The Threshold Point – a simple way to achieve your goals

There is so much you need to achieve in your financial life and you are stressed! Correct?

I have seen investors getting overwhelmed due to the pressure of financial goals in their financial life. You have one life – in which you have to cram multiple financial goals. A house, a car, a corpus for educating your children, a regular stream of money each year to pay for school fees, vacation funds, occasional large expenditures, funds for your retirement and several other items which are too numerous to even list here!. Out of these – some things you want immediately, and some you label as your long-term goals.

However when you keep thinking about these goals and amount of money you need to accumulate in your financial life, you get worried, stressed and feel lost. You doubt if you will ever be able to achieve it and that demotivates you and then you just ignore handling your financial life and go with the flow! – leaving everything to fate! However that’s not the solution!

what’s the solution?

I can’t give a solution, but I can suggest you something which we practice a lot of times when we deal with our financial planning clients. Let me share with you that simple yet powerful concept which Nandish Desai came up with in our early years of handling clients. Years back – we noticed that a lot of clients financial life was so messy and confusing that it was unplannable! Also they were so overwhelmed that we could not do their planning the usual way. We needed to suggest them some plan of action which was lighter and which looked more achievable to them.

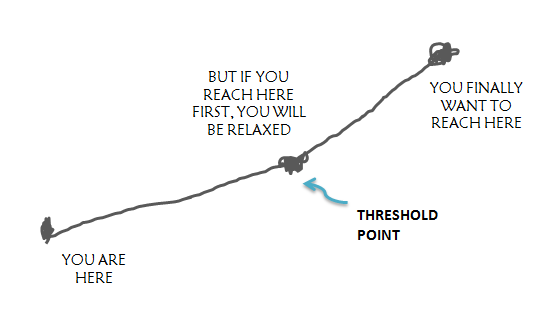

So to those clients, we asked to slow down (listen to this powerful 16 min audio on slowing down recorded by us personally) and ask them to forget about all their future goals. This is because many investors are not able to make a powerful play for their financial goals with empty pockets. To play for your financial goals powerfully you need to first cross or reach your THRESHOLD POINT. Yes! – That’s the concept I am going to unveil today. The concept of threshold point helps an investor to lighten his worries and to be more focused.

Now, what is this threshold point?

The threshold point is the milestone, which when reached in your financial life, gives you a strong sense of achievement. You feel like you have taken that first step and you are a winner in your own eyes. It’s not the final achievement, but a mini-battle that you have won. A threshold point could be generating some lakhs of rupees, having a loan free home, achieving an income level, getting debt free, or combination of these.

All your energy has to be focused on reaching that threshold point. Everything you do in your financial life has to be driven by just one motive in life, and that is reaching that threshold point. If you have to spend money on something, you have to ask first – “Will spending this money help me move towards my threshold point?”

You need to get obsessed with your threshold point so much, that naturally you will achieve it much faster than you had planned. And when you reach your threshold point in some years – you then play a much bigger money game. The threshold point gives you a sense of some freedom, some relief and extra dose of energy.

Some Examples of threshold points

Example 1 – Ajay’s Story

My friend Ajay is unmarried and lives in Varanasi. He was anxious about his future prospects because he does not want to get into a regular job, because he is kind of moody person and leaves his job the moment he does not like it. This creates problems in his cash flows. While he wants to do lots of things such as buying a home, buying a 2nd home, saving enough to roam around the world etc., he told me he does not think it’s POSSIBLE to achieve all this. The truth is he was overwhelmed and could not think what he should do next ! .

I asked him to describe his ideal situation – one that would remove all this worry. A situation that would make him feel more at ease and help him plan his financial life ahead in a better fashion. He said that if he were to start receiving a regular income of Rs 10,000-12,000 per month without working – he would feel far more relaxed. That’s it. That was his Threshold point.

Threshold point – Generating Rs 10,000-12,000 per month income

This is something he now needs to focus on. We found out that if he could generate 20 lakhs in a few years, he could put it all in a Fixed Deposit and get an interest income which will act as the regular income. It would take few years, but once he would reach that point, he would be a winner in some sense. He has already saved quite a few lakhs, and is now on his way to reach his threshold point. He now travels by train, rather than by air, because that takes him closer to is threshold point. He does not spend more than what is required on clothing and saves every extra bit and puts it back in his bank account – all of which takes him closer to his threshold point.

Example 2 – Tarun and Reema from Pune

This couple (Names changed) approached us to avail our financial planning service. We looked at their financial data, their financial goals and their exact situation. They were worried about their future goals like retirement, educating their children etc. Their net worth was less than 3 lakhs and their goals were big-ticket goals.

Threshold point – To generate first 15 lakhs

First, we asked them to eliminate their future. Yes, our future is an illusion that human beings live in. A lot of investors are either worried about their future or they regret their past mistakes, but they are never fully in the present year. I told them, as an investor you can’t step into 2014 or 2012 – you are in 2013 and that is a reality. We then asked them to define their threshold point, an amount that would fill their pockets so that they would have the power to face big future goals. The amount they came up with was 15 lakhs.

We simply asked them to forget everything and focus completely on their threshold point number, which was 15 lakhs. We then helped them to re-structure their cash flow and helped them to devise ways by which they would reach their threshold point soon. Now in this situation they didn’t had multiple goals which scared them, all they had was a SINGLE Goal and that was to generate 15 lacs.

Example 3 – Ramanna’s Story

Ramanna was employed in a big I.T. company in Pune. His aim was to start his farm – as he loved nature and his dream was to run a big venture related to it. But that would only happen when he would have taken care of his expenses each month because starting something of your own is a big risk. Which meant he had to handle rent, bills to pay, monthly expenses to incur at home etc. etc. So he defined his threshold point and it was to own a home and also have sufficient savings to pay his regular bills.

Threshold point – A home and 60 lakhs corpus to get a regular inflated adjusted monthly income of Rs. 35,000 per month to start with

Prior to defining his threshold point, Ramanna was just a regular employee, but the moment he defined it, his mind started actively focusing on it. The song of “I want to achieve my threshold point” was playing constantly in his head!. He was aware that he wouldn’t reach his threshold point very soon, and it would take at-least 10 years to get there. But now he was more focused and targeted.

He was sure if he could travel to the U.S. and work abroad for a few years, reaching his target would be a cinch. From that day, he became a superman at his workplace. His commitment level at work increased because he expected to be moved to the U.S. office on the strength of his performance. He also explored other options to move abroad for a few years. Within the next 2-3 years, he saved money and also managed to get an offer to move to the U.S. office due to his exceptional performance at work. This was 2001.

However, his savings were at that point not sufficient to make a down payment on his house. Undeterred, he moved to US, worked for a year, saved obsessively, and returned to India just to make a down-payment and apply for substantial loan. He took the risk, because getting to the threshold point was his obsession by now. There was no other option, he wanted it any cost.

Over the next 8 years, he earned enough money, saved enough money, lived frugally, constantly worked towards his threshold point. He made sure to communicate about his future vision and goals to her better half when we was getting married. He made sure he didn’t do anything stupid which would open new streams of expenses in his life, which will make it difficult to stick to his plans of leaving the job and starting something of his own. So at the end of 10 yrs, he had 2 houses in Pune, one without any loan and the other with a small outstanding loan (thanks to dollars he earned and powerful savings).

He came back to Pune, sold one house (which fetched him more money) and kept it all into a Fixed Deposit with quarterly interest option and the other house was for self-consumption. He is now free of debt, has no rent to pay and his interest income takes care of his expenses.

He had arrived!

What is your Threshold Point ? Have you ever thought about it ?

If you are low on net worthh or you are a new investor, instead of setting huge financial goals, start to play for your threshold point. This will reduce your stress levels and will help you to enjoy the process of wealth creation. When we do financial planning for some of our clients, a lot of times we avoid giving a very long term plan to them, because we know the plan will sound unrealistic.

A plan has to be realistic for any investor to own it. Then we help them define their threshold point and help them plan for that. We tell them, go achieve that threshold point first and then think ahead. Don’t waste your time and energy in worrying about future for now. The same way, you need to think of your threshold point.

I want you to tell me in comments section about it. Write down and declare your threshold point and if possible your plan to get there! I am waiting to hear back.

August 26, 2013

August 26, 2013

Hi Manish,

I have started reading ur articles from last 1 week .Every time I complete it I am starting to reanalyse my own situation.

My current status-

Status : married women, one kid,both husband and wife working

Wife Age : 31 Husband Age -35

FD : 20 lakhs

PPF :1.5 lakhs

epf-13 L

Shares from Company -3 L

Home Loan : 15 L outsatanding (1st home)

commitment -20 L in next 2 years (for second home which is work in progress)

Monthly Expense : 45,000 p.m (Including Insurance premimum)

Term Plan-90 L

Health cover -6 L from employer

Monthly Income : 1.50 lakhs per month

Bonus per year-3 L minimum

My first Thershold was to put 20 L in FD by 2013 dec so that we can have some monthly income and to increase the financial security in my self which I achived after sacrificing 1 vacation and buying gold jwellery which I feel is not an investment.

My 2nd Threshold is to close existing homeloan and clear 2nd house commitment by 2015 DEC.This I have put by taking consideration of 7% hike in salery year on.

Am I on right track ?

Super article ManishJi.

This is indeed a practical point.

Thanks

Very good article…! Realistic approach…

My motivated threshold – to clear off my new home loan; and giving myself 4 yrs to do that…!

Thanks for sharing that 🙂

Very nice post on how to manage goals realistically while minimizing stress. Taking things on in manageable bites is the only way to go. Thanks for the post and the examples.

Welcome Steven 🙂

Hi Manish,

I am new to your blogs. I have gone through few of your articles and this article is as good as other.

I would request you to come up with a article on retirement(early), as I find few people(including myself ) who are in their late thirties want to have a early retirement. The article should have answers for how and when from finance perspective.

Thanks

Deb

What exactly you want to know about it ? I would suggest reading my 2nd book . there is a chapter on this aspect – https://bitly.com/Financial-planner-book

Very Nice Article .

My Dear Indians you should be Happy that although our Govt is not capable of providing basic education and quality teaching faculty to us . But such valuable lessons are spread and taught by Manish Chauhan and Nandish Desai really I must say Such People Are The Salt Of The Earth. Keep it Up.

Padhega India, Tabhi Toh Badhega India.

Thanks Radhe.Thanks for making us feel proud of our work.I shared your comment on my facebook wall. We all have to help each other to grow and should not depend on government

nandish

Thanks Radhe !

i know the ‘it depends-factors” like appreciation, locality, returns etc play a part but prima facie is it worth it?

– avinash

yes, its worth

thanks a lot manish, that really helped.

now knowing so much about me 😛 , please name one book of yours which u recommend for me.. would like to buy and read it..

thanks again…keep up the great work…

– avinash

Buy our 3rd book – https://bitly.com/financial-freedom-book , written by Nandish . However I suggest get all 3 🙂

ha ha, first 3rd then the rest… but can u pls suggest if i can a digital copy instead of a hard one..

No digital copy !

🙁 *sad face* .. anyway bought the 3rd book in flipkart.. ll read once back in india in a month… thanks a ton for the discussion…

cheers

avinash

Now that you have ordered the book, the publishers came up with e-book version of all 3 books of jagoinvestor.

hey manish,

i have been reading ur posts for a longgggg time now and this is my first comment.. ur blog has been really really motivating for ppl like me. keep writing and all the best.

well i put my situation below and frankly confused about my investment options.

Status : married, one kid.

Age : 29

Liquid Cash : 2 lakhs

RDs : 6000 p.m

SIP : 2000 p.m

Home Loan : Cleared

Monthly Income : 1.75 lakhs per month

Monthly Expense : 80,000 p.m

No outstanding Loans

No Insurances or medical cover (yeah, its bad.. will open one soon) 🙂

the thing am confused what next…like second house or complete MF-SIP retirement saving etc.. can u suggest…i know its a vague question but still …

I can suggest you that, but I would say Its your choice . I mean you have to define it for yourself, not me .

If i were at your place. The threshold point I would choose is “Passive income equal to my expenses”

Manish

firstly thanks for taking time to reply.

yup, expected this answer…

u r suggesting me the magical “financial freedom” .. looked into tat as well but got lost admist blogs/suggestions/jargons..

to generate 80k passive incomes sounds a long shot atleast to my limited fin.literacy… can u suggest a few ways like MF, debt & real estate numbers.

if its getting too specific then pls let me know how do i contact you in person..it would be great if u could accept me as ur client even if its with a fee.. 🙂

thanks manish

Think like this

To generate 80k per month , it might take years and years because it means generating 1 crore+ . And if you want this 80k inflated linked, then 2 crores.

Now that again is kind of scary ! and look like you can achieve it only in next 15-20 yrs . So the purpose of Threshold point is destroyed. What about saying – My basic expenses are only 30k per month , so lets look at generating 30k per month first and then more of it later.

So then the goal is to generate 40 lacs corpus . Now instead of me telling you . You tell me how long you can take to generate 40 lacs in corpus ? if you look at 5 yrs plan , it means 8 lacs per year saving and 70k per month saving . Looking at your numbers, seems to be within limits ?

tell me

Manish

ahh, a simpler perspective was all i needed. 🙂

sounds well within limits even @9% returns.. “My basic expenses are only 30k per month , so lets look at generating 30k per month first and then more of it later.” – this is my catch… ..ll juggle the numbers and find out…

one last query, is buying a second house just for investment purpose worth it ? i the ‘it depends’ factors like appreciation, locality, returns etc but prima facie is it worth it?

Definately its worth it , because its leveraged 🙂 .

So you can put in 10 lacs, take 15 lacs loan and take a house in suburbs which might do well in next 5 yrs and might give you back a good handsome amount.

But it will call for risk and the ability to have surplus to put extra EMI . If you are free from loan, I think its one of the things you can try to get aggresive ! . But then its your call , and you need to act like a very sharp and professional investor who might need to put hard work and lots of time in selecting the property.

Manish

Hi Manish, Nandish

Could you please help to understand BSLI Future Guard Plan term insurance plan?

What is mean by “The BSLI Future Guard plan is a term plan with complete return of premiums to help ensure your family’s security while not losing your capital.”

Is it first term insurance which returns premium paid on survival.? If so then why to go for other term insurance? As if we provide correct medical information then there are less chances to rejection; and BSLI has claim settlement ratio 90.9%. I think this is term insurance cum life insurance plan. But as i have very limited knowledge than you expertise there might be any hidden clause or conditions that I might be ignoring. Your answer could help all readers to know more about this term insuranc so we can choose really beneficial plan.

Thanks,

Parag

Dont take it. This article explains the logic of return of premium term plan – http://jagoinvestor.dev.diginnovators.site/2009/04/return-of-premium-term-insurance-is-it.html

I am a 37yr old housewife and a mother of 2 young daughters. I am an aspiring personal financial advisor so I read up a lot of websites as and when I get time from my busy routine. Your advise is so unbaised and helpful, like a parent giving advise to his own child. I am so impressed. Complete with living people’s example ….

I am yearning for a mentor who takes me under his wings and we then help more and more people attain the much needed financial literacy.

Respect and Salute!

Hey payal it is extremely important to identify your mentor and put a request to get mentored. I am not sure whether you are aware about our advisor website http://www.jagoadvisor.com or not, it is a blog on which we share about our business actions with a huge tribe of advisors. My invitation to you is be on jagoadvisor and sink in the content. We are very soon coming up with our first book on practice building for advisors.

wish you all the best

nandish

Great sharing! I believe everyone must have a TP in mind even without a Financial plan in place. Thanks, NK Vijayvargiya

Yes. Thanks for sharing your thoughts

Dear Manish

Thank you for your good practical article. It is very easy to understand and can apply in our life to get the good result.

Yea . Thats the beauty of this concept !

Dear Manish,

A experienced general fights a battle many times in his head before the actual battle on the field. I am glad that you are touching upon mental aspects of having a good financial life. Its great to see you coming up with articles helping people have a holistic approach.

Joel

Thanks Joel 🙂 . I will keep coming up more of these

Hi Manish,

Very nice article, thank you!

Welcome Ram !

Hi Manish

I am a big fan of you and your articles which have proved very useful for me. As soon as i login into my system I make it a point to read these articles first and then proceed with my day to day work and i have suggested my frends to register themselves to receive these news letters from Jago investor

Comming to the point i am in some sort of dileama on how i should plan for my financial life

I a 30 years old married and work for a huge IT company. My income is approx 32K pm My wife is also working and earns around 8K. I have purchased a plot in Bangalore and have a loan for 13 lakhs with 13K as EMI. . I want to square off the loan in about 2 years time and move on to buy a next property or construct a house and also maintain the family for which i have to save lot of money (atleast 30 to 40 lakhs after squaring off the loan) but in the present scenario i am unable to save even a single pie as I have to pay for my LIC premiums (8K quarterly) house rent and manage other montly expenses which is very expensive in Bangalore.At times i do think whether i had made a mistake by trying to take a huge leap in making a decision to buy a property in Bangalore because of which i am struggling at the moment and should have gone for it after having enough money in hand but now i do not really have an option to back out from it as well as i would end up making my financial life bad to worse

Please advise me on this

Control outflow :

Start with ” …..LIC premiums (8K quarterly) … ” Do away with that first. Switch to a term insurance plan.

Increase inflow :

Switch job

Nice ! .. thats the good start !

The immediate one thing I can tell you is relook at your LIC policy. I am not saying that from returns point of view, but from increasing your cashflow point of view. Also your first threshold point should be to get rid of the LOAN i guess. Is that in your mind ?

Manish

Yes certainly that is my first target because once i clear it off i get a leverage of 13K pm which i can invest somewhere else and also i will have a property in Bangalore which I expect to give a great return in a span of 3 years from now

Nice !

Dear Manish

You have stuck the right cord with this article..very informative

Yea . 🙂

Hi Manish,

I am reading your blogs since last 6 months very silently, as my friend suggested me to read this blog during our tax saving discussion.

Before that, for me “investment” is like Science book to Arts student, your blog truly help me and make me serious about money and aware about future responsibility.

But what I miss here is – suggestions for investors types are below

Who don’t know how to file return but they are newly came under taxable income slab

Who recently married and enjoyed marriage life for first 1-2 year and now having baby but don’t know what is future plan for new arrival like education/insurance

Who don’t know which is the best tax saving instruments? With income of 3.3 lacks only

Who never saved any money or amount till time of after 4 year job (possible that salary may be low)

Who invested in insurance only by friend’s advice and fulfill their goals

Small town investors having salary slabs like – 8000, 12000, 17000, 21000 par month

Please write something for them also

I am agree with Vivek….Manish you should write…

Hi Vivek

Then I must say you have not read all the articles of this blog . Explore all the articles, and you will surely get all answers. Or take help of our forum to ask questions – http://jagoinvestor.dev.diginnovators.site/forum/

As always, a splendidly insightful article. I want to buy a house, own a car, and have a surplus 15L. I have been worried as hell about how to go about it. But I will plan things with focus on short term threshold points.

Again thanks for these splendid articles.

Excellent Vivek.Extremely happy to see the insights you gained from the post.

nandish

Dear Nandish,

Your name is linked to the wrong address kagoinvestor.com rather than jagoinvestor.com. Just found this.

FIXED

Very good post. A good point for people to think about. I think many peoples threshold point should be the present. Forget future goals. Are you ready to face sudden big ticket expenses (due to good or bad reasons) TODAY?

Among the three stories listed, Ajay’s story makes no sense to me.

Thanks pattu for your view. This concept has really worked with a lot of our clients so far and I think it is one of the most practical approach our of all.It is extremely important to eliminate future and be in present.

nandish

Hi Nandish, I don’t disgaree with the concept. My point is individuals should first secure their present before even thinking of any kind of investment. So a secure present is the first the threshold point.

Absolutely pattu. Securing present has to be on the top.

nandish

Hi Manish,

Nice article and really helps to target/achieve/celebrate the threshold point. I am working towards zero debt (home loan emi) and hope to achieve that in next 5 years.

Regards

Vijay

Very clear Vijay ! . Thats what you need to have a good threshold. I would say WRITE DOWN your action points .