Merchants can’t charge 2% extra on Debit Card Payments – Says RBI

Have you ever faced this situation, when you were making payment through your debit card or credit card?

“Sir How are you making payment ?

Debit Card or Cash ?”

“Card”

“Sir, There will be 2% extra charges if you pay by Debit Card ? ”

“Why extra charges ? I use it at every place and no one charges any thing extra ? ”

“Sorry Sir, this is our Policy. You can take out the CASH from the nearby ATM if you want to save that extra charges”

“Huh ! .. &^#$^&*J#^&&#%$&*N”

You often face the above situation, when you buy things like jewelry, Laptops, Mobile phones etc. I faced this 2-3 times myself, but could argue well with the shopkeeper, because I knew this is just a tactic used by shopkeepers to save on the charges they need to pay from their own pocket. Hence I never paid that extra 2% or just left the shop.

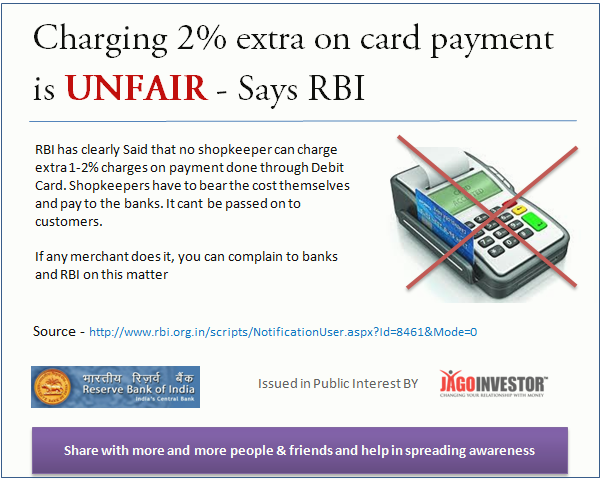

Merchants cant charge any extra charges on Debit Card Payment – say RBI

Now yesterday, RBI has openly cracked down on this unfair trade practice and issued a notification saying that Shop Merchants can not charge any extra charges from customers, if payment is done through Debit Card. Below is the exact wordings from RBI Notification

4. Levying fees on debit card transactions by merchants – There are instances where merchant establishments levy fee as a percentage of the transaction value as charges on customers who are making payments for purchase of goods and services through debit cards. Such fee are not justifiable and are not permissible as per the bilateral agreement between the acquiring bank and the merchants and therefore calls for termination of the relationship of the bank with such establishments.

Why Shopkeepers Charge extra 2% on Debit Card payments ?

When you swipe your debit/credit card for purchasing some item, the merchant has to pay some fees (1%-2%) to the Bank or the rental fees for the swipe machine. The charges goes out of their own pocket, as the cost of running the business and convenience of taking the payments (more customers will come, if card payment is there). If its a small payment like Rs 500 or Rs 1000, then its a charge of Rs 10 or Rs 20, which is fine. But when it becomes a payment of lets say Rs 30,000 (imagine buying laptop or iPad), then its around Rs 300-600 and to save that big charges, they discourage debit/credit card payment.

They often ask customers to pay by CASH and point them to nearby ATM. Almost always, customers could not refuse, because they have already made the buying decision, and dont want to argue for the small charge, and a lot of times, they finally believe that may be its not illegal, and finally give the CASH even if they do not want, or just allow the merchants to charge additional 2% charges.

But, as per RBI, its not a fair practice, because merchants already have agreed in the agreement with the card swiping machine bank that they will not charge anything extra from the customers. Here is one example of asking for 2% extra fees by some Geeta Ramani on rediff website

My worst experience was when I intended to purchase a Tata Sky card worth Rs 1000. The shopkeeper said 2.5% = 25 rupees extra. I told him — you give 10, I will give 15 rupees. He spoke quite roughly — hum kyon den? I told him it was because he was supposed to pay the bank, not I, and that I was doing him a favour and not the other way round. He said he did not earn anything from the transaction. Anyway, I did not give in. I didn’t purchase from him and purchased the same from Indiaplaza instead online without any transaction fee

What you should do, if Shopkeeper does not agree ?

RBI has clearly asked all the banks to break their relationship with those merchants who are practicing this. So, when any merchant asks you for extra 2% charges and even after the debate they do not agree, you can complain to the RBI about this and also complain to the bank. Each Bank has a “Merchant Services” section on their website and when you mail them or complain in personal to their branch, mention that you want to complain about Merchant Services. Example for ICICI bank is here and Axis Bank is here. But

When you take this step, at-least some merchants might fear the consequences and oblige!, but now the problem is how many people will go to this extra mile . It would require some time and effort from your end.

So next time you are asked to pay extra 2% on debit card payment, you can clearly tell them about this RBI notification. If required better take the print out of the notification and keep it with you in your wallet or as an image in your smartphone.

Have you ever faced a situation where you were asked to pay extra 2% charges on debit card payments and were pointed to a near by ATM, and what did you do in that situation, please share !

September 26, 2013

September 26, 2013

do you know any information about sbi gift card charges … today a customer at my shop paid 121.00 rs using sbi gift card and after swiping the card on my bob provided machine i gave the customer copy with 121.00 printed on it with the bill after a few minutes customer started arguing with me that 145.00 was deducted from his card and i have charged extra 20 plus amount to customer and even after i showed her my details payment received report from my swipe machine she was not willing to accept that i have not charged any thing extra from her … and in fact she showed me sms from sbi that 145 was deducted from her balance … so under this circumstance what i am supposed to do as neither it was my fault or hers but for no reason we had heated argument

You need to tell them that its the SBI charge .

What about credit card transactions?

I think even there they cant

hi my name is Vikram, from Chennai.. i left my bike in Suzuki service center (Pramaan suzuki, Adambakkam) 3 days before. I Said that i will pay by Debit card only, as i dnt have cash in hand.. tey accepted on taking bike for suzuki.. but now tey asking 2% charge for Debit card, and that 2% needs to be paid in cash… What shall i do, how shall i complaint abt this…

You need to complain it with merchant (the card machine company like ICICI or HDFC)

Sir nice information.Can we not approach local police? I have faced this problem in Wardha. Most of the shopkeepers..tyre shop, jwellers and many shopkeepers are srraightway and shamelessly asking for 2% charges on purchase.

All banks and media is requested to give a wide publicity to create awareness among public ,local news papers would be the most ideal.

No you cant complain this to police , its not a criminal offence, but the breach of contract the merchants have with the swipe card company. You need to complain with them!

The SBI website doesn’t seem to have provisions for the merchant services. The how to complain against a merchant in this situation?

I am not very clear on the details of this.

I think with Rupay cards where Mastercard and Visa are not involved we can reduce charges for all

i did not really wanted to ask it personally but Mr Manish can u tell me what will the traders do if their margin is around 3-4% do they have to give thier half earning to the bank and 30% of the leftover 2% to the govt as income tax. So you are not coming out with a solution and suggesting we shouldn’t adapt to POS system. Ok now the govt has been pressing on cashless , so you think we arel the dumbest trader in the market. Basically you are killing the business and doing no good.

Thanks

I have no idea on that, but if you are using the swipe machine card, then you cant charge 2% , its not as per law.

Hey my college also charge 2%tax on swipe debit card .I want to knw this is right or wrong incase of college .

Its wrong !

And what About Online Portals LIC is charging heavily on Payment of Premium via Credit Card / Debit Cards, Should RBI not request Govt Enterprises to leave those charges.

This rule from RBI does not talk about online websites. It only talks about swipe machine

I have faced such a situation. Example when MRP is 15000, they willing to give for 13500, by cash and 14000 by card what will you do?

These arguments you can make only in shopping malls where they gonna give u the product only on MRP tag. So please don’t argue whenever the shopkeeper is gonna give you any product which is lesser than MRP rate, at a cost price.

If they are willing for card without service charge go for it, else take some effort got to atm get money.

Thanks for your comment Dr. Sivaramakrishnan

Appreciate what is written. Some points from my side. 1) No shopkeeper myself included would want to take burden of excess cash, so as much as the customers the swipe machine facility is convenient for us as well, ask bank remove 2% charges and give 1% cash back to the customer (Paytm and other credit cards have been giving it) who will then pay by cash 2) Most of the business today run on margin less than 1% (this is called money rotation business, where the turnover is high and more footfalls at the shop allows cross selling of other products), now consider giving 2% again to the bank, have we opened a social welfare club. 3) Many people are worried about the margins that we make (without knowing the exact picture), well then get it yourself from the manufacturer at the minimum order qty., maintain stock, employ people, consider over heads, face customers who has default credits and so on and so forth. 4) Retailers and wholesalers are pretty much the backbone of the economy, the number of employment involved, the tax payers, etc.

Now think as an employer, all your employees will now have salaries credited by a system which will charge 2% extra to the company. Now, which company will not pass on that charge in a way or two to the employees.

Thanks for your comment Manish

Merchants can’t charge extra but see the overheads for one swipe transaction

The commison from 1-2% on the card type and then there is a phone call made

Then you have to do settlement of all the transaction which is one more call so ₹2.4 gone

Many banks keep 1800 now they are charged as premium nos hence call rate is ₹5

Some time we have to connect 2-3 times wrong pin no connection etc so that another 1-3 calls extra so how much have u lost.

Thanks for your comment Uday

Is there any common number to make a complaint against Merchant… How come we come to know that which banks swife machine merchant is using…

No , there is no common number as such !

Could you please let me know “How to & To Whom” we can complaint about this issue (Charging excess on total bill)

I am doing an article on this very soon !

It is time to reform banking system also.for the consumer & merchant.

Thanks for your comment PRASHANT S

I think this is also done by traders who are interested in hiding sales of their goods. Card transactions leave a trail, and they’d have to end up paying tax on these purchases. Cash trail is SO much easier to hide!

Correct !

Actually we had purchased some Hindware products today and they had charged Rs 440 as the service charges. Though the machine was lent by SBI bank

You need to complain this to SBI in that case

Thank you sir I will follow sir

How will we know which Bank Swipe Machine the merchant is using. and where to complain i.e which bank?

You need to see that on the machine

It would be nice if someone could please post the link to the complaint portal. I have also been charged 2% very recently. I have the photos of the bill and the swipe machine slip thus showing the difference.

There is no complaint portal as such !

I am of the opinion that the RIB circular under reference is practically useless since it talks about only what a seller is not expected to do without clearly putting any certain and easy to access remedy in the event of otherwise happening. In fact I believe that after the recent upheaval in our currency system every electronic transfer should be made free of all charges. Electronic transfer also benefits the concerned banks by saving either logistics cost of supplying cash to the ATMs or by reducing work load of the counter. And the country and the banks actually reaps benefits of documentary credit.

Thanks for your comment Ooiseeroop

I am a merchant and I do not charge the extra 2%. However when people come with the street mentality that we small retailers earn more and should give them discount of upto 70%, we cannot do it. Our profit margin is a mere 30% less 6% for VAT. We lose out on business in cash and card both due to bad decisions by govt. and mainly due to online retailers.

Once again as a small retailer we do not charge an extra 2%. All I ask is don’t expect discounts from us.

I think thats Fair Enough .

Absolutely right. Same set of purchasers when they go to MALL, they don’t bargain but when they come to shopkeepers they bargain. Point is simple we wont ask for debit / credit charges but then u dont bargain

Good. Even I mentioned the same in my message

We have started a petition asking RBi and PMO to permanently waive-off this charge.

Please sign this to support fight against blackmoney as well as saving the interest of small shopowners

https://www.change.org/p/reserve-bank-of-india-why-pay-2-extra-on-debit-credit-card-transactions-when-we-are-going-for-cashless-india