Atal Pension Yojana – Features & Eligibility explained in detail

Recently the govt has announced the pension scheme called “Atal Pension Yojana”, which is targeted at workers from lower class who work in unorganized sector which constitutes around 88% of the workforce.

An account needs to be opened under this scheme and monthly contributions needs to be made till the time of retirement after which a pension amount ranging from Rs 1,000 to Rs 5,000 per month would be paid to the account holder and on death of subscriber and spouse, the nominee will get the lump sum accumulated by the end of the period.

Any person below 40 years of age can open an account.

The retirement age will be set to 60 years, hence one will get at least 20 years of contribution. Any person below 40 years can open an account. The retirement age will be set to 60 years, hence one will get at least 20 years of contribution.

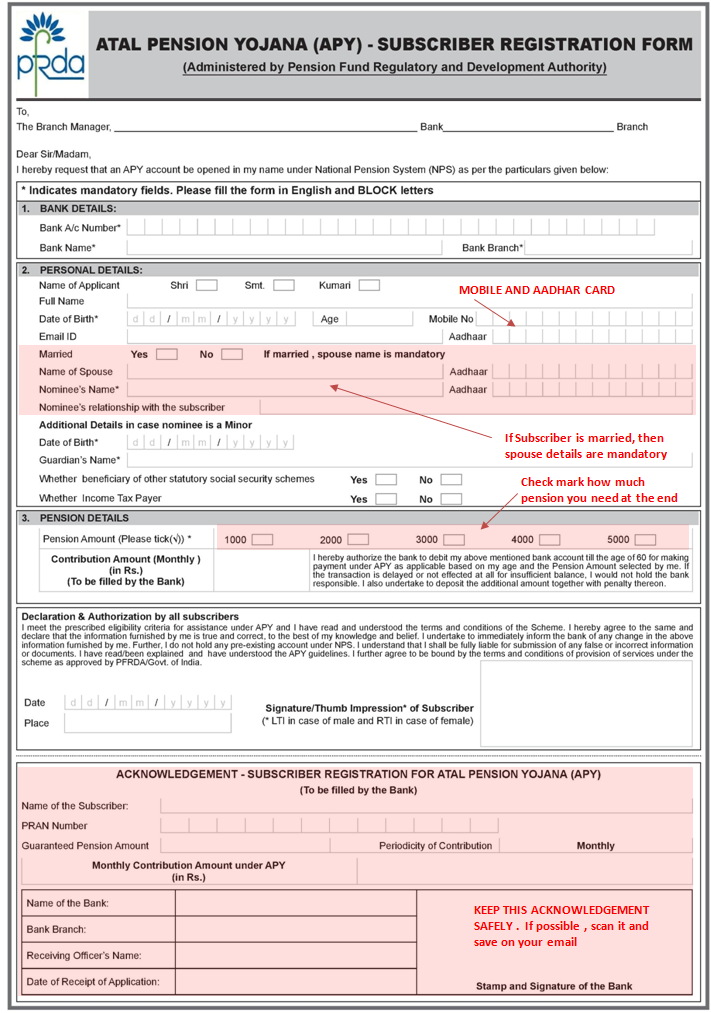

How to open Atal Pension Yojana Account?

- Go to the bank where you have your saving bank account like SBI, ICICI, HDFC or any other bank..

- Fill up the form (download english form or hindi form)

- Make sure you fill all the fields

- Mobile number is compulsory, hence that needs to be filled

- If you have Aadhar card, provide the number in the form (but its not compulsory)

- You also need to provide spouse details if applicable and nominee details, which is compulsory

- You will select the pension amount you need in future and based on that the bank official will write the monthly contribution required on the form

Below is a sample form

Note that the form itself contains a section which mentions that you are authorizing the bank to deduct the monthly contribution from your account till the age of 60 yrs. So once the Atal Pension Yojana account is opened, your bank account will then get auto debited in future every month.

If one does not have a bank account, then one can give their KYC documents along with account opening form with the Atal pension Yojna account form.

Eligibility Criteria for Opening an account

- The age of the subscriber should be between 18 – 40 years.

- One should have a saving bank account or should open a new saving bank account

- One should be having a mobile number, which needs to be furnished at the time of filling up the form

Governments co-contribution for 5 years

If one joins this scheme between 1st June, 2015 to 31st December, 2015 , the govt will co-contribute 50% of the total contribution or Rs. 1,000/- per annum, whichever is lower for the 5 yrs period from 2015-16 to 2019-20, But this govt contribution will be available only for those who are not covered by any Statutory Social Security Schemes and are not income tax payers.

What that means if that if you are an EPF subscriber, then you will not be eligible for govt co-contribution part.

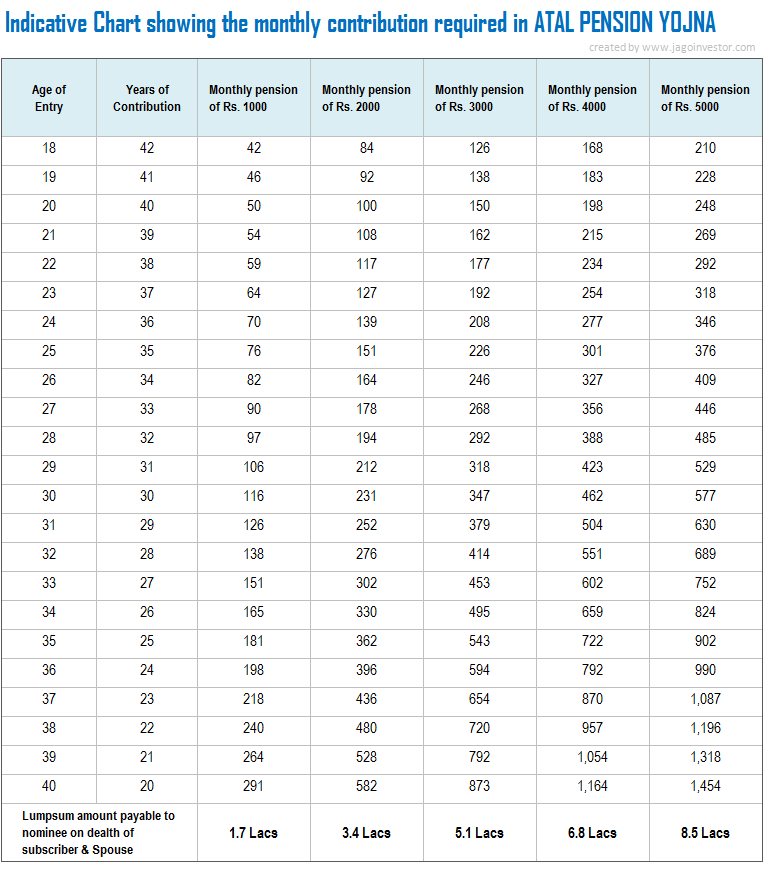

Below is the indicative monthly contribution required in this scheme at various age limits.

The subscriber can increase or decrease their contribution amount at some later stage if they want to do it

Will you get statements of transactions?

Yes, you will be getting regular intimations on your account information through SMS and even a physical statements each month. Note that you can move to any part of India without interrupting your contributions because the deductions will happen automatically from your bank account.

Can you exit or partially withdraw from the scheme ?

1. On attaining the age of 60 years – The first option is when you reach 60 yrs of age. At that time you will be able to use 100% of the money, but only in the pension form. You will only get the pension per month and not the lump-sum amount.

2. In case of death of the Subscriber (once they cross 60 yrs) – In case of death of subscriber, pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension corpus would be returned to his nominee.

3. Exit Before the age of 60 Years – The Exit before age 60 yrs, would be permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease. As per Wikipedia, Terminal illness is a disease that cannot be cured or adequately treated and that is reasonably expected to result in the death of the patient within a short period of time. This term is more commonly used for progressive diseases such as cancer or advanced heart disease than for trauma.

What is your want to discontinue the payments or delay in payments ?

Non-maintenance of required balance in the savings bank account for contribution on the specified date will be considered as default. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re 1 per month to Rs 10/- per month as shown below

- i. Re. 1 per month for contribution upto Rs. 100 per month.

- ii. Re. 2 per month for contribution upto Rs. 101 to 500/- per month.

- iii. Re 5 per month for contribution between Rs 501/- to 1000/- per month.

- iv. Rs 10 per month for contribution beyond Rs 1001/- per month.

Discontinuation of payments of contribution amount shall lead to following

- After 6 months account will be frozen.

- After 12 months account will be deactivated.

- After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Are there any Tax benefits in Atal Pension Yojna scheme ?

No , there are no tax benefits available in this scheme. A lot of people might think that they will get any exemption under 80C or on maturity, but no benefits are available. The pension amount will be considered as the income for the person and will be added in the taxable amount.

What if someone is already a subscriber of Swavalamban Yojana under NPS ?

All the registered subscribers under Swavalamban Yojana aged between 18-40 yrs will be automatically migrated to APY with an option to opt out. However, the benefit of five years of Government Co-contribution under APY would be available only to the extent availed by the Swavalamban subscriber already.

This would imply that if, as a Swavalamban beneficiary, he has received the benefit of government Co-Contribution of 1 year, then the Government co-contribution under APY would be available only for 4 years and so on.

Existing Swavalamban beneficiaries opting out from the proposed APY will be given Government co-contribution till 2016-17, if eligible, and the NPS Swavalamban continued till such people attain the age of exit under that scheme.

Note that, the ultimately the money under this scheme will be managed through NPS only and thats the underlying thing. All the investments decision will happen as per the guidelines of PFRDA.

A good support system for Poor

As I mentioned, this scheme has the maximum pension of Rs 5,000 per month, that too when the person reaches 60 yrs of age, that too will happen only after a minimum of 20 yrs from now (only people below 40 yrs of age can open an account), so Rs 5,000 at that time would be a very miniscule amount.

However note that we are talking about the people in lower section’s who are really poor. At least this Rs 5,000 per month would be a great support in their old age when they won’t be working. A subscriber can open only one APY account.

With this scheme, people will be encouraged to save a small portion each month ranging from Rs 40 to Rs 210 per month. Below is the full chart showing how much money would be required to be deposited each month depending on the time of entry in the scheme and the pension amount chosen.

What is the returns of this scheme and should you invest?

So the question finally is, how good is this scheme and its returns if you consider the returns? I did a XIRR analysis of the scheme considering a 40 yrs old person is investing Rs 1,454 per month for 20 yrs , and then gets a pension of Rs 5,000 all this life (till age of 100 years). The returns I get is 7.74% through the excel sheet.

When I do the same thing for a 25 yrs old person invests Rs 376 per month for next 35 yrs (till age 60) and gets pension till he turns 100 yrs . The overall IIR is 7.9% . This includes the lump sum payment at the end to the nominee

So looking at the numbers, we can conclude that the returns from this scheme is in range of 7.5% to 8%. Considering that, Its a guaranteed return from govt of India, I will leave the judgement of its being good or bad to you only.

You should also read, Debasish Basu critical analysis of this scheme on this link to get more understanding about the issues of this scheme.

I would like to again reiterate the point that this scheme is more for the people of poor background who do not have access to any social security scheme already and will be somewhat beneficial for them, and not high-income earners because Rs 5,000 even after 20 yrs will be very very small amount.

If one wants to still open this account, one should find a good enough reason for themselves.

Are you investing in this scheme?

I would like to know what you think of this scheme and if you will be opening an account for yourself? You can also suggest this scheme to your maid, driver or any person who you think should get a minimum pension by the time they turn 60 .

At the end, I would like to share that we are doing our Bangalore workshop on 2nd Aug, please register asap for the event before its full

June 29, 2015

June 29, 2015

if the person will dead before age limit then after what to do ?

Hi jainendra kumar

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

in this scheme if spouse is nominee then after completion of 60 years i would get pension …fine with that..

my doubt is…

1) whether my wife will have an option of lumpsum or pension after my death (after 60 years)

2) if my wife doesnt have option …if she doesnt have children where does the lumpsum goes…as she is nominee too…?

1. She will get 50% pension of your amount which you used to get

Here is the process to update Date of Birth records in Atal Pension Yojana scheme (APY)

Writing this based on my personal experience with SBI, My DOB was entered 10 yrs more in bank records so wrong premium amount was deducting every month for my APY. Finally got rectified after doing so much follow up. Its beeen a year now. It has been rectified after one year

Hope below information will be helpful, beacuse most of the bank people itself dont know the procedure to udpate the APY DOB details.

1. Contact your branch for updation of your date of birth details in bank records

2. Ask your branch manager to send an update request to Mumbai NPS Hub [ Incase if your requesting bank is SBI ]

3.Your branch manager has to mention below details and send a request back to [email protected]

PRAN

NAME:

Form Acceptance date

Correct DOB

New Age

New Premium

Old Premium

4. NPS Hub in Mumbai Head office will process the request and they need to mention above details on their bank letter head, They need to farward it to NSDL for date of birth updation in APY records.

5. If you have any questions, you may also contact [email protected] or

1st Floor

Times Tower

Kamala Mills Compound

Senapati Bapat Marg

Lower Parel Mumbai 400 013

Glad to know that Sateesh ..

My view

Pros:

1. As rightly pointed out, Good scheme for people of poor background having less access to any social security scheme

2. Increased awareness in public and will sure provoke public to plan their post retirements.(not very specific to this topic)

Cons:

1. Since this scheme is launched by BJP, later other rulling parties may disrupt the scheme

2. Currently the picture is blur, as detail clauses are not available at this point

3. Current picture abut pension of govt. employees is pethatic. Will this scheme takes the same route?

4. Returns are very less as compared to other similar private schemes

my verdict:

Wait for few more months to get all these things get clear. But definitely good for poor background people.

Hi kirankumar

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Sir,

OROP is not justified because :

1. A person who retired 20 years earlier from today ( say 1995) ,will have salary and pension as living expenses during that period were very less. Whereas a person who retires now , will have more salary and obviously more pension. Moreover the older pensioners would have already enjoyed 20 years of pension. Moreover,

Defense personnel work in govt for 15 to 20 yrs but get pension for life ( 30 to 40yrs)

2. In all sectors , world over , children will get more salary than parents . Demand by parents to give them salary same as children is absurd.A SALESMAN today earns Rs 15000 per month. Can his father 30 yrs older than him demand Rs 15000 salary for the past 30 yrs ,saying that as SALESMAN,he used to get only Rs 30 as monthly salary.

3. Lastly pension is paid by tax payers and not by contribution from any employee. Ultimately burden falls on all Indian citizens

4. Finally pension should be abolished for all govt employees , and employee contribution should be returned back with 14 % interest. Govt will be saving lakhs of crores rupees, of common man’s tax money. [ Pension is a charity by govt ]

5.Some people in the defense may lose their lives during war etc., but a vast majority of them are risk free. Whereas all the civilian car drivers , truck drivers, bus drivers risk their lives every day and they do not get any pension.

6. 85 % on Indians are farmers and they do not get any pension

Thanks for your comment citizen

Why should there be a max age limit of 40 years to invest. Why penalize the older citizens who really need pension planning a lot more than the 40 year old. Why not let people of any age invest in this scheme. Govt seems to be marketing this scheme only to the younger generation. What an irony because they are hoping to collect money from this group of people rather than think of the set above the age of 40 who should ideally also have been included in this scheme, Why is no one asking these questions ?

Its targeted at young generation

Hi, few queries on the APY

1. whether any tax exemption is there for the amount invested

2. If I am already enrolled in NPS, which is a DEFINED CONTRIBUTION SCHEME, can I enroll for APY, which is a DEFINED BENEFIT SCHEME.

Hope someone reply to this.

1. No

2. Yes

I recommended to my driver to put the money into PPF instead – returns are higher, necessary minimum investment is lower, risk of loss from non-payment lower, possible to retrieve savings to tide over exigencies after 5 yrs, tax-free on redemption ….

Hi cbrao

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

sir can you tell any other guaranteed pension scheme for people aged between 25-30

There is none

hi

can you please advise me what is the plan plan to get 50000 per month or 50 lakhs after 20-25 years

for that how much i need to invest per month/annual .can you please name the policy with details .

If you can invest 10,000 per month, you can build a wealth of around 4-5 crores in 25-30 yrs

I doubt , if Rs 5000 per month will be sufficient in our future to survive.

Yes, it will not be . But not for everyone in India , I am not sure on that !

This is excellent scheme although I have some concerns. If we can invest and get better benefits from other plans why should we opt for a plan which will give benefit after 20 years?

Secondly no doubt that after the age of 60 i will be benefited with 5000INR/month, but will it be covered under any type of taxation?

Third, we all know if we are applying for a pension today (say a very poor person) how the corruption in govt. offices make a person suffer for some years (sometimes 2 sometimes 10) to get his pension activated, has our govt. any plan regarding this so that after 20 years the beneficiary will get the benefits on time?

Hi Avinash

As of now, as this plan has just launched, I think it will take time for the dust to settle down and we will get answers to other things only at some later point of time

Manish

Many people always told that there is no value of 5000 after 20 yrs but my question to all that persons are ,today no values of Rs 10. but still if we get rs.10 note we left it,no we take it—-money has always value. I think it at least cover any ones mediclaim premium of one year

Good point Vikrant !

This detailed information has cleared all the doubts…

nice article… A must read for every one.

Thanks for your comment YashKumar

Hello Manishji,

I go thru all the newsletters u sent me thru email. tks for the same.

I too think Mr. Jitendrakumar Agarwal has a point. He has calculated RD amount at the end of the term. Even if it is taken as 8.5 to 9% on RD for 42 yrs at Rs.42/mth it will around Rs.2lac + and this wud mean that the investor can get more than Rs.1700+(8%) every month while keeping the corpus intact. So how is it helping the poor who as it is ..is illeterate and go by the good faith… is it not that…d govt will be cheating on them and keeping/fleecing their hard earned money.

U mentioned that on the death of both investor n spouse the corpus ( pension amt) will b returned to d nominee where Agarwal has misunderstood this point. Am I right.

But I m of the opinion that Modi Sarkar has tried to bring something fr the poor so that they can have save n get pension in their old age which is a very good thought.

Also it is not clear what happens if d person dies … does the spouse wait till the dead person reaches 60 ..no …

It will be d duty of the Govt to pay the spouse the intended pension the very next month till her death … this is the only risk they wud be taking like any Insurance co. which may be only 10% of cases.

If the above flaw can b brought to their notice thru Experts like urself n Agarwal…that ppl r skeptical about their schemes .. nothing like it. From what we hear PM Modi has always worked for the Good and upliftment of the poor and marginalised ppl esp in his state of gujarat.

Rgds

Hi Shetty

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

When the Govt. announces a social security scheme, people expect that it will spend some money on the scheme. But on the contrary, Mr. Narendra Modi has found a way to make money through APY.

Thanks for your comment Prashant

there is no confusion about atal pesnion yojana at all.

it is very clear from the manish article & also various other data.

any indian citizen, even if crorepathy is eligible for this. only thing is that the government contribution will not be given for tax payers & other people who are getting anyother social security schemes.

the limit is of 5000 per month as pension when you attain 60 & you should be less than 40 , to be eligible.

so we are all eligible. my only question is, is it tax free ? ( i have understood that it is not tax free!!). if the 5000/ pm pension that you may get after 20 years from now, is taxable…. is it worth.

after generating 8.5 laks in 20 years by paying 1400/pm for 240 months ( for 7% returns!!!), is it worth????

my direct question is why cant we invest the same 1400/ pm in rd of canara bank , we can accumulate more than 8.5 lacs in 20 years & then the same 8.5 lac can be invested in monthly income scheme of canara bank, which will fetch almost same money, in addition there is benefit of liquidity….

regards,

kiran

Kiran, it is not Rs. 1400/- per month, it is Rs. 1454/- per month for getting a pension of Rs. 5000/- after 20 years.

The most important thing to consider when going for any of these long term schemes is how inflation will erode the value of money and whether what you’re gonna get 20 or 30 years down the line will be worth anything or be meaningful to you. Second most important thing is of course what is the annualized return that you’ll be getting.

From that perspective I think even the highest payout of 5000/month is a joke since that will be like receiving 500/month in today’s term for anyone in their early 20s who have just started investing. Even BPL folks will not be able to get by with this amount. I wonder what the government was thinking while formulating such a scheme.

Secondly, the annualized rate of return (as calculated by Manish) is roughly 7.5%. Whether this is good enough is up for debate in my books though. Interest rates have been steadily going down over the last 2 decades and I think the trend will continue as India march towards development. SBI’s highest FD rate is already down to 8%. If this trend continues, 20 years later the interest rate of debt instruments might hit the 5% mark. So any long term plan that allows you to lock in a reasonable rate of return for 20-40 years is always a blessing in my book.

This scheme also shouldn’t punish people for not being able to keep up with the payments. That’s just bollocks and make it totally unsuitable for the poorer section of society whose income is never steady.

Hi Anjan

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Thanks for your comment kiran

An investment of Rs. 42/- per month or Rs. 504/- per year continuously for 42 years (considering the age of investor as 18 years) will accumulate to more than Rs. 270,969 at a moderate interest of 10%. From this corpus, we can easily give a pension of Rs. 27,097/- per year, or Rs. 2258/- per month forever keeping the corpus intact. However, Modi Govt. will give a pension of only Rs. 1000/-, that too only till the investor/spouse/nominee is alive. After that Govt. will eat away all the money.

This scheme is similar to FPF-71/EPS-95 through which the Govt. is looting and robbing the countrymen. It is specially bad for poor people since the poor suffer more if their hard earned money is robbed by somebody. Nobody should ever go for this scheme.

Hi JitendraKumarAgrawal

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

What if contributor is DIED before age 60 ?

What will happen?

His wife will get lumpsump payment or pension (from 60 or right from death of contributor ) ???

Please clear my doubt .

Thanks

Ashok kumar

In that case, the nominee will get the amount accumualated !

One of the drawback of the system is that once one dies his wife will get the pension and once she dies(say at 67) her nominee will get the pension by that time her 1st child would be around at 42Yrs (If 1st child was born at her 25th Age).What is the use of giving away the money to a self earning child instead of using it for the couple’s welfare in their old age?

Hi Suresh

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish