Why you should collect NOC (No Objection Certificate) once your loan is complete ?

Once you pay off your loan, a big responsibility is off your mind and you feel relaxed. Its a moment where you do not want any further run around and want to now move on to other things in life.

And this is exactly why most of the loan customer do not collect a document called “NOC” or “No Objection Certificate” from their lender and it can get them into trouble later in life. At some places you will hear the word “No Dues Certificate” , but generally most of the executives in real life use the word “NOC” only

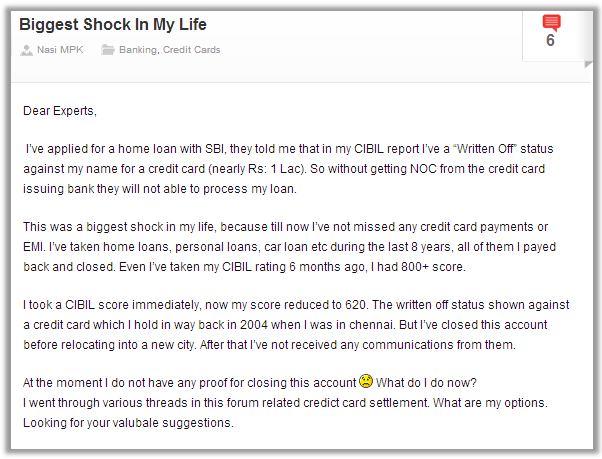

Read the incident below to understand its importance

What is NO Objection Certificate (NOC) ?

With reference to loans, An NOC or No Objection Certificate is a legal document provided by the lender which states that the loan has been complete and their is no outstanding to be paid by the customer as on a specific date. Whenever a person pays off a loan, its important to take this NOC document from your lender.

How to get the NOC ?

Generally, all the lenders dispatch the NOC document to your registered address once your loan is complete. However at times, people do not pay attention to it and loose out on it for some or the other reason. Also if the registered address with lender is your old address (suppose you changed the address in between the loan), then also you will miss the NOC document.

So if you do not get the NOC, better contact your lender and ask for it specifically.

What kind of problems can happen if you dont have NOC ?

A lot of people think that just because the EMI’s are paid off fully, the job is done. However its extremelly important to have a legal document with you which clearly states that you do not owe anything more to then lender.

This way you are protected legally and if someone claims later in life that you owe more to the lender, you can produce the NOC if required. I would like you to have a look at the incident below which create some issue for one of the loan customer, who had paid off the loan, but didnt have the NOC with him

Hi Manish,

I have taken a personal loan from Bajaj Finance in the year 2004. All along, I have been thinking that I have paid the loan. To this effect, Cibil report also says, there is no balance outstanding and the account is closed on 31.12.2008. I don’t have NOC.

Today, I have received a call from a Lawyer saying that he has a summons to arrest me and I need to pay the balance amount of Rs.3750/- and that too I need to pay before 3 pm.

Could you please responds me as to what should I do. My question is will he really have Summons or just he is threatening. I can pay, but he is asking me to pay beofre 3 pm. That’s what I am not able

understand.

Here is another incident where Rahul settled his outstanding credit card dues with Standard Chartered bank and didnt collect the NOC . Then after many years he got a notice from the bank to pay 7.7 lacs. Here are his comments

Its been 12 years now, and I dont have the copy of NOC (or No Dues Certificate) with me. How do I prove my case as SCB isin’t ready to check me credit card history to see where the problem was. They just keep saying “they can’t retreive the information as they have sold those accounts to saha finlease.

And what about the notice they sent me asking me to attend conciliation camp to be held on 11th November?

Read the full incident on our forum

How NOC can help you in future if some problem arise

NOC is a legal document which has weightage . It proves that you really have paid off the loan fully and if there is any confusion, then NOC solves it.

Read these two incidents which were shared on our forum and you will understand its importance

Dear Manish,

Same problem as Sandesh I had with Indus Ind Bank Kolkata recently. They told me that my score is very low so they are not considering me. However, I submitted them my CIBIL Report which clearly says 763. There was an issue with a credit card which I cleared 1 year back.

I submitted them the NOC too. The HR here told me that she has forwarded the details to her central office. Now I am waiting to hear from them.

(Source)

Dear Ravish,

If you have the NOC issued by the bank, saying all dues have been cleared and there is nothing pending, you can get a loan. But as Dear Ashal has suggested file dispute with CIBIL and wait for 2-3 months to get it rectified.

I had the same experience about 3 years back and credit card in question was issued by HSBC. I got the NOC issued by HSBC and applied for loan with HDFC, while submitting the application I informed HDFC about the HSBC story. Later on, HDFC asked for the NOC and cleared my loan.

(Source)

Go get your NOC right now

So now, if you had any loan in past which you have completed and paid off, make sure you have applied for the NOC and keep it safely in your records

September 11, 2014

September 11, 2014

I have home loan, crdit card loan in same bank & other banks. due to some financial problems, i settled the credit card loans with other banks. Is it effect on my current bank home loan (they can provide NOC), if i wish to sold my flat to some one.

I took home loan for buying a property. When I finished paying off the loan, the builder forced me to submit the original NOC to him instead of a photocopy, how do I receover the original copy?

I think you only have option to talk to builder now!

Can a credit card exposure impact a personal loan NOC letter? I have a credit card and had a personal loan from the same bank. I have made the full loan amount of the PL account and seeking the NOC letter and to which Bank responded that the NOC is put on hold because of credit card exposure. Now my question is, both the accounts are different and I have paid all the dues against my PL, so is there any rule that is there to hold back my NOC because credit card?

It might happen .. Are you saying you also have an unpaid credit card debt or you are regularly paying credit card bills?

NOC may be stopped because its the way to also recover back the other dues which has risk of default. While it may sound unethical from customer point, I think any business will surely take that route. I am not sure if there is any legal guideline for that. ITs upto the bank how they want to take it up

HI, My HDFC Credit card debt manager gave me a settlement to pay 50000. But he did not close the case as he promised. Now, after 2 years, When I applied for a car loan in SBI the bank refuse my loan for HDFC Credit card Write Off in CIBIL account. After then I paid all the outstanding amount of Rs. 28539.00 against my HDFC Credit card through netbanking and talk to the HDFC Bank Debt recovery deptt and asking them to issue NOC and closure of my credit card and update my CIBIL. After to many times Contacted with customer representative they provide me a NDC on 28.09.2021 and they told me that my CIBIL Status will update within 40 days. Now I have a question that should I eligible for the loan by produce the NDC to SBI before my CIBIL update ?

Yes, based on the NDC , the bank may issue the loan to you .. Meet the bank manager for this.

I made one time settlement for education loan in canara bank,they are refusing to pay NOC and marked cibil status as written off.. for OTS, cibil statement should be settled or post(wo) settled right? Due to this im getting problems for applying home loan.

You will not get a full and final NOC as you have not paid the full amount. If you paid less amount in settlement, it will go as remarks in your CIBIL .. Very tough to fix this

Manish

Credit card bills were not sent by the bank, and they incurred interest. After a year, debt manager gave me a settlement on phone to pay 35k. But he did not close the case as he promised. Now, after 4 years, the bank is harassing me again, asking me to pay the outstanding bill. I agreed to pay the difference in the usage money. Meaning, how much ever I have used, I will repay it.

The bank is considering this as a settlement payment, and giving me a SETTLED status on CIBIL score.

The reason for not paying the interest is because they did not send me bills, and their employee gave me unofficial settlement in the first place. And they are also disclosing my personal details to third party which is against customer rights.

I asked them to waive off, and provide me a lesser settlement for the problems/harrasment they have done or to even put the case as CLOSED. And they are denying.

Should I take this to court?

Hi Bhavya

If you feel that bank is at fault here, do complain this to banking ombudsman first and then to consumer care and finally in regular court . If you have sufficient case, then you will win, but it will test your patience and take time

Manish

I had cleared all my outstanding of my cab but finance company had hold my NOC saying that my guaranter had outstanding with them so they had hold my NOC but I had regularly chessing and confirming them that I am not guranter for him he is my guranted me I had not so do any one guide me how to get my NOC is there in law as per I am not guranter do I file case in court for harresment or any other option for this

Its strange actually.. Lender cant do that!

please issue legal notice from your advocate to the finance then file a consumer complaint in district consumer forum

I have purchase an bike which have on financed by first party. Now the final installment paid by first party. Hence I request you, How I get NOC from party party. As per statement of first Party, He say that NOC will be received by him by post. so I request you to suggest whether the first party says is right or not. How many time is spend to get the NOC.

Looks like a complicated matter. Why not touch base with the company itself !

Hi Manish,

I had closed two credit cards on 2009 with some waiver and not got any NDC/NOC that time. But when I check my cibil report now, those tow cards are saying the status of “settled” [With 0 balance]. Because of this I can’t able to get the housing loan now, even though my cibil score is more than 800. How can I solve this issue.

You need to check with the lender on why they updated the status as SETTLED and not CLOSED.

I hope you did pay the full outstanding amount and not the less amount.

Hi Manish,

i have taken two wheeler loan in 2012 & i did not pay last 12 emi’s bcz the vehicle condition was very bad. I returned that vehicle to the Financier but the case is not solved till now as i have not taken NOC from them due to which my CIBIL Score is 600 & my loan application rejects every time. Now i am going to take NOC from the Financier & will be submitting to my bank.

After submitting NOC of my pending loan will they provide me loan ?

OR

will my cibil score increase ?

I dont think it will solve any issue. Unless you pay the loan, its going to be tough !

i had a one time loan settlement with uco bank where they waived of lacs of rupees and they issued a no objection certificate

In future can they ask for remaining money ?

My Noc document will help me to fight in future ?

Yes, they will not ask for money. But thats all ..

They are still free to report it to CIBIL with bad remark.

Manish

Hi Manish ,

In July 2015, I took loan but i was not able to pay some EMI’s on time but instead of settlement , paid whole amount in Oct 5 2016 and got NOC. But when I applied for credit card on Oct 15 , it got rejected . How can i apply for credit card and what should i do now.

First apply for your CIBIL report and see if there is any remark in that report ?

Hi Manish,

I’m Harish.. Actually in the 2013 took vehicle loan and cleared it in the year 2014 by paying in EMI.. Also collected the cheques given to the bank.. But at that time, bank didn’t give me NOC.. Also I didn’t knew at that time I have to get that document.. But today 2016 they’ve sent message asking to pay 5k inorder to get NOC.. Is it the correct way for the bank to suddenly after 2yrs without any communications in last 2 years.?

No , they cant charge you just to give NOC. Complain about this with RBI and banking ombudsman

Hi,

I recently paid off my educational loan from SBI to a private ARC. I have received the NOC for the same as well. But I think my SBI account is still frozen. What steps do i have to take to further? Also we can use the electronic copy of NOC right?

Hi Rahul

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

hi

i defaulted on my credit card payment and it was fully paid off june 2015 but till today HDFC hasnt removed my name of cibil and neither are issuing a noc letter. i have contacted customer service and they asking me to contact collections and when i call that phone no they never answer. i have also moved to a different state and currently live in mumbai. can someone guide me how i can get this resolved. the credit card was paid in full including all fees as they froze my account for five months and took all the money and were not ready to settle.

You need to check with HDFC, why they have no updated it with CIBIL

Hi

I had used HDFC Bank 2 wheeler loan 6 year ago. i have paid all the emi , but haven’t got any NOC till date on my address. Will they provide it after such long time.

Thanks

Yes they will provide it

Hi Manish

I’ve credit card from HDFC bank but still now I’ve not used it. I’m planning to surrender my credit card. Pls suggest what documents should we get from them once the card is surrendered. Thanks in advance

Get the NOC

HEY I PAID MY ALL EMI NOW THEY ARE ASKING FOR EXTRA 1259 FOR CHARGES I DONT KNOW COMPANY

BAJAJ AUTO FINANCE

Hi EUGENE

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi i am veena

today i apply NOC for my land (site) and also request to verify the documents and sample of the documents, so

how much time it will take.

thank you

Hi veena

Thanks for asking your question. However we do not have answer to your question.

Manish

Hi,

my loan accounts has been closed , and now I want my NOC to get. please let me know the procedure for the same.

Just ask the company for it. They will give it