How you become a loser when you pay in black for your real estate property ?

Naresh recently visited a new residential project in Pune which was ready for possession. The property cost was in his budget and he was about to finalize the deal. The total cost of property was around Rs 40 lacs. Stamp duty and Registration cost was to be paid separately which would take total cost to around 43 lacs. This was a bit heavy on Naresh pocket, so out of his regular habit, he inquired if there is any trick by which he can save some money on the deal ?

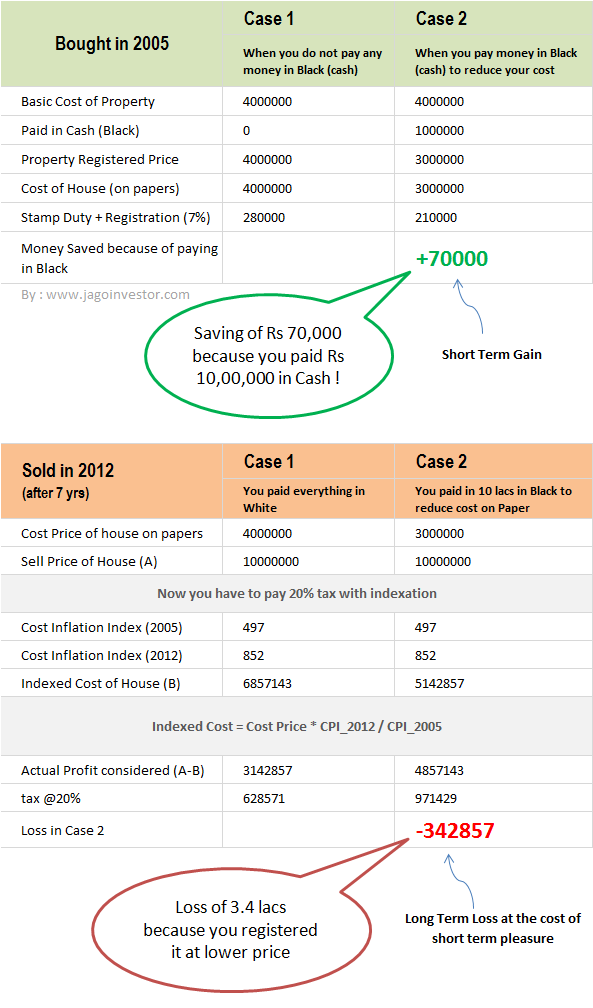

The builder was quick to give him a great saving advice – “Sir , You have to pay 6% stamp duty and 1% registration cost on the agreement price. Which comes to 7% of 40 lacs, thats 2.8 lacs additional, thats the reason the total cost comes around 43 lacs . Now if you want to save money, what you can do is pay some part of the deal in cash to us (means pay in black) and we will reduce the agreement cost by that much, that way – we will also save our tax on the black money part and you will save 7% on that cash amount. Like if you pay us Rs 10 lacs in Cash, then we will make the agreement for Rs 30 lacs only and you will have to pay stamp duty and registration cost on only 30 lacs which will be 2.1 lacs, and it will save you Rs 70,000 without doing anything extra ! . Cool na ! .”

The offer was tempting and Naresh fell for it, how cool is saving Rs 70,000 , all you need to do is pay some part in cash and lower the agreement amount in records. But do you understand, what is your loss in long term because of this kind of deal ? Let me break some hearts today, who have already done this mistake while buying their properties.

Stamp duty and Registration Costs

First understand that stamp duty and registration costs vary from one state to other state. For example – In Maharashtra, its 6% + 1% = 7% in total , so whatever is your total agreement cost , you will have to bear additional 7% on that amount as stamp duty + registration costs. Given the huge amount involved and the financial crunch every buyer faces at the last moment of the deal and hunger of builders to save every bit of tax, makes sure that buyers fall for this trick of paying huge amount in CASH (black money) and register the property at lower price just for few thousands (actually sizable if you look at it). This looks like win-win situation to buyers and they are pretty happy about it, however truly speaking, this is a loosing deal for the buyers in a very long run (if you are going to sell the property later) and only benefits the builders and let me now explain you why is it so ?

At the time of selling – The cost of house matters

I hope you are very clear that when you sell your property in future , you pay the tax on the profits made. And the profit is decided by your COST of the house and the sell price. So lower the cost of your house, the higher the profits on paper for you in future. You might be aware of the fact that indexation is applied in case of real estate transactions and 20% tax is paid on the profit.

Now lets take this same example we are discussing and see how much you save at the time of purchase and how much you loose at the time of selling , which can be in distant future. See the working below and try to understand the whole situation

In the example above you can clearly see that by paying Rs 10 lacs in cash, a person is able to save Rs 70,000 instantly. However they are not able to look beyond the obvious and visualize the kind of loss they will incur in future when they decide to sell the property. The same person will pay 3.4 lacs of additional tax in future because he/she paid Rs 10 lacs in cash years back.

Now there are few points which can be debated here like there can be changes in laws in future, or one can save the tax by investing in another real estate properties (which again depends on future laws) , but the point here is to educate you on the long term implications of this. Now if you fully understand the message of this post, you can take your decisions with full responsibility.

Whats your take on this ?

June 6, 2013

June 6, 2013

HI, GOOD INFORMATION.

I JUST WANT TO KNOW ABOUT NET PROFIT IN THESE BOTH CASES. IF YOU SEE IT IN TERM OF NET PROFIT, CASE 2 IS PROVIDING MORE PROFIT AS COMPARED TO CASE 1, PLEASE CORRECT ME IF I AM WRONG.

That will depend on case to case basis .. but overall I would say option in which you dont pay black money is more profitable for you (but in future)

Manish

Hi Manish,

Can I complain about a builder somewhere they are taking black money? If yes then what will happen with the person who bought the property?

Both will be punished for the same or not?

Thanks!

Muksh

The moment its in open that there was a black transactions, now its WHITE 🙂 .. So there will be investigation and tax will have to be paid. In blank only the exchange is made in CASH .. that’s just a medium of exchange.. One can also pay in cash and have everything documented and tax can be paid.

So its not CASH, but hiding of cash which is the issue.

The tax will have to be paid by builder .. and the payer also have to give a proof that tax has been paid by him on the money

Manish

Hi Manish

1. Recently I sold an apartment and I would like to invest the capital gains.

2. I have a sale deed being done from a builder from whom I am buying an apartment under construction. I had the sale agreement for about 55 lacs and the builder wants to show the sale deed for about 30 lacs as per guidance value. The total cost in sale agreement is given in white only. .

Will my capital gains tax be calculated by taking the sale deed value or the sale agreement value only??

3. Also if this new property is being sold after 5 yrs what will be taken as the cost of purchasing– is it sale deed value or sale agreement value of item 2.

Thanks

It will be taken as per SALE DEED, because sale deed is the proof of purchase.

Sale agreement is just a PROMISE to SELL , does not mean much !

sir, it is my suggestion that govt should reduce stamp duty instead of circle rate

Manish following you for quite some time. Doubts regarding the article 1 What if reselling the property at again lesser than 1 crore price to repeat buying cycle while selling 2. EMI initially is on interest portion then max deduction is of 2 lakh under 80ee, increase in buying cost increase in interest portion beyond 2 lakh exemption limit which is loss what your take on this?

Hi MayankUpadhayay

I am not clear on what is your question. Please repeat it with more clarity

Manish

Jantri value in some states does not reflect the true cost of property. It usually is much lower than it’s real value.

Is it wise to force the seller to transact only in ‘white’ money even if the cost of property goes above the Jantri value?

No one can force anyone for anything.

Sir, Please guide. As its the matter of My whole life ka kamai.

What precautions should I take while paying Black Money to the builder, as I wont be having any proof of the black money paid.

Thanks

There cant be any proof of black money, you will give it in cash and thats all . But dont worry, there should not be any issues as such for real estate transaction!

Thanks a lot sir for your quick response.

The Building is ready to stay. and builder said they are waiting for the OC which they said will come any time in couple of weeks time. He said to give booking cheque of 1 Lack which he will only deposit after obtaining OC and before increasing the ‘After OC Rate’! my worry is he is not depositing the token/booking cheque now & asking to pay blk cash.

Is thr some way where I can have proof of the money I gave in any way? Please help.

Thanks

Sanjay

You cant have proof. Because if there is proof, then its not black, and builder wants it in black. Black money means money which does not have record

Manish

Hello,

Having a flat of 500L worth market value / regd value. I wanted to sell that flat but the highest value I am offered is only 400L because the building is 75yrs old and damaged.

So what to do now, will I have to pay tax in the difference value or on the amount of 400L only.If so paid will it lead to problems in future.

You need to pay tax only on your profit part !

Manish,

What to do when the builder is not ready to accept cheques for the full amount of the property and not ready to make sale deed to the full amount of deal.

You cant do much other than not dealing with him.

But it is the practice in Gujarat. 50-50, white and black. Is there any law enforcement or anything that can better of the situation.

I am not sure !

Dear Manish Chauhan ,

I have question , hope i will get your expert advice please ..

1. Can buyer do register conveyance deed of a plot at more price than the circle rate prescribed in govt books ?

2. Suppose the circle rate is 1000 rs per meter and the market rate is 3000 rs per square meter ,can the seller accepts the market rate i.e 3000 rs per square meter in their capital gains account by cheque or demand draft as white money ?

3. Can you please share the details related to this property law online ?

with warm regards

Ms. Sumita

[email protected]

I am not sure of the answers here !

pls consult with your expert circle , waiting for your reply , thanks .

the stamp duty paid should also be included in the cost of the house.

But it does not work that way !

What is the minimum token amount required for a buyer to pay while buying a house in Mumbai. have heard that a token amount of minimum 20% should be paid or else the MOU is considered fake. This is done to save innocent sellers from big fraud builders to stuck someones property.. Is that true???

Please help

I dont have an idea on this, But yes the token amount would be a good % like 15-20% atleast !

Hi Manish,

If am buying a flat in Maharashtra and the total cost of the flat is 65,50000/-. Here i have two options –

1. I do registration on total cost of 65,50000. in this case i will also have to pay TDS which is 1%. So now i will have to pay 8% on total cost (6% stamp-duty + 1 Registration and + 1% TDS) = I will have to pay 524000

2. I do registration on below then 50 lacs, suppose 4950,000 and i pay 16,00,000 in case. So i will have to pay just 7% which is = 3,46500

I just wanted to know weather is doing right or wrong in this case?

Also while selling my flat in future can i also demand for cash amount so that i can save on profit tax?

kindly advise!

You can do that if you want, but it cant be lower than the govt ready reckoner rates ..

Is there any discount on stamp duty on resale flat

no

Hi Manish,

Your blogs are very helpful. I have a concern to discuss.

I understand as per the law a builder is not suppose to charge for the parking. But is there any work around. I have recently invested under cons.. and builder has demanded 6L in cash for parking. Though its illegal every builder easily manages to shell the out this money from every owner.

Will filing a legal complaint help when there is no proof of builder demanding such amount. OR at the time of registration can I fight legally that I should be allotted parking for free. In this case builder will easily get away telling the govt that the parking was allotted on lottery basis and every builder ensures to keep the parking slots a little less than the number of flats.

Kindly share your opinion

UNless you have any proof, how will you fight for this ? Also if the builder was not going to charge for it, then he must have raised the prices of hte flat itself.

Hi Manish

I purchased a flat in pune and registration have been done . took possession also and from last 6 months am staying in the flat

facing so many problems like no PMC water,security etc…

but did’t pay the black money to builder yet and given the 3 cheques for the same.

now he asking me that will deposit the cheque.

Am ready to pay the amount but once he clear all the problems then only…

please suggest what should I do now if he deposit the cheque in bank…

You cant do much if he deposits, because if you have issued the cheque, it means you have paid him.

I have bought under constructed flat in Pune. Price of is 35 lakhs including Service tax, VAT, agreement etc.

now builder has asked me for 2.5 lakhs in cash for parking space and mseb. i have already paid 1.35 Lakhs to him.

should i really give him remaining amount? what he can do if i not paid remaining amont? i have not got possession yet?

what are govt. rules? is everyone paying cash to builder?

is it compulsory for any builder to provide parking space for every flat owner.

As per supreme court , builder cant charge for the parking space seperately ..

Sir,

I Want to buy an open plot. The circle rate is Rs 1000/Sq,Yd. However, the market price is 4000/SqYd approx.

Can I do the registration at the market price itself (the actual amount I will pay) or is there any restriction that I have do the registration as per Circle Rate?

THe rule is that the registration has to be done on atleast circle rate

Dear Sir , i have one more question regarding similar case , A 200 square yards plot having circle rate is 12000/- per square yard (in sale deed) and the current market value is 30,000/- per square yard

I want to sale it in white money only , can i accept whole amount 60 lac rs in white (via cheque/dd/payorder) in my capital gain account ? and is the buyer has to do sale deed registration at the circle rate i.e( 12000/- per square yard or the amount he paid i.e 60 lacs ? pls clarify , thanks in advance ! from Shivani Thakur .

Its better to talk to a real estate consultant on this

the registry amount can be received in parts like cash + Cheque — 50-50%. pls suggest

Hi Hitesh

Your cases is a bit complex and I think we are not the right people to comment on it.

My suggestion would be hire someone who is professional in this area and consult them

Manish

kindly help me all..

In solving my family and site problems, I have agreed to sell my site for 18.00 laks,but the cirlce rates is 22.00 laks. The buyer will register at circle rates and pay me all white money, after registartion , the difference amount of 4.00 laks (22 – 18) is to be returned.. How should i take the money and how should i return the difference amount (thro cash or dd).

Should i take in writing for the return of money for tax purpose.. have i done a mistake. will i face any taxman problems. Kindly tell me implications of taxation. Fully confused. correct me..

If 22 lacs comes to your account, then it will be your income, I suggest you do it via cheque

true sir.. but i am supposed to return the difference amount of 4 laks .. should i pay the buyer by cash or cheque. should i taken any proof for filing tax purpose.

Pay by Cheque