Does your Income tax website account have your CA phone number ? You can now claim it back

Let me start by sharing with you what was the situation of millions of tax payers in India till now.

If they wanted to do e-filing and went to income tax website and tried to login to their account, they failed at it, because they did not have the password, because it was created by their CA’s or someone else who assisted them once in filing their tax.

And the person could not even use the “forget password” option, because it asked for some information like Phone/Email to send the OTP pin or authentication link and obviously their phone and email was not used while creating the account.

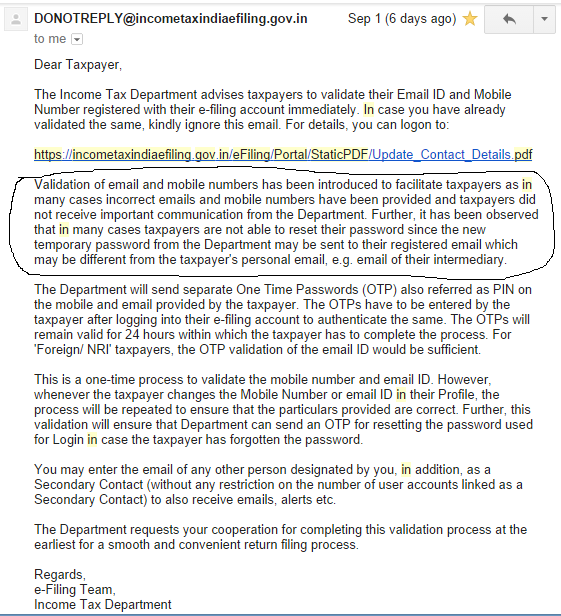

And this meant depending on the CA for this. However recently Income Tax Department has taken strict action on this. Income Tax department has sent an email to all the income tax payers to update their emails and phone numbers if they want to do that.

Now as per new rule, A person can use his phone/email on maximum 10 accounts (now CA’s wont be able to update their personal phone/emails on all their clients, which is also a bit big issue for most of the CA’s , because a lot of their clients are not net savvy and its very convenient for CA’s to manage their accounts)

Anyways, Here is a an email snapshot of the email which was sent by income tax department.

More details on this page below

https://incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Update_Contact_Details.pdf

How to update your Phone Number and Email on income tax website

If you are a new user, then its very simple and you can just go to their website and create a fresh login/password. Now its mandatory to give phone and email id. There will be one time password (OTP) sent and authenticated.

Now if you are a registered user (your PAN is your User id) and if you want to make sure that the full control of your login is with you, then make sure you update your email and phone on the website.

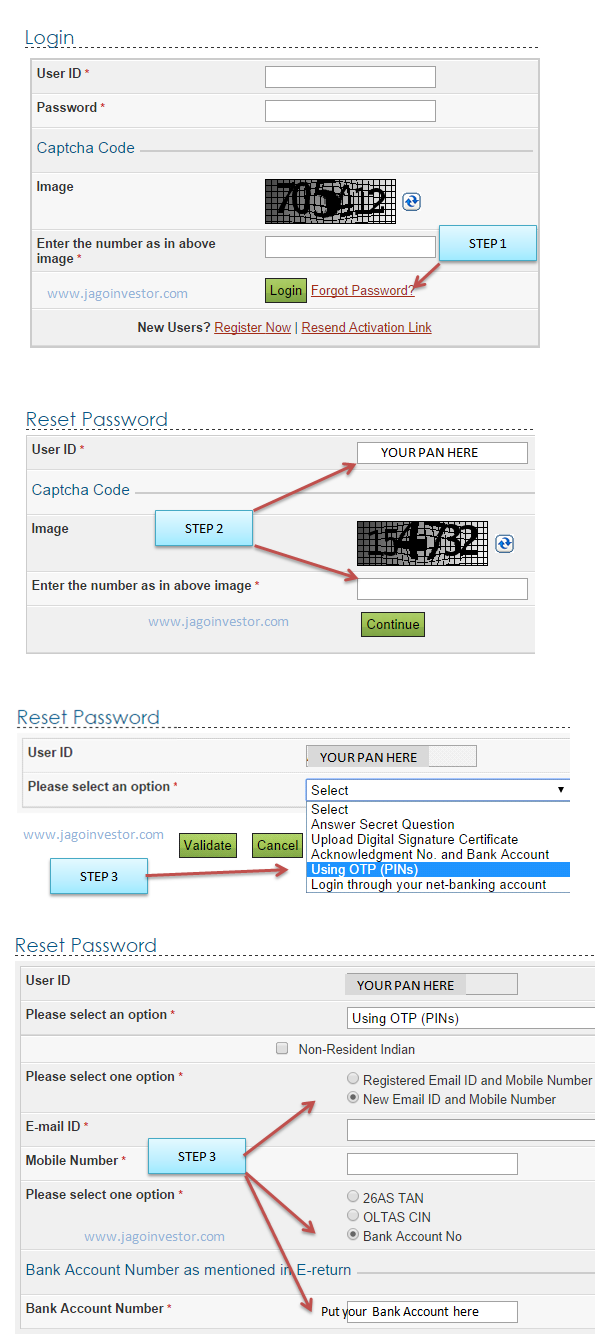

Here is what you need to do to update your phone and email on their website

1. Go to https://incometaxindiaefiling.gov.in/ and try to login

2. Click on “Forgot Password” link and put your User id (your PAN) and move ahead

3. One the next pages you will get an option to update your email and phone.

4. Choose that and follow the steps.

Below is an image snapshot of how it looks like

Note that there is also an issue with this new move, because now any person who has information about your details can create a new email and phone and can use that to claim an account (assuming he also has information about the bank details which was used by the person) .

A lot of CA’s are also not liking this change by the income tax department, because now their clients will go away as they are not under control of their CA’s .

Would like to know what you do you think about this move by IT department.

September 8, 2014

September 8, 2014

As I am also tax advisor, its good move from ITD yet it will create more problem to assessee because incomplete knowledge about all those communications that can hurt them in long run, and if a CA received the communication, he can understand the the gravity of this. Many people may face problem if he has not taken tax demand notices carefully because now a days about 90% of tax demands arises due to wrong quotation of TAN No of tax deducted…. General people may not understand this as long it become too late

Hi Surya Tiwari

Obviously. As far as a person is involved with a CA this is fine. We mainly are talking about cases, where CA is no longer in touch and working with the investor, but still emails go to them !

Dear Manish

I have the same situation as the mail id and no have been given are of our CA.

I have settled it back in my favour. But at the same time I have got a big question as My CA knows my Account no so

1.can he be able to reset the password with the help of new mail id and Mobile no option

2. Can they do the same and reverse our registration back without intimation ?

Regards

Rajesh Thakur

No he cant do that, as it will ask for your email and phone ..

Manish Thanks,

my ca went out of country and I was wondering how to handle.. your article helped me.

One question.. Can they do the same and reverse our registration back without intimation ? …

Yes its possible !

Thank You for this article.

Good initiative by IT.. .. to spread awareness and educate tax-payers; simplify systems, use technology, improve upon transparency, encourage compliance.. better governance, that is the way forward..!!