4 early life mistakes which investors should avoid at any cost

We see most of the investors having a complex and bad financial life mainly because they have done a lot of mistakes when they started their financial life, which I think should be minimized by learning from other investors mistakes.

So we are listing down 4 common mistakes which most of the new investors make when they start their financial life.

Mistake #1 – Buying products only for “saving tax”

I have experienced the power of “tax-saving” season in an investor’s financial life. When I was into my first job, the cafeteria and the reception area was filled with my employee’s sitting with some agent or advisor with various kind of forms all over the table.

The tax season was on and all the people were busy “arranging for the investment proof” and not investing their money. Especially the new employee’s who had no idea about anything and they followed the herd to save tax.

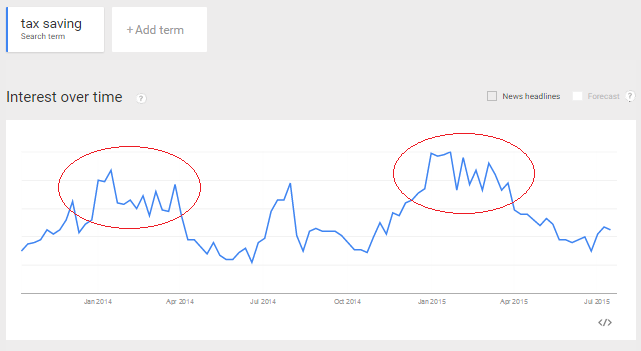

Below is the google trend showing you, how most the people starting thinking about the “tax saving” only in the month of Jan/Feb/Mar when they got emails from their employers. The search trend clearly shows that.

Only after many years, people realize that they have not done great justice to their money and invested mainly for instant gratification of saving tax. If you are a new investor, I suggest do not get carried away and only think about saving tax.

I know tax saving is important and one has to do it, but do it meaningfully.

Explore what all options you have and which one them will align well with your long-term goals and then invest in those products.

Mistake #2 – Waiting for the “right time” to invest

When we work with our clients, we observe that one of the biggest regrets, they have is that they didn’t start their investments early in life and lost the valuable time. A person in India spends close to 20 yrs in school/college and most of the students have seen a lot of struggle around money, because of which all their early life, they suppress their desires. They never freely spend money on anything and keep waiting for that D-day when they will have no restrictions around money. The first salary is nothing less than a big jackpot.

The first few months when they see a lot of money in their account, is the time of celebration and fulfilling all their wishes they had from years. There is nothing wrong about splurging, spending and enjoying it all. But some people extend it over many years and over-do it. When it comes to investing their money, they say that they dont save enough after their expenses and once their salary increase, they will invest then.

In short, they keep waiting for the “right time” and it never arrives. Because the nature of money is such that, the more you earn, the more you will spend and your lifestyle will keep changing its shape to fit in your salary.

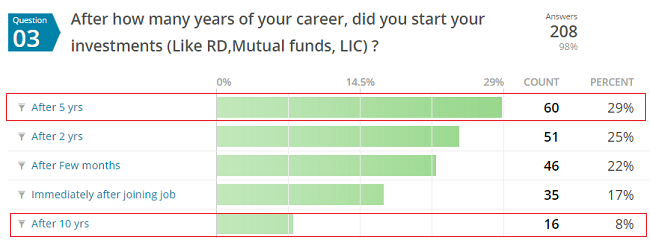

1 out of 3 investors wait for 5 yrs before making first investments

I ran a survey on this topic, which was taken by 208 investors and as much as 37% of investors said that they made their first investments after 5 yrs of their career. Think about this , around 1/3rd investors wait for 5 yrs before they make their first investment. Thats quite high. If you see the same survey results below, almost 8% investors didn’t invest anything for first 10 yrs of their earning life.

This makes them loose valuable time, and for many years they do not accumulate any wealth and get into the mode of living on paycheck to paycheck. Even if they had started a recurring deposit of Rs 2,000 per month, even that would be a great thing, because they are atleast getting into that habit of saving some money regularly and later its just about increasing it.

So if you have just joined your first job, I would suggest start a recurring deposit RIGHT NOW, not for a big amount, but just Rs 500 atleast.

Mistake #3 – Getting high on debt, early in life

Debt is not a problem in itself, if you handle it carefully and responsibly. I do not come from a class of people, who suggest that one should not take loans or avoid debt 100%, because thats not possible for a majority of people and its not practical in today’s times.

However, rore and more people are embracing the EMI culture and we are turning into an EMI nation. Everything is available on EMI ranging from gym memberships to Mobile Phones, from vacations to jeans to even flight tickets. Because of EMI, one can afford anything and everything.

So most and more people are buying not so important things TODAY, for which they have to pay in FUTURE.

Are you getting my point?

This is a perfect recipe to get into the never ending debt cycle. There are many investors for whom EMI payments is going on for years and years. For many years, they have never consumed 100% of their monthly salary themselves.

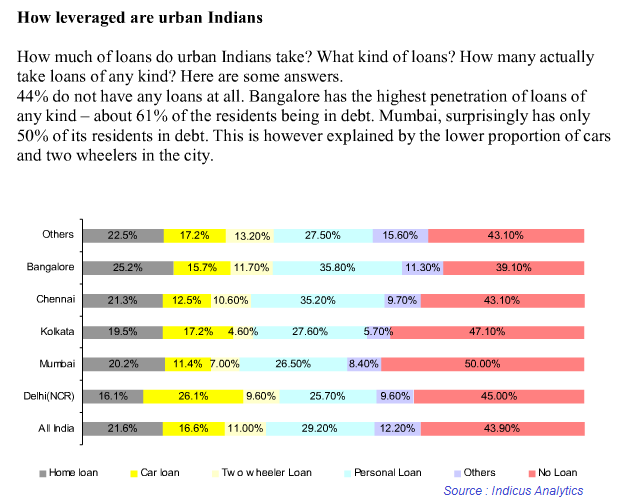

Below is a bit old study by Indicus Analytics on how leveraged are urban Indians, and you will be surprised to know that around 61% of residents in Bangalore have some or the other kind of debt. For Mumbai its 50% . Below is a snapshot of their finding’s.

So if you are young, try to see that you control your desires beyond a point else you will get into huge trouble later in life. Use the credit card and personal loans only and only if you really need it and you have no other options of borrowing and even then pay back the money as soon as possible.

Mistake #4 – Over relying on relatives, friends and parents for your financial decisions

Parents, friends and relatives can bring in a lot of experience and life lessons for us. But a lot of youngsters instead of learning about money, prefer to hand over their overall financial life to their parents. Parents have seen more life then their kids, but then times have changed a lot compared to last 1-2 decades and the many rules don’t apply today.

Also their way of thinking about risk, opportunities, returns etc might differ from you. Hence its not always a good idea to over-rely on parents advice. Mr Anand shares his view about this point in one of my old article

The times have changed so we have to change with the times. In most of the families, it is the ego of the parents which is finally ending with the suffering for the children. Parents feel that the children are incapable of handling money or they may get spoilt if the money is in their name. Also in some families it has become a question of pride saying – My children are so obedient that they are handling over their income to us.

The so called elderly, experienced people do not want to learn the new things and change and their beliefs are passed on to their children also. If we look around many Government employees, we can easily make out this. They are afraid to tell the children about the investments.

Relatives and friends role in your financial life

Also a lot of investors are influenced by their relatives and friends advice. A lot of them turn out to be life insurance agents who want to take advantage of the relation to meet their business targets. Out of 100 people I have come across, 95 people surely have an LIC policy sold by their relative, relative friend, friends relative, parents friend, or someone close.

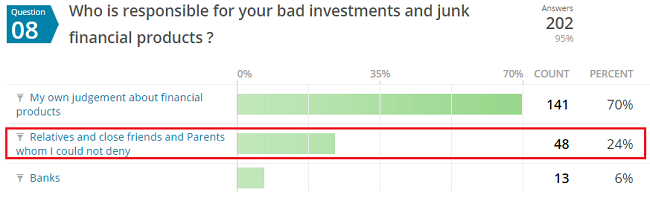

As per our survey, 1 out of every 4 investors financial life is messed up because of their relatives and friends who sold them some financial product or advice on something and they could not deny them.

We recently found that one of our client who recently joined job is paying close to 40% of his yearly salary in 6 life insurance policies. When we enquired more, we found that it were taken by his father for him 3 yrs back, and now as he has started earning, his father has passed the premium paying responsibility to him. The policies were sold by his father’s sister son’ who was behind his yearly targets

I would suggest learning things in the start of your career and not over relying on advice of your friends/ relatives and even parents. You could do many things like read personal finance books, attend workshops on money (we have next workshop in Bangalore on 2nd Aug, 2015) or just surf internet and ready various things.

How should an investor start his financial life at the start of his/her career ?

When a person joins a job, its a special moment in his life and a very crucial point. Taking good care at this point will be helpful for his whole life and many years worth of mistakes will not happen which happens with millions of people. Hence below is a very crisp checklist of what a new investor can start with.

- See how much term plan you need and take it

- See that you buy a good health insurance policy

- See that you have started a recurring deposit or SIP in mutual funds for a minimum amount you are sure will not stop for next 5 yrs

- Keep 2 months worth of expenses on the side in a saving account which you generally do not touch

- Make sure you are meaningfully saving your taxes

- Hire a good CA or Financial advisor if you feel you need handholding

Wish you best of luck for your financial life. Would like to hear your views on this topic

July 20, 2015

July 20, 2015

Hi Manish,

I want to do SIP for 3 years. Will you please let me know whether i have to go with debt or equity fund.

Please suggest.

Thanks, Prashant

Hi Prashant

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

Manish

Hi Manish,

I agree with all the 4 mistakes which anyone could make. I think the 3rd point which mentions that getting high on dept at an early age is the most important point of all. Thanks for the post !

Thanks for your comment Anirudh

Hi Manish.My first investment was in PLI after 2years of my job.After reading so many articles on internet,mostly by you I chose mutual fund SIPs rather to go for Child Plans.My kid is 3yrs old now.Since 1yr I have been investing in MFs.500 in reliance tax saver,500 in sundaram SMILE,1000 in axis long term,1000 Birla sun life pure value fund,2000 in sbi blue chip.are my funds good?I want to increase my SIP amount further.shall I choose another fund or increase the existing.i have some lumpsump around 3lacs in FDs after 6months of emergency fund put aside.Can u suggest me where to park them.i can wait for 3yrs.And except blue chip,I have invested all the funds through broker.Is there any loss in continuing them?or shall I stop those sips and continue another sip with direct plan.

I invest 5750p.m. InPLI which will be matured at my 40th year.I got one LIC policy 14400per year for 25 yrs which I bought WITHOUT MUCH THOUGHT AND ON ADVICE OF FAMILY MEMBERS.I am regular with my RDs which generally are for 1yr.

Really thankful for all your articles or I may have got another child policy.

Its suggested to just increase your current SIP ..

Hi Manish, I want to invest Rs. 15000 p.m. in SIP for 10 years. I have also selected a diversified equity fund ,name, ICICI PRU EXP. AND OTHER SERVICES RP ( G ). please suggest me about this..i’ve not taken any dicission still now. Is this fund ok regarding it’s performance. Please suggest.

Hi Sougat

Its a good fund. You can do with this.

Let us know if you need our teams support in setting up your SIP !

Manish

Thx for ur valuable suggestion Manish. It is pleasure to me if u help me setting up my sip. I need near abt 35 to 40 lac Rs. just after 10 years , for my daughter education purpose. I will start my sip 3/4 months after. Please can u help me regardin this. – Sougat.

Hi Sougat

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

Manish

I m working in railway,and investin Rs. 7500 p.m . In new pension scheme. My age is 39, How much i can get at my retirement.- sougat

Hi Sougat

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Dear Manish…

I would like to know what would be your recommendation to start investing from a substantial corpus, which has been parked in a normal bank Savings account as of now. While there are a whole lot of options for a knowledgeable investor, I would like to know if you would recommend immediate deployment of the entire corpus or would suggest a systematic plan of transfer/ investment.

Goals are for the long term.

Thanks.

I would recommend a STP for 1 yr into Debt -> Equity !

Thanks Manish…

I lost about $2000 in forex trading when I was too young 🙁

Thanks for your comment Ahmed

Hi Manish,

Well explained and learned from your post. Keep posting ?

I have just started saving money from last 4-5 months in mutual funds around ~40-50k. My monthly earnings are 1.5lacs after tax. And i’m planning to get married in coming 7 months so I want save money for my marriage. Could you please suggest me if there are any short term savings with the proper plan.

Thanks,

-Srinivas

If its just 7 months, I would say go for simple liquid funds or Recurring deposit

Manish

Dear Manish,

Your financial advices are good. You have time and again mentioned how starting investment early in life is important. How compounding helps if we start early.

As important as I know it is to inform youngsters about the importance of early investment I always feel that there is very little knowledge out there for those who are starting little late (like in my case as I am approaching 30 and just now planning to invest seriously). There are a lot of people who realize importance of saving and investment a little late or are only able to do it later in life for circumstantial reasons. Unfortunate but true.

I always seek to know how the people starting late can cope up or make up a little bit of lost advantage of early investing. I am not sure if you have already written about this but if you can highlight this it will serve as a catalyst and will motivate such investors, the reason being it is kind of demotivating to always read that if one had started earlier it would have been a better scenario.

Thanks,

Ranjeet

Hi Ranjeet

As a remedy, you have two options

1. Take a bit higher risk so that you cover up fast in terms of returns

2. If you get any lumpsum money, make sure you put to work , so that you have some base . For example if a person starts early and invests Rs 3,000 per month , then in 5 yrs , he would accumulate 3 lacs for example. Now someone who is late by 5 yrs, just needs to make sure that they somehow arrange for this 3 lacs.

So create a base from any lump sum and take calculated risks to make up 🙂

Thanks for the advice.

Thanks for your comment Ranjeet

Hi Manish,

Nice article.I am 29 Year old and having home loan on 21 lac of SBI maxgain just now.I am thinking to make an RD to make repayement.So is better to directly put the savings into Maxgain account or make an RD and then put cummulative yearly amount into Maxgain account.Also i am planning to invest some amount into SIP.So is it good or i can use the same to repay the home loan

Instead of making an RD , I suggest add the same amount to the EMI and increase it !

Manish

Thanks Manish!

Manishji,

I am 46 years old , have not settled yet. I had a troubled small business which got closed 2 years back. My present life depends on agriculture income which is around 4 lac per year . I have wife , son ( studying in 9th std.) and old mother.No savings worth mentioning . Only assets are my parents plot and the plot of my business which are currently selling due to depression in property market. .

I owe home loan of rs. 13.50 lac , crop loan of rs.6.5 lac , agriculture gold loan of rs. 5 lac , and other personal loan of rs. 2.25 lac.

I accept the fact that I am in debt trap. I wish to repay the loan whenever property sells at the right value

Whatever some cash flow I receive a use it for repaying the loans ( after meeting the household expenses ).

My question is shall I invest some money from the cash flow instead of using all of it for repaying the loan. can I beat the loan interest by regularly investing small amounts in equities ?

.Or can you guide me or share your wisdom with me.

Yours’

Troubled , educated farmer in Vidarbha , Maharashtra

Hi Dipak,

I my opinion, since you already have three running loans, its not wise to start equity investment, since due to very nature of equity, markets can move in any direction, and may / may not beat you loan interest.

So, I would suggest you try to replay the loan with highest interest rate and avoid any kind of penalty on any of those. Getting rid of existing loans should b your first and farmost target for the time being.

Then you can plan for Equity investment with a longer time horizon. And always go with SIP to Equity Mutual Fund.

I think in case like yours the main focus has to be on clearing the loan and getting out of the debt trap. Dont focus on getting 1-2% extra return as of now.

Just get out of debt trap and later think of wealth creation

Manish

HI Manish,

I have taken a home loan of 17 lacs 2 years ago on a under constructed scheme. now I am getting the possession of my flat. with that I am planning to transfer my existing loan with SBI and planning to take 4 lac as a top up loan. with that top up amount I am planning to start a 2 businesses one for my wife and one for my sister. I will continue with my job.

Request you to kindly guide me whether I am getting in Debt trap here?

Loan after loan after loan is surely an indication that you are heavily dependent on loans .

Informational post but i need more information.

Glad to know that Amit ..

I saved 19 lakhs in FDs and earned an interest of 1.5 lakhs in one year. But I lost 50000 as tax. Had I made the FD’s in my major son’s name, the 50000 would have remained with us. Could anyone have been more stupid? This shows how important financial planning is.

True !

Dear Manish,

I am confused about ELSS Mutual Funds Locking period. If I started investing in SIP from Year Aug 2015 monthly basis I can withdraw In Sept 2017. But what about if i continue investing after 3 years (2015,2016,2017& 2018……….).

1) Can I get tax benefit for investment after 3 years?

2) Investment made from 4th year also lock for 3 years period or I can withdraw it at any point?

3) 5 or 10 years continues investment is good or bad in ELSS Mutual Funds?

Please guide me waiting for your reply.

Thanks

hi,

U can continue the investment, but for every financial year fresh investment would count.

Say for the first year you are investing 1K per month. So basically 12K you could show for tax saving every year, provided the SIP continues.

1. You get tax benefit only for the amount invested in a year

2. Yes, each installment gets locked for 3 yrs

3. Its good !

Victim of mistake#1 and mistake#4, however managed to avoid mistake#3 despite pressure from everyone :).

Glad to know that Sri ..

I have invested Rs 2 Lacks on my wife’s name two years back (Equity shares). No i want sell the same and the current value is 3 Laks. Now if she wants to invest the 3 Laks into Fixed deposit whether only 1 lack (i.e. capital gain) is considered as her income or entire amount is considered as her income (for tax purpose). Do I need to pay the tax for interest earned for 2 Lac?

If your wife is a housewife, then I think clubbing of income rules would be applicable to you. What this means is that you have to consider this as your income only and pay tax accordingly. If this weren’t the case, everybody will start investing in their wife’s name and effectively double their non-taxable income limit.

There wont be any tax , as its earned from equity !

It is always better to learn from other people’s mistakes first before doing them yourself.

May I ask though why you still recommend a recurring deposit or SIP in mutual funds instead of ETFs? Haven’t those mutual funds clearly proven us in the past that they are not able to beat the stock index (= ETFs) after fees and taxes?

Hi Tacomob , what you said it not true for Indian markets 🙂

Its not true for India !

I feel that individuals at very beginning of their carrier follow just two simple thumb-rules:

1.) Earn more than you spend: This shall lead to a saving which directly, after a contingency reserve can be invested for creating a capital. This capital takes care of the ONE-OFS while creating a financial buffer.

2.) Borrowing fund is not mine: SAY NO to borrowing, if the ROI you pay is less than the ROI you earn. So basically, even here, the first thumb-rule plays a role to suggest EARN MORE THAN YOU SPEND.

I started my savings when i was 19, and now that has benefited me in a great way. A simple logic of compounding plays that benefiting role when you start investing early. That’s the reason “COMPOUNDING” is also referred as the 8th wonder by financial analysts.

Hi Parth

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Hi Manish

Always we are ready to share some good knowledge to people. you too keep up the good work. We are shortly coming up with a blog for knowledge updations. Do keep in touch of our website.

Glad to know that Parth ..

if one can get a good CA or a financial advisor then its a great blessing

Glad to know that vandana ..