What happens if policyholder dies within grace period ? The answer may surprise you !

Do you know what happens when the policyholder dies within the grace period provided after the due date of paying the premium. The answer might surprise you because there is a big myth around this topic.

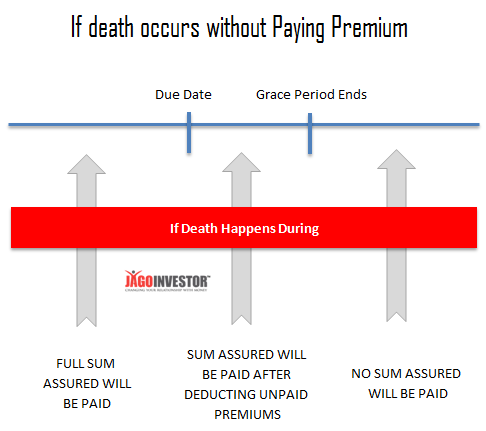

Every life insurance company provide a grace period of 30 days for paying the premium after the due date is over. Companies send reminders on SMS and emails to make sure the customer pays their premiums on or before the due date. But if they forget to pay the premiums on time, still they get 30 days of grace period.

If premium are not yet paid after the grace period, then the policy is considered to be LAPSED and no death benefits will be given if the death happens after the grace period.

Do you get sum assured if death happens during grace period ?

And the answer is YES. As per the rules, if the death of the policy holder occurs on the due date of the premium payment or during the grace period, still the policy is valid and the beneficiaries will get the sum assured. But after deducting the the unpaid premium for the current year.

As a proof I am putting up a proof of what the website of Max New York Life Insurance says below. You can see the exact wordings below.

So if a person has taken a 1 crore term plan for a 30 yrs period with premium Rs 10,000 per year on 20th dec 2010 and imagine the policy has run for 3 yrs , and now its the 4th premium is to be paid on 20th dec 2014 . The grace period will be upto 20th Jan 2015 .

Now if the premium was not paid and the death happens on 25th Dec 2014 , then its during the grace period. How much will be the sum assured paid to the customer family ?

It would be Sum Assured – all unpaid premiums for the current year

= 1 crore – 10,090

= 99.9 Lacs

There have been a lot of cases, where a person just discontinued his policy for some reason and they faced an accident and died. Internet is full of these kind of cases.

A lot of times death happens during the grace period and because the family is not well educated on this aspect, they don’t know that they are still liable for a claim (we provide our clients family claim assistance service).

Conclusion

So make sure you do not forget to pay your premiums and make sure you do not wait for the reminders from the insurance company. You can set up your own reminders and be more alert and proactive on this.

Let us know if you knew about this information or not ?

November 17, 2014

November 17, 2014

Hello Manish,

My brother have jeevan anandh policy he already paid 3 premiums quartly but he is not pay the fourth premium unfortunatly and he was died one month back and within grace period he is not pay amount its ove 2 months so we are eligible for policy premium or not please let us know?

can you please respond me

Hi venkata reddy

The best answer you can get only from the agent you invested through or just contact the company. The thing is your case is a bit personalised and other than company, no one can give accurate information

Manish

Hey,

If someone takes a new policy then after paying one or 2 premium if they die , are they eligible to get the insurance amount

Definately !

thanks manish for replying me

sir,

In a policy where the premiums are payable monthly, suppose a claim occurs after paying just one or two monthly premiums, is the sum assures still receivable?

Yes

Hello Sir,

I have two question.

1)Let’s say I took term plan from a company(let’s take LIC) and I took it for 30 years. I paid all the premiums for all 30 years and I am not dead then what will happen? I will get all money that I paid in premium only or the sum insured(let’s say 1 crore)

2) If I will not pay premium due to any reason for let’s say 2 years then will it be active or deativate?

Thanks in advance

Hi Gaurang

In term plan you get the sum insured only in case of the mis-happening against it is insured. It only offers the financial protection against a mis-happening . Thus , in your situation you would not be paid anything in the first case.

While in second it would be deactivate or lapse.

HI MANISH,

MY BROTHER HAD A LIC POLICY NAMED JEEVAN SURABHI ( TABLE 106). THE POLICY IS FOR 15 YEARS AND PREMIUM IS PAYABLE FOR 12 YEARS.THE LAST 12TH PREMIUM WAS PAID ON 12.07.2014(PAID WITHIN GRACE PERIOD) AND MY BROTHER DIED ON NOV 2014.

NOW POLICY READS AS FOLLOWS:

IF AT ANY TIME WHEN THIS POLICY IS IN FORCE FOR THE SUM ASSURED, THE LIFE ASSURED BEFORE THE EXPIRY OF THE PERIOD FOR WHICH THE PREMIUM IS PAYABLE OR…………………IS INVOLVED IN AN ACCIDENT RESULTING IN………….DEATH…….

MY QUERY IS WHETHER DEATH ACCIDENT BENEFIT IS PAYABLE OR NOT?????

LAST PREMIUM IS PAID FOR WHICH YEAR….COMING YEAR OR PAST YEAR????

Yes, if the premium was paid in grace period, then the policy would be active. So you should get the claim

My father was the policy holder for aegon policy.The due date was 26/7/2015 the policy was in lapsed stage.He died on 15th January 2016.Am i Eligible for any payment. Premium amount was 80000 on surrender they are giving us only 27000 is that correct?such huge dedcution only first premium was pain.

No , the policy is lapsed !

Hello Sir,

Please answer the below queries from your expertise.

1. The policy holder is my father and the life insured is my elder brother on one policy and similarly my father is the policy holder but the life insured is me on another policy and like this there are 6 policies where policy holder is my father but life insured is one of my siblings, so just in case if the policy holder dies and life insured survives (premium’s being paid on time or let’s say my father discontinued after 3 years of premium making it paid up), does the life insured becomes the defaulter to pay the rest of the premium’s?

2. If the life insured doesn’t become the policy holder in case of policy holder’s death, then how much amount is returned and if the policy is for 20 years do we have to wait for 20 years or all amount will be given to the life insured immediately?

3. If the life insured is the nominee himself and he dies but the life insured is his son, then how is the claim settled?

4. My understanding is the sum assured will be given only if the life insured dies and not the policy holder, am i right?

Thank you!

1. No

2. If policy holder dies,there is no impact on policy , You get the money at maturity or in between with lower amount

I think you should talk to agent to understand more on this

Thanks for answering and sorry my question # 3 was supposed to mean “If the policy holder is the nominee himself and he dies but the life insured is his son, then how is the claim settled?

The only is only paid when the life insured person dies.

Sir

I have max life life insurance policy.

The cheater agent told me that your policy have 3 year lock in period and you will be pay only 6 anual premium after them you can withdrawal your amount with interest

After some month i contact to customer care he said that you can not withdrawal before 20 yers

What can i do so for

Thanking you

No you can withdraw the money even after 3 yrs lock in . The customer care is wrong here. Check your policy documents

Manish

Thanks a lot for your suggestion.

Yes we can withdrawal atter lock in period

But company cut almost fifty percent amount. They called it surrender value.

If its as per terms and conditions, you cant do much here

My father was two lic policies…unfortunately he died…..policy bond lost….

IF you have no info of policies, then I am not sure what you can do !

Pl. see the below case, and comment & advise about the claim

1. 1st year premium rs. 10000/- had paid on 27/8/2012 of 2.5lac policy from LIC

2. Second premium due date was 26/8/2013 without grace period

3. Policy holder has expired on 30/8/2013 i/e during grace period

4. No one in family had knowledge of such policy. but in Nov 2015 policy number has found written in a dairy.

5. Then wife of policy holder contacted to concern LIC office.

6. This office denied any possibility of acceptance on verbal request in Nov 2015

7. No official letter or information has received from LIC till date.

My query:

1. Is it possible to get death claim amount rs. 2.5 lac in any circumstances ?

2. Is it lapse of family member of policy holder if bond paper is lost and late information?

3. What further steps can be taken to get claim amount or paid premium amount?

1. Yes

2. Yes, but still the claim should be settled.

3. Follow the article for that. You need to check with LIC on this

Hi Manish,

I took a new Jeevan Anand Policy (815) of Sum Assured : 4 Lac today.

LIC guys explained me the policy as below. Could you please check and let me know if that is correct.

Sum Assured: 4 Lac

Term: 16 years

Bonus: 294400

FAB: 10000

Return on Maturity Time = 704400/-

=======

1) If a policy holder dies (due to accidental or natural death) within the policy term (16 years) only “Sum Assured+Bonus Acquired as on date” will be paid to the nomiee.

2) If a policy holder dies (due to accidental death) after policy period (after 16 years but below 70 age), “Sum Assured+5Lac Rupees” will be given to the nominee.

3) If a policy holder dies (due to natural death) after policy period (after 16 years but below 70 age), “Only Sum Assured” will be given to the nominee.

4) If a policy holder dies (due to accidental or natural death) after policy period (after 16 years but below 100 age), “Only Sum Assured” will be given to the nominee.

========

My question is, why is Accident Insurance of 5 Lac not covered when the policy holder dies before the policy period (ie, 16 years).

Email: [email protected]

=========

Hi Samuel

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Any rider attached to the policy will cease at the age 60 Yrs. of policy holder.

Hi Good Morning Sir/Madam ,my friend mother expired upon whom 1lakh rupees has been invested and her legal heirs had agreed inorder to take each 50% of the amount ,my friend took the amount where as his sibling(sister) didnt took the amount until now ? can we ask RTI & get information regarding this .please kindly give me rply .

thanking you

Hi rajesh k

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Dear

I want to know about all kind terms of condition for the policyholders

Hi Alam Qadri

Please ask about a particular feature ! .. Do you want me to connect you to HDFC, so that you can clear all your doubts !

Manish

Hi Manish,

My question is related to ongoing policies whether Life Insurance (ULIP, Term or Endowment) or Health Insurance (Mediclaim or Fixed benefit). With reference to existing policies (which were taken lets say 2/3/5 or 10 years back) what all information should be shared from insured to Insurance companies and on what all events.

For example: I have read at different platforms that if status of a person changes from Resident Indian to NRI, this should be informed to Insurance company

Similarly what all other events should be reported so that there is no problem in case of claims. In case someone gets diagnosed with any disease (minor or major) or change in life style (smoker to non smoker or vice versa) or addition of new born baby to family or change in city etc.

Regards,

Vijay

Nothing other than change of your residential status has to be reported.

I wanted to know who can be a nominee in lic policy. Friends or any other person who has no blood relation with policy holder can be a nominee for LIC policy. Reply please.

Thanks.

Yes , they can

Dear Manish,

I have registered premium payment thru Smart pay facility of Credit card. I have received the SMS from Credit card that the auto debit of premium will be done as per due date of Grace period.

What are the implications of this?

Thanks

Swapneel

I think its not a very good idea .. also schedule your credit card payments before the due date and I would say before 4-5 days !

…Continued.. It was a life insurance policy and my mother was suffering from cancer and after her death company refused the policy stating that we didnt intimate the company about the disease and there was clause in the policy about this to intimate about the policy and that was written so small in italics and customer does overlook such things while taking the policy or if at all they read the policy also. and I also wondered that if the customer is having any health problem (major and deadly) they will be so busy in trying to cure that and the life insurance companies expect them to intimate that to them. Say if the customer does want to intimate them. Then they should provide some kind of form to the customer in the policy document so that the customer can remember it at the time of signing the form. But the insurance company does non and still they expect us to intimate them. Any comments are welcome…. on this

Insurance is a contract between two parties. If any of the contract clauses are violated, the contract can become void.

The people at the company try their level best to find a reason why not to pay and they are being paid for that. In this thorough(sometimes unreasonable) scrutiny, genuine cases may face problem. One is to be ready for this. Hence one need to be well aware of the policy terms to avoid last minute unpleasentness.

That said, the ombudsman system helps the customers provided they approach them. I used banking ombudsman and income tax ombudsman and I am satisfied with their service.

Vinay

You can always hire a consumer court lawyer for your help by paying the fees. Its allowed. The clarity should be surely there and you must have written down all the points which can come up and what answer will you give about it . Discuss those points with someone knowledgeable before going to them ..

Thank u manish… I would like you to check for us regarding Insurance Ombudsmen, like what steps the customer need to take care before approaching insurance Ombudsmen so that he can win the case if the customer is genuine. Because when a customer approaches insurance Ombudsmen they dont know how to talk or how to react to the situations as because a lawyer is not allowed on behalf of the customer and so it becomes tough for the customer to speak about the case and he get crossed by the judges or the counterparts. I myself faced this in an insurance case against a reputed company where i lost it though i was genuine as i was not able to explain them properly what was the situation. So if u can advise every one in this that will be great help. Now again i had to file it in state forum eventually i won the case in the state and now i am fighting it in national forum.

Thanks for sharing it across

i have my story…here …bit long and may take some to read..

my mother expired and she had a life insurance policy for a personal loan from SBI Life and the premium was deducted from SBI it was a group insurance policy. We never knew about this policy until we checked my mother’s pass book where the preimum was getting deducted annually. when we approached the insurance company they said that the policy was closed and hence dont need to pay the amount. we asked if they did advertise about this closer of the master policy in the newspaper under rti. I was surprised from their reply ” they replied that it was there on the notice board of the bank” so now i am filed the case against them. There was another big mistake from them. SBI was cutting the premium not on the due date or grace period but when ever they wished each year. so we checked all the bank statments and found that and now we have put a consumer case against them and we have won it in district and state forum now waiting to check if they will pay the money or will they go for national forum… so i ask every one to check ur premiums deducted each year if from the bank. promptly wheather it is a life or health insurance….

Thanks for sharing that Vinay !