Recurring Deposits – How to get maximum benefit from them in your financial life !

Today I will talk about the simplest financial product known to me – the Recurring Deposit or RD as it is called. Most investors know about Recurring Deposits and have used them at some point of time. However, many investors are still confused regarding this straightforward product.

Also, I will share tips on extracting the maximum benefit out of Recurring Deposits and on using this product to lead a better financial life.

Simple and Beautiful financial Product

Recurring Deposits are often rightfully called one of the simplest financial products in the world. You open a Recurring Deposit for a fixed amount and for a fixed tenure. Each month that fixed amount is invested and you earn interest (at a predefined rate) on the Recurring Deposit.

For example – You can open a Rs. 1,000 Recurring Deposit for 2 years @ 9% interest. Now for the next 24 months, Rs. 1,000 will be invested from your bank account and it will get accumulated in the Recurring Deposit and will accrue interest at the rate that was offered. This is exactly the same as putting Rs. 1,000 in a piggy bank on a certain date for the next 2 years, except that in Recurring Deposit you also get interest income (which is not an option with the piggy bank).

I have been unequivocal in stating that almost all new investors who enter the world of personal finance should start with Recurring Deposits. Typically, new investors do not fully understand the principles behind personal finance and so to protect their money from the they leave funds dormant in their savings account or use them up for some other purpose. Instead, by creating a Recurring Deposit, they will ensure their income is getting channeled into investments and more importantly that they earn interest on their money – eventually leading to good investing habits being formed. Gradually over the next 1-2 years, they can start investing in other instruments such as mutual funds, real estate or bonds.

Planning your Short Term Goals using Recurring Deposits

A Recurring Deposit is a safe investment, or in other words, it is a financial product with guaranteed returns. Stocks or mutual funds are not ideal investments for short tenures. There is no guaranteed return in equity-based productsand consistent returns can only be expected over a long horizon of 8-10 years.

Recurring deposits are therefore the ideal products to consider when planning short-term goals over a horizon of 1-3 yrs. These may include

- A corpus for a downpayment of our new home

- Education fees for your children (yearly fees paid in one shot)

- Home Renovation expenses

- Higher Education Expenses if you are in Job

- Upcoming Marriage expenses due in 2-3 years (e.g. sister’s/brother’s marriage)

- Setting aside funds for a vacation

Now if you look at most of these goals above, Recurring Deposits give returns similar to those of Fixed Deposits. Returns are at the moment in the range of 8-10% depending on the tenure chosen. As Recurring Deposits do not carry risk, they are the ideal investment solution for short-term goals (such as the ones above) where the investor is looking for guaranteed and liquid returns on savings.

Using Recurring Deposits for Ultra Short term goals in life

But the real reason why I love Recurring Deposits the most is this – Recurring Deposits are without doubt, the most powerful way to reach your ultra short-term goals in life. The parts below are excerpted from my 2nd book – “How to be your own financial planner in 10 steps“.

How many long-term financial goals do you have in life – A maximum of 3 or 4, right? Investors tend to overemphasize their focus on this handful of goals in life and spend most of their time working towards them. However most of these goals are so distant in the future, that planning for them is virtually impossible. On the other hand, we have dozens of small goals in life, which are due in next 6 or 8 months or a year at the most. We really aspire to achieve these goals, but ironically, never plan for them – because we think they can be achieved without planning.

Let me explain –

Imagine you want to buy Nokia ‘Lumia 720’ in the coming 6 months. This is very small goal. But most people think about it and leave it hoping to have sufficient money for the phone when the time comes. Now imagine 8 months go by. If at that time, the person has enough money in his account, the idea to buy the phone will again occur to him and he will make the purchase. And if the money is not there, the purchase idea yet again gets pushed out in to the future.

The same habit recurs in a case where you might wish to gift a small vacation to your parents on their birthday next year. Lets say you want to send your parents on a small vacation after a year, and it would cost Rs. 25,000. Now again no one “plans” for it. The matter of having sufficient funds when the time comes is left to chance.

Now here comes the power of Recurring Deposits where you convert each ‘small expenditure’ that is due in the next 6 months to 2 years (not more than this please) into a goal – and open a Recurring Deposit for it. You then let the money flow out of your bank account each month without manually getting involved, set reminders for each goal on the target date and keep achieving those goals!

Example of using Recurring Deposits in a Scenario

Imagine you have 3 small goals within next 1.5 years and those are

- Buy Nokia Lumia 720 in next 10 months – Rs 20,000

- Gift a Vacation to Parents in next 1 yr – Rs 25,000

- Pay Installment of you Kid Pre-school in next 1 yr – Rs 25,000

Most people have goals similar to the ones listed above. To achieve these goals, you can open 3 Recurring Deposits (one for each of these), for the exact tenure (10 months, 1 year and 1.5 years). Consequently, just by having small investments each month, your planning for short-term goals will become quite robust. As the deposits mature, you will find that you have the financial means to achieve your goals without scrabbling to arrange money at the last moment or worse, having to drop your goals altogether.

Taking the above example, The RD’s would be like this

- Buy Phone – Start 10 months RD for Rs 2,000

- Gifting Vacation – Start 1 yr RD for Rs 2,000

- Pre-school Fees – Start 1 yr RD for Rs 2,000

- Total Money going in RD each month – Rs 6,000

What you have done above is to give concrete shape to your short- term goals by using Recurring Deposits and prevent your goals from turning into perennially postponed wishes or wishes that remain unfulfilled throughout your life.

Simplicity means Fast Action

Setting up a Recurring Deposit is so easy it’s almost effortless. You can log onto your Internet-banking page and open an online Recurring Deposit within seconds. You just have to pick the amount per month, the tenure and the date you want the money to be debited from your bank account – and your Recurring Deposit is all set. This simplicity in setting up also helps you take actions faster

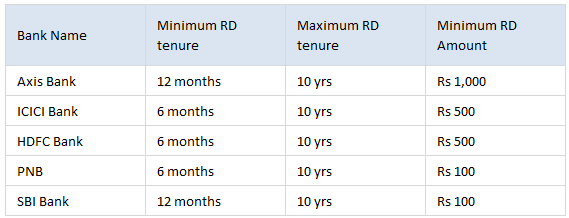

Recurring Deposits Tenure’s and minimum Requirement

The minimum and maximum tenure and amount for recurring deposits varies from one bank to the other. In general, PSU banks such as SBI Bank, PNB or Andhra Bank have a minimum limit of Rs. 100 to open a recurring deposit. However, private banks such as ICICI, HDFC or Axis have minimum limits of Rs. 500 or Rs. 1000. The maximum tenure for Recurring Deposits is up to 10 yrs. Here is a snapshot just to give you an idea

Some other Features of Recurring Deposits

- There is no TDS applicable on recurring deposits, but the interest income is fully taxable in your hands.

- You can break your recurring deposits anytime before maturity with some penal interest. The interest applicable will be the rates applicable for the tenure RD was running and not the original tenure chosen.

- Some Banks offer flexi recurring deposits also, where you can increase the amount of deposit each month (but cant decrease it)

- The minimum tenure for RD is 6 months and maximum is 10 yrs

- You can start recurring deposits for minimum of Rs 500 or Rs 1,000 . In post office its minimum Rs 10

- Recurring deposits comes with Nomination Facility, so your nominee will be contacted and handed over the money if you die.

- You can take loans against your recurring deposits for 80-90% of RD worth

- Interest is compounded on quarterly basis in recurring deposits

Please share what you think about Recurring Deposits. Have you used them? Can you share one insight or hidden information about Recurring Deposits, which you feel may help others!

November 18, 2013

November 18, 2013

Dear Mahesh, I have R.D. Account opened in SBI for Rs 10000/- per month for 60 months and authorized it to for payment

of installments from my SB account, by mistake I paid Rs 10000/- by mistake through net banking and it became double

payment i.e. two instalments in one month, my query is do I get the interst for extra payment or not please clarify?

Yes, you will get interest for any amount of RD you make..

Dear Mahesh ji, same query as above.. i made duplicate payment of installments past 2 months(kept standing instructions duplicates). Will it fetch same interest as RD deposits and do have to pay original

RD installment or it should be equal/higher than previous installments paid(read somewhere that this is the case). kindly clarify!

I think there is no harm in paying more.. you shall get interest!

I approached for my RD A/C maturity amount on 18-9-20 where as it was matured on 10-07-20. Bank refused to give SB interest on Matured amount for 3 months, they are telling that amount goes in Overdue A/C. Please guide me about the rules about whether i am eligible for 3 months SB interest?

Yes, if its matured and if you dont renew . you dont get interest.. You can get benefit of being late !

Can you explain this point ? For RD tax is deducted if the interest earned is more than rs 10000? I want to save rs 1000 per month in RD. And iam a housewife

No , its not like that. If your interest is more than 10k a year, then only TDS is deducted not TAX

Thank you so much for idea of multiple recurring deposits, it indeed was helpful. My question is whether I can open multiple recurring deposits in same bank

Yes you can

Hello,

I have a RD for 12000 for 1 year , I want to add more more money i.e 8000 more to 12000 to make it 20000, and i have paid up to 6 months now .Is it possible and how should i add money to it?

You will have to visit the bank for this. Talk to them .. they will help you

In a month how many times i can deposit in my RD account.

RD is a account with auto mode, The money gets deducted automatically !

Hi I have open rd in hdfc bank last month, The date is come, so how to pay the next month rd through netbanking. please help

As far as I know, RD will automatically get deducted from your account .

The tax deducted from interest earned through RD falls under the same slab as your income tax. So, is it fine to first give the RD amount to my mother (for example), whose taxable income is 0 and then open the RD through her name. Will I be saving tax in this way? Plus is it legal and not shady?

Yes, you will save tax this way and its legal

Hello Chauhan,

I really dont understand the following:

“There is no TDS applicable on recurring deposits, but the interest income is fully taxable in your hands.”

What does it mean!

No tds means there is no tax on interests and the money deposited for RD?

And interest income is fully taxable in your hands??

Please say it in a clear language, thanks, raj

No , you need to get your basics right here.

TDS means an automatic way of tax deduction by banks/companies and paying it to govt on your behalf.

NO TDS means someone else will not do it, you will have to do it on your own .

So in case of RD, it means that whatever is the interest, you need to calculated the tax and pay it on your own. If there was TDS, the bank would have done this step for you

Manish

Hi Manish, Thanks. So it is our responsibility to calculate the tax and pay. Do everyone do it? Or if we dont do what will happen? I am just to know..

Thanks, Raj

Yes, we need to do it ourself or if you dont want to take that pain, you can hire a CA for that.

Hello:

If i open a NRE RD account to 5 years..and what will happen if I return india after 2 or 3 years??

Thanks

It will be treated as NORMAL FD then

thanks, but how will the banker know about it.

Thats a good question . If you dont tell them and later if you bank comes to know about it. Then you will not get any interest also .

if i open an rd flexi in sbi @ 15000/9 per month for 3 years, what is the total amount of return that i will enjoy sir?

Hi Saurav

Calculate it using the excel sheet withthe interest rate

How many RD accounts can be owned by an individual?

Means if i want 13 rd account month wise (means 1 to 13 month each month Rs 1000 a/c is opened ) can this be possible?

yes its possible !

How much is the maximum money you can invest in RD per month ? Is there any cut off ? Can one invest 50k or 60k per month ?

There is no limit like that . you can invest crores also if you want !

Sir i invest monthly 1000for ten years .i deposit in this from 16month .now i want to deposit 3000 in this account. Can i received more interest

You will get more interest from the time you invest more money !

if i open a recurring deposit of thousand and if i deposit 10000 every month will get the same interest rate?

Yes

how you review

DHFL– Recurring Deposit

Rate of Interest of 8.75 %

Dear Manish,

Does the matured RD amount be considered under ‘Other Incomes’ in ITR, and, the TDS Amount be stated while filing ITR ???

Mr. Rana

Yes, It should be considered into “Others Income” only

I came to know a lot.

Regards

I opened RD of 10000/month for tenure of 6 month, can i extend tenure period ?

Yes, you can do that

Hello Manish sir..,thanks for such a useful article.

I have got one RD of 5 years term.Due to some prob I have stopped paying Installment after 2 years from the start date.In this case if the amount of those installment which I have paid earlier would be credited to the account associated with my RD.Or if I need to apply for the withdrawal.Plz help me with your reply.