The Biggest and Most Detailed Guide on – Income Tax Return Filing FAQ’s (ITR)

Do you have some doubt on Income Tax Return Filing Process or some question whose answer you are not getting anywhere? This post might be the end of your struggle.

Few weeks back, we ran a survey and asked investors to send us their queries and doubts on Income Tax Return Filing, whatever it may be. We then picked up some of the most asked and common doubts which investors face and thought of creating this comprehensive guide which will act like the bible to your ITR related queries.

Nobody in this world likes the annual exercise of filing Income Tax Return. Yet due to legal responsibility, everybody has to file his Income Tax Return. Now before understanding the Income Tax Return filing, let’s understand few common things first, which will help you to resolve your queries on ITR.

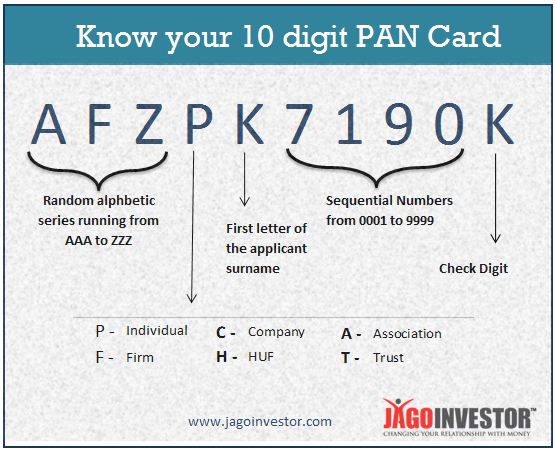

1. Permanent Account Number (PAN)

Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department, to any “person” who applies for it or to whom the department allots the number without an application. PAN enables the department to link all transactions of the “person” with the department.

These transactions include tax payments, TDS/TCS credits, returns of Income/wealth/gift/FBT, specified transactions, correspondence, and so on. PAN, thus, acts as an identifier for the “person” with the tax department.

A typical PAN is AFZPK7190K

First three characters i.e. “AFZ” in the above PAN are alphabetic series running from AAA to ZZZ

Fourth character of PAN i.e. “P” in the above PAN represents the status of the PAN holder.

- “P” stands for Individual,

- “F” stands for Firm,

- “C” stands for Company,

- “H” stands for HUF,

- “A” stands for AOP, “T” stands for TRUST etc.

Fifth character i.e. “K” in the above PAN represents first character of the PAN holder’s last name/surname.

Next four characters i.e. “7190” in the above PAN are sequential number running from 0001 to 9999.

Last character i.e. “K” in the above PAN is an alphabetic check digit. (More Details on PAN)

2. Tax Deduction Account Number (TAN)

TAN or Tax Deduction and Collection Account Number is a 10 digit alpha numeric number required to be obtained by all persons who are responsible for deducting or collecting tax. It is compulsory to quote TAN in TDS/TCS return (including any e-TDS/TCS return), any TDS/TCS payment challan and TDS/TCS certificates. (More Details on TAN)

3. Financial Year

In India, the Financial Year is defined as a period starting from 1st April of a Calendar Year & ending on 31st March of the next immediate Calendar year. All the income earned by a tax assessee has to be accounted for segregation on the basis of dates in different Financial Years.

4. Assessment Year

The applicable Assessment Year for a given Financial Year is the next +1 year. For example, if a FY is 2012-2013, the relevant AY ‘ll be 2013-2014. All the income earned by you in a FY and taxes paid by you in that FY ‘ll be assessed only in the relevant AY.

5. Form-16

It’s the statement of your yearly income provided by your employer to you after the end of FY. This includes your gross income, deductions claimed by you, net income, tax liability there on, Tax deducted by your employer, any tax liability or refund.

The most important thing to be remember in form 16 is the TAN of your employer should be written clearly & so do your own PAN.

6. Form-16A

Form 16 is issued by the Tax deducting authority where the TDS is applied on your investments (say FD in banks) or non salary cases. Say TDS applied by tenant against rent paid to landlord. Here again TAN & PAN quotation is must.

7. Types of Income

As per Income Tax Act 1961, the income can be classified only under the following heads.

1. Income From Salary or Pension

2. Income from House Property – Rental Income

3. Income from Business or Profession – Say Income to a Doctor or an Agent or Advocate or a Shopkeeper

4. Income from Capital Gains – Income arising out of sell of capital assets like Property, Gold, Art, Coins, Mutual Fund Units, Equity, Precious stones

5. Income from other sources – Any income which can not be classified in the previous 4 categories, comes under this head. Interest income, winning amount in Lottery or Quiz show (example KBC), Horse racing winning, Amount received as Gift from non relatives are some examples.

Now from the above list you can identify that you are having at least 2-3 income sources. Income Tax Deptt. has created different types of Income Tax Return Forms for the combination of different income sources.

Before Discussing Income Tax Return Forms, let’s discuss Income Tax Return itself.

8. What is the importance of Income Tax Return

If your income exceeds the zero tax limits, it’s mandatory for you to file an Income Tax return. During your income earning in the whole FY, there may be a situation that the tax deducted from you is more than the actual liability or there are some losses or deductions which you could not claim during the income earning phase or you paid less tax than the actual liability.

In all such case, you can only save yourself by filing an Income Tax Return. Actually your Income Tax Return form is the account statement of your income, tax liability there on & the tax paid by you. If there is excess tax payment, you ‘ll get refund. If the paid tax is less than your tax liability you w’d have to pay the difference amount.

Below is the official version for Income Tax Return filing essentially.

“The filing of income tax/wealth-tax return is a legal obligation of every person whose total income and wealth tax during the previous year exceeds the maximum amount which is not chargeable to income tax or wealth tax under the provisions of I.T.

Act, 1961 or Wealth Tax Act 1957, as the case may be. The return should be furnished in the prescribed form on or before the due date(s). Penalty of Rs. 5000 is imposable for non-filing of return within the assessment year.

Interest is also chargeable for non-filing or late filing.”

Watch this video to know why you should file income tax return:

9. Types of Income Tax Assessees

As there are multiple source & types of Income, so are types of Income Tax Assessees. Here are few examples –

- Individual

- Hindu Undivided Family

- Firm

- Limited Liability Partnership

- Association of Persons

- Company

- Trust

- Body of Individuals

- Artificial Judicial Person

- Local Authority

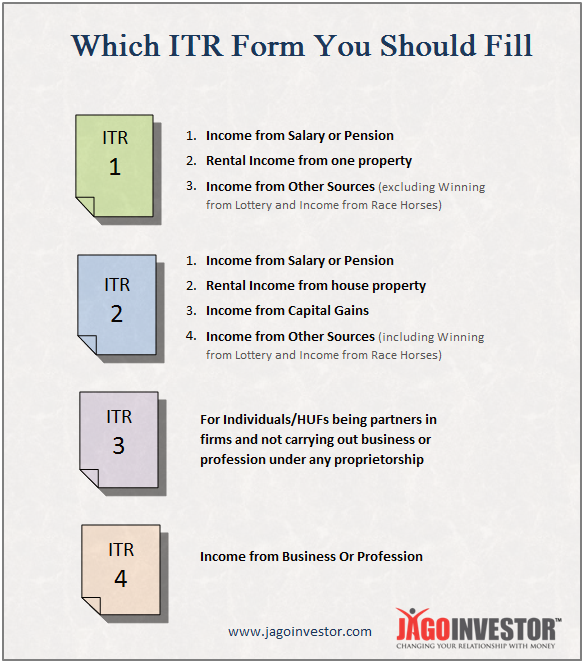

10. Types of Income Tax Return Forms

On the basis of the income combinations as well as Assessee types as discussed above, the Income Tax Deptt. has issued multiple Income Tax Return forms. these are numbered as ITR-1, ITR-2 ……. ITR-7.

Here is a table to understand the combinations of types Incomes for Individual Assesses & the applicable ITR form. Please do note, ITR-5, ITR-6 & ITR-7 are used by assesses other than Individuals & HUFs, hence not discussed here to keep this matter relevant for general public & common Individual assessee.

Majority of common individual tax payers fall in ITR-1 & ITR-2 category.

11. Online & Offline filing of Income Tax Return

The Income Tax Department is slowly transforming itself. Earlier all the returns were only offline mode. First non Individual & non HUF ITRs were made online filing compulsory. After that for Individuals & HUFs having income more than 10L Rs. were made online filing compulsory.

Now From AY 2013-2014, the income limit has been reduced to 5L Rs. for online filing. So we can safely assume that from next AY i.e. 2014-2015, the online return filing ‘ll be compulsory for each & every tax payer.

12. How to file online ITR

It’s quite easy. Now a days, a person can e-file either self by logging into the official site of e-filing. Apart from this, there are many other private online portals who are helping you to e-file your ITR. (Taxsmile, Taxspanner, Taxyogi, Cleartax are few examples)

Frequency asked doubts on Income Tax Return Filing

We hope that you are very clear about the basic information which every tax payer should be aware about. Now lets see some of the most commonly asked questions on Tax Filing. We collected these questions from one of our surveys and just categorized them into 13 questions. Here are they –

1. I forget (or could not produce in time) to claim HRA/Savings/Home Loan/LTC/Medical Bills etc from my employer. What to do?

Please relax. For all such cases, where either you could not claim on time or forget all together, your return filing is the time to tell the Income Tax department about the same & now you can claim the refund for the excess tax deducted from you. Note that the declaration given to employer is just to make sure that your TDS cut by employer is inline with your plans in a financial year. Incase something does not match, It can be finally done at the time of tax returns filing.

2. Where should I produce Bills/papers/receipts of the things related to Q. 1 above

Please do note that current ITR forms are ‘annexure less’ forms. Which means, that you need not produce any support documents to the Income Tax Department at the time of filing. Just keep the documents safely with you, so that you can produce the same if Income Tax people demand it from you in future. Documentation should be surely done by you, because incase there is a scrutiny case in future, you should have to documentary evidence.

3. I could not file my previous years income tax return on time or forget it .

It happens ! . There are penalty provisions if you do not file your due Income Tax Return on time. To correct the mistake, please file a delayed return now if you have not filed the previous years return. For ITRs related to previous years, please take help of a Tax professional to do the same. Filing late is better than not filing at all. Just contact a CA or tax filing portals, and they will be able to help you. Read this article on Late Tax Filing for clarity

4. I did not get the refund order/cheque . What to do ?

First check your refund status here. In case your refund status is available as cheque issued & the same is not received by you. Please contact at the E-mail or Phone nos. in the shared link. Also you read this article on how to Check your Income tax refund status online & Learn how to use RTI

5. I received the Refund cheque but I misplaced it/delivered at wrong address/wrong bank account number.

A lot of these issues happens because the address you provided at the time of filing returns years back is not the same where you are residing now, and the cheque goes back. For all such cases, you should contact your Jurisdictional Assessing Officer for offline filed ITR or CPC Bangalore for online filed ITRs. For online filed ITR, there is a link within your login window for Refund Reissue Request, use this for refund reissue.

6. How can I calculate my tax liability arising out of capital gains

Relax. You just need to punch in the required data in the excel sheet for ITR e-filing available at the e-filing portal. The sheet ‘ll calculate your tax liability on it’s own. Or you can refer to this article which will guide you on how to calculate capital gains.

7. How can I pay my due taxes as per calculation done by me or ITR excel sheet

Paying your due taxes is very easy. There are 2 ways to it. a) Use your net-banking account . b) Use the Official Portal . Please do note for self payment of Income tax, the applicable challan number is 280.

8. I fall in 20-30% tax slab. Bank deducted TDS @ 10%. Should I pay more Tax

The answer is yes. Bank has merely done it’s legal responsibility. Your Tax liability is more than the work done by bank. So please calculate your actual tax liability by adding the interest income into your gross income & pay your due taxes. Here is a full article on TDS related issues.

9. I forget to put in some data or wrong data was put in during my original return filing. How to rectify it ?

No problem, you can file a revised return to rectify these mistakes. The revised return can be filed before the assessment year is over for your original filed return. Here one important point is that the original return must be filed within due date. Just note this point, that if you have filed your returns and if there are any issues or errors, you can always file a revised return later.

10. I own a house in the same city & reside in a rented accommodation. Can I claim HRA & Home loan benefit simultaneously ?

The answer is YES. If you are actually residing on rent due to your Job or any other issues & the home loan house is also in the same city, you can claim both HRA as well as Home Loan benefits. Read this article for more on this

11. I was earning salary earlier. But now there is no income due to break or because I have become NRI with no Indian Income. Should I still file my ITR for zero income ?

The answer is no. if you do not have income or income is within the zero tax slab, you need not file your ITR. Yes in case, some TDS was there, you w’d have to file your ITR to claim the refund of this TDS amount..

12. My wife is a home maker & investing small money into direct Equity & earning some income. Which ITR should she use ?

First of all make sure her income is under zero tax slab or more than it. In case she is earning more than zero tax slab, she should file her ITR. Now the quantity of trades done by her to earn that income ‘ll decide the applicability of ITR. In normal situations, such earning ‘ll be Capital gains (Here it’s assume that gains are short term in nature due to holding less than 1Y) & she should use ITR-2.

For a very high quantity of trading activities, the applicable form ‘ll be ITR-3.

13. I worked with 2 employers in a FY. How to handle & file my ITR ?

First of all please collect form 16 from both of your employers. Now consolidate the income from both employers & check for an pending tax to be paid. Pay it now. Once all this is over, please file your ITR.

We hope all your queries about income tax return filing is solved in this article. If not, please post your doubts over comment section.

This article is contributed by Ashal Jauhari . A key member of Jagoinvestor community and a Tax expert . He writes on his blog here

May 30, 2013

May 30, 2013

Hello Team

My father gets pension(army pension) from bank,and has not filed any income tax return yet,Where do we get form 16 at financial year end in order to file IT returns next year

Hi mitz

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

i have filed ITR 6 on 30.9.2016 and realised to enter proposed dividend

can i file revised ITR 6 ?

is there any problem we will face in future?

Hi phelegreen

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

i had sold my property for Rs.62 lacs and have used this 62 lacs to purchas a property worth of Rs.75 lacs with loan from LIC for 13 lacs during AY 15-16. Now income tax department sent a notice to me to pay tax for the above said sold property . How to reply to them. I have already filed my income tax return for said period. Kindly help me to reply to them

Hi solomon

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

I’m a homemaker & my husband purchased a house in my name & subsequently sold it in Jan 2016 attracting short term capital gains of about Rs 53000. There was a tax deduction of Rs 1.1 lacs on this transaction. My husband has taxable income but I do not. Should I file a return for claiming tax refund or should my husband include this in his return?

I think you are talking about the TDS here and not tax deduction

Manish

Yes, should I file return to claim refund or should my husband claim it

You will have to claim it

IF HUSBAND AND WIFE BOTH SALARIED AND HAVING FORM 16, INCOME TAX RETURN FILING IS MUST FOR BOTH? OR ANY ONE IS ENOUGH”

For both

I have a doubt regarding trust. How to present my computation and Form 10B in case my application is more than the sum received ???

Hi Shaily

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

Hi Manish, In section 80 TTA, I have entered Rs.823 [Interest from my Savings account] but it is not getting deducted under Chapter VI A Gross amount. I dont why it is not getting deducted?

[My Declaration – 80C Rs.150000, 80D Rs.5000 [Preventive Health Checkup], 80G Rs.1000 [Donation], 80TTA Rs.823 – Total: 156823, but It shows only 156000]

Please advise.

Hi Chandru

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

Thanks Manish 🙂

Dear Sir,

Today I was looking for information to decide the ITR form to file.

My income is only from interest on deposits & bonds. I was under impression that I must file

ITR 1. But on Internet I found that ITR-1 can not be filed if exempt income is more than Rs. 5000/- & ITR-2A

can be filed only if I have Salary Income. So, I am confused which form to file?

I started filling Form ITR-2A. But it seems filling details in Schedule OS 1d are mandatory even if income from

the heads is 0. In fact none of the heads in 1d (5BB,115A(i,ii etc) are applicable to me but Calculate Tax does

not allow to leave 1d(1,2,3,4,5) empty & I have to select heads forcibly & randomly with Income 0. This does not

look proper to me. Kindly suggest ASAP.

Can you send me a link which provides detailed information about filling or leaving different Schedules & their

sub sections.

Kindly reply ASAP.

Thanking you. Best regards, RAKESH

Hi rakesh

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

I did job earlier and enjoy tax benifit under sec 80c paid against PF and others.

Now, i resigned my job and claimed PF. My PF was settled with 10% deduction

Can i claim the refund of this 10% .

Accumulated PF is for 2 years, Amount is more than 50,000

Submitted Pan copy and 15G ( mentioned income above 3 lacks)

YOu can do that only if you are eligible for tax refund !

I opened a bank account when i started college. It has many many transaction of my expenses, college fees, allowances etc. Now i started my job and will be filling for taxes. Do i need to mention those things too. Someone told me that to start with taxes i must open a new bank account from now.

There is no reason to open a new account. You need to mention your bank account anyways, because if there are any transactions, you need to count that !

My brother’s pan card was made after april 2016, can he file income tax return for financial year 2015-16 or say assessment year 2016-17. And if he can file income tax returns for previous financial years also.

I am not sure on this. Check with a CA on this

Form 16 issued by my employer includes the salary of month of March, 2016. But, the payment of march, 2016 was made in April 2016 i.e. FY 2016-17. Can i claim a lower amount as my salary income while filing IT returns for FY 15-16 , than what is reflected on the Form 16 ?

Hi Neha

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

under section 89 it is taxable in financial year march 2016

Section 15(a) of the Income-tax Act, 1961 says, regarding income chargeable under salaries as: “any salary due from an employer or a former employer to an assessee in the previous year, whether paid or not”

This indicates that you have to show the salary for the month of March, 2016, as the income for the FY 2015-16 (AY 2016-17), whether received or not.

Thanks for your comment Wam

my friend is running a man power recruitment and supply agency.The pan card is in his name only.While registering his to obtain EPFO code number after verifying at the official website of IT department he given his name as RAJENDRAN JOE JULIAS and it was accepted.The problem is when he tried upload his pan card it was displayed at EPFO web site something is wrong with the pan card where his name appears as R JOE JULIUS RAJENDRAN.My question is how to rectify? and upload the pan card

Change the name in PAN itself .

I am salaried person with regular TDS done and for the last 8 years I have been filling ITR-1. From this year onwards I have also started trading on stocks. At the end of FY March-2016 I made a very minimal short term capital gain of Rs 300. I have not even transferred this gain to my bank account. Do I need to show this in ITR? If yes which ITR form I need to use?

Hi Anand

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Same case with me and I have researched a lot, I have small gain of Rs 825 You have to fill ITR-2

I am a home maker for 8 years. I worked in IT industry for 12 years and have a home of my own where my parents reside. I don’t collect any rent from them and neither want to. I have not filed any income tax all these 8 years. I want to invest in a single premium Annuity plan. My husband is currently working and putting the Annuity plan under his name means paying 30% of monthly annuity to Income Tax Dept. So, I want to put it in my name, I can submit PF, Gratuity, Last Salary, Super Annuation as source. We want to invest 15 lakhs (9K monthly annuity for self & spouse for life) and I need to show source additionally for 5 lakhs. Which of the following ones will be more valid and what are the supporting documents that we need? (1) Giving all Gold to my husband and getting money transferred from him (2) My husband paying rental arrears for the last few years to me on behalf of my parents?! Considering my husband’s job security factor and the fact that we have to financially support both side extended families, planning for 30% Tax for this bare minimum 9000/- monthly Annuity would be bad. Please guide us on how to take the insurance in my name with self source to avoid tax.

Truely speaking your query is too complicated for me to understand exactly what you want. Please share your query in short and be crisp please

I’m a student… I deposited my mom’s saving of Rs.5lak in FD and getting an interest of 8.5%… As I’m unemployed do I have to file income tax returns…

It does not matter if you are unemployed or employed, what matters is what income got generated by you in a year. For 5 lacs, the interest is hardly 45k or 40k in a year, so its below the taxable limit and hence no tax.

I want to claim LTA while filling tax. I am still using my maiden name in all the documents and official papers. However while booking the ticket the travel Agent used my married surname instead of my maiden name. Will it be a problem if i submit this ticket details while claiming for LTA?? Providing my marriage certificate along with the tickets, will solve the problem??

Sir, I am house wife. I own bank deposits jointly with my husband. Can I take only 50% of the interest earned on those bank deposits for computing my Income for the purpose of Tax assessment since the remaining 50% of interest goes to my husband. Please clarify me in this aspect.

No , the FD interest will be for the person who is primary holder !

Is it possible to show form 10(I) under 80DDB at time of ITR filing. right now im running out of time to produce it before my organisation for tax declaration.

Which product are you talking about ?

Sir i have created my pan card i am a student while creating i have ticked income from other sources so is there necessary to file income tax returns

NO , you need to file returns only when your income is above the limits