CIBIL marketplace – Get Customised loan offers based your credit score

CIBIL has introduced a new facility called “Cibil Marketplace“, which will act like a portal where a person can get customized loan and credit card offers based on his cibil score. Right now, what happens is – when a person applies for some kind of loan or a credit card, the lending institution checks his credit report and credit score and based on their internal criteria and rules, reject or accept the application and move to the next step .

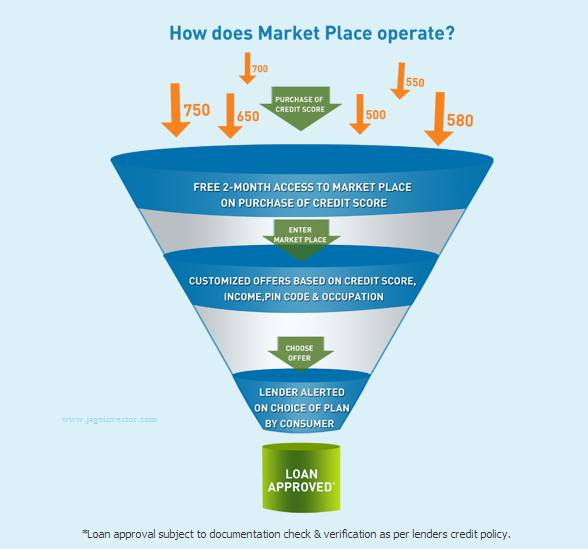

How does CIBIL marketplace work?

With CIBIL marketplace, the whole process is reversed. Here, you can find out which lending institutions are ready to give you different kind of loans, interest rates and other conditions based on your credit score. So a lot of lenders will participate in the cibil marketplace and will give their criteria and checklist, like what kind of customer they would like to offer loans. For example – A lender can say that they are ready to give Car loan @13% interest rate to a person having cibil score between 700-800 and @12% if cibil score is more than 800 . Thats one example .

Another lender can say that he is ready to give home loan to people who have credit score below 700 score, but on a condition that he should be working in a software job, however the interest rate would be as high as 15% – this is just an example of how it might look like. So this is how all the lenders will give their own criteria and when you enter the market place, after the filtering you will be shown only those lenders and loan offers which are exactly for your profile. So if you want to increase the number of loan offers, you need to improve your cibil score for that.

Right now the CIBIL marketplace is started with only Credit Cards. But very soon, you will see Home loans, Auto Loans, Personal Loans and even Business Loans on the portal. Just wait for some time or the next update from CIBIL on this.

How to Apply for Loan with CIBIL marketplace ?

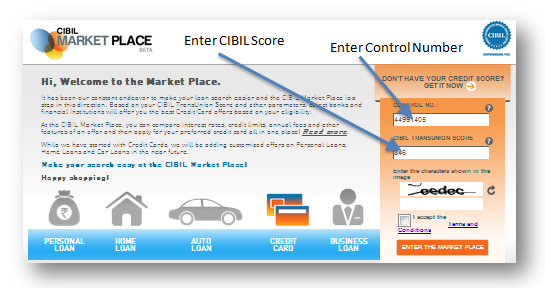

Step 1 : You need to first visit Cibil Marketplace website. When you go there you need to fill in two information.

Step 2 : You need to enter your Control Number (which is 9 digit number that is mentioned at the top right of the CIBIL report) and your latest Credit Score, which should be maximum 2 months old. That means, if you had applied for a credit score long back (more than 2 months back) , you will not be able to use that data to enter CIBIL marketplace. You will first have to apply for a latest cibil score (You can get your cibil score online) and only then you will be able to enter the marketplace. One reason for this is that, cibil score and report keeps getting changed each month when banks update the customers information with CIBIL. So ideally if you know control number and cibil score of some other person, you can enter the cibil marketplace with that information and see all the data . Therefore make sure you dont share this data with anyone whom you dont rely.

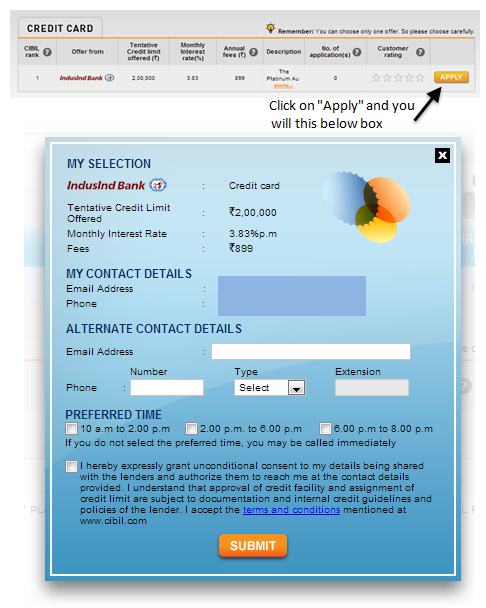

Step 3 : The next step is to go inside the marketplace. You can see different kind of loans section and how many lenders are ready to lend you in each section. For example you can see that only 1 lender is interested to lend in this example and that’s “credit card” section . As of now, only credit cards are offered as this is new facility. But in future you can see more lenders in different sections. All you need to do here is click on the kind of loan you want.

Step 4 : After you choose the section, you can see the list of all the lenders individually with some information like Tentative Credit Limit offer, interest rate, fees, charges and other information. You can click on “Apply” button and instantly a small box will appear where you can apply for the loan there itself. Now this will be a kind of pre-approved loan because this is customized to your cibil score, but the next step will be the documentation check, which is part of the check in general . For those who would like to learn more about CIBIL and Credit Score etc, there is a detailed 40 min video course on our Wealth Club.

So these are the 4 steps you need to do to take the benefit of CIBIL marketplace.

Few Important Points related to Cibil MarketPlace

- You can choose only one offer in each category

- While purchasing your CIBIL TransUnion Score (and CIR), please make sure you fill up your income details accurately. As this will ensure the offers that are displayed in your Market Place are the ones you are eligible for. Any incorrect income detail will mean incorrect offer eligibility and can be rejected by the lender at the time of verification.

- It also depends how many lenders choose to participate in CIBIL marketplace. There might be lenders who choose not to.

- Once you have selected an offer then the respective lender will get in touch with you. Please ensure the details entered by you in the CIBIL TransUnion Score (including CIR) purchase form is accurate. This will enable the lender to respond to you at the earliest. You can also provide alternate contact details while selecting and confirming the offer in the CIBIL Market Place.

Who will benefit with Cibil Marketplace ?

CIBIL marketplace is an innovative platform and will also be helpful to those people who have low cibil score and a bad credit report , but still want to go for some kind of loan, even if it means on certain terms and conditions. It may be the case that they might pay a little more interest, but that would be better than not getting loan at all. This platform might also be the first step in providing incentive to those customers who have excellent cibil score. They might get loads of loan offers from lenders with lower interest rates compared to normal customer. Only the time will tell how this platform will evolve.

Let us know what do think about CIBIL marketplace and is it useful for you ?

March 11, 2013

March 11, 2013

My cibil score was 575 can i get cc loan against property modgage

I think its going to be tough !

I have taken loan from fullerton India long back and paid the same. they have also given me NOC. But the same is still not updated in CIBIL records. My financials status is now good and I can pay loan installments regularly. I am good salaried and paying IT also regularly. Can this improve my CIBIL Score and Can I get Loan ?

Shivani

You then need to check with Fullerton on this. Ask them why they have not updated it !

my cibil score is 575. can i get credit card from icici bank?

Depends on the ICICI bank.

Hi Manish.,

My cibil score is 748 .. which credit card will be available for me..

There is no answer to this.

Hai Manish I have two cc is over due and iam some means4loans all loans iamm making regular payment. Is happening. But only cc is having overdue now iam going clear all dues shall get housing loan after. Clearence

So whats the query?

Hi

My score is 575. there were two credit cards for which dues were pending since 5 years. I had paid one of them. It was full payment and card was zeroised. For the another one it does not belonged to me and bank has reverted the updates from CIBIL.

in how much time my score can increase to 700+

There is no specific timeline for that. You can expect it in 6 months time

Hello Manish my CIBIL Score is 800 just got updated. i had an outstanding amount for CC which was clearly fully now. The Score was NH 45 days back after paying the outstanding amount it shows as 800. Year 2011,2112 and 2104 i did enquired for few loans or cards, and i can see all those entries are available in my CIBIL Report. i would like to know still i can apply any Loan ? My Cibil reports says the below, need your valuable help to proceed on the same

(MEMBER NAME) (ACCOUNT TYPE) (ACCOUNT NUMBER) (OWNERSHIP)

ACCOUNT DETAILS

CREDIT LIMIT – RATE OF INTEREST 37.800

HIGH CREDIT 1,03,152 REPAYMENT TENURE –

CURRENT BALANCE 0 EMI AMOUNT –

CASH LIMIT 5,000 PAYMENT FREQUENCY MONTHLY

AMOUNT OVERDUE – ACTUAL PAYMENT AMOUNT 20,007

26-06-2007

27-02-2006 04-12-2006

DATES

DATE CLOSED

DATE OPENED/DISBURSED DATE OF LAST PAYMENT

DATE REPORTED AND CERTIFIED 23-06-2015

PAYMENT START DATE 01-07-2012 PAYMENT END DATE 01-06-2015

PAYMENT HISTORY (UP TO 36 MONTHS)

DD-MM-YYYY DD-MM-YYYY

DAYS PAST DUE (No.of Days) or ASSET CLASSIFICATION (STD, SMA, SUB, DBT, LSS)

YEAR

MONTH DEC NOV OCT SEP AUG JUL JUN MAY APR MAR FEB JAN

2015 XXX 000 XXX XXX XXX XXX

2014 XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

2013 XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

2012 XXX XXX XXX XXX XXX XXX

COLLATERAL DEFAULT STATUS

VALUE OF COLLATERAL – SUIT FILED/WILFUL DEFAULT –

TYPE OF COLLATERAL – WRITTEN-OFF STATUS –

WRITTEN-OFF AMOUNT(TOTAL) –

WRITTEN-OFF AMOUNT(PRINCIPAL) –

SETTLEMENT AMOUNT –

————————————————————————————————————

(MEMBER NAME) (ACCOUNT TYPE) (ACCOUNT NUMBER) (OWNERSHIP)

ACCOUNT DETAILS

CREDIT LIMIT – RATE OF INTEREST –

SANCTIONED AMOUNT – REPAYMENT TENURE –

CURRENT BALANCE 0 EMI AMOUNT –

CASH LIMIT – PAYMENT FREQUENCY –

AMOUNT OVERDUE – ACTUAL PAYMENT AMOUNT –

14-10-2011

29-10-2004 26-08-2006

DATES

DATE CLOSED

DATE OPENED/DISBURSED DATE OF LAST PAYMENT

DATE REPORTED AND CERTIFIED 02-11-2011

PAYMENT START DATE 01-03-2010 PAYMENT END DATE 01-11-2011

PAYMENT HISTORY (UP TO 36 MONTHS)

DD-MM-YYYY DD-MM-YYYY

DAYS PAST DUE (No.of Days) or ASSET CLASSIFICATION (STD, SMA, SUB, DBT, LSS)

YEAR

MONTH DEC NOV OCT SEP AUG JUL JUN MAY APR MAR FEB JAN

2011 000 000 000 000 000 000 XXX 900 900 900 900

2010 900 900 900 900 900 900 900 XXX XXX 900

COLLATERAL DEFAULT STATUS

VALUE OF COLLATERAL – SUIT FILED/WILFUL DEFAULT –

TYPE OF COLLATERAL – WRITTEN-OFF STATUS –

WRITTEN-OFF AMOUNT(TOTAL) –

WRITTEN-OFF AMOUNT(PRINCIPAL) –

SETTLEMENT AMOUNT –

————————————————————————————————————————————–

ENQUIRY INFORMATION

MEMBER NAME DATE OF ENQUIRY ENQUIRY PURPOSE ENQUIRY AMOUNT

ICICI BANK 08-12-2014 CREDIT CARD 10,000

HDFC BANK 26-12-2013 PERSONAL LOAN 6,00,000

HDFC BANK 04-10-2013 CREDIT CARD 1,000

HDFC BANK 20-09-2013 TWO-WHEELER LOAN 44,000

INDUSIND BANK 13-07-2013 CREDIT CARD 10,000

MAGMA 27-06-2013 AUTO LOAN (PERSONAL) 4,20,000

HDFC BANK 27-06-2013 AUTO LOAN (PERSONAL) 4,20,000

HDFC BANK 09-03-2013 PERSONAL LOAN 4,85,000

SBI CARDS 18-12-2012 CREDIT CARD 50,000

HDFC BANK 19-11-2011 PERSONAL LOAN 2,75,000

KOTAK BANK 05-10-2011 CREDIT CARD 40,000

HDFC BANK 25-09-2011 CREDIT CARD 1,000

HDFC BANK 13-08-2011 CREDIT CARD 1,000

HDFC BANK 12-08-2011 CREDIT CARD 1,000

KOTAK BANK 29-07-2011 CREDIT CARD 40,000

HDFC BANK 06-08-2009 CREDIT CARD 1,000

CITIBANK 06-07-2006 AUTO LOAN (PERSONAL) 1,00,000

First check with you bank on why they have not updated that with the CIBIL

This is the updated CIBIl Manish, with this Can i apply for a Loan ? Score is 801 and details are above mentioned

Yes, you can apply for loan. Its a good score.

Thank you manish , so my Report is ok now ?? i did pasted in forum. did you saw that as well.

Looks ok to me .. Too many enquires are there , which is not good !

Yeah, I Agree, those were sometime back, do you think or chances for rejections for loans ? what else i need to do to see a better report ? i would really need a car loan …and thought to apply …please suggest. with these can i goahead ?

If you dont have bad remarks like settled or default or clean DPD section, then you dont have to face any issues. ANyways, its a bank decision on how htey want to react on the high number of enquiries

ok, is my report shows clean apart from the Enquiry ? am really sorry i do not know how to check those.and Thnaks alot for your help always

Hi Manish,

Now i finished my HDFC Personal Loan. Am also using credit card past 5 months and paying the payment on date. Now my credit score is 772. Last 10 month i there no remark on report.In my whole history there is 4 DPT. One DPT Happened in July 2013 and other three happened in July,Aug, Sept 2014. now my salary is 46,000 working in gud MNC Company. i want to take personal loan for 4 Lakh. Is this wright time take loan ?. if i applied means can i get loan or not. In my report only problem is 4 DPT. please suggest me?.

You can apply for it , but there is formula to tell that you will get it or not .

Plz Say what formula is

Thank you mainsh.. Please say the formula manish….

Err .. I meant to say there is NO FORMULA . By mistake I said there is formula 🙂

Thank for the reply.

Hi manish,

What will happen to my credit Score, if my credit got expired and there is no due is pending…..

In that case your credit score will not get affected

Nice Article .

Specially i like this Points related to Cibil Market Place.

Thanks for your comment Sia Sharma

HI Manish

1. i taken credit card on 06-08-2011 and used for just 4 months and then closed on 25-12-2011.

with full amounts(not settlement).

2. i taken consumer loan for washing machine in bajaj finance in 11-06-2013 for 8 months.

i closed this loan within 4 months with full amount.

3. i taken personal loan 1,50,000 in HDFC for 3 years 0n 16-03-2012 emi due (Rs 5461).

in the month of October 2013 am not able to pay that amount on time and i paid that amount on end of the october 2013.

next issue is july,aug,sep 2014 again am not able to pay the amount because am not in job .

but in the end of sept 2014 i paid all the due amounts(july,aug,sep 2014).

from october 2014 onwards i paying loan on wright time.

now hdfc loan is going to completed on march 2015(2 more dues is there).

4. now am planning to get personal loan again. i taken my cibil report 31 dec 2014. my cibil point is 734 only.

am working as software engineer in chennai in Grade C company. my salary in hand is Rs 31808 credited in axis bank.

few freinds are saying you have bad record so they will reject you.

if they rejeced means your cibil points also will come down so dont apply they are saying.am having fear to apply.

in cibil market place only indusand is ready to give personal loan.

So please suggest me is this wright time to apply loan ?

how long i have wait to apply ?.

is there any suggestion to clear on bad record ?.

is there any way to imporve my credit score ?.

732 is an average score, More than score, you should look at your CIBIL report remarks. I am sure you must have some DPD entries as you have not paid things on time , so you can face an issue. I suggest that if you are getting personal loan from indusind , better go for it as of now .

My cibil rating 804 can i get home loan ?

Are there any bad remarks in your CIBIL report ?

What is a Bad remarks

Settled, Written Off.. these are all bad remarks!

hi my cibil score is 801 can i get loans

What are your CIBIL report remarks ? Are they clean ?

Hi Manish!

I had a Credit Card with HDFC BANK which was blocked due to Non Payment in the month of November 2013. Then I cleared all the outstanding at me end in Feb, 2014. I asked HDFC Bank if there is any dues remaining. They confirmed that No Dues are pending and everything is clear.

I asked them to send me NOC, till now Aug 2014 I have not received that. I bought my Credit Score today & It doesn’t shows any account closure date. Its only showing Date of Disbursement, Date of Last Payment and Date of Reporting (31.07.2014). Apart from this the report is showing a High Credit amount of Rs 20000(The Outstanding) in High Credit section. Is it valid report? If I made all the payment, I think the account should be closed properly without any dues and higher credit.

When I approached Bank (2nd SEP 2014). They are saying they have already closed the account. About Higher credit, they are saying that this is the format of Cibil reporting.

Is this correct? KINDLY HELP ME OUT.

Awaiting your early response.

Thanks

Ranvijay

Yes, CIBIL report is fine .It mentions what was your highest credit usage . You cant do anything about it . However I think your report is clean , not much to worry if you have paid off everything . Just that make sure you have the NOC

Manish

My cibil score is 801 is it good or bad can i apply for loan

Its a good score .

Hi,, I cold see people score more than 700+ here in this blog..I am sure no one can help if the score is below 700. I am purchasing my report today and try today in marketplace.

Can you see any possibility of getting a creditcard to below 700 points? I settled 5 cards this year and only one card left..

please advice..

Why cant one help if score is below 700 ?

True Manish, I mean any banks which might have any kind of schemes for less than 700 points? with higher interest rate?

I am close to other card as well. i am sure my cibil rating will be more than 700 points. if its >700 points will i be eligible for getting a loan or a card?? as i have a doubt these settlement of cards will reflect in the cibil report?

Its only banks which can decide on what CIBIL score they would like to give loan . There can be companies which are ready to give loan at below 700 point, but then they will charge higher interest rates

Has it been started for home loan, because it shows 0 in home loan offer. My score is 769. Pls reply.

I am not sure what is the latest development on home loans

Hi,

I have 3/4 credit cards with settled / write off status, but my score is 789. When I applied through cibil marketplace, my application got rejected. What could be reasons behind rejecting my application?

Forget score .. its of no use unless your credit report remarks are cleaner .. Your applications are rejected, because your report contains all your history !

But, I am getting consumer loan / personal loan from Bajaj Finserve

hi my cibil score is 804 is it good or bad i am having gold loans

Hi Manish,

You are doing a wonderul job here for enlightening so many people who are not aware of these things.

My question is, I had a personal loan with a bank which was showing as ‘Written Off” with some X amt in my previous CIBIL report in 2012 with 640 score. I cleared the amount in the same year (2012) and got the loan account closed.

Now I just extracted the latest CIBIL report and found my score to be 823 with no loans / credit cards due..but the DPD of the closed loan account has impacted.

Now am in need of PL. Will my latest CIBIL report with 823 score along with bad DPD make me eligible for loans.? please advice as i dont want to take any chances of “Rejection” again since it took more than 2 yrs to maintain a clean record.

Thanks in advance.

Hi Arun

YOu can never guarantee a rejection. I think when you apply for loan, just talk to the agent about it and tell him that you do not want any rejections, he should be able to give his views on this topic

Hi Arun ,

Am also having same problem like you. Am having 4 DPT in my past 5 years record. did u got PL ?.