6 proven ways of becoming RICH (are you one of them) ?

Can you name a billionaire who didn’t start a company?

Or a $ millionaire for that case?

In this article, we are going to talk about various ways people become RICH. No, it’s not a tutorial on how to become rich, but just a conversation on are various ways using which people have become rich. Maybe you will get some idea of which path you want to take or try for yourself.

#1 – Starting a successful business

One of the ways, most people become rich is owning a successful business. Yes, think of any rich person and chances are that they own a business. It can be a tech company, a big store or some kind of traditional business, but it’s BUSINESS.

A job gives you linear income and growth. The business gives you exponential growth and income over time, along with the huge risk of losing the money. That’s the primary reason why most of the people are into jobs and not business.

My point is simple. If your goal is to be in the middle class or higher middle class, you can continue doing your job. However if your dream is to own that exotic villa, or to drive the most amazing cars and never worry about money all your life, you need to own a business, otherwise, it’s going to be really tough to get rich (apart from other 9 points)

You might want to read this article called Indian Entrepreneurs Success Stories – Who Started With Nothing to some inspiration.

#2 – Let someone else run business and get a share

A lot of people have become extremely wealthy by investing money in other business and just holding the shares for long. No, this is not stock investing.

I am talking about funding others’ businesses and keeping a share of ownership to cash on in the future. This is definitely not very common or an easy thing to do. The failure rate is very high, but many people have become very rich through this method.

Paytm Founder sold 40% equity for 8 lacs many years back

For example, you have heard about PAYTM. Right?

You know it’s now a multibillion company and its owner is already a billionaire. But did you know that years ago, there was a guy who helped paytm founder with Rs 8 lacs and in exchange took 40% of the company and exited the company with a couple of 100 crores?

Watch the interview with Paytm founder Vijay Shekar Sharma, where he shares about his journey and this incident (Just click the video and watch the next 1 min)

It’s not always the case that you have to start the business, the main point is to be part of a business and contribute in the journey of the business since the start when it was not successful.

Most of the people who joined large companies as employees got equity in the company (ESOP’s and stocks) and years later when the company becomes big, they all became rich.

Take Infosys for example, It was a business owned by a few people, but those who stayed with Infosys and contributed for its growth over years were rewarded and now they are quite RICH.

At Infosys, drivers, electricians are millionaires

The Infosys management has over the years rewarded selected staff belonging to the C, D and E grades with shares for faithful service and excellence in work. By the time Infy began skyrocketing in value, 67 of these people including eight drivers, owned enough stock to make them very rich men indeed. Kannan’s portfolio of 2,000 shares when multiplied by the latest share value makes for a huge value statement

#3 – By Inheritance

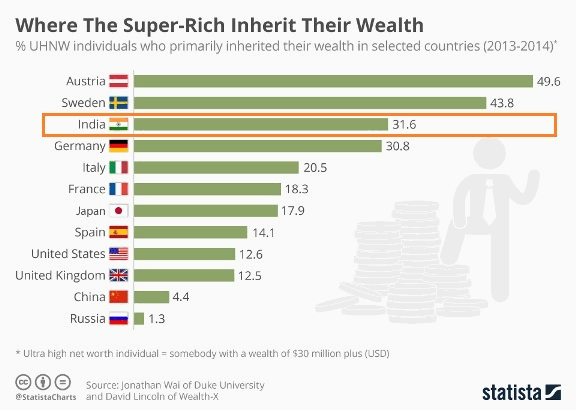

Another way a lot of people become rich is when they inherit a lot of money from their parents or some relative. As per this report, around 31% of ultra-rich people in India have inherited their wealth, which is quite a good number. Every 1 out of 3 people in an ultra-rich category is rich through inheritance.

However, this option is not applicable to most people like us.

#4 – Become a highly paid top executive

If you are very clear that you do want to own a business and will keep continuing doing the job, then your salary is the most important factor which can make you rich. No, we are not talking about packaged of Rs 10 lacs or 20 lacs here.

We are talking about packages which some top executives earn at important positions in the company. They are people like

- CEO

- Managing Directors

- Vice Presidents

- Top Managerial Positions

- Top-Level Professionals (Doctors, Lawyers)

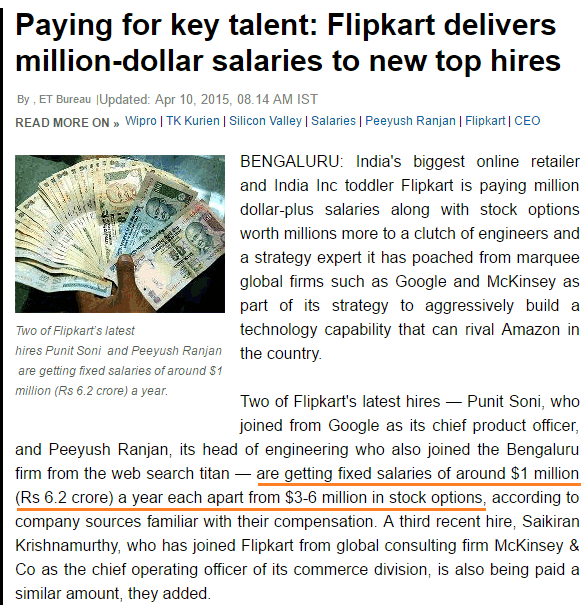

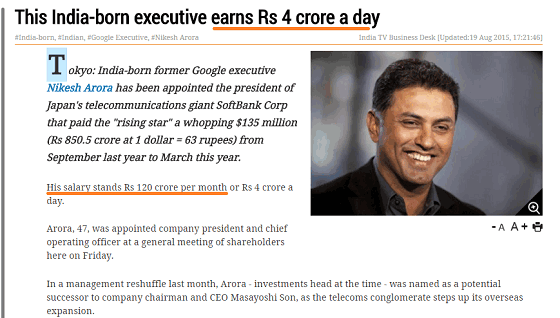

It comes only when you are really out of the class in what you do. If you have skills to manage the company or help a company excel at something, you can reach these top positions, but it takes quite an amount of hard work, smart moves and a bit of luck too. Many professionals earn very high salaries like examples below.

Here is another example of a high salary –

It’s not always the case that you own a business to earn high income. To run a company or business many skills are required and if you have that in you, you can help someone else to build and manage the company in exchange for your skills.

As per this report, around 42,800 have reported an income of Rs 1 crore per annum in India. You now have to set yourself to be in that club

#5 – Speculation or Gambling

This is not a recommendation, but a lot of people become rich by speculation or gambling. This has more to do with Luck and smart thinking at times, but not with hard work.

I do not want to label speculation as BAD, because speculation takes guts and courage and those who take that route also get lucky at times and make a lot of money. There are two kinds of speculation

- Blind Speculation – A speculation where you are just shooting in the dark. Things like buying lottery, horse race etc is pure speculation and unless you get lucky, you will lose your time and money. A lot of people are into these speculative and gambling activities

- Calculation Speculation – Then there are many situations where you have to take a very calculated risk, where the risk is still high, but then the return potential is huge and clear at times. These are high risk, high return situations where if you take a chance, you can get really lucky.

One can get lucky, only when you take a risk and speculate. Speculation is seen as a bad word, but one can’t deny that it also has a brighter side to it. If you want to innovate something, you need to speculate on the fact that it will become successful.

#6 – By Investing money regularly – the boring & long route

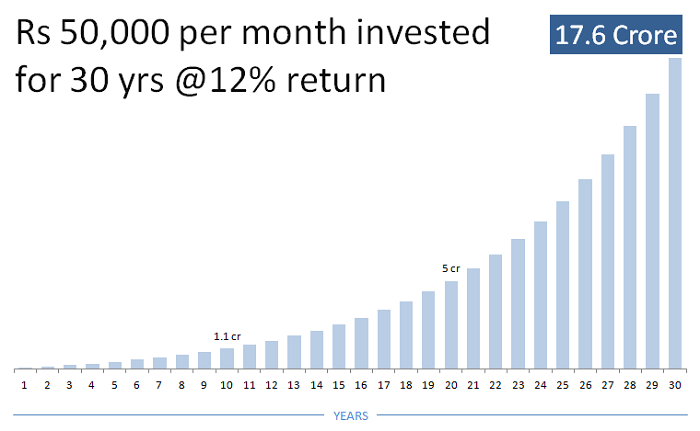

In the end, if you feel you are not made for the above 5 points, then the only way to get rich is to invest your surplus money on regular basis and that too in high return instruments like equity mutual funds or stocks and wait for a long time to become rich.

The big problem is that there is too much-delayed gratification here. If you start your investments today, you can’t expect to get rich in just a few years which is possible in other ways mentioned above.

You need to have time on your side and extreme discipline. On top of that, you need to invest a good amount of money. You can’t expect to become rich by doing just Rs 4,000 SIP in an equity fund. You need to invest a good amount like Rs 20,000 or Rs 50,000 per month (at times Rs 1 lacs per month too) to accumulate a good amount of wealth.

So, the only option left for most of people to become rich (that too in future) is only by investing their money and that will happen only if you earn a good income because only then you will be able to invest a good chunk left out of it.

Let us know what do you think about the points mentioned above?

December 13, 2016

December 13, 2016

Hi Manish, I have read all your articles till 2014 and its a great eye opener for a person like me who does not have any idea on personal finances. There was a gap in 2016 where I could not find any latest articles. But now again it is back and I am glad to follow…..

Glad to hear that Anupriya !

How come you didnt read our articles after 2014 onwards? We have written lots of articles in last 2 yrs and you should surely check them out !

Manish

Hello, it is good to see that you are suggesting ways to become rich, but rather I would also like to know how we can invest and approach others to invest in their businesses.e..g suppose I want to invest Rs.1000 in some startup or any business, now depending on the performance of the business I will decided whether to increase the investment amount or not.So this will give the confidence for me as well as the owner of the business.

regards,

Shantanu Marathe

All you need to do is contact the founders of the startup and tell them you are interested in funding (investing money in their startup) and if you all agree with terms and conditions , you can just invest in them.

Manish

If the intent of the article to say that the only way for users of this forum to get rich is Way 6, then its not coming out properly. If someone falls in the first 5, he wouldn’t be here.

Overall a redundant one.

No , thats not an intention.

The intention is to give a food for thought on how people become RICH generally if you can find ways to something in your life.

Manish,

I am a regular reader of your blog. I feeling that from the last 4-5 months the quality of content articles is going down.

Request your team for extensive research on this.

Yes GT

We are not creating the overall content in the same way like we did in past. We will work on that .

Can you share more on why you felt like that?

Earning income is not sufficient, building pipeline is more important.

Thanks for your comment Anil V

A nice article to read. But does it have anything new ?

Success stories are all well known and are part of motivational speeches.

I like to know whether any business like चाट wala, मूंगफली wala, newspaper wala, cigarette seller, fruit seller, juice sellers have become millionaires.

Thanks.

Nem Chandra Singhal

Sir

All business people are not rich.

However most of the RICH people are business owners.

THe focus of article is not to say that just opening some business will make you rich, however opening a business is one of the way to become RICH.

Absolutely there are people like that who are born poor, worked for low wages & now they are very rich. Let me tell you an example

There is a guy named Vijay Sankeshwar who is from Karnataka state. In his early days he worked as a wood logger & now he is very rich. He slept less than 5hrs a day. To read further go to this link http://www.theweekendleader.com/Success/2489/mover-and-shaker.html

Interesting article. The article could have started with author’s definition of ‘Rich’.

1. Business : It needs three key elements a. Needs capital (these days 7-8 digits) b. Hit Idea/Location etc.. c. Owner should spend considerable time ( few Yrs) in launching and understanding the business. All 3 are out of the reach for 99% of us.

2. Passive Ownership : If you are buying a listed company stock, you need to buy decent amt of stock and business should be successful for very long time to make you rich. Alas, Angel, Venture, Crowd funding opportunities for great ideas are out of reach for 99% of people. Even Pre-IPO options are not available.

3. Inheritance : This is passing on success from one gen to other but again earlier generation must have gotten rich through business, stock investing or high paid executive or even speculation. 99% of the commoners does not have such privileged previous gen.

4. Highly paid top executive : One need to be from top college and would have survived corporate politics and upheavals. Very very tough route and very few make it.

For most, only Option 5 & 6 are available. The problem is one guy/gal gets rich at expense of millions of gamblers by option # 5. NO # 5 option would most likely turn many middle/upper middle class into poorer class than upper class. Option # 6, one needs bigger monthly savings and long term investing which is again out of reach for many.

This article sends blunt message that getting rich is out of question for so many and I totally agree with it.

Thanks for comment.

Yes, the article clearly tells you that its not possible for many people to get rich and only lists down the ways people get RICH. Its surely not a process sharing how to get rich 🙂

Manish

Manish, Excellent!!!

Thanks for your comment RK

good article.keep it up.

Hi Manish, Great Article. Looking forward to see an article on Home Loan prepayment vs investing in Equity SIP. I believe investing in SIP rather than doing repayment of home loan every year. Plan for a term say 5~7 years and invest regularly in SIP and pay your home loan completely after the said period which gives you a capital and some interest.

Yes, I will soon do that, thanks for the suggestion.

Grt article Manish I have joined recently and closely following ur updates I feel taking risks and rewards as u mentioned are part of the game, but it clearly proves that starting any business or grt job offer is not an easy decision to make, and I am struggling to make one too. For there are few success stories and exponential failures. Would request you to share some failure storirs also not as a deterrent but as checks and balances , and help people what all to avoid, what all not one should not repeat in his quest for financial freedom/ richness. Thanks again

GOod point. Let me write a story on that !

Yes Manish, Amit has a valid point

We always get to read Inspirational stories but but what about failures and why they failed is good way to learn dark side, and i am happy you are about to write the story on this topic, eagerly waiting for that one….. 🙂

Will do it soon, but no deadline 🙂

Too may things on plate 🙂

Manish, nice article as always….

Thanks for your comment Meghasyam

As always, very good article Manish. I started reading posts in your blog around 3-4 years back and what I learnt here, I apply in day to day financial decision. Not to boast but because of your blog (and few others while searching blogs like yours) I have learned a lot about finance and investment that helps me to give inputs to relatives and friends in their financial decision.

Glad to hear that Mukesh 🙂

Good article

I think what ever you doing either business or Job step 6 must have to follow to create tax free white money in lone term.

Thanks for your comment Jwalant

Ofcourse.

a good one…

I think Owning a business for the risk takers would be most apt way to be RICH

Yup !

Highly informative, I planned to venture into business, and the credit goes to you sir

Glad to know that Sivaram Thangavel ..

Nice. Very concise and sweet. Dear Manish, When I started to learn personal finance, your blog taught me how to get the basics right. I owe a lot of thanks to you. Ganesh.

Glad to hear that Ganesh !

Nice Article. Well said. Well diversified Equity investments are very essential to become richer sooner.

Glad to know that Vinoth Kanna ..

“Calculation Speculation”….do i know something more on this?…Great Article.

Thanks for your comment Upendra G

Hi Manish,

as always a very awesome and a clicking thought…

I wish to read more on the topic and brainstorm more on the same lines…

May be after a week or month you can rewrite on the same…

I will try to write more on same lines 🙂

Few days back I questioned myself what does it takes to become a Billionaire. You provided me the insights. Thanks for this beautiful article

Glad to hear that Nikhil !