How to withdraw your PPF account money anywhere in India? Here is the Process

Today I am going to share very interesting and rare information related to PPF with you all.

Have you ever wondered how can one withdraw their PPF money without visiting the base branch (from where PPF was opened)? A lot of people open PPF account in one city and then move to another city. It’s really a headache to travel to another city just for the sake of closing the PPF account or withdrawing the money either at maturity or partially.

I tried to see if this is a problem that PPF holders face, and I found that a lot of people search for “Can I withdraw PPF from any SBI branch”? This means that this is widespread query and I decided to write on this.

There are many articles and people on internet who will tell you that you need to visit the base branch only to withdraw or close your PPF account, but recently I figured out that its not true and there is a process using which you can close or withdraw PPF money from any city without visiting the base branch where you opened the PPF account.

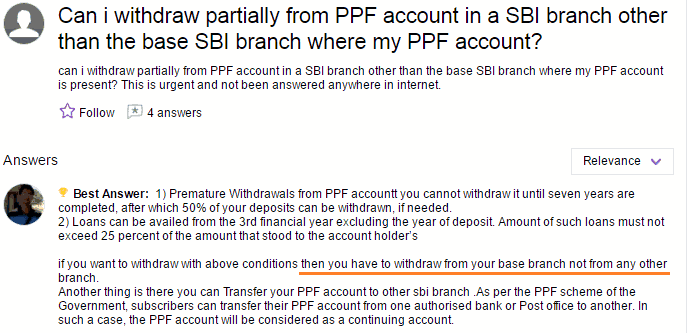

Here is one reference of a query like that on Yahoo answers

I want to share with you today that its a big myth and its actually POSSIBLE.

A few days back, I got in touch with Priyesh Sampat, Legacy & Succession Counsellor from Mumbai, who has handled hundreds of PPF related cases in the past. He shared with me how is it possible to withdraw money from the PPF account without visiting the original branch and he has seen it work in real life for his old clients.

He was very helpful and shared many insights and his experience on this topic. I thank him for that.

Steps to withdraw from your PPF account from a different city

Before I share the steps for PPF withdrawal from a different city, I want to mention that the steps below are applicable when you have your PPF account with SBI or some other public bank like PNB, Vijaya Bank, etc.

The steps below will not work in case you have PPF with Post office, in which case you first have to transfer your PPF from post office to SBI bank and then you can take the following steps.

Step #1 – Arrange your KYC documents

The first step is to make sure you arrange all your KYC documents like

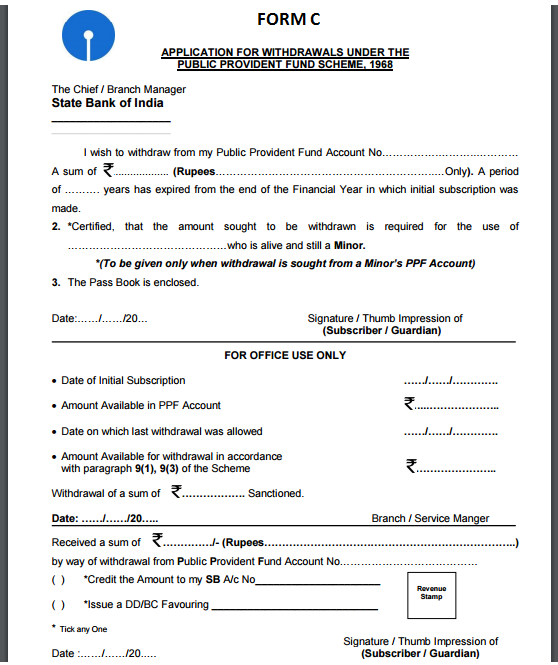

- Form C – For PPF withdrawal

- Canceled Cheque – The account in which you want to money to be credited

- Your Identity & Address Proof

- Your PPF passbook (in case it is available with you)

Do not sign these documents at the moment, because these need to be signed in the presence of the bank officials. You can download PPF form C here

Step #2 – Go to a local branch of the bank

The next step is to visit the local bank branch of the city where you reside or are present and talk to the staff there. Tell them that you want to withdraw your PPF, but it’s base branch is in some other city, so you want them to attest the documents.

They will ask you to sign on the documents in your presence and might also put their signature or seal on the documents confirming that your attestation is complete. Also, request the attesting banker to mention his/her name and signature code issued by RBI. This makes the attestation complete in all regards.

Step #3 – Send documents to Main Branch using Speed/Registered post

Once the bank staff completes your verification and attestation, it might happen that they keep the documents and tell you that they will themselves send the documents to the main branch, in which case take an acknowledgement from them which has their signature and seal, so that you have the proof that you gave the documents to local branch.

Otherwise, you yourself will have to send the documents to the base branch where you opened your PPF account by speed post or registered post.

It’s important that you use a speed/registered post so that you have confirmation when the documents are delivered. Also as post office is a govt organization, you have all the records and you can also find out information using RTI later.

Step #4 – Get PPF money credited in your account by NEFT/RTGS

Once the original branch gets your documents, they will process them and credit back your PPF maturity amount by NEFT/RTGS.

In earlier days the banks used to hand over the Pay orders or DD which was supposed to be received by a person, but now with NEFT/RTGS facility the money is transferred electronically.

So the process for PPF withdrawal is very simple as explained above, but let us see some finer details or cases now

Can I use the same process mentioned above in case of partial withdrawal?

The answer is YES. The above process is not just for the PPF withdrawal at maturity, but even in case of partial PPF withdrawal after completion of 7 yrs.

I have PPF in Post office, how can I withdraw?

As I mentioned above, the above process will work only in case you have your PPF with a PSU bank, so the first step is to transfer your PPF account from Post office to the PSU bank. The steps are already mentioned in this article. Read the comments where many people have shared how they successfully transferred their PPF accounts to PSU banks.

I am an NRI, how can I withdraw my PPF account from outside India?

If you are an NRI, first thing you should know that that you cannot extend your PPF account after it matures in 15 yrs period. I am sure most of the NRI’s keep travelling to India every year or once in a while if not every year. So whenever you visit India next time, you can follow the same process which is given above.

However, if you still want to try withdrawing your PPF from abroad, let me share you the process which is not guaranteed to work always, but it’s already tried by Priyesh on one of her NRI clients and it worked for them.

The process for PPF withdrawal by NRI

Basically the PSU bank can only process your PPF withdrawal request if your signature is attested by an authority, which can be the PSU bank itself (which will need your presence) or some other authority.

If an NRI has an NRE/NRO account in a bank (a good bank balance or relationship with a bank will be a plus), then they can follow this process

- Courier the documents to India in the city where you have the NRE/NRO account. Make sure you send these documents to a person (relative, parents, siblings etc or friends)

- Give an authority letter mentioning that you are allowing the person to follow this process on your behalf

- Ask the person to go to the bank where you have NRE/NRO account and ask them to attest these documents (mainly the signature part) . At this step you can expect the friction, because this is not a standard process.

- Once the attestation is done, then you can ask your person to visit the PSU bank for PPF withdrawal and they might accept these documents which are attested by your bank.

Note that Priyesh has done the same steps for one of her NRI client and it worked because the NRI was giving a very good premium each year to the bank and bank was more than happy to “help” the client 🙂

Why can’t you withdraw PPF from any branch?

Truly speaking I have no answer for that.

I know that with the advancement of technology, the PPF withdrawal process should be smoother now and it should be possible with a button of click, but as of now, it’s not the reality.

A lot of people still wait to travel to their base branch city where they opened their PPF and follow the process. However many investors never withdraw their PPF because they are not clear if it’s possible or not.

It was my attempt to bring this process in notice of yours so that you can at least try this and see if it works. If someone has done something different and successfully withdrawn their PPF from a different city, please share that with us in comment section and we will add it in the main article.

We would like to know if you got any new insights or not and this article was helpful or not?

September 26, 2016

September 26, 2016

Excellent info specially applicable during Covid Times. Just like any other account PPF should also be made a remotely managed account.

Thanks for sharing your views

Excellent information ! Thanks for sharing the information.

Thanks

Thanks for the article!

Welcome !

Hi,

Could be please throw some light on withdrawal of money from PRAN Account before 10 years?

I am not sure on that as of now

I really dont remember how but i have done this process 5 years ago. Transferred PPF account from IDBI to ICICI and operated PPF account from ICICI online.

Thanks for your comment RajanGhadi

Is there any limit (amount) for gift given by coparcener of HUF to HUF? Is it necessary to have a gift deed or a document for such gift?

Hi KIRITKUMAR

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

can i withdraw SOME AMOUNTS OF MONEY FROM contributory providend fund (C.P.F) ACCOUNT FOR HOUSE REPAIRING PURPOSE. AS I AM A REGULAR GOVT SERVANT IN SIKKIM SINCE 2007. I HOLD TIRE 1

Hi drona

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

In case of fund withdrawal from PPF account held with Post office, the concerned staff insist for a Power of Attorney which is not older than 6 months. Nowhere it is mentioned but they are very rigid on their rules. is there any way, that we can take up the matter to higher authority because the Head Post master also support their staff and customer is reluctant to follow their so called rigid rules.

Hi KIRITKUMAR

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Thanks for reply. I appreciate.

Hi Manish,

I have PPF ac in ICICI bank. Is the same process applicable for ICICI bank PPF ac also?

As per Priyesh, who gave the inputs for this article, this process is applicable to PSU banks , but I dont think it will be very different for ICICI. Go check it out once.. And as ICICI has top notch technologies at its end, I think you should be able to withdraw it online too. But we are not sure. You will need to explore this with your branch. Better to check this up with ICICI customer care once.

Manish

Thank you very much Manish

Since SBI allows one to invest in PPF online with just a few clicks, it stands to reason that they should also allow withdrawals online just as easily. Authentication can be done by both OTP and email for double security. This old age method of filling up forms and waiting for days for the money needs to go.

Yea Anjan

I agree with you. I think banking these days is advanced enough to handle these kind of things. But not sure why these things still require old age methods. Lets hope this changes soon

Manish

Very nice explanation.

Thanks for your comment RadhaKrishna

hello sir,

i am venkateswarlu, previous worked in industrery.present i am not working same industry.please give me suggestion and procedure for with draw the my pf amount.my mail id is [email protected]

Hi venkat

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Sir,my establishment is in Smaker Management Services Pvt. Ltd from 25-04-2008 and EPF was being deducted from the beginning to May 2015 (Over 7 years).The company

show me exit from 31.05.2015 in the records but I am working on same post in same company and salary is being paid by the same company but deduction of EPF has been closed. I am working after ( 60 years old )retirement from M.P.Forest Deptt.

Can i draw deposited EPF+ company share?

Yes, one can withdraw both the things. .check with them on this

I am sure in next few years going forward, SBI will make it lot easier and smooth transfer of withdrawal of PPF… PARTIALLY or FULLY.

As of now, we can deposit the amount from any SBI Branch… so similarly since all the details are with all the branch DUE TO INTERCONNECTIVITY AND SINCE KYC HAS BEEN DONE BY EVERYONE COMPUSORILY …Shouldn’t it be lot easier to withdraw and get the same credited to our account by NEFT/RTGS.

Rgds

Mrs. Shetty

I agree .. it should be much easier than the current process.

Best way may be to transfer SBI PPF account to your new place and do the withdrawal. Takes 2 to 3 week.

Thanks for sharing that Pankaj

As per my knowledge, we have to visit home branch to update the nomination details of PPF account by filling the nomination form. Can I do the same from any branch in any city of the same bank?

Yes, you can do that same in the same manner discussed in the article

Another easy way to do the same with SBI is

1. Transfer your CIF with base branch to your local branch by sending a mail to base branch

2. Then link your PPF account to your local SBI branch account

3. Withdraw PPF money from local branch without much hassle

I am trying to do the same !

Thanks for sharing that.

Incase it works for you, please update us !

Very informative. Have this practically been tried and tested

Sir

I have an account with a post office in TN and got transferred to CG. All it took was my current address proof and Pan card to change the address on the passbook. Even though my account is in TN, I can operate my account like an account at the local branch in CG. I have done partial withdrawals and was also promised full closure privileges when the time comes.

This is my experience at Head PO, Raipur, CG

Thanks for sharing that ..

So does it mean that one just needs to update their passbook with the new address while transfer and they can then operate it without hassle !

Yes. I am doing exactly that. Got a fresh passbook with the new address issued after filling in the KYC form. Full transaction privileges and all that goes with it. I was actually surprised in getting it done. I had read your article earlier and I went to the post office in TN armed with all the papers only to get shot down with the reply” It is very dangerous to shift to the post office in north india. All your money may get lost!!”. Since I travel once in a while between the two places, I thought of trying this and succeeded.

Thanks

Arun

Hey Arun

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Sir please explain how the post office recurring deposit interest is calculated and how it will be taxed at the end of maturity or yearwise

Hi Sandeep

It calls for a totally new article. However the RD calculation is as any other bank.

Manish

Great article. Is there a lock on PPF withdrawal? When can one withdraw the PPF money and what would be the tax implication?

Nice Article, Manish.

PPF matures 15 years from the end of financial year when you opened the account. So, consider a lock-in of 15 years.

There is a limited facility of partial withdrawals and loans against your PPF balance.

Recently, Govt. permitted premature withdrawal after 5 years for medical treatment and education. However, premature withdrawal comes with a interest rate penalty if 1%.

PPF belongs to EEE tax bracket. The amount is never taxed.

Yea , thanks for sharing that 🙂

Yes there is a 15 yrs lock in .

and after 7 years you can do partial withdrawal

Manish