Should you invest in ESPP plan? Here are 2 critical points everyone should know

Today we will talk about various aspects of ESPP Plan? We will also see if it really makes sense to invest in your employers ESPP plan or not, and what are the pros and cons of that.

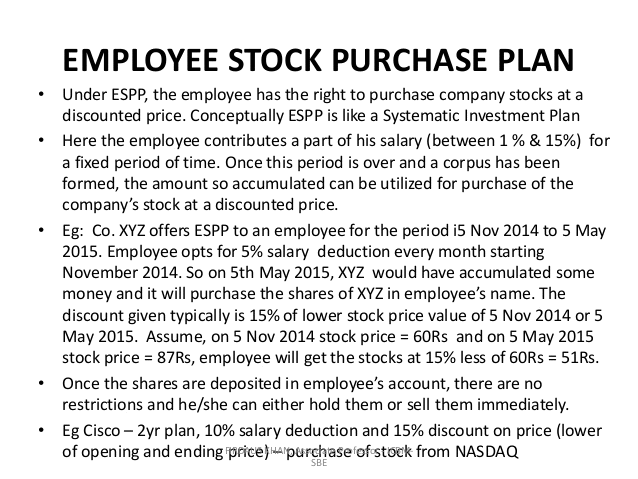

For those who have no idea about ESPP, its full form is Employee Stock Purchase Plans and It’s mainly an offer from your employer to buy the stocks of the company at some discounted price.

How does ESPP Plan look like?

Let me give you a rough idea of how an ESPP plan looks like. Under this plan, your employer might offer the discount of 15% of the stock price, and you can contribute some part of your salary for purchase of ESPP.

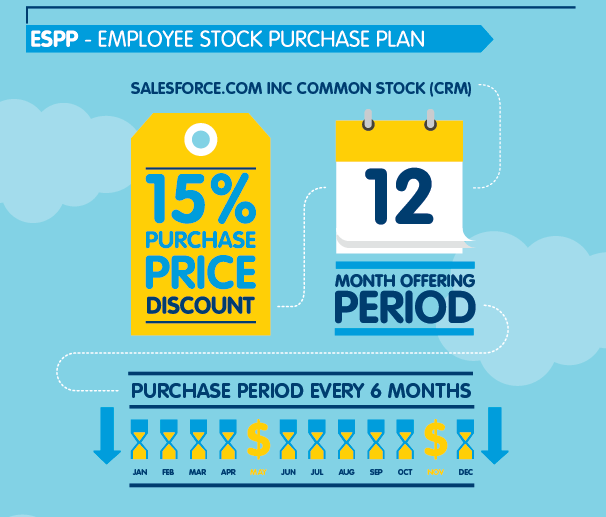

This might run for 3 or 6 months and then at the end of the period, all the money which you have paid, will be used to purchase the stocks at a discounted price (It might be the current market value or the lowest of the period, it all depends on your companies offer plan)

- So you get the stock at a discounted value

- You invest the money for X number of months

- The stocks are purchased at the end of 3/6 months period

- You get the stocks on your name

Is ESPP Plan worth?

Now let’s come to the main point. Is investing in ESPP plan worth? Should you do it? Is there any catch?

Below is an example of Salesforce ESPP plan, where they are offering 15% discount and the offering tenure is 12 months (employee will pay for 12 months), while the purchase will happen every 6 months.

Now the main question is – “IS IT WORTH?”

and the Answer is ALMOST ALL THE TIMES.

Yes, most of the times, it makes sense to invest in ESPP plan because you get the stocks at a good discount and if you sell it off after they are allotted to you, you will make a good enough profit (15-20%) in most of the cases, unless things go really bad.

In some cases, you might want to think hard before you invest in ESPP plan offered by your employer.

Point #1 – At the end of the day, you are buying a Stock

ESPP is nothing but a plan where you buy a STOCK. Hence the price of the stock will move up or down. So if the stock does not do well, you will not be able to make good profit and your hard earned money will not give you the desired returns.

Imagine a stock which is on decline or not doing well. Your ESPP plan will give you the stock at 15% discount of the lowest price (mostly the latest price) . Not every time, people sell it off immediately, and keep holding it. Now if the stock price does not come above your purchase price and you kept on holding it, you might suffer good amount of loss.

Look at Yahoo, as an example (I worked there for more than 3 yrs). Imagine people who bought ESPP of Yahoo and kept on holding it? Even if they got it for discount, does not mean that they will make profits.

So don’t get emotional and look at your company stock and see if as an outsider. Check out what are the future prospects, Is it promising? Does your company find its place in most of the mutual funds portfolio?

Point #2 – Your Income and Profits come from same company

You earn your income from your company, and now your portfolio is also linked to same company. If the company is doing very well, your income will rise and so will your portfolio value. But what happens if things go bad?

- What happened to Satyam?

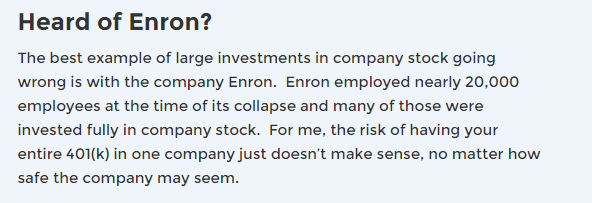

- What happened to Enron?

- What happened to Yahoo?

If someone worked in companies above, they lost their jobs. And at the same time, their stock prices were either worthless or reached the lowest value and they suffered huge losses. The snapshot below was taken from this website, which talks about Enron collapse.

The point is, when you invest in an ESPP plan, all your eggs are in same basket. If things work out and your company does well (Google, Facebook), you will enjoy the benefits of promotions, income rise and your stocks value rise, but in the other case, it will be the opposite and it’s not going to be the best situation.

Conclusion

At the end, you need to ask yourself about the prospects of your current company where you work? Do you think it’s going to be great in coming times? If Yes, then not just ESPP, you can even go for ESOP’s and other plans from your employer.

November 21, 2016

November 21, 2016

Can Somebody explain about new bonus act 2016 and who are all eligible for this.. It’s so complex

I am not aware of that . ANy link ?

Dear Manish

Please find below the link for your reference

http://economictimes.indiatimes.com/wealth/personal-finance-news/govt-hikes-wage-ceiling-for-bonus-to-rs-21000-per-month-from-rs-10000/articleshow/50284285.cms

Thanks for sharing that hari

Always, always sell off ESPP shares as soon as they are allotted. If you have the discipline to do that, investing in ESPP is a no brainer. Your salary is deducted every month for 6 months and you get guaranteed 15% minus costs. That’s 15% return for an average 3 months investment and potential larger upside. The article does not go into an additional risk factor and the costs of $ ESPP for Indians. The cost is what your brokerage will charge to sell your stock and wire the money to India which can be significant. The additional risk is currency risk because your money is converted to $$ for purchase and you have to convert back to Rs on sale. Even with these additional gotchas ESPP makes a lot of sense.

Thanks for sharing that Ganesan Rajagopal

Always go for ESPP!

Most important fact people miss out and get stuck into is that “15%” discount, thus fail to realize CAGR return it offers.

This is how it works:

Jan 1000 – stays invested for 6 months

Feb 1000 – stays invested for 5 months

Mar 1000 – stays invested for 4 months

Apr 1000 – stays invested for 3 months

May 1000 – stays invested for 2 months

Jun 1000 – stays invested for 1 months

And at the end of 6th month, you get 15% discount on each periodic investment made. Now if you calculate CAGR, even if price remains same during 6 months period, it will turn out to be ~56% which is huge. You can calculate it in rest of the 2 scenarios where price might go up or down, but in any case, if you sell it on same day, you are likely going to make ~50% + CAGR return. Not worth missing out.

It would be nice, if you would have covered taxing of ESPP when the company is of foreign origin. Taxing is completly different from Indian companies. Please share your thoughts in a different article

Its discussed here – http://jagoinvestor.dev.diginnovators.site/2013/03/rsu-espp-esop-meaning-and-tax-treatment.html

Hi Manish,

Thanks.I was thinking to ask about ESPP to some experts as i was not clear when my employer asked about my interest in IESPP.This article gives good overview.Keep rocking.. By Velmurugan M

Glad to know that Velmurugan ..