Here are the 5 most important things to know before you Submit Investment proofs for tax saving

Do you know everything regarding investment proofs which you provide to your employer at the time of tax-saving season? If your answer is NO, then this article will help you understand a lot of things which you don’t know or partially know about.

So, I will talk about some of the common things you should take care while giving your investment proofs to your employer for tax saving purpose.

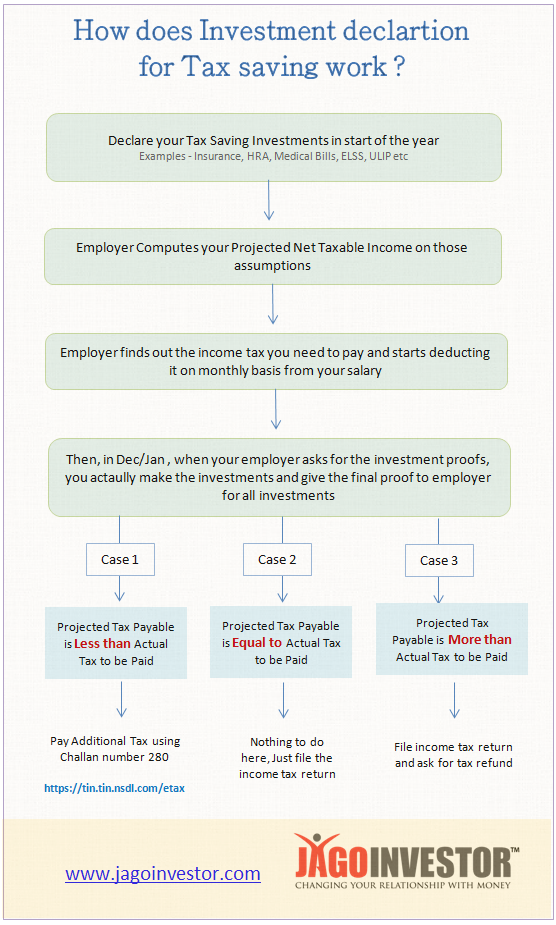

1. Investment declaration helps employer to deduct appropriate tax

The first and most basic thing, that you as an employee should know is that your employer is supposed to deduct your income tax on monthly basis and deposit it with govt on 7th of the following month.

For this, the employer should calculate your taxable salary and it can only happen if you before hand give him an idea about how you are planning to save tax, and apart from that how much of HRA, LTA, Medical reimbursements you are entitled for.

For this purpose, your employer asks you to declare your various investments in the start of the year itself, so that they can compute your net taxable salary and then pay your salaries accordingly, after deducting TDS from your salaries.

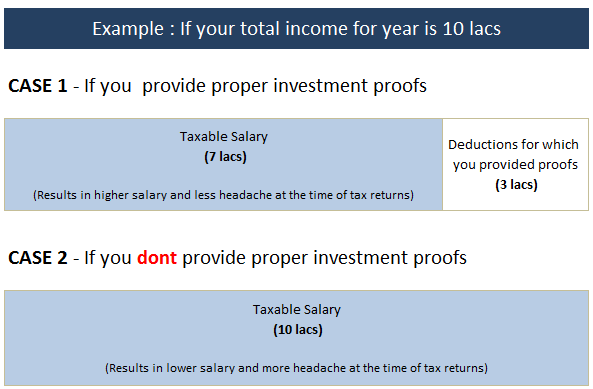

And then, finally around Dec/Jan, they start asking you to provide them the actual proofs of your investments and receipts so that they can match things with their initial calculations and if there are any difference they have 2-3 months in hand to handle the discrepancies. Below is a small example of it

What If you failed to submit investment proofs?

If you failed to submit your investments proofs (you declared them, but didn’t invest in reality), in that case you are liable to pay higher income tax, but employer has not deducted it and hence they get a 2-3 months of extra time to adjust it from your salary.

Following things are required by employer as investment proofs.

- To claim LTA, you need to provide Travel receipts (flight boarding pass, train tickets)

- Home loan certificates if you want to claim deductions under principal and interest repayment

- ELSS investments proofs or any other 80C investments

- Life insurance and health insurance premium receipts

- Various donations receipts

- Rent receipts to claim HRA

2. You can also share your saving bank interest, FD interest with employer

A lot of people do not know this, but you can share your saving bank interest, FD/RD interest earned during year, any capital gains from shares or mutual fund, rental income and other kind of incomes with your employer, so that they get a complete picture of your taxable salary and deduct your income tax which will be more accurate.

If you do not disclose these additional incomes to your employer, in that case – you will have to separately pay additional income tax yourself and then take these things into account while filing your income tax returns.

Note that another advantage of declaring these additional income with employer is that you will not have to pay any penalty which might arise due to not paying advance tax on time.

Also, you won’t have to take the burden of paying the additional tax at the end of the year, the tax will get distributed almost equally throughout the year.

3. Didn’t submit income tax proofs to employer? You can claim things later

A lot of investors have this myth, that if they didn’t do their investment proof submission to employer, they will never be able to claim the deductions and will have to pay higher income tax. This is not true.

Yes, it’s a good practice to give the investments proof to your employer on time, and that will save you a lot of headache later while filing the returns.

But for some reason, if you fail to provide the investment proofs (example, like you don’t have money in the month of Jan and you decided to buy a life insurance policy only in Mar), in that case – your employer will deduct the income tax, but then at the time of filing your tax returns you can claim the tax refund, if you finally managed to invest in tax saving products later.

Here is a chart which will give you a better idea

Here is another detailed example of how it happens

- Ajay has the salary of 12 lacs a year, and he declares to his employer that he will invest Rs 1.5 lacs in 80C products

- Employer based on Ajay declaration will calculate that Ajay taxable salary is 10.5 lacs and will be based on that suppose the total income tax for the year is 60k (just for example) . So Ajay final salary will be 10.5 lacs – 60k = 9.9 lacs. This 9.9 lacs divided by 12 will be 82500 which he will get on monthly basis and the employer will deposit Rs 5,000 as his tax to govt on monthly basis

- Now in Jan, when the employer asks Ajay to give them the investment proof, suppose Ajay realizes that he forgot to make the investments and does not have money to invest 1.5 lacs in 80C products. But he will do it in Mar himself. And he fails to provide the income tax proofs to his employer.

- Now his employer will come to know that Ajay real taxable salary is 12 lacs and not 10.5 lacs as declared by him and lets say on this his income tax is 1 lac, so additional 40k is to be recovered from Ajay, which will be adjusted from Ajay’s salary in Feb/Mar

- Ajay then invests 1.5 lacs in Mar and finally his taxable income should be just 60k , as per the planning (because his taxable income is 10.5 lacs as declared in the start). However his employer has deducted 1 lac in total from his salary and paid to govt.

- Now Ajay can declare in his tax returns that he has invested in 80C products and he is liable to get refund of Rs 40,000 which he will get in next few months.

In the example above, you can see that not giving investment proofs on time has resulted in some inconvenience for Ajay, but that does not mean that he will lose out on his tax benefits. One can always invest around the end of the year and then claim back the tax refund later.

However, there is one exemption here

Few exemptions are made only at employer level, like LTA and medical reimbursements. So if you fail to provide LTA and Medical reimbursements proof to your employer on time, then you lose the benefit. You can’t claim it back at the time of filing returns.

4. You DONT need to submit any proofs while filing your tax returns

Another important point you should remember is that while filing income tax returns, you just have to furnish the information about your investments, and not attach any investment proof.

Please do not attach xerox copies at all. It’s not required.

Its required by the employer because they are deducting the TDS and as a third party they need the documents for verification purpose.

But if you are claiming at all the benefits yourself at the end of the year, you just need to declare things. However note that you should keep the receipts and all the required documents with you for some years, because if their is any scrutiny later, you need to be prepared to answer income tax authorities along with documentary evidence.

Which means that you should never lie about your investments which you have not done in reality. Always provide true information.

5. You need to give “proposed investment” proofs for the month of Feb and March

A lot of people are confused on how will they provide the investment proofs for the month of Feb and Mar in Jan itself, when the employer asks for investment proofs. It might happen that your life insurance premium is due in Mar or if you are doing SIP in ELSS funds, you still don’t have the statements showing the investments.

In those cases, you have to provide a declaration that you are going to make the investments for Feb/Mar and based on that declaration, your employer will process the TDS.

All the employers provide you with the declaration form. You just need to write there that you promise to do the investments for tax saving in next 2 months and your exemptions should be given to you based on your declaration.

Let me know if you have any questions or if you want to share some important information on this topic

September 8, 2015

September 8, 2015

I joined an organisation on April 2019 and I need to clarify if I’ve to submit the investment proofs so that I don’t hahe to end up paying taxes.. or should I complete one year in an organisation to be eligible for submitting the investment proof..? Please let me know

Its not like that.

When you submit proofs then you are just telling them about your investments intention and based on that the company deducts your TDS if any.

Manish

HI Manish,

I need one clarification with regard to latest tax rebate u/s 87a increase from Rs. 2000 to Rs. 5000. My employer has still deducted only Rs. 2000 as tax rebate (my taxable income is within Rs. 5L). When I asked my HR, they are saying that the rebate is in the proposal stage and there is no official Government Gazette notification. Is it right?

Yes, it might happen . Its not yet notified I guess!

Dear Sir

I have taken home loan from sbi jointly with my wife in last year September 2015 . the property is under construction it will complete by end 0f 2017 . already i have borrowed some amount from loan and paid to builder as per demand not compete and also i started repaying of same loan through monthly installment till date final disbursement is not yet done it will take another 6-9 month . So whether as per IT rules is it possible to get income tax deduction for principal and interest to me or my wife (or both 50: 50) and how much deduction is allowed for interest and how much for principal please guide me in this matter

thanking u in anticipation

and also i request u to write a article on same

and also is it possible to file return on my own as i am salaried what is procedure for same or is any artilce podcast please give me link

You cant get deductuions benefit unless you get the possession

I have ppf contribution of Rs.1,50,000, lic contribution of Rs.49805 and 10% of salary approx. Rs.60000 in nps and employers contribution of Rs.60000.

Should i invest extra Rs.50000 in nps for claiming deduction under section 80ccd (1b) or can i show the rs.60000 contribution which is 10% of my salary as saving under section 80ccd(1b) as limit of 1.5 lakh is already obtained by ppf and lic contribution.

If you want, you can invest

Manish, Thanks for writing such a wonderful article. I am an ardent follower of your blog.

It will be great if you could write an article about the overall process/workflow from TDS to E-filing income tax return.

What happens exactly when the employer deducts more tax in Jan/Feb and how to produce those investments in E-filing IT return. How will I show the additional investments which an individual misses to declare in the TDS.

Thanks for your time.

Will write on that soon

Suppose I have given the final declaration in January that I would be investing this n dat in Feb n March but failed to do so. What will be the consequences. I work under central govt

In that case, the tax which you need to pay will be deducted from the last month and you will get less salary !

thanks manish for such a nice detailed article. i have a query regarding extra investment in NPS for tax relief under 80CCD-1B over and above 1.5L under 80c. although we are getting a lot of promo SMS and email from NPS to fund money in NPS to avail tax reilef yet my employer is not conceived that whether this reilef can ve given in FY 15-16. as per him , income tax site shows it will be effective from 1st april 2016( for 80 CCD 1 B of NPS ). so he is telling that tax relief will be applicable from next FY ie 16-17. can you help me at this front?

I am still not clear what is your question.

HI Manish,

Thanks for your informative article. I am a regular follower of your articles.

I stay in a PG paying 6000 rent . Now, when submitting HRA proofs, I have given my rent receipt to my employer . They put it on “HOLD” saying they need PAN details of my landlord.

I spoke to him and he is unwilling to share the same. What can I do now? Please advice. In case, I don’t submit HRA, what can be the tax implications?

Thanks,

Kaustav

Your employer is not right here.

THe landlord PAN is mandatory only incase the rent exceeds Rs 1 lac a year. So talk to them once.

If your landlord is not giving you PAN ,you cant do much !

Hi Manish,

I have recently transferred my home loan from LIC to ICICI and have couple of queries regarding claiming the tax benefit on home loan:

1. Should I simply add the principal paid to both institutions and claim the same under 80C (& similarly add interest paid to both and claim under Section 24)?

2. Also the letter which I got from LIC shows the principal paid as the overall pending loan amount (since I have pre-closed the loan & transferred to ICICI). Pl advise what principal amount should I consider in this case.

Thanks for your help!!

1. Yes

2. You need to include the actual amount paid and the pending amount you are going to pay in Feb/Mar

Thank you writing such a detailed article, addressing almost all the commonly unasked questions! Good job Manish.

Glad to know that Vijay ..

Nice Article, Manish.

Thanks for your comment young

Very Helpful article

everything is written in well manneredin this article,But one thing written here about non claimable about LTA & medical bills in ITR I am not agree with it. As per my knowledge , you can claim every exemptions & deductions during filing of your ITR provided you should keep all proof in your record up to 2 years . Because your taxation is directly related to Government, not with employer.

Thats what I am saying , Incase of medicals and LTA, its employer specific and not govt

Manish, you are right.

Surya, I am not able to find the exact IT law, but both LTA and Medical Reimbursements are needed to be claimed only through the employer. I was able to find an ET article on this.

http://articles.economictimes.indiatimes.com/2015-03-16/news/60174715_1_lta-deduction-sudhir-kaushik

That means, if you missed the submitting the documents to your employer, you cannot claim it in the ITR.

Manish,

One thing is incorrect in the article. For LTA claims, there is no obligation to submit the proofs (like boarding passes, tickets etc). This is according to a supreme court judgement. You can find more details on Google, but here is a sample link http://www.pankajbatra.com/news/lta-proof-reimbursement-to-employer-not-required-supreme-court-india-ruling/

But due to the poor understanding, employers deny this benefit to employers. You cannot argue with your employer, can you? But, I am convinced that in theory at the least, you do not need to submit the proofs.

Thanks so much for your article.

Ahmed

Thanks for confirming that!

Need some clarification on the point @ap16j55 discussed

Suppose if I have accumulated an interest component in excess of Rs. 10000 /year as per my deposits (savings+FD) in a particular bank then,

a) Will it reflect in my form 26AS

b) If it does not reflect in form 26AS and I compute from my bank statements and if i capture in my tax return filing then will the mismatch between my tax filing and 26AS form will create any particular headache for me in future

c) 26AS captures details from PAN so all my bank details should be automatically linked in my 26AS statement, right ?

Form 26 AS is a tax credit statement which shows all taxes paid on one’s PAN number. If I pay advance tax, it will reflect. If my employer deducts TDS and deposits basis my PAN, it will reflect. If bank cuts TDS and deposits, the same gets reflected. If income tax dept gives any refund, the same also gets reflected.

1. If bank cuts TDS and deposits, then only it reflects. In this case one can demand a TDS certificate from bank for records.

2. If a TDS(any TDS) does not reflect in 26AS, the same can be taken up with concerned. It can be a mistake. The same can be rectified by talking to concerned. If an entity deducts TDS one can demand a TDS certificate and keep for records. At the time of return filing total income and tax on total income be calculated properly and the difference between that and tax already paid can be paid/demand as refund. It will be the responsibility and in the interest of tax payer to see that a TDS entry reflects in 26AS. If the deductor has a proof that the tax was paid and if the same is not shown in 26AS, the same can be taken up with IT dept.

3. 26AS captures all taxes deducted and paid to IT dept. Reflects all entries of a PAN from various sources.

I wanted to know more about LTA.

how will one utilize…are only flight tickets and rail tickets covered under it?

See this – http://jagoinvestor.dev.diginnovators.site/2009/02/lta-and-medial-reimbursements.html

Some points which I learnt over a period of time.

Advanced tax.

As the name suggests, advance tax refers to paying a part of your taxes before the end of the financial year. Advance tax is the income tax payable if your tax liability is more than Rs. 10,000 in a financial year. It should be paid in the year in which the income is received.

If you are a salaried employee, you need not pay advance tax (on salary income) as your employer deducts tax at source (TDS). Advance tax is applicable when an individual has sources of income other than his salary. For instance, if an assessee earns income via capital gains on shares, interest on fixed deposits, winnings from lottery or races, capital gains on house property besides his regular business/salaried income then after adjusting for expenses or losses he needs to pay advance tax. Please note that advance tax is payable even by salaried employees on their other incomes.

TDS(Tax deductible at source)

TDS is deducted by employer on an employee’s sources of income known to employer/declared to employer. declaration of sources of income, is to be furnished yearly by employee. The responsibility of furnishing and help deducting tax is on employee. After correct declaration, responsibility will be with employer to deduct and pay to authorities.

Tax on income from bank : Bank gives interest on savings account as well as on FDs. Savings bank account innterest is tax exempt upto 10000. Above that, it is the responsibility of the customer to check and pay correct Tax on savings interest earned. For FD, if the interest crosses Rs 10000/Year, banks deduct 10% TDS. However, the customer should add the interest amount to his regular income compute total tax and pay it. Some people resort to splitting of FDs across branches/banks to avoid showing interest earned. As income tax authorities can check interest earnings using one’s PAN across banks/branches, they can check it even if a person doesnot declare and pay tax. This will be deemed as tax evasion.

Hey Srinivas

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Thanks Manish.

Basic but essential information. I would like to know under which section or clause it is declared that LTA and medical etc. exemptions are made only at employer level. Is HRA in the list of such exemption?

~Samir

Hi Samir

What I wrote was based on all the information I got from various sources already on net and also from other bloggers. HRA as far as I know you can claim even later

Manish

Thanks for prompt response Manish. I too will investigate from my end.

~Samir