How banks make money when you swipe your card and by lending your money to others !

During my school and college years, I often used to wonder– “How do Banks make money?”. I did not however put a lot of effort in understanding the subject and naively assumed that the government was running banks in order to provide services to its citizens and to shore up the country’s infrastructure. It was only over time, that I realized how wrong I was! .

Banking is a purely profit oriented business, Just like any other business – It has its own costs and income streams. In today’s article, I would like to give you some idea of the various ways a bank earns income and makes profits. We will also talk about expenses in the banking business and hopefully provide you with a holistic view of banking.

1. Earning money through Lending

This is the heart of banking business.

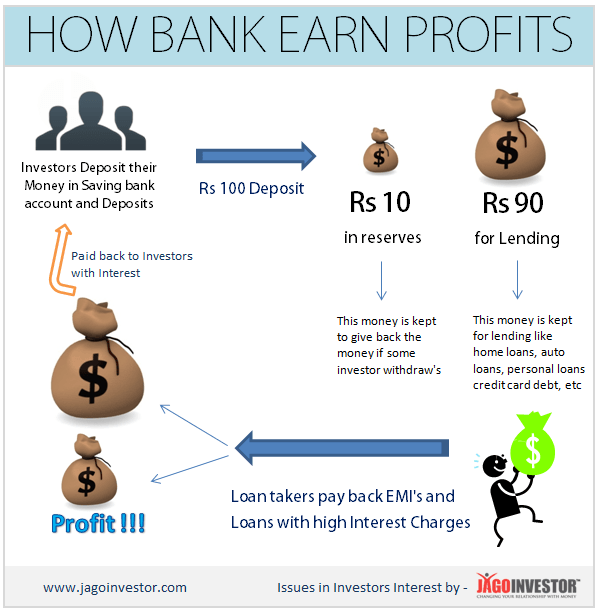

Lending to its customers is the biggest money-spinner for banks. The usual way this works is that banks accept deposits from their customers (through savings bank account, fixed/recurring deposits), providing the bank with a big pool of money. Now this pool of money is then used to lend to customers who need loans.Its very obvious that not all the money deposited will be withdrawn the next day itself. If a bank has Rs 100 as deposits, not more than Rs 10 is often needed to repay back to customers, which means Rs 90 can be lent to those who are ready to pay high interest and have repayment capability.

High Interest Charged, Low interest paid

Now, riskier the loan, higher the interest charges it carries, so that in the event of a loan going bad (called as NPA – Non Performing Asset), the huge interest charged more than makes up for the loss incurred by the bank. This also explains why home loans and education loans (which have security deposits – if you cant repay, the home is there to sell off and recover the loan) have comparatively low interest rates compared to loans that are totally unsecured (e.g. personal loans or credit card debt). That explains which why CIBIL report containing high number of unsecured loans do not get loans, because they give an impression that they are so much dependent on credit in their financial life.

Anyways, To put this concept in simple terms, banks make their money by paying interest to depositors at about 4% (saving bank account – the low interest rate is because you can take out the money anytime) or 8% p.a (in FD or RD, because of some kind of lock in there, and a kind of approval by you that you will leave that money for a long time with bank and not withdraw in short term), while they give out loans/credit and earn interest themselves about 12-13% p.a. – thus earning the 5% spread in between. When you further deduct from this, the significant overhead expenses banks have to pay (like rent for offices, salaries to employees and other costs), what you are left with is the profits of the bank.

This also answers a common question – how banks make money on credit cards?

In case of credit cards, a few bad customers who do not pay on time, pay huge interest charges (3.5% monthly or more than 40% years) and late payment fees, which are good enough to make up for the services given to a good customer who is paying on time and availing the benefits of the card. That should answer those who ask – “How can banks afford to give me a credit for 40 days?” – Its not the bank , but those bad customers who are helping you to get that free credit ! – they pay the BIG charges.

2. Earning money through Services and Products

The other way banks earn money is by providing lots of services in addition to their core banking products. For example, when you open an account, you do not pay for basic services such as banking, transactions on an ATM machine and getting a chequebook.

However, if you need more than these basic features, you will have to pay for them. Such “extra” things are

- Extra cheque book in a quarter

- Feature rich credit cards with yearly fees

- More account statements other than the default you get

- NEFT/ RTGS charges

- Charges for SMS notification

- Processing charges for giving loans

There are all some examples of these paid services.

Why banks keep distributing credit cards ?

I was also curious about the eagerness displayed by banks in providing consumers with credit cards – what made them do so and how were they benefiting from it. I came to the realization later that the greater the frequency of a customer’s credit card use, the more money banks make. This is because every time you swipe your card at a shop,the bank which owns the swipe machine pockets a cool transaction fee of up to 1-2% of the transaction amount. That explains why these days banks are tying up with e-commerce companies to provide “Swipe on Delivery” service to customers other than “Cash on Delivery”

So imagine if you swipe your card for Rs. 10,000 in a month.The shopkeeper has to pay 1-2% of the transaction amount to the credit card company which owns the swipe machine (Break your 4 big myths about credit cards here). So 1-2% of Rs 10,000 is Rs 100-200. Now imagine millions of people swiping their debit/credit card each month over the years, and you can clearly visualize how much money banks make (Of course these banking services have their attendant expenses including the cost of the swiping terminals, employee salaries, rental/ purchase charges for the bank premises and other general administrative costs). So it make sense for banks to keep giving credit cards and debit cards to anyone who has potential for spending and repaying it back 🙂 . So your SPENDING creates INCOME for bank 🙂 .

Here is a detailed note of how banks money when you swipe your debit or credit cards on terminals – Thanks Vivek for the explanation

Do you know why Banks market Credit cards aggressively and give to all and sundry. It is because its one of the highest revenue generating asset for the bank. The interest rates on Credit cards are as high as 3.4% per month (APR 41%), plus service tax of 12.36% on the interest portion, effectively taking it to 3.8% pm (APR 46%). But did you know, that credit card companies have another income stream. It is INTERCHANGE FEE.

For every Credit card transaction done by you, the bank gets fixed 1.1% of the transaction amount as Interchange fee (APR 132.2%). Who actually pays this fee.

The merchant installs a POS terminal called EDC Machine at his place. Customers charge bill to their credit cards on the merchants EDC machine. The merchant in turn submits the charges to his bank called “Acquiring Bank” who acquires the charges. The Acquiring banks pays the merchant the transaction amount, less commission called Merchant Service Fee or Discount rate which is in the range of 1.6 to 4%. Typically, it is 2%. The Acquiring bank presents these charges to the Issuer bank through clearing mechanism, and gets the transaction amount, less Interchange fee. All in all, Credit card is an important folio for banks. The Customer should use to card to his advantage.

It is not free money and if one misuses it, he will have to pay through his nose. I would suggest one to have a Credit limit of not more than Rs.35,000/- or at best Rs.50,000/-. The maximum cards should be restricted to 2. Remember, Credit card debt is a TOXIC Debt. One is better off using Debit card. Interest free Grace period should not be a criterion to have a credit card.

Were you aware about these points? Lets discuss more about this in comments section. Please share your views on this topic!

November 14, 2013

November 14, 2013

Hello ,

I disagree with your pictorial representation.You say 10 Rs. is kept as reserves and 90 Rupees on lending. Please answer then how do they maintain their CRR SLR with RBI.

You need to answer this question and correct me if I am wrong.

Deepesh

Those numbers are not real numbers, its just to explain the concept at higher level . I dont want to say that Banks keep Rs 10 out of Rs 100 in reality . Its for illustration purpose .

i have a own EDC machine in my cash counter whether i can swipe my own credit card on this EDC machine for requirement of money

bcoz when money is needed we have to borrow on int of 2%per month, so it is better to het money in this way bcozi get 45days int free period

Thats great

Nice .. never thought this way !

Hi

A small question about credit cards.

My bill date is 01st and I have a total amount due, payable on 20th of every month.

Generally I pay the entire amount on 18th of every month. However every month I also have some credit transactions (due to ticket cancellations or cash back offers etc)

In such a scenario , should I make the payment of entire amount due or reduce the payment by the amount of cashback received between 01st and 20th ?

Regards

You should actually pay the FULL amount, what ever credits are going to come, will be adjusted next month. Do not make less payments, else there will be panalties!

Manish

Thanks for the confirmation.

Currently I pay the full amount only

A very good video posted by my friend on banking system, https://www.youtube.com/watch?v=0uFAUtCajds . See and decide.

Thanks for sharing that Manu !

> If a bank has Rs 100 as deposits, not more than Rs 10 is often needed to repay back to customers, which means Rs 90 can be lent to those who are ready to pay high interest and have repayment capability.

To add to this – ‘banks multiply the available money’. Lets say you put in 100 in a bank. Banks are required to hold some percentage (called CRR – Cash reserve ratio) which is set by RBI.

Lets say this is 10%. So banks lend out remaining 90Rs. Now the borrower buys something with this amount. The seller will deposit that 90 in his bank. So that bank can now lend 90*0.9 = 81Rs to someone else who will deposit in another account. So now the money in the third account (81Rs) will allow a loan of 81*0.9 = 72.9 rupees.

And so on. This is a geometric progression. If you remember the formula – Effectively 100Rs deposited in the bank has given rise to 100/(1-0.9) = 1000!! Rupees of lending. And the banks make money on these 1000Rs of loans.

See http://en.wikipedia.org/wiki/Fractional_reserve_banking#Example_of_deposit_multiplication for details.

Thanks for sharing that ! ..

There is a secret about Savings and Fixed-Recurring Deposits that banks won’t tell you. These are traditional means of savings used by a majority of people in countries like India and China, where investing in riskier assets is still not as widespread as in countries like U.S

Savings and Fixed-Recurring Deposits are good for short-term deposits, money needed for the next few months/years. The natural tendency as people grow older is to save on expenses and grow this money, so these amounts grow from pensions, rents, interest etc.

There also comes time for many people that life just ends, and for many people, the money they have saved in banks outlives their lives. When this happens and the nomination records haven’t been set, these accounts are unused and the amounts in them stay in the bank.

The banks have a procedure to age and lock such accounts, and as they age, the banks use the money in them for riskier loans and investments that have a higher ROI. Over time, these gains earn more for the bank that the operational accounts. Each year, they add more such accounts to their assets.

Some banks wont even give ATM cards to those earning pension because they feel relatives will use them to cash out on these accounts, they make elderly people physically come to them for withdrawals!

Thanks for sharing that Naveen , are you just talking from 2-3 personal experience ? or have you come across such news or reports ? Please give link incase you have !

Manish

Manish, this hasn’t affected me, but I learnt this from listening to the complaints from a customer of Canara Bank to their Manager. It is important to have the nomination records set up in the bank, and in their absence, the bank has the authority to withhold payments from unused/locked accounts. While the issues get resolved, the bank freezes them. The Provident Fund accounts also have a significant amount of such money. When the money is unclaimed or there are issues with nomination, the amounts are itemized into a separate category and used for loans and investments.

Thanks for that information, Yes I can see that as a bank its very easy to do this . If nomination is not present, it can also happen that family member also are not aware about the bank account or are just lazy to look at it thinking its a small money and then its just bank money 🙂

Manish

These amounts can be quite significant. I am not sure if banks report these amounts in their financial statements. The typical savers in life, and I was one of them in your class (!), save through the end of their lives and leave behind what they didn’t spend. It is all fine if this money passes on to dear ones, but banks hold on to it until it is transferred.

Are there any bankers on this list who have more information on what happens to such money? How are the banks obligated to handle the money from such accounts?

Hmm . I do not have any one here in group , but I am planning to write on this in detail and while studying this, I will try to find out more on this

Manish

What benefit is to a merchant if he were to accept credit card or debit card payment? He needs to buy the EDC machine, and also pay 2% over the customer’s bill to the bank. Here are some benefits: Guaranteed payment (bank pays for customer, and even if customer defaults, he will have to settle dues at high interest), no worries about counterfeit currency (Some customers could dupe merchant by deliberately giving fake notes), no worries about soiled or mutilated notes.

In the long run, is it very profitable to any merchant to go for debit card or credit card payment? As a customer, I have suffered paying the extra 2% charge to merchants as I had no choice.

You also said not to have more than 2 credit cards, I own 4, but use them wisely. I have not defaulted on any payment in 14 years since I got my first card, and pay my dues 6 days before due date, so that on days when there are holidays spread over several days, I need not worry if the drop box is not cleared.

You also said not to exceed 60% of your credit limit. If you are old customer and enjoy good relationship with bank, why not go to 90%? How will this impact your credit report, even if you not defaulted with payments? The purpose of credit card is for customer’s benefit. If you can shed more on this, it would really help us.

Dear Ashwin,

One of the components that go into calculating your credit score is the utilisation of your credit card. If you utilise high amounts regularly, it affects your credit score negatively. Even if you have never defaulted on your payments, it is better to keep expenses on your credit cards within prescribed limits. Also, having too many credit cards results is an additional and unnecessary debt burden. If you are not using the card, it is better to close it. A correct balance of secured and unsecured loan accounts will benefit your credit bureau score.

Also, as per RBI rules, merchants are not allowed to charge the extra 2% from customers.

Regards,

Credexpert

http://www.credexpert.in

Thanks Manish for sharing this usefull information.

One more way:

Interest earned on clearing cheques balance

Banks settle cheques thru clearing house the very next day after you deposit a cheque. However, your account is credited only 3 business days or more later, on the assumption that the cheque issuing bank may decide not to honour the cheque for any reason.

RBI needs to take note as this is actually denying interest to the cheque depositor.

This is another excellent post on ‘How Banks make money’. They absorb deposits at low interest rate and give loans at high interest rate

However, I would like to know how the Central Bank. That is, the Reserve Bank of India makes money. As you know, we can’t open savings or current account with them. Also, can’t apply for FD/RD account or any type of loan.

It just prints money, regulates banks and announces monetary policy.

So, what are the various ways in which RBI makes money?

sorry it would be 31st Dec 2013.

What is your opinion regarding 5% cash back (limit rs.200) offer by HDFC credit cards for first 6 months on utility bills including insurance bills. The processing fee of Rs. 10/- will be waived for whole life. These offers are valid if registered before 31 Dec 2014. Is it a good offer?

It seems like a good offer. the devil is in the details which is that you should not have any defaults which wipes off your Rs 200 cash back. Good to use since you can setup auto pay and dont need to remember to pay also will get you reminders and such.

What is your opinion regarding 5% cash back (limit rs.200) offer by HDFC credit cards for first 6 months on ulility bills including insurance bills. The processing fee of Rs. 10/- will be waived for whole life. These offers are valid if registered before 31 Dec 2014. Is it a good offer?

Nice. Specially the parts explaining how banks money for 40 days from credit cards and how swiping of cards is helping banks generate revenues. Good insights.

In case I am paying all of my outstanding before time and hence not charged any interest rate, should I continue to use credit card to max possible amount ?

Does this have any negative implications on credit score/history? Because I can use this credit limit of 30-40 K every month to buy and get saving bank interest on this amount for one month of credit free period.

Good question. I too have same doubt

Amit

You should not use it to FULL LIMIT . Always use upto 50-60% of your limit. Because using it fully might have some small negative impact on your credit report . So if you want to go upto 30k per month, make sure your limit is raised to 50k . Talk to your bank !

This is for everyone, not only for those who are paying on time or not paying on time , read more about this here – http://jagoinvestor.dev.diginnovators.site/2013/03/dont-close-loan-improve-credit-score.html

Manish

I still wonder how banks make money when the credit card payments are done on/before the last date?

Aparna

If you read the post again , I have already shared that banks do not make money on all customers . If you are paying on time or before the due date , You are going to benefit , but bank is not going to make money out of you, But they will make money from other customers who are bad , so 10% customers will make the bank enough income which is sufficient to handle 100 customers. Just like in insurance business, you do not know which customer which be “profitable” , but you know that 5% of the overall customer base will be profitable ! .

I hope you got the point ?

Manish

The fee charged by Banks for online transactions is even higher and goes upto 5%

Thankfully, RBI has introduced a mandate that the fees charged on paying online through Debit Cards cannot be more than 0.75%

Cant be more than 0.75% in case value of transaction is less than Rs. 2000 and cant be more than 1% in case value of transaction is more than Rs. 2000

I hope the same is done for Credit Cards as well…

The reason for a lower charge on Debit Cards as compared to credit cards is that there is no credit risk for the bank in case of Debit Cards

Thanks for sharing that information Karan !

Manish