Penalty Charges on failed transactions due to insufficient balance at other banks ATM

Imagine this situation. You are in urgent need of cash and looking around for your bank ATM, but you are not able to locate one, but you can see other banks ATM and then finally you give up and want to withdraw the cash from other banks ATM knowing that its FREE to withdraw the money from other banks ATM (at least 3 times a month)

Then, You go to other bank ATM and withdraw Rs 5,000, but you see the message on screen “Insufficient Balance, transaction Failed” only to realize that in a hurry, you have punched in an extra ZERO and have tried to withdraw Rs 50,000. You then ignore this minor mistake thinking that it means nothing and then finally you withdraw Rs 5,000 and leave the ATM happily!.

However, By the end of the month – when you are looking at your bank statement, you are in horror to see that there is some Rs 28 debited from your account as ATM decline charges and you are like – “What the hell is that”? You talk to customer care and come to know that there are some “ATM decline Charges due to insufficient balance”, you are not happy as you were not aware of it and customer care just has one answer – “It’s as per RBI guidelines”!

Penalty charges due to Insufficient Funds

Almost all the banks charge you a penalty charge if your transaction at other banks ATM is declined due to insufficient fund. So if you have an ICICI bank account and you are withdrawing money from HDFC or SBI ATM and if the transaction fails due to insufficient balance or fewer banknotes inside the ATM, the transaction will fail and you will be charged!

Here is a real life incident which happened with my Father, when back home, he tried to take out some money from SBI bank ATM (the account is with ICICI bank) and he was not that sure of the exact balance and he tried to take out the money 3 times in a row. We only realized about this charge when I was looking at the bank statement at the end of the month.

| 2 | 07/02/2011 | ATM DECLINE CHG/08-JAN-11/2713 | DR | INR 28.00 |

| 3 | 07/02/2011 | ATM DECLINE CHG/08-JAN-11/2713 | DR | INR 28.00 |

| 4 | 07/02/2011 | ATM DECLINE CHG/08-JAN-11/2713 | DR | INR 28.00 |

How ATM decline charges are calculated?

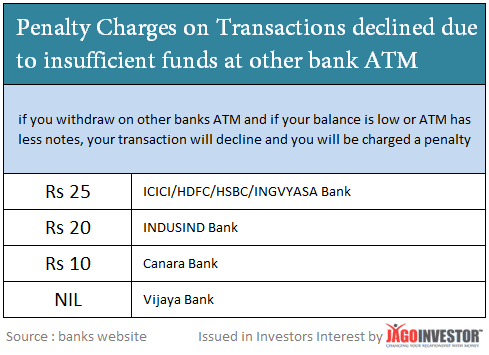

Decline charges are the base charges + service tax! Each bank is free to define the penalty charge. So in the case of ICICI Bank (and other several banks), the penalty charges are Rs 25 per failed transaction. So when you add service tax, the final figure is Rs 28 (approx). Here are some of the bank penalty charges I found out on their websites.

Is it for real that people pay penalty when there is insufficient cash in the ATM?

If it’s customer mistake, one can still understand the penalty charges, but what do you say about charges, when your transaction is declined because of the bank mistake ! , like if notes in the ATM are not sufficient? What if you are trying to withdraw Rs 5,000 but there are just Rs 100 notes in the ATM (Rs 500 are over) and the transaction failed (maximum 40 notes at a time is allowed) and you are charged for the failed transaction in other bank ATM ?

Here is one incident !

Dear Sir, I the undersigned wish to inform you that i am having saving account no. ******84712 with State Bank of India, Vadgaon Branch, Pune. When I was having balance of Rs.5106.19 (9th January 2014) in my account I went to SBI ATM at laxmi road, Pune but due to technical reason it was not in working position. So I went to opposite Bank of India, Laxmi Road ATM. When I tried to withdraw Rs.3300/- from that ATM it declined saying insufficient balance when I checked with security guard there he informed me that there are only 500 rs. notes available so you withdraw in multiples of 500 only.

So I withdrew Rs.3500/- (ATM 40091 BOI LAXMI ROAD II PUNE MHIN). When i checked today my account it is showing TO TRANSFER INSUF BAL ATM DECLINE CHARGE – ****** Transfer to ******14906 Rs.17/-. Will you please explain me the reason behind this charges.

Here is one more experience you should read where the bank had charged a customer for no mistake!

My friend once had a bad experience with SBI credit card. During some emergency, using his SBI Credit card he wanted to withdraw Rs.10000 from an SBI ATM. He entered Rs.10000 but the ATM refused to dispense that amount and gave a message that it could dispense only 40 notes at a time. Unfortunately only Rs.100 were present in the ATM (This point was not mentioned any where). So, he had to use his card thrice to get the required amount (Rs. 4000 X 2 times and Rs.2000 X 1). After he got his credit card statement, we were surprised to see that he was charged, cash withdrawal charges – 3 times (Rs.250 X 3 = Rs.750). Had the ATM been filled with Rs.1000 notes, the transaction would have been only one and my friend could have saved Rs.500. Is this ethical to charge the customers for such things? (Source)

Have you been charged for Failed ATM transaction due to insufficient balance at some other bank ATM ? Do you feel its justified?

January 30, 2014

January 30, 2014

SI fail due to insufficient balance..I am holding salary account in hdfc bank and i was charged 230 INR for insufficient balance.Is that salary account requires any minimum balance?

No , salary account does not need any MB .. check with bank on this

I was charged for the same, by using an SBI debit card at the SBI ATM Machine, But they still charged Rs. 23 as ATM decline Charge. This is ridiculous. what loss do they incur to initiate such ridiculous charges?

Can U please explain for these Losses as mention below.

08-Nov-2016 (08-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-111016 23.00

08-Nov-2016 (08-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-111016 23.00

08-Nov-2016 (08-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-071116 23.00

07-Nov-2016 (07-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-071116 23.00

07-Nov-2016 (07-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-071116 23.00

07-Nov-2016 (07-Nov-2016) TO TRANSFER

INSUF BAL ATM DECLINE CHARGE-071116 23.00

Hi Mohammed Altaf khan

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

I hold a SB account with SBI, . I had availed a consumer loan with bajaj finser and the EMI was going through ECS. This month I have received a message from the bajaj finserv that ‘ a ECS/cheque bounce charge may be debited by your banker for cheque return. Please ensure sufficient balance next time” . I immediately checked my balance and found that I had sufficient balance. Still I dont understand what type of ECS/Cheque bounce charges have been levied for ECS and that too no fault of mine.

Hi N.Rajendran

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

SI fail due to insufficient balance..I am holding salary account in hdfc bank and i was charged 230 INR for insufficient balance.Is that salary account requires any minimum balance?

No , salary accounts are 0 balance accounts

I was charged for the same, by using an SBI debit card at the SBI ATM Machine, While I entered wrong amount, I wasn’t worried as it wasn’t another bank ATM. But they still charged Rs. 23 as ATM decline Charge. This is ridiculous. what loss do they incur to initiate such ridiculous charges?

You should check this with SBI then !

TO TRANSFER-INSUF BALATM DECLINE CHARGE-290516-TRANSFER TO

98353090018 ,this was the remarks and notes mentioned in my account statement SBI ACCOUNT the ATM is left with only 500 notes i have punched 100’s instead i was charged with 17 rupees .. 🙁

Hi SRIKANTH

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Same thing happend with me, the last 0+11 digit number was different though!

NICE WORK MAN IT WAS INDEED OF GREAT HELP

Thanks for your comment OMKAR

This did happen to me as well. Wrote back to HDFC asking when the communication was sent out informing me of this change.

They didnt reply but reversed the 28 Rs debit mentioning “long standing customer”.

So when did this rule get introduced? Shouldn’t bank send a communication informing of the same?

Bank must have send some communication to you on this

I have received this message on my statement but I didn’t even go to an ATM to receive this message. What does this mean? Was someone trying to take out money from my account from an ATM? HELP

It might happen . You should check with the bank on the time when the ATM was used and then investigate further !

i have for got to provide you RBI rules

https://rbi.org.in/scripts/BS_ViewMasCirculardetails.aspx?id=9008

you can have everything here about the rules you can search more on internet

thank you

Hello Guys,

I have faced same problem Many Many times

but iam gald to say that i got refund of the all the amount which i have been debited from my account

I have an account with ICICI bank ..

mostly i wont check my balance with the ATM ..i use Online Banking so there is not much Occasions

where i used to go bank and when i have to Go i wash out all the money with in 3 transactions..

Let me tell you one of my experience

I have used my card in a Dmart Hyderabad ..After i completed my shopping

i have giving my debit card for payment at the bill counter ..shocking it says declined.i asked him to swipe it again as i was sure about the balance which i have checked online a hour i move to shopping as i was sure i was asking him to swipe it again and again but no use

as i went to near ATM and check the balance there was some amount debited to the RD which has to be debited a 3 days before ..i unknowingly asked the person to swipe it for 5 times

after a month ..i have seen my account is debited with 28 rupees for 5 times

i was shocked to see the transaction.

Guys frankly saying i hate to call the customer service and holding for minutes together to get the Representative to the line and we need to waste the balance in the mobile ..for that ..

That why i use customer care email id which is more responsible and accountable to the customer and

i request you all use email than a call .. as there will be a proof of conversation which you having with the representative ..that will be the good record if we move to the consumer court ..

You wont be having any proof or record of the conversation if you talk to them on phone .

and they will never provide you the conversation audio if you ask.. i hope you guys got the tricks the bank play

Let come to my experience i have placed

email regarding my declined charges ..they have reversed the amount to my account

not only this declined charges ..a month back i have been debited with a Dcard yearly charges ..of 168 ruppes

where i have place a email .and i got it reversed by couple of email

I don’t understand why should we pay D card charges every year when we are already payed for the card first time of rupees 250 for the card ..

This is the Email

” Dear MR. Prasad,

We understand your concern.

we inform that Debit CARD FEE 4546 APR 15-MAR 16 Rs 168.54 has been reversed on June 12,2015.and point of sale decline charges Rs.28.50 has been reversed on June 23,2015.

We thank you for giving us an opportunity to be of service to you.

Sincerely,

Rupa,

Customer Service Officer

ICICI Bank Limited

NEVER SHARE your Card number, CVV, PIN, OTP, Internet Banking User ID, Password or URN with anyone, even if the caller claims to be a bank employee. Sharing these details can lead to unauthorised access to your account.

On 6/24/2015 5:48:33 PM ”

I got only one transaction reversed

and i placed a email for the other 4 transaction to be reversed ..

AND GUYS THERE IS NOT RBI RULE TILL NOW SAYING TO THE BANKS TO TAKE AWAY THE CUSTOMERS MONEY IN WHAT EVERY THE POSSIBLE WAYS

BANKS HAVE ESTABLISHED FOR THERE BUSINESS NO FOR THE CUSTOMERS

WE THE CUSTOMERS MAINTAINING THE BALANCE MAKING BANK PEOPLE LIVE A LUXURIES LIFE

GO GUYS MAIL TO YOUR BANKS AND GET YOUR HARD EARN MONEY BACK TO YOUR ACCOUNT AND ENJOY YOUR EVERY EARNED PENNY ..

Bank are getting billions of rupees profit apart from there maintenance of the staff , banks space rents and ATM machines,

SO RAISE YOU VOICE OR EMAIL OR WHAT ELSE TO WANT TO RAISE BUT FINALLY GET YOUR MONEY BACK

PLEASE USE EMAIL FOR FREE OF COST AND FOR PROOF ..

I am sure i will get my other 4 transactions back ..if not also i am not worried i will appeal to the consumer court and will place a PIL to make it transparent to these kind of issues..

you can find your respective customer care email addresses in internet or on your introduction pack

ALL the best ..Guys

Hey Laxmiprasad

Thanks for sharing your experience with all of us. It was a great learning.

Manish

I was also not aware but the same happened with me last week. I am a SBI customer and withdrew fro Bank of maharashtra ATM. Bank charged ₹ 17 per declined transaction for insufficient funds.

Thanks for your comment Man

You deserve the thanx manish. I wish I w’d have read your post earlier..

Welcome !

Too bad.. din’t saw it earlier, I lost ~120 for four decilned transactions,

don’t feel it is justified at all. They should atleast send one sms stating the same.

Hi rajiv

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Many many thanks…really helped and explained in clear cut way…

Thanks for your comment Harishanker

Its really bad the way this ATM thing works. I have about rs 8000/- and since there is a bandh in my city tomorrow, i went to take out just rs 2000/- with my SBI ATM card. First it was declined saying there is insufficient fund. so i checked my balance and found that i still have around 8000/- balance!. So i went to another SBI ATM booth and there the same thing is repeated. This time i took out a mini statement of my transaction and to my surprise, i found that for each attempt i had been charged Rs 17. I found that they had deducted 17×3=51 rupees!. This is not ethical and the bank should rectify this kind of problem which is not the fault of the customer at all!.

Hi T. newmei

Thanks for sharing that. I know its a issue. I suggest you raise this with the bank grievance cell also

Thanks man, nice & clear article .

Welcome !

i have experienced same incident many times.. i dont know what is the problem…can anybody reply me.. when i checked my account statement it was written like this…

09-aug-2014 To transfer insuf bal pos decline charge-080814

Transfer to 98353029214 Rs.17…

whose account number is this ? Please tell me…Bro

YESTERDAY I HAPPENED TO ME . I WAS USING AXIS BANK ATM TO WITHDRAW MONEY FROM ALLAHABAD BANK ACCOUNT BUT MISTAKENLY USED SBI CARD WHERE FUND WAS INSUFFICIENT , AND SERVICE DECLINED . AGAIN I TRIED AND GOT BOUNCE . THEN I GOT THAT POINT . BUT I THOUGHT THAT THIS IS THE LAST OF MONTH AND I HAVE SOME FREE USAGE AT OTHERS ATM . BUT WHEN I CHECKED STATEMENT OF MY SBI ACCOUNT TODAY 17+17 HAD BEEN CHARGED. VERY BAD EXPERIENCE .

Thanks for sharing that !

Hi Manish,

Are such “Insufficient Funds” charges also applicable for online transactions ?

Like, for example, few days ago, I tried to create an FD in ICICI Bank, using other Bank debit card option, but selected ICICI Bank as the Funds source by mistake, because of which I got the message “Insufficient Funds in the account”. I thereby promptly corrected the option to “Other Bank Debit Card” and created the FD. However, now I can see a debit transaction of Rs. 39 /- in my ICICI account, which, after enquiring from Customer Care , I got to know, is for insufficient funds.

Is it correct for the bank to deduct such charges ? It makes no sense to me, as the transaction wasn’t even completed in the first place. Isn’t the insufficient funds parameter just supposed to be a check rather than a mechanism to collect unwarranted charges from the customers ?

Ravindra

Not for online transactions I guess. . but not sure !

Hi Manish,

I came across the situation with SBI ATM (with SBI card). They are collecting 17 rs for declined transaction. I think its unfair coz they are declining the transaction and charging as if they have given money for the credit though the account is out of funds.

@other readers I could see the term Service by Govt Banks. But in my opinion they are not providing any service as they are charging like anything from common people and feeding tycoons (like Malya). Really shame that the Govts are always in the service of Richies and not at all bothered about the common man interests.

Vijay

Thanks for sharing that Vijay ! ..