How to pay Income tax online in 5 min ? Use Challan 280

Today I will show you, how you can pay your income tax online using challan number 280 on the income tax website. Most of the people rely on their CA and other service providers to paying income tax. Salaried class mostly don’t need to pay additional income tax most of the times at the end of the year because anyway their employers pay it on their behalf.

However, one might come across a situation where they have to pay their income tax themselves in following situations like.

- If TDS deducted is less than the actual tax liability?

- If you have got a notice for balance tax to be paid

- If one has any other income apart from salary

What is Challan 280?

Challan 280 is the form which is required to be filled when you want to pay your income taxes. This can be done offline at the bank, or you can also pay it online. We will see both of them

How to pay income tax offline at the bank?

One can physically go to the bank and submit the filled challan 280 form along with the money. You can download the challan 280 from Income Tax website.

How to pay income tax online?

Another way to pay the taxes is by filling up challan 280 online and making the payment through your net banking facility. I have included the steps one needs to take below. Also, you can see the video below to learn the steps.

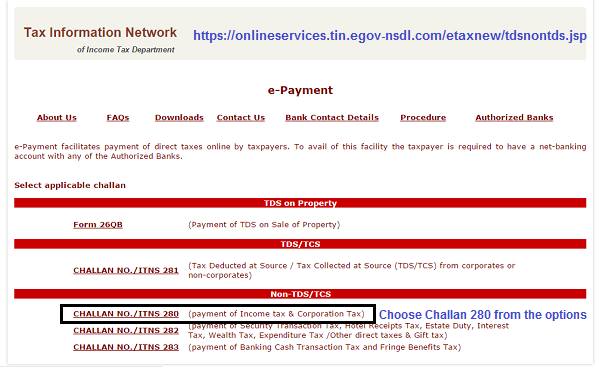

Step 1#: Choose the option “Challan 280” from income tax website

The first step is to visit this link and click on the option “Challan 280”.

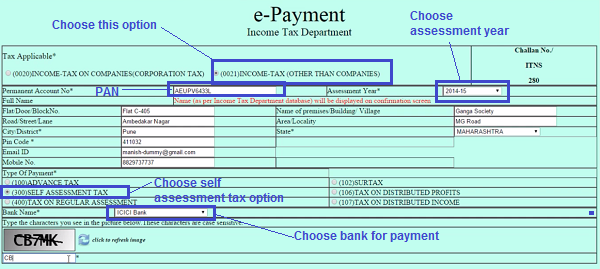

Step 2#: Fill details on the Challan 280 form

Once you click on the challan 280 link, you will be directed to the page which will ask you various details.

- Choose (0021)INCOME-TAX (OTHER THAN COMPANIES), which is to be chosen by individuals

- Choose an assessment year, which is next year for which you are paying income tax. So if you are paying income tax for the year 2013-2014, the assessment year will be 2014-2015

- Enter your PAN Number, address, Email, Phone etc

- For Type of Payment, you can choose “(300) SELF ASSESSMENT TAX” if you are paying the final income tax for the year, or “(100)ADVANCE TAX” if you are paying the advance tax.

- Choose the bank name from where you are going to make the payment and finally click on the “Proceed” button which will take you to the next page for confirmation of all the details entered by you

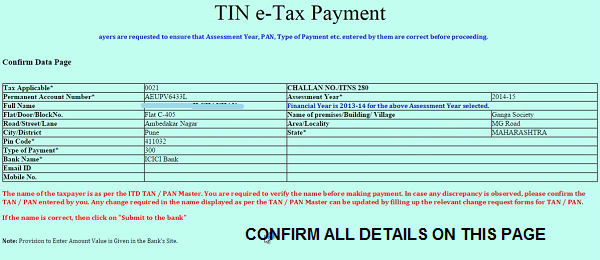

Step 3#: Verify Details and proceed for payment

On the next page, you will be asked to verify all the details you had filled. It’s important to check that the name mentioned on this page is for the same person for whom the income tax is to be paid. It should match with the PAN card holder name, also match the assessment year, email and phone number and other details.

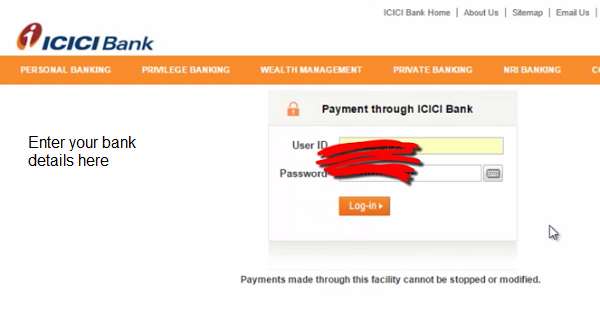

Step 4#: Enter your login details for the bank

On the next page, you need to enter your bank username and password, so that you can make the payment finally.

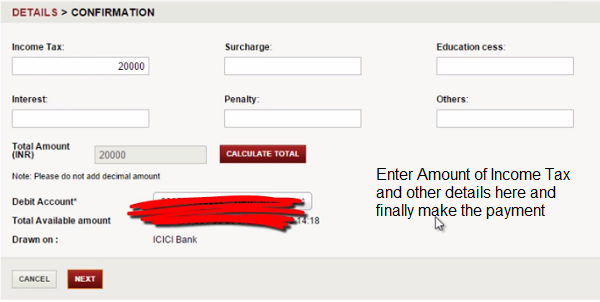

Step 5#: Fill the Income-tax payable and make payment

The next step is to enter the income tax amount and other details as applicable and then finally hit the payment button.

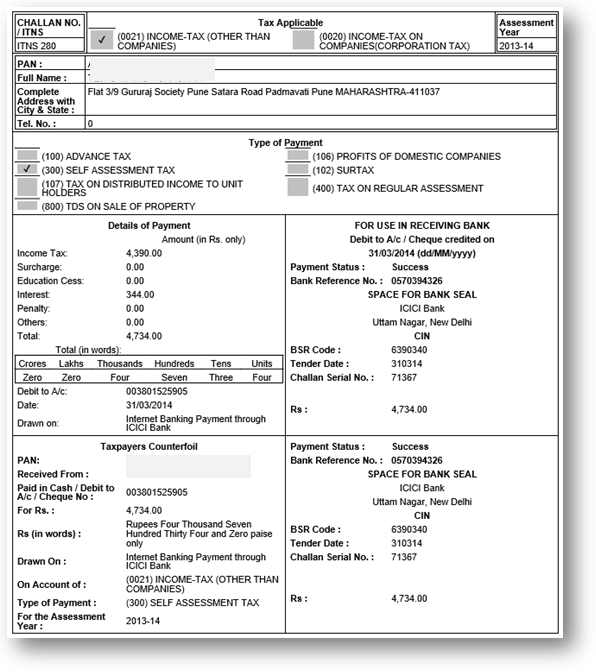

Step 6#: Download the PDF receipt and also get it in your email

Once you make the payment, it will give you an option to download the challan receipt in PDF format. You can save it on your computer. Also, you will get the email containing the challan copy anyways.

I hope you got a good idea of how to pay income tax online. In case you have any questions, please ask in the comments section below.

March 22, 2015

March 22, 2015

Thanks a lot, You have done a fabulous job..

Thanks for your comment Arun

Helped a lot. Thanks

Bank name do not list citibank or standardchartered, and i do not have any other bank account.

Please suggest how do i pay the tax online.

I am not sure then. You will have to visit the banks offline and make payment using cheque !

Good article to fill challan 280. my question is after i generated the challan where i should fill these details like challan number,date and code in my ITR e form.

Yes

Hi

I received FD interest with 10% TDS and need to pay the balance self assessment tax as am in 30% tax bracket. Do I use Challan 280 or 282 as 282 mentions interest tax ?

Hi Anil

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

I have filed ITR online and done the E-verification. Now in my ITR-V some amount is showing as “Tax Payable”. As TDS deducted was less than my actual tax liability.

Please guide me:

How can I pay my remaining tax now? (Can I use Challan-280?)

How it can be reflected against my PAN?

After filling the remaining tax, how I can get revised ITR-V?

Thanks.

Hi Gaurav

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

I have paid my challan 280 online. I did not get a CIN number to be entered in the ITR . Is there a place i can get the cin from somewhere using my pan card ?

If you have paid online using your netbanking, it would have the records . Try to talk to customer care . See the challan reciept

hi…

I have paid online assessment tax but scheduled for next day, i have not received any email or sms about receipt & amount has been debited from account. Please advise how to get receipt of the same?

regards,

shiv

If you have paid it online, you can get it from your netbanking account.

I have paid my Tax using challan 282 instead of 280. How to rectify this issue with Bank and Income Tax Department?

Hi Naveen

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi Naveen

Same thing happen with me..how you corrected it ?

when deposited tax will be reflected in Form 26AS

In few days time , it should reflect

I have got interest of almost 1L on FDs, however the bank did not deduct 10% of tax and neither is the FD interest information updated on form 26AS. I have not submitted any form 15 to the bank for the same. It is a co-operative bank and hence probably they have not deducted the TDS on the FD interest. In this scenario, how do I go about filing my returns?

1. Do I need to pay additional tax even though the amount is not present in form 26AS?

2. If I need to pay additional tax, how do I calculate it over my Form 16 that I have received from the company

You need to then include your FD income in final income and pay tax as per your slab

i have paid tax by challan 280 two days back. how i proceed and how it will shown in my pan ? what should i do?

You need to put that while you file your returns

Hi Manish,

I due have some interest accrued in my SB account which is over 10 K (say 30 K). I assume the self-assessment tax needs to be paid for actual interest – 10 K (80TTA) = 20 K. However I have a small doubt on challan 280

1) Should the basic tax be on this 20 K + interest amounts (234 a/b/c) as calculated in ITR form +3% education cess?

2) While I fill in ITR, the amount to be paid is calculated as 30% of 20 K. Is this the amount I need to pay via challan 280? does this amount also include the interest + education cess?

Please advise

Sam

Yes , option 1 seems correct . 10k will be tax free !

Hi Manish

I am planning to pay tax thru online website. I have received my Form 16 from employer. added to this i could sense that the interest in saving account is more than 10000/-. Not sure if i have to file the tax online with Form -16 and later need to used Challan 280 ( for interest exceeding 10,000/-).

Hope i don’t need to wait and show the amount paid thru Challan 280 ( I mean while e-filling the tax thru online website). Can you clarify pls.

I believe challan 280 needs to be paid BEFORE you submit returns. If you wait for assessment order is passed, then you will have to pay penalty along with basic tax+interest+cess.suggest to complete the challan 280, pay online and then use the BSR and CIN numbers while filling the TDS schedule in the ITR along with details from form 16..

1) Advance tax is to be paid before financial year close. something like a voluntary payment

2) self-assessment tax is to be paid after financial year close, BUT before fling returns

3) Regular assessment: I think this is if IT dept scruitnizes your returns and finds that you need to pay additional income tax. This will attract penalty.

Sam

Hi karthik

I am not the right person for this. Its suggested to take help from a tax filing website or a CA

Thanks Manish, it is very easy. Now my question is I have earned some dividend from shares, do I have to pay tax for those? Will I have to declare it in the return? I have mutual funds as well, but I have not redeemed any of them in 2014-15 fiscal. Is there any capital gain if I had not withdraw/redeem any MF?

No ,dividends dont have any tax in investors hand . No declaration also

No capital gains on MF , unless you redeem them !

Hi manish…just wanted to know..how to file an ITR..?

Adesh

If you want to do it yourself, then you can check out some videos on youtube, Its a bit complicated. Else pay a CA and he will do it for you

Thanks Manish..I just thought I might find the exact video on ur website since there are many irrelevant videos and its the most basic thing most of us don’t know..!!

Though after so many years of blog writing somebody might decode it and you seemed the right person..Its ok I will search.

Sure

This article is very informative and explanation is also very clear. THANK YOU.

Thanks for your comment abby

Manish, would you care to clarify one doubt in my mind? I usually file my IT returns as soon as the forms are released in May/June and also pay any dues using Challan 280.

Then 6 months later, IT office sends a Intimation Letter under 143(1) which is inherently a demand notice asking me to pay the amount due in taxes. Now since I pay any dues while filing my returns, do I need to pay again? Why does the IT office send a demand notice even when I have already cleared my dues?

The possible reason could be difference in any penalty that may be applicable on delay in paying the taxes.

In case you have been taxes on time (either your employer deducting it from salary or you may be paying as self assessment) then please check for any calculation error.

A lot of times they calculate it in their own way which might be the RIGHT number. So you pay the difference !

Dear Manish,

Thanks for the guide. My income is less than 200000 and TDS deducted is around 20000 from the company.

Should I fill (300)SELF ASSESSMENT TAX as “0” to claim entire amount as it is already paid as an advance tax by my employer? Is it “Zero” IT return?

Thanks

Gautam

Hi Gautam

Your cases is a bit complex and I think we are not the right people to comment on it.

My suggestion would be hire someone who is professional in this area and consult them

Manish

Thanks for the info manish.. i would also like to ask you to check about the LPG gas insurance provided by LPG distributors as this info is not provided by any one and the cliam process. That would be of a great knowledge for all of us if u would like to share it with us.

Yes, I have listed that as to do article . WIll write soon