Direct Plan of Mutual Funds – Everything you wanted to learn about it !

A lot of buzz is going around “Direct Plan” when it comes to Mutual funds. A lot of investors still don’t understand the full impact of Direct Option and if they should invest in the same old way or with this new option. In this article – we are going to unearth all the aspects of Direct and Normal Option of investing in mutual funds.

Direct Plan in Mutual Funds – What does it mean ?

SEBI few months back announced that all the AMC’s should come out with two options for each and every mutual funds scheme they have, One will be normal one (which you have been looking till date) , And Then the other option will be DIRECT PLAN, which will have a lower expense ratio compared to the Normal Option . This is because when you invest in mutual funds direct plan, there is no intermediary involved in between and a lot of costs which are associated goes away . That’s the reason direct plan will have less expense ration. So If I have to explain in one line. Direct option of mutual funds will have no agent in between , you will be directly investing with AMC . However with the NORMAL Option, you will be investing through an agent which can be any individual or a online broker.

A mutual fund scheme will have to affix “-DIRECT” word in their scheme name. So for example now there following options for investments if you want to invest in HDFC Top 200 mutual funds.

- HDFC top 200 Growth Option

- HDFC Top 200 Growth Option – DIRECT

- HDFC top 200 Dividend Option

- HDFC Top 200 Dividend Option – DIRECT

Its a big worry for those agents who are not adding any value through their advice and have HNI/big clients.

And guess what already Direct Plans are HIT among investors and a lot of investors and big corporate investors (who invest in DEBT mutual funds) have seems to have shifted to mutual funds direct plans. This is proved by the fact that in the first month of Jan – 2013 alone, 56% of the total incremental flow of 60,732 crores in mutual funds was through direct option, which is around Rs 33,830 crore, which means that out of total Rs 100 , which was invested in mutual funds, Rs 56 came in through Direct Plan and only Rs 44 came in through Standard plan, but the majority of that would be in Debt fund, but anyways – the point if that Direct Plans are already popular and investors have started taking the advantage.

Is Direct Option Superior in Terms of Returns ?

Now lets look at the returns from Direct Plans vs Standard Plans and lets see some aspects related to it.

Expense Ratio of Direct Plans vs Standard Plans

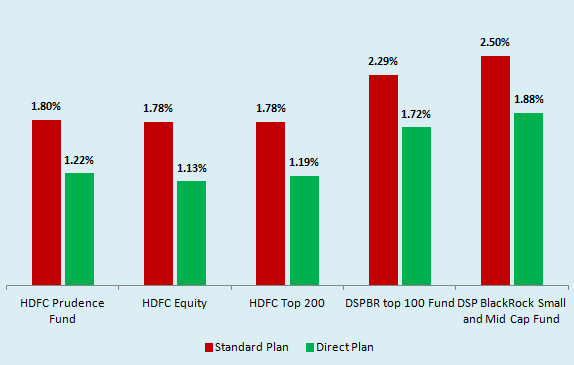

Expense ratio of a mutual fund has a deep impact on the final returns over long term. A small decrease in expense ratio can increase your long term returns by a very good margin, provided every thing else is same. Direct option of mutual funds are going to have a good enough difference when it comes to expense ratio. If you talk about equity funds, the direct plans will have anywhere from 0.40% to 0.75% less expense ratio compared to a standard plan . For example – If I have talk about HDFC Top 200 mutual fund , the standard plan has an expense ratio of 1.78% per year . Where as the Direct Plan expense ratio is only 1.19% , which is a 0.59% difference and whopping 33.15% less than standard plan , Means that you will save 33% costs when you migrate to Direct Plan of HDFC Top 200 as an example . Note that all the numbers I just quoted are as of 28th Mar 2013, and change in future. I checked few equity funds from HDFC Mutual funds and DSP Black Rock and found that that the ‘Direct’ option have lesser Expense ratio compared to their Standard Plans . Here is a snapshot for 5 funds.

Difference between Expense Ratio

Difference in NAV ?

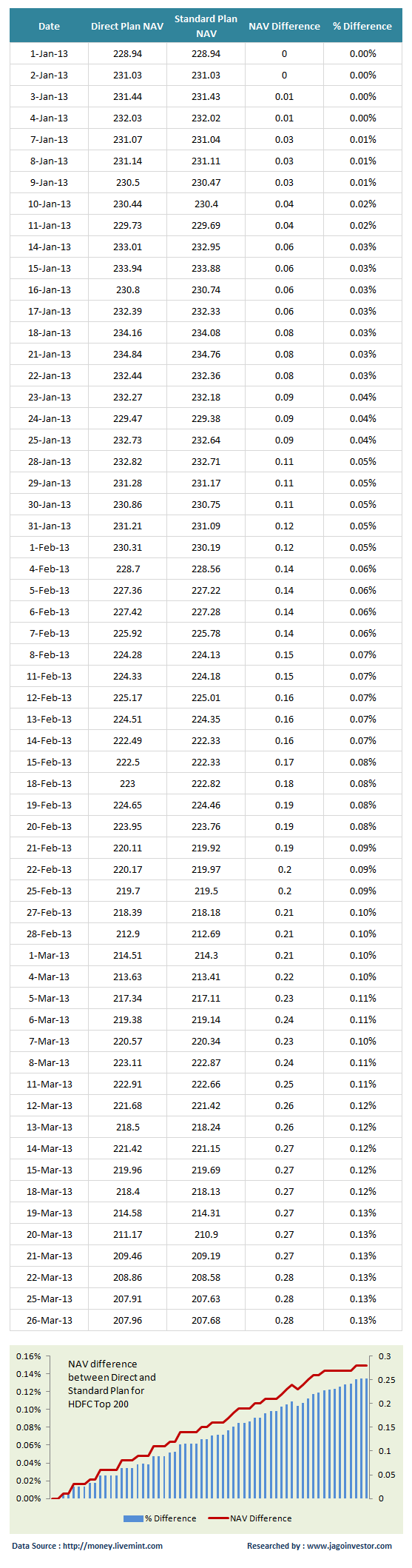

The Direct Plans took effect from Jan 1,2013 . Means that on Jan 1,2013 the NAV must be same for Direct and Standard Plan and from there, the NAV must be different for both plans. And As Direct Plan expense ratio is going to be lower, the NAV for direct plan should also be lower and the gap should widen too. To just make sure that its happening in reality. I picked up the same HDFC Top 200 and listed down the NAV for both standard as well as Direct Plan from Jan 1,2013 to Mar 26th 2013 and checked out the difference between them and I was correct . The NAV gap was growing and Nav in direct option was 0.13% higher than the standard plan NAV , thats just 3 months of difference and if you extrapolate in future, the difference might be as good as 0.5%-1.00% difference in a year. Thats a big enough amount, 0.5% on Rs 10 lacs portfolio means Rs 5,000 . Isn’t that a good ! . And if you look into very long term in your financial life , the difference will be very high, which we will see now

Impact on Wealth ?

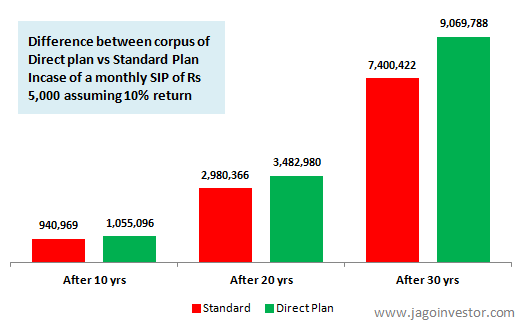

Considering the same example of HDFC Top 200 and their expenses ratio of 1.72% (standard plan) and 1.29% (Direct Plan) , What happens to your wealth after 10,20,30 yrs if you consider these two options ? Will the corpus you will accumulate at the end will be huge ? Even if we assume a conservative returns of 10% on equity in long term, the difference in corpus at the end is huge because of sizable difference in the expense ratio. Below I have provided the corpus of two options and the difference between them over 10 yrs, 20 yrs and 30 yrs.

Note that these numbers and difference might look big to you, but you will not realize the difference to be very big in a short term like few months of every 2-3 yrs. Also you might argue that one might not invest for such a long term, but we are only highlighting the impact of such costs and its impact in long run.

So, Now I hope you must be clear about the Impact of mutual funds direct plan on your wealth.

Who should invest in Direct Options

Now coming to the important question – Who should Invest in Direct option of mutual funds ? A lot of people might feel that direct plan is for each and every investor , but thats not right way of looking at it . Only those investors should go with the direct plan of mutual funds who are

- Capable of choosing right mutual funds for themselves

- Who are ready to review their portfolios all by themselves without anyone help

- Those who can point to bad performing mutual funds and remove from their portfolio

- Who are ready to invest with each AMC seperately

I guess a lot of people will fall into this category and would be ready to go the direct route for the kind of benefit they get out of it. However lets see who should not choose Direct Plan

Who should not Choose Direct Plan?

You must be wondering who should not invest in direct plan ? A lot of investors have very very good advisers , who have good capability to advice and record keeping abilities. The value of their timely advice is so much that it over weights the advantage of direct plan. So if you feel that you have an adviser who helps you pick good funds and helps you in removing bad funds over time and because of him you are able to get extra 2-3% returns on your portfolio, its worth paying commissions he deserves . Also It might happen that you are a busy person who wants a third party to handle your portfolio and inform you on time to time basis about your portfolio and whats going on where , you might want to consider not moving to direct plan.

So at the end , its about the question – “Is there any value in sticking with your adviser , platform or financial planner?” and if its adding enough value to your financial life , and do they deserve the commissions they get out of your portfolio with them. Its a question you need to ask yourself . Do not rush to convert your mutual funds into Direct plan .. Take some time to think over it and look at the long term effects of it.

How to invest in Direct Plan of mutual funds ?

The only thing you need to do is when you fill up the mutual funds investment form, there is an option called as “Direct Plan” there, all you need to do is put a tick mark there, If its ticked marked, then your investments will be into the DIRECT plan . Even if the agent/distributor puts his ARN code (the unique code which identifies a mutual fund agent) , he will not get any commissions from your investments. Also in some of the forms , that separate tick-mark option might not be available, in which case you have to mention the word “DIRECT” in the ARN column . Note that if you forget to mention that you want it to be under DIRECT plan and also the agent code is missing, by default the investment is going to be under mutual funds direct plan .

You can fill up this form directly with the AMC by going to their Office , or you can also use CAMS/Karvy for making investments , who are back-office partners for a lot of AMC’s . If you invest through CAMS/Karvy , still the investments will be into Direct plan, just make sure you do not leave the DIRECT unticked.

How to Change your Existing Mutual funds to Direct option?

Your existing investments in mutual funds will NOT switch to direct plans automatically, no matter you did it with an agent or directly with AMC (Read which AMC is better then other) . It will has the same expense ratio as of old funds.

To convert your existing holding from a standard to a direct plan, you need to submit a switch request. All you need to do is contact your AMC and ask for Switch reuest form . Which is a written request telling them that you want your existing mutual funds to be now converted into DIRECT plan . Once they get this request , they will process it , they will intimate you once its done . Your agent will not like you for this 🙂 .

Will my existing SIP’s be considered under Direct plan by Default? ?

All the SIP’s which were made through an agent/distributor will still be under the standard plan , you will have to manually request the switch to Direct Plan . But if you had any SIP which was done directly with AMC (without involving Agent Code) , in that case your SIP’s done after Jan 1, 2013 will automatically be considered under DIRECT plan , but all the old SIP’s which were done before Jan 1,2013 will still be there under Standard Plan and the higher expense ratio will apply there.

Can you convert your existing Tax Saving Mutual Funds (ELSS) under Direct Plan ?

If your tax saving mutual funds are still in lock in period , then you CANNOT convert them right now, only when the lock in period is over, you will be able to convert them into Direct Plan.

Will there be Exit Load applied when I move to Direct plan ?

Yes and NO !

If your existing mutual funds investments is through an agent/distributor , then there will be exit load at the time of switching them into a Direct version of mutual funds, but if your existing investments are through AMC directly, then there will not be any Exit Load while switching to Direct plan.

Important Points

- There is no DIRECT option in ETF’s and closed ended mutual funds

- There will be no difference between the portfolio’s of Direct Plan and Standard Plan . Every thing will be same except that the Direct plan will have a lower expense ration. Thats all !

Finally Are you going to invest into the Direct Plan of Mutual funds or going to continue with your old investments through an agent or distributor ? Please share your thoughts and inputs about it. What do you think about the Direct Plan of Mutual funds ?

April 1, 2013

April 1, 2013

Can one buy a MF with SIP option and travel out of country and still continue to contribute?

Yes

Hello sir,

I am a customer of icicidirect. I have a MF – ICICI Prudential Banking and Financial Services Fund. For this plan, they don’t give DIRECT option. So I am unable to switch to direct plan. Please help me with your valuable suggestion — Thank you so much!

Yes, they dont have direct option . You cant do anything here. Just sell it off and buy direct from other platforms. This is the best you can do

Hi Manish,

How Direct plans are beneficial as we are buying them at Direct plan rates. For example when we opt to buy any MF under direct plan the higher rate is applied.

Its beneficial for you as you get them at lower NAV . However just see that you can handle your investments on your own, Only you can answer that.

Thanks for the response.

I will re-frame my question.

For example, as on 2nd Sept 2016, for SBI Magnum Balanced Fund – Growth mutual fund

for Regular the closing NAV is 105.3609 and for Direct plan it is 108.6847.

So when i place the buying request under direct plan 108.6847 rate will be applied.

Assuming after 1 year for Regular the closing NAV is 205 and for Direct plan it is 208 and I sell the units, it will sold at the rate of 208. So profit is 100.6847 per unit. But if i had purchased under regular plan profit would be 100.3609. So where is the benefit ?

Generally you will find the direct NAV is lower than the Regular one .. I think you should do a calcualtion on the real number (buying and selling) and you will find out how you benefit

[…] need to be wary of expense ratios as they can have a significant impact on returns. A comparative study of NAVs of direct versus regular plans of HDFC Top 200 was conducted for the period between Jan […]

Hi Manish,

Can you please give some info on the MF Utility ( https://www.mfuindia.com ) for investing MF direct options ?

Thanks,

Ramesh

Hi Manish,

I have brought funds in HDFC TOP 200 and stopped investment and started investing in the HDFC TOP 200 – DIRECT. But can I convert my existing fund that I brought through the AMC to DIRECT and will the NAV change for my existing purchases that was done prior to DIRECT option.

Yes, you can do that . Just visit AMC and they will guide you on which form to fill

Hello manish; I have started sip Hdfc mid cap of 1000/- ; equity fund 25000/- liquid fund 50k; Icici value prudential discovey fund sip 1000; equity fund 20k; liquid fund 20k invested in Feb 2016. I have invested through arn. He has suggested me to do in that fund. I am getting stmt through mail. But can I now onwards if I want to top up I have to go to arn. Can I online topup without going to arn. Can I see my status online

2) Is my universe website good to have all account; Lic insurance;mutual fund under one roof

.

If you want to get access to an online portfolio software and also a platform to invest/redeem online. you can choose to invest through us. We give this to our clients

http://jagoinvestor.dev.diginnovators.site/solutions/invest-in-mutual-funds

Manish

Do direct plans offer STP & SWP features?

Yes

In direct plan as the NAV is high so units allocated will be less in long duration and the regular plan having less NAV will allocate more units , then also how is direct plan creating more wealth , kindly clarify ?

Its the return which matters, NAV is just a formula !

Dear Mr.Manish

Can i invest through using 2 online portals (new live direct portals -invezta,oro-wealth,unovest.) with different mutual funds, just to try out , eg from invezta 2 funds & oro-wealth 2 funds. will there be any problem with that. kindly advise

You can go ahead with them for sure … They are good platforms, but I have not seem them personally till now

Plz suggest a single platform that can buy direct schemes under one platform

Just read about orowealth.com

Investza.com

Hi Manish,

I have invested in both regular & direct dividend plan in Axis Long term equity fund to check on the growth.

I have received 2 dividends on regular plan but not even once on direct plan.

I don’t know why they are not declared dividend on direct even both are dividend plan.

Pls share your views on this.

Thanks,

Madhu

Madhu

Its purely the funds decision if they want to declare the dividend or not!

Manish

Hi,

I started investing in MFs through HDFCSEC trading account for the past 3 months. Now I realized this is not a good option because of the charges.

Now I want to invest directly and did a bit of research. I found ‘fundsindia’ which supports many MFs. Can somebody clarify me the following doubts :

1. Is this account free? Aren’t there any annual charges or commissions?

2. In the trading account I used to buy MF units by a click at my convenient time. Can this fundsindia do the same i.e., instead of automated SIPs can I manually buy like an online purchase ?or it seems I can simulate the same by buying certain number of units initially and later keep on adding additional units to it.

– Thank you,

Balaji

1. Account is FREE, and no annual charges, but the commission are there because htey will be the distributors. If you want to go ahead with advisor mode, then even we provide it. Let us know if interested

2. Yes, its there .. you can buy on your own anytime you want

Manish

Thanks Manish for the reply. Still I have a doubt.

Then, the plans offered are regular ? NOT direct. Isn’t it?

Yes, they are regular plans .. not direct

Isn’t there any site apart from the fund house sites through which I can invest in direct funds?what about mfutilities?

There are some startups in this area who are working on this .

Yes, its regular

Thanks a lot Manish for all the replies 😉

I have started direct plans with dsp blackrock and franklin templeton AMC directly.

Great !

Hi Manish

I have a question regarding MF. I have been Investing in one of the diversified equity funds via SIP. I have been investing in this fund for past 5 years. however, I am in need of some money and I wish to withdraw. I only need 50% of the money. the other 50% I wish to invest in Direct Plan. my questions are as below.

1. Is it good idea to withdraw only partial or full money and invest the other 50% in to Direct plan?

2. I am also concerned regarding the taxes. Will I have to pay tax on the amount I withdraw?

3. Will I have to pay tax for the 50% of money invested back again?

Regards,

Suresh

If one year is passed then you will not have to pay any taxes.

Hello Manish :

Will any investment in units of Direct MFs still result in the said units being held with NSDL in demat form ?

I talked with Franklin Templeton Cust Support recently who said NO. All units would be held with Franklin itself. In this case, I am concerned that the AMC would probably collect money and misuse it. Please comment.

AMC is right . There is no reason for you to worry on that, because the units will not be HELD directly by AMC , Its always is with CUSTODIAN !

Hi Manish,

Firstly thanks for sharing the useful information.

I have a basic doubt regarding switching to Direct plans from regular ones.

Does switching means an automatic process of below steps:

1. Redemption from Regular Plan

2. Fresh investment in Direct Plan.

If yes, then considering the case of ELSS funds.. if I switch my funds which has clear units (more than 3 year old units) to Direct one. Will the 3 year locking period be applicable again or not, on the switched units, as switching is treated as a fresh investment?

One more doubt is I have SIP for SBI Magnum Tax saver – Regular plan, does switching my clear Units to Direct Plan ,will also mean that any new monthly investment will be into Direct plan? Or do i need to first stop the Regular SIP plan and start a fresh Direct SIP plan?

Thanks,

Manish A

Hi Manish

In case of switching the money will not come to your account, but internally shift to Direct plans. I am not clear about what happens in case of ELSS. please talk to the AMC for that

i have opened HDFC midcap opportunities fund Direct growth plan on August 2014 and monthly amount of RS. 1000/- deposited on 10 to 15 every month automatically through my SB account. since then i have deposited 13000 thousand rupees in my HDFC midcap opportunities fund Direct growth plan account but received only a profit of Rs 323. How my account balance will grow as i always read on news paper and internet.

please sir reply me.

pankaj chauhan

If you wait for 10-15 yrs , you will surely get amazing returns . Equity is not like FD which has predictible return.

Dear Manish,

I have opened an account with fundsindia which is KYC compliant. I was about to start a SIP when I came across your excellent article. I have not started any transaction with fundsindia. Suppose I want to start an HDFC balanced fund (growth) SIP, should I forget fundsindia and go to the HDFC MF website? What happens to my KYC compliance? Will I have to submit fresh KYC to HDFC MF? I do not see any funds marked ‘direct’ in fundsindia, though I do see some funds marked ‘regular’ and others not marked anything. What does it mean?

Your KYC will be valid, but you can still invest directly if you want. However I dont think you should outright think that direct is always better. If you feel fundsindia is helping you with any quality advice and assistance, it would be a good thing

Hello,

I have current investment about 10000/month in couple of funds through agent, I want to know If I am willing to invest in the same funds would it be possible to use the same folio nos (As that of regular plans) for investing in direct plans?

Rushi

Yes, you can use the same folio number

Hi Manish

Thanks for spreading personal financial information. I am investing in mutual funds from last 5 years through SIP in following funds.

1. HDFC Growth fund (G)

2. ICICI Pru Dynamic Plan (G)

3. IDFC Sterling equity fund (G)

4. Reliance Equity opportunities fund Retail Plan (G)

All these investments are through mutual fund agent. I was not aware about trail commission which is affecting my overall returns every year and my agent is not providing me any report or suggestions etc. I am checking reports on my own efforts.

For some reasons i had stopped my SIP for HDFC Growth fund and ICICI Dynamic plan after SIP of 5 years in each fund.

For diversification i am thinking of switching of my exciting units of HDFC Growth fund to HDFC Midcap opportunities fund(Diversify to Midcap) and Icici Pru dynamic plan to Icici bluechip equity fund (diversify to Large cap) in direct plan and continue SIP for long term.

If i switch then my portfolio will be

1. HDFC Midcap opportunities fund (Midcap)

2. ICICI Pru bluechip equity fund (Largecap)

3. Reliance Equity Opportunities fund (Diversify fund)

4. Idfc Sterling Equity fund (Small & Midcap)

Please suggest if i am wrong.

If the agent is not providing you any value in return, then you should go direct