What are Arbitrage mutual funds and how they are safe and tax efficient ?

Do you want to invest in a mutual fund which has near zero-risk, offers returns in range of 6-9% with high liquidity and at the same time, they are tax efficient? Welcome to the world of “Arbitrage Mutual Funds”.

Arbitrage mutual funds are a category of mutual funds which are comparable to liquid funds or a pure debt fund whose returns are in range of 6-9% per annum, but from taxation perspective they are treated like equity mutual funds. These arbitrage funds have suddenly become very famous with investors after this tax budget, because the taxation on debt funds changed and became unattractive compared to past.

How does an Arbitrage mutual fund work ?

You should first understand the word “arbitrage”. In short arbitrage means – “simultaneous purchase and sale of an asset in order to profit from a difference in the price”.

Let me give you an example

- Imagine that a person wants to buy a second hand phone and is ready to pay Rs 2,000 for it. You go to OLX and see that the same phone is selling at Rs 1,200 there. You then buy the phone at 1200 and sell it at 2000 and make the profit of Rs 800 . This is one example of arbitrage

- Another example is gold. Gold prices are different in various cities. So there is a possibility that gold can be cheaper in bangalore compared to chennai and a gold dealer buys it from Bangalore and sells it in Chennai. This is another example of arbitrage

In the examples above, the problem is that the buy and selling happens at two different times, and hence there is small risk.

But what will happen if you are able to buy and sell at the same time? In that case, there is no risk, because instantly you are locking the profits (the difference price)

This is exactly what happens in Arbitrage mutual funds

In case of arbitrage mutual funds, the funds explore the arbitrage opportunities where the same stock is quoting at two different prices at BSE and NSE at the same time and they buy and sell in different markets and make the profits.

The other thing which an arbitrage fund does is use cash and derivative markets. For example, a stock might be available at Rs 100 on stock market, but it might be selling at Rs 104 in future’s market (if you dont understand derivative markets, thats ok , dont worry) and they make the difference as profits.

Lets not go to much into detail of how they work, as of now just understand that arbitrage funds use the arbitrage technique to earn the profits from the gaps in markets and its almost risk free.

Arbitrage funds returns are tax free after a year

So lets come to the biggest plus point of an arbitrage fund.

The biggest advantage of arbitrage funds is that they are treated as equity mutual funds, when it comes to taxation. Hence any return you earn after holding it for 12 months is tax free, and incase you hold it for less than 12 montsh and make any profits, the taxation is 15% (short term capital gains tax).

So, return wise arbitrage funds can be compared to a liquid fund and the returns potential are in range of 6-9% depending on the time frame and the yield of the instruments they have invested into.

Now think about this scenario

If you want to park a big sum of money for some months or approx one year, but you dont want to take a lot of risk on the capital and at the same time want a highly tax optimized solution, what are your options?

FD is not that great option, because if you are in 30% tax bracket, you will be paying tax at the rate of 30% and if you break your FD in between before maturity, you will also pay penalty. In that case, these arbitrage funds can be a very good alternative, because they can give decent returns, high liquidity and lower tax (no tax if held for more than a yr)

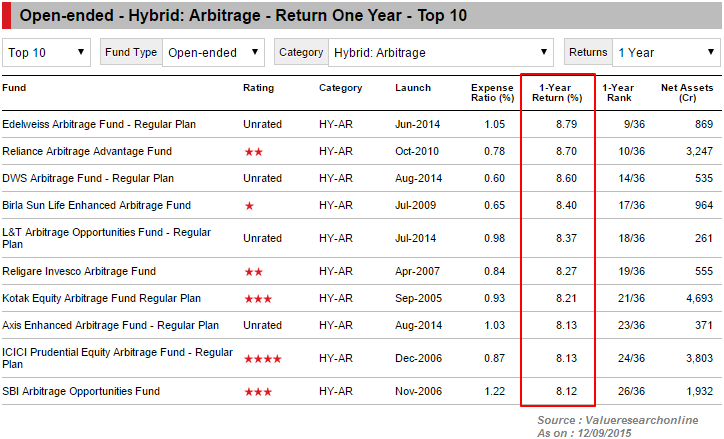

Below you can see some of arbitrage mutual funds and their performance over the last 1 yr (as on sep, 2015)

You will see that the returns from these funds have been in the range on 8%, which is quite good and comparable to Fixed deposits and liquid funds.

Are there any risk in Arbitrage Funds?

Yes, But more then risk, I would say these are some points which every investor should be aware about before they invest in arbitrage funds.

You should understand that arbitrage opportunities must exist if arbitrage funds have to perform better, means if the markets are uncertain, then good opportunities will exist for arbitrage funds and they will give decent profits, but if markets are not volatile enough, it might happen that the returns from arbitrage funds are unattractive.

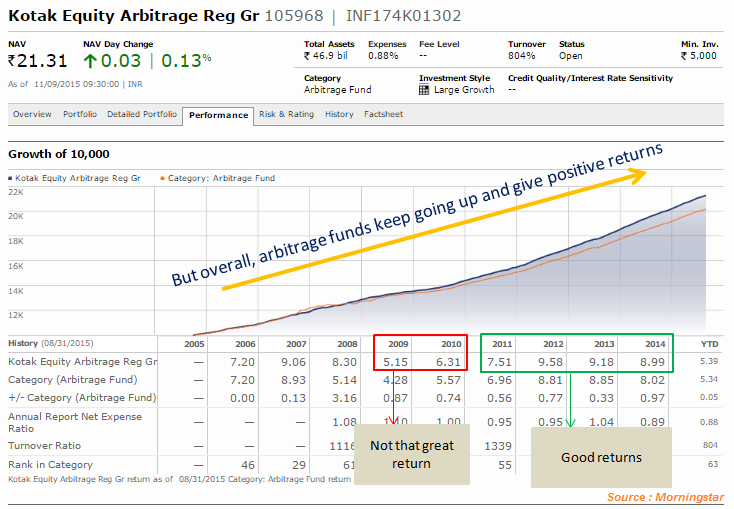

If you look at past 3 yrs returns, you will find that the returns have been very good, but if you go a bit in history you will see that they have not give the same kind of return always. See the chart below for Kotak Equity Arbitrage fund, a very good fund in that category

You will see that in the year 2009 and 2010, the fund has not performed well like it did in earliar years or after 2011. So be very clear that you cant expect them to return in the range of 8-9% always. There will be times when they will return 4% or 5%, but that happens rarely.

How liquid are Arbitrage funds ?

Lets talk about liquidity factor now.

You will often hear that arbitrage funds can be compared to liquid funds as they are highly liquid and risk free. So some extent this is very true, but if you go deeper, there are few differences.

- Arbitrage funds redemption can take 3-4 days : An arbitrage fund redemption can take 3-4 days compared to just 1 day in case of liquid fund, so if your requirement is that the money should come back to you the next day if you want to redeem, then arbitrage funds are not the right choice.

- Arbitrage funds have exit load for 90 days – Most of the arbitrage funds have a small exit load anywhere from 0.25% to 0.5% if you take out the money before 90 days. If compared to liquid funds, there does not exist any exit load and you can take out the money even in a week without any loads. For example, incase of ICICI Prudential Equity arbitrage fund, its exit load is 0.25% if redemption before 30 days

The above two points conclude, that one should ideally choose arbitrage funds if one is looking to park funds anywhere from 3 months to 2 yrs. Also someone who is falling under a lower tax slab, will not benefit too much from investing in arbitrage fund because anyways their tax slab is less.

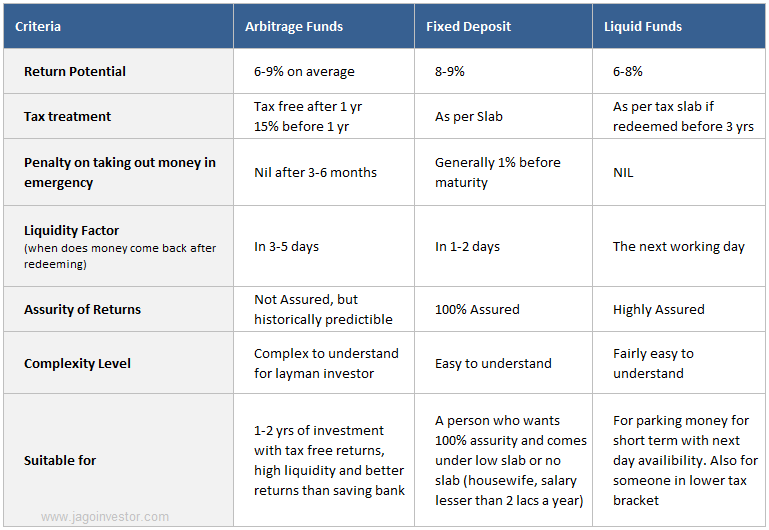

Comparing Arbitrage fund with Fixed deposit and Liquid fund

Finally, let me give a rough comparision of arbitrage fund with bank FD and liquid funds, which will make you more clear. The comparision chart below shows various criteria and how these products compare.

So shall you invest in arbitrage funds?

I think based on the above information, you can now take the call if you want to invest in arbitrage funds or not. Let me know what you are going to do and what comes to your mind about this category of mutual funds.

September 12, 2015

September 12, 2015

Hi Manish,

I have a lumpsump to invest. Does it make sense to do a SIP in Arbitrage funds, or just do a lumpsum investment (as the risk is comparatively less in arbitrage funds)?

Thanks,

Melwyn

You can just do the lumpsum in arbitrage fund . No need to do SIP per se.

If you want our team can help you in that.

We think our pro membership will help you as it fits in your requirement. We have various benefits under it like life insurance, health insurance, mutual funds and your financial analysis too..

Just check out our Pro membership once and schedule a FREE call with us to know more – http://jagoinvestor.dev.diginnovators.site/pro

Lucidly explained for all.

Thanks for your comment DebabrataMnadal

Manish

Very good article. Kudos to you for this.

Glad to know that amitabh ..

I want to invest in arbitrage funds and few other mutual funds via sip. Can I do so from home online ? I have my kyc in place already and have an account with Cams. What is the process? Or do I need to visit individual fund houses – I don’t have so much free time. Thanks.

You can download the CAMS mobile app and do it from there. Or you can visit the AMC website and do it from there

Manish

What would be the best SIP date for Arbitrage Funds?

there is no best date !

hmm but because fund manager has to sell off the futures on the settlement day and get will some profit; won’t the NAV of the fund raise on the settlement day? I am just throwing up (excuse me if I am talking non sense).

I am not sure if I am the right person to comment on it at this level .

For example the fund manager buys a stock in cash at Rs 100 and simultaneously sells in future at 110. So he locks in a gross profit of Rs 10 today itself. On expiry date the spot and futures prices will converge. So if the stock prices goes up by Rs 10, On the expiry day he will make a profit of Rs 10 on spot price. In case the sock price goes down by Rs 10 he will make a loss of Rs 10 in spot market and a profit of Rs 20 in future market. In both the cases the gross profit remains intact.

I am reading your blogs regularly. I would like to know the best investment post retirement.

How much risk you can take ?

In 2008-9 Ihad invested in two Arbitrage Funds. One day I got letter from one of them that ” Since during the last quarter we did not find Arbitrage opportunities, Fund had invested more than 35% in debt instrument. Accordingly as per Income Tax rules Fund will be treated as Debt Mutual Fund ”

Please note this clause since Shri Arun Jaitely has made 3 year LTCG amendment since July 2014.

Thanks for sharing that Ramesh

Can you name the fund?

Hi !

Is SIP possible for entering an Arbitrage mutual fund ?

Will it be beneficial as compared to investing in SIP of a liquid fund ?

Yes, you can do SIP in arbitrage fund !

Manish,

Excellent article.

What about the continued opportunity for arbitrage at scale?

With growth from 12,000 Cr to 29,000 Cr this year, will they be able to retain a 8+%age of return or will that drop significantly?

I am not qualified to answer at that level

This is quite logical that the returns will continue to diminish over a period though not substantial reduction in returns. Arbitrage funds benefits from the market inefficiencies, so more people going for these funds will reduce the inefficiencies in the markets

Very Good Info.

What will happen to TAX if Liquid fund hold more than 3 Yr?

Thanks

The indexation will apply . read this – http://jagoinvestor.dev.diginnovators.site/2009/05/how-to-calculate-capital-gains-and-what_7801.html

Why gain are limited to 6-9 percent in arbitrage funds . In Theory, there have potential of much higher returns..

I am not sure on that

Ajay, in a perfect market with no information asymmetry, there should not be any arbitrage opportunity, so not sure why you are saying otherwise. In real world, at a stock level there may be sufficient opportunity for an individual, but not for a big investor like arbitrage fund to take a big position without impacting prices of underlying securities that will result in reduction of arbitrage opportunity.

As Puneet Arora has rightly pointed out, more money chasing same opportunities will result in diminished returns for this category of funds, especially when the market volatility reduces.

its good article. For Sure i would like to try out this option. according to me this option is well suited for the fund which is collected for medium term expenses.

Glad to know that Vishnumoorth ..

pl.let me know ur contact no. i m interested in investing in arbitrage mutual fund.seek ur guidance

Hi yamdagni

You should look at our services – http://www.jagoinvestor.com/services/

Hi Manish

A very lucid way of explaining otherwise high sounding financial instrument. One is tempted to try out the product immediately. You have professionally provided the information and left it to the reader to make his choice of the fund. I have a doubt. Will there be any TDS at the time of redemption?

Gangadhar

There is no TDS concept in Mutual funds

I think,

There is a concept of TDS but for NRIs.

Manish can get it confirmed with reliable sources.

Thanks

Really ?

I have never heard about TDS for NRI in case of mutual funds. I really dont think its there

Very useful post, Manish.

As I understand, there is TDS for NRIs if there is tax liability on redemption. So, if there are any short term gains on equity funds or any gains in debt funds, AMC will deduct TDS before making a payment to the NRI investor.

http://www.hdfcfund.com/CMT/UPLOAD/ARTICLEATTACHMENTS/HDFC_AMC_Tax_Reckoner_2015_16.pdf

That was a new information to me . Thanks for sharing that !

A complex situation simply explained.Thank you

Thanks for your comment Ramamurthy

THANKS MANISH, ACTUALLY THE ARTICLE ON ARBITRAGE FUND I AM FEELING RICH MYSELFAFTER READING. WITH MY LESS KNOWLWDGE, IN THIS CATEGORY PREVIOUSLY I NEVER PITCHED PROPERLY FOR MY INVESTOR.S NOW I CAN SUGGEST THEM ACCORDINGLY. ALSO I CAN PASS THIS ARTICLE TO THEM FOR READY REFERENCES. THANKS AGAIN .

Glad to know that PRABIRSINHAKOLKATA ..

Your timing is awesome Manish. Whenever I have a doubt regarding some new topic, you have a n answer immediately.

Thanks for the details which is understandable to layman.

I have a time frame of 7 months and i left with random surplus every month to invest. As the amount is not fixed every month, i opened an iWish account from icici bank. I thought of liquid funds, but after taxation, i guess it would be same as RDs.

So can I move my investments to Abrdige funds from iWish account? Please suggest.

You can do that if you are comfortable with the arbitrage funds !

Hi..

It is a nice article with all necessary points a investor should look for..

Thank U..

Kalai

Hi Kalai

Thanks for your comment. I have made the correction