the account is sent to the registered address of the account holder. These documents will be sent in physical or electronic form i.e. via e-mail as per the account holder’s choice.

3) SMS Alert:

The account holder should register his mobile number to get the facility of SMS alert. Here you will get SMS for every transaction in your account.

4) Delivery Instruction Slip (DIS):

Two delivery Instruction Slips will be provided to you for free at the time of opening the Basic Services Demat Account.

These are the services which are slightly different in the case of Basic Service Demat Account then normal Demat Account. If you want to read more details about the services and charges of BSDA then you can download the circular by SEBI.

Can I convert my current Demat account into BSDA?

Yes, if you feel you are not making much use of your Demat account or if your portfolio is of less size, you can contact your DP to get your Demat converted to basic services Demat account.

This Basic Services Demat Account is a kind of free account because you don’t need to pay any maintenance charge if your transactions are below Rs.50,000. And Rs.100 only if your transactions are between Rs.50,000 to rs.2,00,000.

I hope you get all the basic details about BSDA. Do let us know if you need more details about the Basic Service Demat Account…..

September 20, 2017

September 20, 2017

Dear Sir,

Thanks a lot for your information, Great job keep it up

Thanks for your comment Kanak

Hello

Many thanks for providing us many valuable information over the years.

Could you please let me know if i can continue using BSDA account even if my holding / market value of the account exceeds two lakh?

No , not in that case. I think its for those whose holding is only till 50k ! . So you are not eligible . But its better to once talk to your demat provider customer care !

Thanks for the information. Are NRIs allowed to hold BSDA account?

BSDA is nothing but a demat account, which is for NRI also

you are doing a great job by providing these quality information to us. it will surely help in creating some awareness

Thanks for your comment sumit gupta

Thanks for sharing the information, keep the good work going. best of luck and keep blogging!!!!

Thanks for your comment Deepak singh

What is process to open BSDA?

Hi DHARMESH

The process will be similar to the process of opening regular demat account. You can visit the bank or institute where you want to open the account, they can guide you better about this.

Good information especially for small investors.

Thanks

Thanks for your comment HAREESH KUMAR

i was planning to open one demat account so i was worried for AMCs as my investment will be in less amount, but more importantly i was expecting this kind of help from JagoInvestor’s Blog only. Thank you very much.

Glad to know that Abhishek Tiwari ..

Eye opener. Now a low profile investor too can consider opening BSDA.

Thanks for your comment Vinod Sharma

Thanks a ton for this information. You guys are doing good job.

Thanks for your comment Ranjeet pal

Very informative article.. Thanks for sharing such a valuable information…

Thanks Gurpreet Dhami

Respected sir ,

many many thanks for your valuable information .

Your welcome ARUP KUMAR BARAT . and thanks for comment

Very informative article.. Thanks for sharing this valuable information with jagoinvestor’ readers…

Thanks for your comment Gurpreet Dhami

thank for information

very informative…i did not know bsda

thanks

Thanks for your comment jackey

Interesting and Important Information. I guess now many people will be able to make use of this.

Hi Chintan Chheda

Thanks for comment.