UAN – All you wanted to know about the new EPF system

EPFO has brought some major changes in the way it works and a new system called UAN (Unique Account Number) is in place now. This UAN is a way to simplifying the process of collecting and managing the provident fund money for employees.

Background – The pain of the old EPF system

Before I start explaining, Let me go back a bit to help you understand a bit of background. Earlier when a person joined a new job for the first time, he got an EPF account opened by the employer where his provident fund money was deposited. For years, this money got accumulated in that EPF account.

Now when this person left his job and joined some other organization, the new employer again assigned him a new EPF account and started depositing his provident fund money in that account.

This way, if a person changed his job 5 times, he had 5 different EPF account numbers and in case he wanted to withdraw his EPF money, he had to apply at 5 different employers or transfer then one by one to his latest EPF account and this called for a big headache

This way, if a person changed his job at 5 different places, he had 5 EPF accounts and now he had to either withdraw money from his EPF accounts one by one, or they have to transfer the old EPF money to new EPF account.

But that was a big pain!.

Transferring your old EPF money to new EPF meant filling up the forms, then EPFO department sent to your old employer to get their signatures and if they denied or didn’t exist at all (if they closed down), then things would fall apart and now you were stuck with no information, no proper status and no idea what you need to do.

Calling EPFO department or emailing them didn’t work most of the times, and a lot of people just let their old EPF account exist and didn’t do anything, because of the sheer amount of uncertainty and ambiguity. This whole system was raw, old and not friendly for the employees at all.

Things have changed now quite a bit after UAN has been introduced and most of the pain points have been addressed. Let me now share some critical points about UAN or Universal Account Number as it’s called.

What is UAN?

In simple words, UAN is a 12 digit single account number which will be linked to your provided fund money. Now you don’t need to worry about different EPF accounts and then transfer them when you join a new job. Now

each employer will just give you a member id, and all those member ids will be linked with the same UAN. Even the employee’s having EPF under private trusts will be assigned the UAN.

This is the new system and will be applicable now for your current and future employment. Any EPF account you had before this, sadly will not be handled in this system. You will have to manually deal with old EPF accounts, for anything new will now be under UAN. The image below clearly shows the situation now and then.

3 Steps of obtaining and activating your UAN?

Below there are steps to be followed if you want to get your UAN and activate it.

Step 1 – Get the UAN from your Employer

The first step is to ask your employer for your UAN. EPFO department has already allotted most of the UAN (4.2 crores as the last count) and communicated it with employers. So most probably your employer must have shared your UAN number to you.

If your employer has not yet shared it with you. You can still validate if your UAN has been issued or not. For that, you need to follow the steps below

- Go to https://uanmembers.epfoservices.in/check_uan_status.php

- Choose your State and Office jurisdiction for EPF

- Enter your Establishment Code and EPF account number

Then click on the “Check Status” button and it will show a message saying “UAN is activated” in case it’s already activated by EPFO department. Once you see that message, then check it with your employer. Below screenshot gives you an idea about how to do it.

So like this, you can first verify if your UAN is allocated or not against your EPF. Also, note that UAN is to be allotted to only contributing members whose accounts are active. All the dormant/inactive account is going to get closed.

So if you have 3 EPF account, out of which 2 are old and dormant, please check the status using your current EPF account number which is active.

Step 2 – Activate the UAN

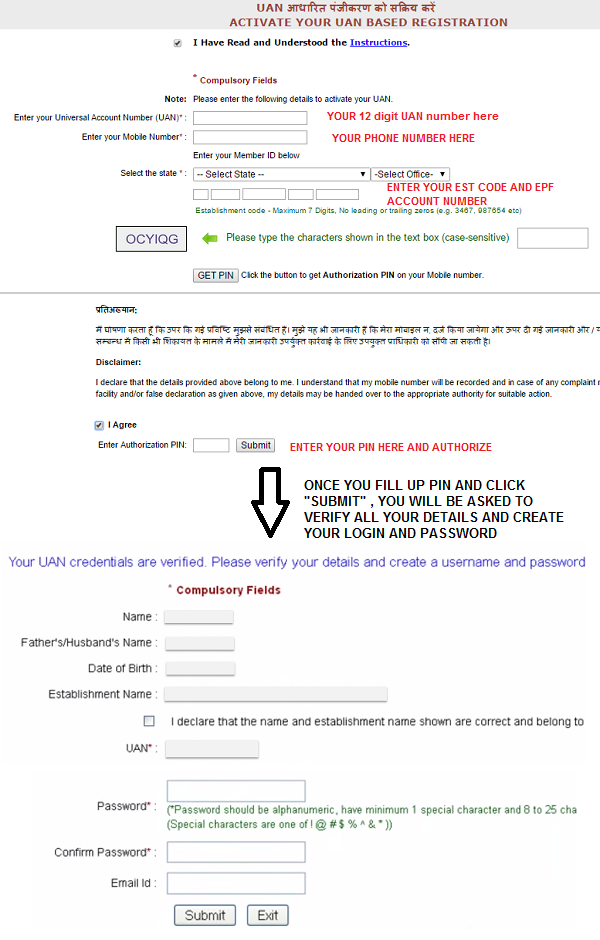

The next step is to activate your UAN. For that, you need to follow the steps below

- https://uanmembers.epfoservices.in/uan_reg_form.php

- Enter your UAN, mobile number and EPF account details

- Get authorization PIN on your mobile

- Submit PIN and activate your UAN

- Then generate your login/password and registration is complete.

Step 3 – Update your KYC details

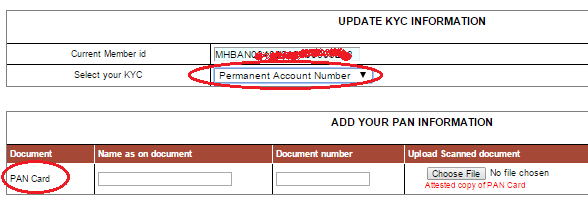

After that, you should log in to UAN portal with your username and password and once you enter the portal, you will see many options like for downloading passbook, downloading UAN card, and editing your details. Apart from that, you will see an option to Edit your KYC Details.

Following are the documents which can be used for KYC. You need to upload a scanned copy of any one document

- National Population Register

- AADHAR Card

- Permanent Account Number

- Bank Account Number

- Passport

- Driving License

- Election Card

- Ration Card

Below you can see an example of how it looks when you choose PAN as an option.

Special Benefits of UAN

Let us now see some of the benefits of UAN compared to the old EPF system. Some changes in UAN were really required from last many years (even decades). Let’s see them one by one.

Benefit #1- Communication directly between employee and EPFO

The best thing about UAN is that now the communication can happen directly with EPFO and Employee. Earlier the employer was in between employee and EPFO for most of the things, especially for withdrawals and transfer of EPF.

Your employer had to sign the documents from their side, now this will not happen. The employer will now act like a depositor in your account and nothing else.

Benefit #2- UAN will remain same throughout the career

The best part is that Universal account number is going to be same throughout your whole career. Each time you change your job, all you need to do is provide your UAN to your new employer and he will tag the member id they create for you to that same UAN.

Note that your overall career moves will be recorded at one place because your UAN is nothing but a central database of all your employers and your past employment, but this will only be visible to the employee and no one else.

Benefit #3- Sms notifications when your Provident Fund is deposited

Now each month, when your employer deposits your provident fund money, you will directly get an SMS notification informing you about it. This is really great because now you know if your employer is actually depositing the money with EPFO or not.

This will be exactly like you get notifications from your bank when your account is credited with salary. This is especially nice because in past there have been cases where the employer didn’t deposit the EPF money for years and months and employee came to know about it much later and then they had to lose their hard earned money

Benefit #4- Update your KYC at one place

Now you just have one single window where you can update your address, mobile, email and other KYC details in case they change in future. A lot of issues happened in the earlier model where the same person had a different address and contact details with different employers and that created issues while withdrawal and transfers.

Benefit #5- Transfer of your Provident fund money automatically

Now the transfer of EPF is very simple. When you join a new job, you just need to furnish your UAN number to your employer and automatically within 1-2 months, your provident fund money will be transferred. In a way, it just has to get linked to your UAN

Benefit #6- Extremely friendly process for EPF withdrawal or Applying for Loan

This is still in process and can take up more than 6 months to a year, but once it’s complete, then the process for withdrawal and loan will be super fast and simple. You might not be aware that you can withdraw from your EPF for important events in life like marriage, buying a house, or medical emergency subject to some rules and restrictions.

Once UAN system is fully functional, you then just need to fill up a form and provide your fingerprint to a biometric reader and once things are matched, the amount will be transferred to your registered bank account within an hour.

This used to take months and years earlier. I am not sure if in reality, it would be as simple and fast, as they claim – but still, things are bound to get simple and fast.

Conclusion

Make sure your UAN is activated and you have uploaded the KYC document. If you have any other queries regarding UAN, please share it with us and we will try to find out the answer.

February 5, 2015

February 5, 2015

I transferred my EPF amt from my first employer to second employer. But EPS amt was not transferred. let me know what need to do to transfer the EPS amt

Did you also fill EPS form for transfer?

Hello sir suppose i m wrokig with a compny “A” and i hv my UAN numb n i withdraw my pf amt also,now i change the job to company “B” and i dont want to show them my previous exp so wht should i need to do ?,and if thy creat new UAN so wht i need to do to deactivate a 1st UAN .

If you declare the first UAN, then your employer will be able to find out about your past employement

Well, if your previous employer used your Aadhar to create a PF account and UAN, and UAN is linked to Aadhaar, then I’m sorry to say man, that you can’t deny having a previous job and previous EPF a/c. Because if you don’t mention previous employer in CV, don’t tell the interviewer of new company about previous job, don’t submit UAN during the Onboarding process, and submit Aadhaar, PAN, Bank a/c details, then your new employer will use ur Aadhaar to create new UAN. The moment your new employer saves these details whike registering you, using the EPFO Employers’ Portal, that portal will flash an error message showing existing UAN, and your new employer can use your UAN to see your previous employer, and can demand explanation from you.

It was possible to hide your previous employment and EPF a/c when the old EPF system was in force(before 2014). Before 2014, every employer opened different a/c for each member, and they weren’t linked to each other, making it easier for you to deny previous employment and PF a/c, because the new company would open a new EPF a/c for u and deposit PF contributions in that a/c.

Actually recently i changed my contact number in my bank account… which number is different from my epf account’s contact number.

Glad to know that R? Karma ..

Hi, is it mandatory to be same contact number in both my epf account and bank account to withdrawal my pf amount?

Yes, its always the best thing

i have left the organization and at that time there was no adhaar card now they are asking for it and i have uploaded it in my uan portal but my employer is not approved it. how can i get my withdrwal

Hi anita

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi… Have withdrawn the money from my previous PF account. Is UAN number will remain same or will it change?

UAN will always be same

Hello Manish I have applied PF Withdrawal through normal forms (10c & 19) but meanwhile company signing authority is changed & new signing authority’s digital signature is not yet uploaded because of which my withdrawal form is pending with employer only from last 3 months.

I also wanted to fill UAN based withdrawal forms where employer signature is not required but the problem is i have closed my bank account which was uploaded in UAN Portal & approved by my employer & i dont see any where Bank account filling option in UAN based Forms . Is there a solution to this issue ?

Hi Veena

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

sir, I have leave the previous employer and join the new organization and i have withdrawal my EPF amount. I can’t withdraw the pension fund due to service period was more than 10 years from last employer.

so i have 2 query :-

So my new PF a/c NO will be automatically added with UAN

what will happened for my Employee pension fund.

Please elaborate with details

Hi vikas singhai

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

I have done the needed formalities. Now my previous company needs to update the KYC status in UAN. But the finance guy has kept delaying this saying the PF website is not working, we cannot do anything & things like this. I am tired of following up. Is there a plan B?

Hi Shereen

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

[…] makes a lot sense, because EPF should not be linked to employer anyways. Few months back, with the concept of UAN, the EPFO had anyways delinked the EPFO from the employer to some extent, and this move looks like […]

I have withdrawn my PF amount..will same UAN continues or it will be deleted

It will still be there I guess

HI,

I am BJM,I have joined new company recently i gave my UAN number to second employer . Now both PF accounts are linked to same UAN number.

In UAN portal my date of joining and exit has not been mentioned by previous employer..wat do I need to update that?

can i withdraw my previous PF amount??If so,please help me out how do I proceed?

I am not clear of this at this level.

Hi ,

I have my UAN no activated from my old company , also all my KYC like aadhar and pan and a/c no. are all Approved by employer. Now i have joined a new company. I need to withdraw my old PF for my old company, if I provide my new company the UAN number , will I still be able to withdraw pf amount of the old company or not. Also what would be the taxes on it as my tenure was 3 years only.

it will be added to your income and taxed accordingly !

Hello Mr. Chauhan, I have recently changed my job and provided my UAN to new employer. They are unable to link my new account with UAN and transfer. My DOB doesn’t match, said by employer. When I opened my UAN account, I found father’s name, DOB, DOJ and DOE were not mentioned. Previous employer is not ready to listen. Please suggest.

Hi himanshu verma

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

I get uan from.previous company & activated (present no pf contribution)

can i link /.view the old pf accounts status with uan facility

Hi mady

Yes , you can do that only you need to get transfer claim form approved by your employer or previous employer.

Hi,

I joined new organization recently and my UAN activated with me previous org. Now I just received a sms alert saying that PF transfer claim Form 13 submitted and in under process. But I did not initiate any such thing.

Can you please explain me whether this is happened due to UAN has two member id now and the new member id will have the amount from old member id (i.e PF account) and this is automatic process.

Otherwise if it is any fraudulent case then what action I need to take?

Regards,

Dhruba Dutta

Hi DhrubaDutta

I understand your worry . But there is no issue . As you have mentioned you have changed your organisation. So when you change your organisation your epf account get transferred to your new organisation. That is only done to keep your fund in one account only. It Not a fraudulent activity in your account.

Hi i had applied for my withdrawal after 6o days of my resignation and recently joined a new company. When i call PF office i have been told that the amount has been settled to the pf office account linked to my UAN with my new org. I had not asked or initiated for transfer of my PF with my new PF. Could you let me know what exactly the issue here is and how to proceed.

Regards

Hi Senthil

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hello Sir

I was planning to withdraw PF using the UAN. I have PAN number, account number has been verified by employer in the UAN website but i dont have Aadhar card. So i was wondering if it is mandatory to have Aadhar card for PF withdrawal using the form 19, 10-c and form -31.

Looking forward to hear from you.

Thanks

Prafulla

No , if you are withdrawing offline, adhaar is not mandatory

Hi, I transferred my PF amount from previous two employers to the current PF account of current company using UAN. But now I am looking to withdraw PF amount for my marriage. Since UAN is linked to current PF account, do I need to get approval from current employer for PF withdrawal or directly I can claim for it without seeking their approval?

You can claim it directly, but the approval process will happen by EPFO (not employer)

Is DOE or date of leaving is neccessory to update for withdraw the EPF amount.

Or member can update DOE? If yes then how?

Plz help me about this topic

Hi vinod

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish