Inactive EPF accounts will get interest from Apr 1, 2016

Good news, the inactive EPF accounts will now get interest from next month, i.e. Apr 1, 2016. Around 5 yrs back, under UPA rule, EPFO came up with the rule that any inoperative EPF account will stop getting interest after 3 yrs of inactivity.

So if a person left the job and never withdrew the money, he would stop getting the interest after 36 months. Inactive accounts are those accounts where there is no addition from employer or employee side. Now that old decision is reversed. There was a meeting of Central Board of Trustees at EPFO and this decision was taken.

A lot of employees will be happy due to this change because at a lot of people do not want to withdraw their EPF and still want to earn the interest. Also the withdrawal/transfer process is a bit cumbersome and many investors do not want to take the pain and let their accounts be there.

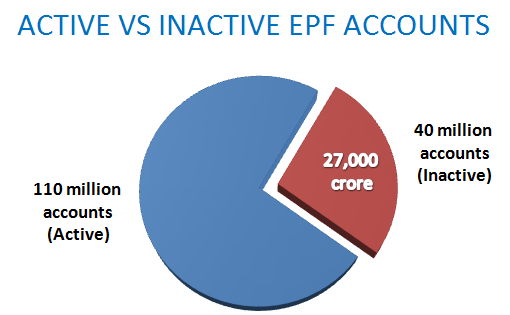

Inactive vs. Active EPF Account

As per a report, around 27,000 crore is lying in 40 million inactive EPF accounts (total accounts = 150 million), This money will now start earning interest.

Few weeks back, Govt also decided to restrict employees to withdraw the employer share in EPF till the retirement age of 58 yrs.

That time many people were confused if the interest will be given to them or not if the accounts become inactive? Now that confusion is also cleared.

65% investment in G-Sec

As per this report, there is one more change in the way money will be invested by EPF in G-Secs

When asked about a proposal on enhancing proportion of incremental investments of the EPFO in government securities (G-Sec) from 50 per cent to 65 per cent, Labour Secretary Shankar Aggarwal said, “It has already been decided by the Ministry of Finance.”

The Secretary said that the limit of 50 percent was enhanced as they were getting good offers but unable to invest in such instruments as the limit had been exhausted.

“If we get higher returns in G-Secs then we should be allowed to invest more in these instruments,” he said further.

Please share what is your reaction on this move?

March 29, 2016

March 29, 2016

am moving out of country for 5 years from december, 2016. I will be working for the same company but will be under different payroll and my India payroll will not be active, so my employer will not credit any amount to my PF account. In future I may change my employer in other country itself and after 5 or 6 years I may come back to India and work again in India payroll. Is it possible to close the PF accoint and take all the money accumulated through the years?. If so, Is it advisable to close the PF in my situation, because if the account is generating interest (I read from your article) then I want it to continue and intent to use the same PF after my return to India?

I dont think you should close and withdraw it now as the interest will keep coming to that account (new law) . Unless you really need money, I dont suggest that

Thanks I am keeping it for future. But is it really possible to close it if I want?, as my employer says I can not close it. Thanks again.

You can withdraw the money only if you are UNEMPLOYED, else you cant

This is good news. However from the UAN portal, we still do not see any credit of Interest for FY 15 yet. I have never seen that happen during the UPA rules for sure. It also makes an impression that the current government have their eyes on the EPF corpus. Like it or not, this is June 2016 End, and still no clue of what interest was credited.

Hi Indro

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hello Manish,

An informative article as always. Been following your blog for more than 5 years now and it has tremendously helped me in managing my personal finances as well as shooing away rogue agents trying to sell me idiotic plans 🙂

This is a welcome move by EPFO. I have a doubt that I have been unable to get an answer to. I have an inoperative account since 2015. Now as per this new ruling, the inoperative accounts will start earning interest 1st April 2016. Does this mean that my inoperative account(since 2015) will get interest only for the period post 1st April 2016 OR will my account also get interest arrears since 2015 as well(as if it never became inactive)?

Thanks & Keep up the good work.

Yes, it will get only from the time this news has come into !

Dear Sir,

What are the rules for repayment of interest free loan given to parent? How parents can refund to son which they have taken years ago and invested?

regds,

They can just send it to bank account by cheque or netbanking

Hi manish,

This is meenu I have left my worked cxoimpanyt in 2009 & have submitted lot required documents but what has happened I don’t know but whenever I use to followup they use to tell they will get back to me.At last now they are telling that I need to fellow up directorly with of people. I don’t even know whether they have summited my forms or not I don’t have idea.kindly suggest on this to get my pf

Yes, you need to follow up directly !

Sir I need your help

I don’t know my epf number.. I cannot contact the company i worked with . how can I know my EPF account number.

Hi Praveen

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

this rule apply to inactive PF accounts held under private companies’ PF Trusts?

I guess yes !

Wonderful.I have inactive pf accounts from 2 companies. Could you please let me know if I need to create epf account.?

Ruchi,

EPF accounts are generated by the employer. So, if you are currently working with any organization they would be already deducting your share and depositing an equal amount from their side in your current EPF account. You should have got your UAN as well by now. So you can transfer your fund of those two previous accounts into the active account where your money is currently been deposited. This way you would get all the fund in one place and your service years would be considered as continuous and you may be eligible for Pension from EPF after 58 years of age when you have a continuous service of 10 years.

Here is the link to transfer your fund online:

http://memberclaims.epfoservices.in/

It will get created when you are employed !

Thank you Manish. This helps.

Mr.Manish, really it is a very good news, you have shared in jagoinvestor. Please share the information regarding EPFO scheme certificate and it’s detailed information in jago investor.

Thanks for your comment R.JAGAN MOHAN RAO

Well said Vijay.

Does this rule apply to inactive PF accounts held under private companies’ PF Trusts?

Kushal,

Irrespective of who is managing the fund, a trust or the PF body, interest would be paid on all the accounts. though the money may be managed by the trust but finally it has to abide by the government rules from time to time.

Thanks Vijay for your clarification.

Yes

I think this is to answer the query regarding what happen to amount which one can not withdraw before retirement age , i.e. will we get interest on the remaining amount in the account which may be inactive then.

So now when you stop working and your account becomes inactive, so the amount will still get interest even though the account may be inactive.

Thanks for your comment sankalp

A welcome move. Now inoperative accounts can also earn interest.

Exactly this govt want to remain employee as employees till retirement , useless laws for employees. Utter frustration seeing this kind of rules , tax tax and only tax to salaried class people. I hate this government. Indians will never flurish with kind of immature policies.

Thanks for your comment Raj

Great, instead of doing the right thing and getting rid of the No Withdrawal before 58 rule, they try to pacify us by giving interest on inoperative accounts. Clearly this government wants salaried class to remain slaves till 58. How can people even think of turning into entrepreneurs after working for 10 years with such rules in place? Many could have used this EPF money as capital for their business and now that door is closed.

I disagree with you Anjan. The government has a bigger panorama to look into. Govt focuses on the steps which may benefit bigger section of the society. So, How many people out of salaried class do turn into entrepreneurs. I bet it won’t be over 10%. So what about the rest 90%? If you will look into the habits of modern people in the age group of 22-35 years, most of them never tend to save anything for their future. They forget that they will grow old, they would have kids to go to school, college and pursue their career which may need handsome money to make their kids abreast with the time. They forget that they would retire, their health would be fragile and inflation would cost their money to lose its value spontaneously.

These people are busy planning to make their weekends exotic, memorable and make their girlfriends and boyfriends feel very important to them by just gifting them some really unnecessary gifts. Gone are the days when kids used to think about their parents. Gone are the days when kids wanted to reciprocate the same love, care, affection and duty which their parents discharged when they were infants,toddlers and adults. Now, parents must plan for their own as no one would be their to take care of them during their golden period. So, my point is whatever savings are happening for those 90% of salaried people who won’t be a businessman till their end is good and it should continue. Rest 10% who have that burning desire to be an entrepreneur won’t get stopped just for their PF money, they will find the way to generate the necessary funding to grow their business. Govt has taken a great decision to restrict withdrawal of employer’s share and further I would appreciate more if they restrict employees share as well from withdrawal. Indeed, its a very good decision to give interest on dormant accounts. It would have been better if they had taken a decision to invest max of 50% of employee’s share in equity and rest in debt fund for those who are below 50 years of age to generate better returns. Just like the NPS modal.

Look mate it’s not the government’s responsibility to force us to save money and neither is it supposed to spoon-feed us to do the right thing at every step of the way. We are not babies. People should know they reap what they sow. Nobody should have to force you to save money, that’s entirely your prerogative.

I take offense to the fact that the government thinks it can force me to save or spend in a certain way against my will. I never had a choice to opt-out of EPF when I joined my company. So my hard earned money is being locked away from me against my will. You think this is justified? I’m sorry but not everyone has ideal lives where they can do slavery for 35 years and retire blissfully at 60 years of age. Many of us have bigger dreams. Even those of us who do not have bigger dreams may need the money for life threatening emergencies.

If we compare the our total population vs number of people works in the organized sector who has a PF facilities , we will be surprised. Irrespective of How many turns to be an entrepreneur, If you look at the number of unclaimed money lying in the thousands of PF accounts from so many years, reasons for the same may be numerous. reason may employee’s demise, organization failed to transfer the money to the new account, incomplete documentation etc. due to which employees always suffers.

As the Time Value , Money in hand today may worth than it in the future, when there is a uncertainty on the receipt prevails. Majority of the people do not even remember where they have kept there Fixed Deposite advise invested last month ? so how one will remember that there is a money in PF account at the Age of 58.

So let an individual decide what he has to do with his hard earned & saved money. From Social Security measure , yes Government has a bigger panorama, than just a PF.

Thanks for your comment SUYOG

Agreed, but 58yrs is too far away. It would have been nice if it was 45yrs.

Thanks for your comment Anjan