Sukanya Samriddhi Account with 80C benefits – Special scheme for girl child

You must have heard about “Beti Bachao Beti Padhao” initiative recently on television advertisements. As part of it, the government has recently announced a scheme called “SUKANYA SAMRIDDHI ACCOUNT”, which is mainly for saving money for the girl child.

This is a welcome move because a lot of investors will get some extra incentive to save in the name of their girl child once they are born from a long-term perspective. You can see the exact PDF containing all information.

Let me share with you all the benefits and features of this scheme in details.

What is Sukanya Samriddhi Account?

Sukanya Samriddhi Account (SSA) is an investment scheme which can be opened for a girl child. The scheme is specially designed for girls higher education or marriage needs and should be opened by her parents or legal guardian(in case parents are missing).

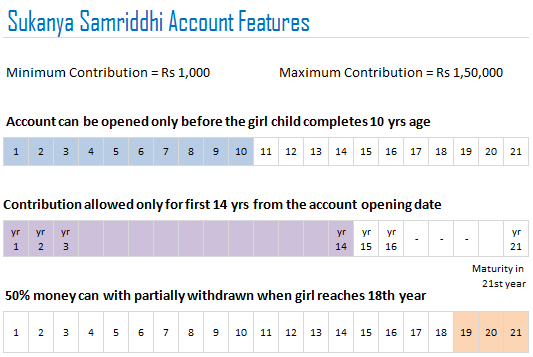

One can deposit a maximum of Rs 1,50,000 per financial year (Apr-Mar) and the yearly interest rate in this account is 9.1% compounded on a yearly basis. Note that this interest rate is not fixed and will be notified on a yearly basis or from time to time whenever applicable, very much like PPF.

The best part is that the investment in this account is exempted from income tax under sec 80C.

Amount of Deposit and Frequency

The minimum amount one has to deposit per year is Rs 1,000 and the maximum amount is Rs 1,50,000. There is no limit of the number of transactions in a year. When you open the account for the first time, you have to deposit a minimum of Rs 1,000 and above that any multiple of Rs 100 (like Rs 1200 or Rs 1400, but not Rs 1,450).

You also need to make sure that you do not skip your payments each year, otherwise a penalty of Rs. 50 will be levied for each year of non-contribution. At this point in time, it’s not clear if NRI can invest in these schemes or not. I don’t see any wording in the official document published by govt. If someone has clarity on that, please share it in the comments section.

This account can be opened before the girl attains 10 yr of age. So the moment the girl child is born, you can open this account in her name or wait for some years and open it later, but once the age of 10 is reached, one can’t open a new account for the girl child.

You can deposit the money in the account only for the 14 yr period, from the date of opening, so the best thing is to open the account early itself so that you get the maximum window of 14 yr to accumulate the money.

You will need following documents to open this Sukanya Samriddhi account.

- Birth certificate of the girl child

- Address proof

- Identity proof

One can open only maximum of 1 account per girl child and in total only 2 accounts can be opened by parents for 2 girls (one for each), but in case the second birth has resulted in twins, then 3 accounts are allowed. You can’t open multiple accounts for the same child as you do in saving bank account.

Where can you open this account?

As per the notification, this account can be opened either in a Post Office or any public sector bank. You will get a passbook under this scheme which will have details of the account holder (daughter name) along with other information like date of opening etc like it happens in the case of PPF account. Also, the account can be transferred to any city in India later if you wish.

As this has been recently announced, I believe the banks and post office must be in the implementation mode right now and must be training their staff on this.

So if you immediately visit them to open an account, you might face problems as the staff might not be 100% clear of rules. So I suggest to wait for 2-3 months and let the whole thing settle down.

Maturity and Premature Withdrawal

Sukanya Samriddhi Account will get matured after 21 yrs from the date of opening the account or before the marriage of the girl, whichever is earlier. The good part is that if parents want to close the account before 21 years for marriage purpose, they have to give an affidavit that the girl has reached at least 18 yr of age so that one can’t use it for child marriage (before 18 yr).

One can also partially withdraw 50% of the balance amount after the girl reaches 18 years of age, for the educational purpose and rest has to be left in the account so that it can be used for the marriage purpose.

Also in the worst case, if there is the death of the girl child, the account will have to be closed and the money will be paid to the legal heirs (mostly parents). Apart from that, the account can still be closed much before in cases of extreme compassionate grounds such as medical support in life threatening diseases. death, etc.

There is no loan facility under this scheme.

How can you deposit the money under this scheme?

You can make the payment by Cash, Cheque or demand draft by going to the post office or the bank where you have opened the account.

Unlike PPF or Saving bank account, you can’t deposit the money online as of now, which will really discourage those investors who are too much into online transactions. However, I am sure this is not a cause of concern for people from smaller cities and villages who are the main target for this scheme.

Tax applicable on the money deposited and earned and maturity amount?

As of now, the taxation status of this scheme is ETE (Exempt, taxed, Exempt), which means money deposited is exempted from tax, interest earned is taxable, but the maturity amount is again exempted from tax.

This is exactly how tax-saving fixed deposits work, they also have ETE status. Some people will compare with PPF which is EEE (Exempt, Exempt, Exempt) and there is no tax to be paid in any case.

How much corpus you can accumulate by investing in Sukanya Samriddhi Account?

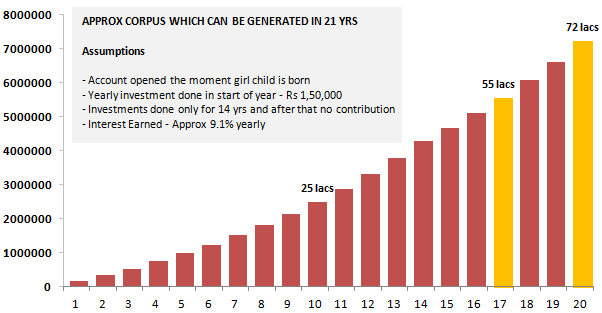

So how much money you can accumulate in this scheme if you try to get the maximum benefit from this scheme. Assuming you open the account the moment your girl child is born, you will have complete 21 yrs in hand, and if you invest the maximum permissible amount Rs.1,50,000 per year for 14 yrs (tenure allowed for investment).

It can accumulate to the approx amount of Rs 72 lacs after 21 yrs tenure. You will have approx 55 lacs, by the time the girl turns 18 years. So in a way this account can be meet your girl’s education and marriage expenses.

You can withdraw 45-50 lacs for education purpose and also have 25-30 lacs for marriage expenses (try to focus more on education expenses rather than marriage).

The below graph gives an approximate idea of how your corpus will grow in this scheme.

Should you open Sukanya Samriddhi Account for your daughter or not?

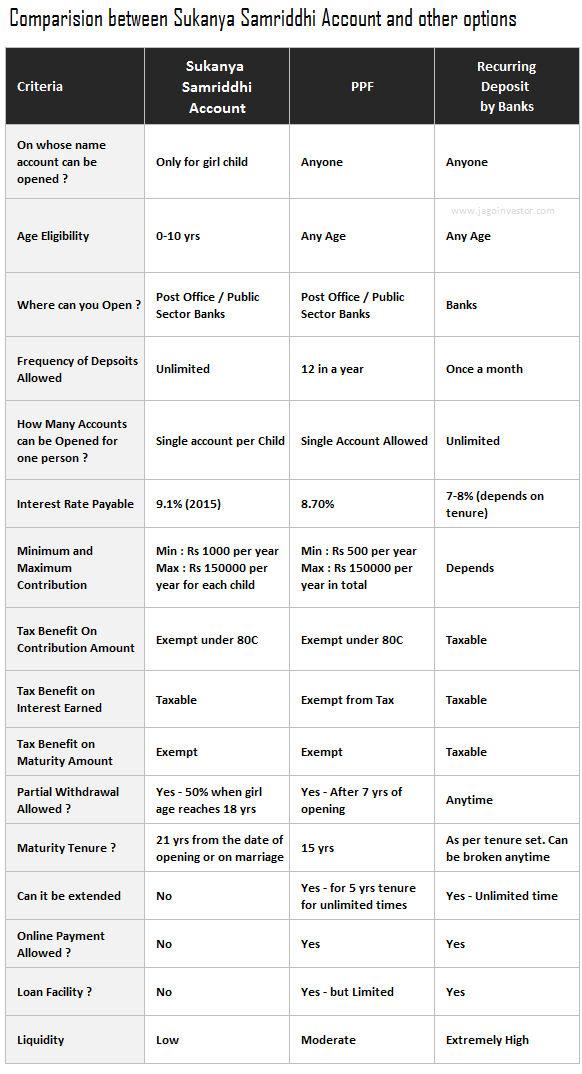

If you look at the features of this scheme, then you will realize that it’s very much close to PPF features, the lock-in period, interest rate, passbook facility, partial withdrawal, and taxation status.

So the real question is if it is better than PPF? Or Recurring deposit? In my opinion, overall it’s a good initiative by the government, the intention is pure and something very much required, but it still does not beat PPF as the product. I personally didn’t find any reason why I would prefer this scheme and not PPF?

However, when you look at this scheme, it’s much better than the traditional child policies and child plans (non-equity) from insurance companies. I would recommend this one over them.

How to open Sukanya Samriddhi Account – Real Experience

Thanks to Dr Dinesh Rohilla for sharing his real life experience of opening the SSA account. I am sharing his exact words and experience below

Quite surprised by the updated knowledge of post office staff in a small town like Pataudi regarding this scheme while the commercial banks in the area didn’t have any instructions regarding SSA neither there customer care helpline.

Anyway following is the procedure adapted by me :-

1) Downloaded form from internet along with gazette notification

2) Fill the form and deposit it along with –

- Date of Birth Certificate of my daughter

- My identity proof

- Latest electricity bill for residence proof

Note:- I had pasted photo on form on which it is written that photo is optional but at post office they told me to give them two more photos. So be prepared.

3) Please check whether they had correctly written in pass book the name of the account holder (girl child) and the depositor (parent/guardian).

In my case they had written just depositor name ( girl child which is not correct way) and after bringing it to their notice they promptly corrected and said they write this way on all pass books but will be happy to know the correct method.

4) Please deposit original birth certificate .Postal staff told me that there is no need to deposit original certificate and photocopy will be sufficient. Being a Birth and Death registrar earlier I know that wherever required Birth/Death certificate should be original. You can take as many as certificates as you wish from authorities by paying fee .

5) On the day of opening account you cannot do other transaction as per staff but can open account with any amount.

Overall experience was very pleasant and efficient working of staff really made me happy .

Thanks India post.

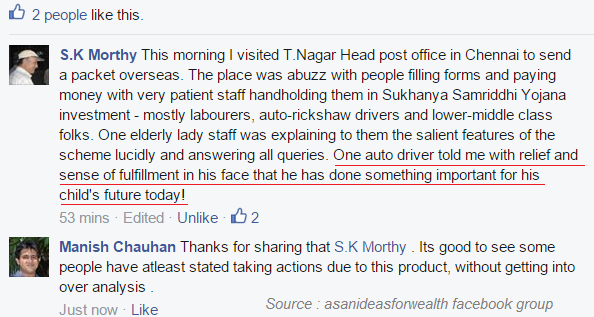

S.K Morthy also confirms that many people have started opening this account in the head post office in Chennai .. See his message below

Given the long-term nature of girls education and marriage goal, it’s important to beat the inflation and some part should be invested in equity component too. I would suggest SIP in mutual funds for some amount at least if not full.

For someone who is not willing to take any risk, this scheme is a good choice. Also, note that it’s a good idea to open this account if you are already exhausting your PPF limit and cant invest more on girls child name. Even though you will not be getting tax benefits, but you can still invest more money with help of this account.

Sukanya Samriddhi Scheme vs Other investment options

Also, one good point of this scheme is very much focused on girl’s education and marriage expenses and their future, so mentally it’s easy for investors to relate to it and keep their investment separate.

Below there is a comparison between Sukanya Samriddhi Account and PPF account (SSA vs PPF), along with recurring deposit – because you can open all 3 accounts for long-term and invest on a regular basis like on a per-month basis.

I hope you are the best person to judge if this is better than other alternatives or not.

Please share your thoughts on this initiative and comment back.

January 29, 2015

January 29, 2015

Manish , I have opened two accounts for my two daughters. Let me know that can I deposit 1.5 in each of the account or its is the combined limit .

Its a combined limit

Hi,

I have 2 quires.

1) Can I pay the amount in Mumbai Post office, If I open the Account in Bangalore Post office?

2) Ho do I get the my money back after my daughter is crossed 21 years ? Will it be cash, Cheque or online ?

Thanking you.

Hello,

I want to know that there is any option in this scheme we could see the money. Actually we have only pass book. Pass book does not show with the interest money. Is there any tool which I can see total money with the interest? Please tell me

I have no idea on that !

Thank you Manish!

Hi, I want to know if we continue paying for 5 years and due to unavoidable circumstances if we could not continue future investment then what will happen to the money which was invested for 5 years.

Thats not an issue .. you will still get the money

Hi Manish,

Can NRI parents open SSA for their girl child,

Please update.

No

Yes, there is no such flexibility for NRI’s. As per new Sukanya Samriddhi Amendments, if after opening the account your kid become NRI, the account need to be closed within time line given.

Thanks for sharing that SankanyaSamriddhiAccount

Hi Manish,

Please update the following information .

This scheme has been classified as EEE . That is from Tax Exemption point of view :

Investment in Sukanya Samriddhi Yojana scheme is exempted from Income Tax under section 80C. The scheme offers Tax Benefit under TripleE regimen ie. Principal, interest and outflow all are tax exempted

Thanks for the update, will do that !

Hi Manish,

Thanks for the detailed article.

My daughter is a OCI card holder and is US citizen. In some of the comments I saw that if daughter is US citizen then she cannot have SSA account. I was able to open her SSA account with her US birth certificate. Also, in the gazette notification I do not see any requirements for citizenship. Can you please clarify?

May be the rule was changed later.

Hi ! which bank did you open the SSA a/c ?

Suppose I inves t 15000 per year and unfortunetly I died what happen for my paid money

Pose tell me fact

YOur nominee will get it

I have a 2years daughter I feel this scheme free my 80 % stress about my daughter’s future fulfill

Glad to know that shashikumar k naidu ..

Is the scheme still operative can i invest now.

Yes, its still operational , you can invest in that

Dear Sir,

I have already invested 1.50 Lakhs in PPF for this financial year.Can I invest further in Sukanya Samruddhi and get further tax benefit.

Kindly confirm weather one can invest in both schemes 1.5 Lakhs each?

You wont get extra tax benefit, however you can put the money if you want

Hi Manish,

I am planning to invest Rs, 18000/year to my kid in sukanya scheme. Can I do mode of payment in yearly. Can you please confirm me yearly is possible in sukanya schemr?

Thanks

I dont think its possible

My grand daughter is born in US.Parents are now living in India and are indians.Post office says her birth certificate from US is not acceptable . Is PIO card not sufficient to open SSY a/c .Please clarify to mail Id ‘[email protected]

Hi spguptahyd

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi Manish,

I have a doubt regarding SSA. Both my wife and I are working, and I’ve opened an SSA account in our daughter’s name in SBI bank, with me as the operator. Now, my wife wants to know

1. if she can also deposit money in the SSA account (online transfer is possible)

2. if so, whether she’ll be able to claim tax benefit for her share of deposit.

Tried searching the net for the answers but not successful. Will be really grateful if you could clarify.

Thanks.

1. She can do it, but only offline

2. Yes

Hi Sir,

Thanks for nice article…….

My husband are paying the amount to sukanya samriddhi yojana……….. Can I get the tax benefit ?

Thanks & Regards

Suma

No you cant

Hi,

In PPF to earn better interest, it’s advisable to deposit amount on/before 5th of every month. Is there any such best practice to follow for SSA account?

Thanks,

..Narsing

No , I think that would be an over kill .. The final amount will not matter too much even if you apply too much of optimization

Hi Manishji,

1) Can we invest twice in a year instead of in one time lump sum or every monthly for e.g 75,000/- Now in Oct’15 as 1st Installment and next installment of 75000 in Apr’16?

So Total Investment for 1 Year comes out to be 1,50,000.

2) If allowed then in this case will Maturity Amount at 21st Year will be Less than what paid in Lump sum or same?

Regards,

Jaykumar

I dont think it allows half yearly payments

What is better invest for girl child SIP or sukanya smiridhi yojana?

SIP would be a better choice !

Dear Sir,

Rather than being generic, I will put the question straightforward.

I am trying to meet PPF amount investment to the fullest possible every year (ie 1,50,000) and that is the only pure debt investment I currently rely on, but unable to do so due to shortage of funds because of diversification of investments across debt , insurance and equity/oriented funds. But then I am content if not happy with current diversification and portfolio. Now the confusion is whether should I split my planned yearly contribution to PPF and SSA from now onwards.

Now 2 questions:

1) Dont you think (esp for an educated and (hopefully) organized investor like me,) increasing amount of debt in single compounding fund (say PPF) fetches more than splitting it it to 2 debt funds? Wont I lose the base amount on which compounding happens, if I split. ( I am not concerned about 14 yrs withdrawal option, maturity period etc features)

2) Only thing I think SSA needs to be considered by me is that the govt may in future declare more interest rate for SSA than PPF….. and at later point of time I should not repend why I had not invested in SSA earlier… Isnt it? (This is also confusing existing planned investors. These kind of things should be addressed too actually when government declares them. )

Thank you

Bhargav

Dear Bhargav, you have hit the bullseye. I had exact same question.

Question 1: Compounding. I really believe its better to continue with PPF to get max benefit of compounding rather than splitting it.

Manish, Nandish look forward for your valuable inputs here.

Question2 again very good perspective. You never can predict GOI steps. But I am thinking I will just invest 1 lakh to begin with and subsequent years keep it few thousands

Please ask your query in one one lines.

Dear Sir,

Question 1: I am currently investing around 40000 yearly in PPF and that is the only debt instrument that I invest in. Now sukanya samridhi scheme came which is very similar. Do you suggest splitting my yearly debt investment (say 20K each) between PPF and Sukanya samridhi ( I have an year old daughter). Reason for my asking is splitting reduces overall returns on these fixed return instruments, right?

No , dont complicate it. Just keep continuing in PPF

0

down vote

favorite

I am living in Saudi Arabia from 25 Jan 2008 to till date. My salary is 110000 rupees per month. I have some friend they are working 600 km from city. They tell to me send money for them also. In this case more than 15 lakh rupees send by me. Will there be any problem for me in future. Just give me your opinion.

What kind of problem are you expecting ?