Open PPF account in ICICI Bank – Few Points you can’t miss !

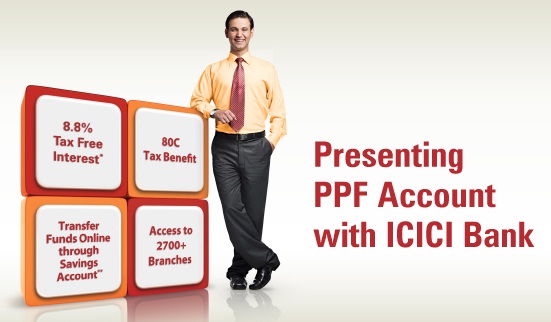

Do you want to open PPF account in ICICI Bank ? Yes It’s possible now. Few months back, ICICI started the facility of PPF account. The way it was advertised was “Online PPF” , but it mainly meant that you can deposit and maintain your account online. While you can also apply for the PPF account online, still you need to provide them the documents physically. In this article we will look at how to open Public Provident Fund account in ICICI Bank.

Can you open PPF account in any ICICI Branch ?

No , you can not open PPF account in any ICICI Branch . For each city, there are special designated branches for opening PPF account. You will have to open the PPF account there, here is the list of those designated braches . Note that you need to have a ICICI Bank account before you open the PPF account in ICICI, however the account can be in any branch of ICICI .

Documents required for opening the PPF account in ICICI Bank ?

Case 1 : For customers who have a relationship with ICICI Bank that is < 5 years.

- Form A

- Passport size photograph

- Copy of PAN card

Case 2 : For customers who have a relationship with ICICI Bank that is > 5 years

- Form A

- Passport size photograph

- Copy of PAN card

- Residence proof – Passport/ Electricity Bill

In case 2 , the additional Residence Proof must be required mostly because if the customer is quite old, his address must have got changed. Note that if you do not have a ICICI Bank account already, you will have to first open an account , in which case you will fall into case 1

How to transfer your existing PPF account to ICICI Bank account ?

As per the PPF scheme of the Government, subscribers can transfer their PPF account from one authorised bank or Post office to another (Check detailed article on how to transfer a PPF account from Post Office to SBI bank) . In such a case, the PPF account will be considered as a continuing account. To enable customers to transfer their existing PPF accounts to ICICI Bank, the following process must be followed.

- The customer approaches the bank or the Post office where his current PPF account is held and makes an application for transfer of PPF account to ICICI Bank’s branch.

- Once the application is processed, the existing bank/Post office arrange to send the original documents such as a certified copy of the account, the account opening application, nomination form, specimen signature etc. to ICICI Bank branch address provided by the customer, along with a cheque/DD for the outstanding balance in the PPF account.

Once transfer in documents are received at ICICI Bank branch, customers are required to submit fresh PPF account opening form (Form A) and Nomination form (Form E/ Form F in case of change of nomination), along with their original passbook . Also customer is required to submit a fresh set of KYC documents.

You will not get PPF passbook in ICICI bank by default

This is something interesting I found which was getting discussed on our jagoinvestor forum . Looks like by default ICICI bank does not provide a PPF passbook when you open it. If you really need it, you will have to give a written request and only after its processed it will be given. Under its PPF terms and conditions its mentioned that

3.3. Passbook shall not be made available to the Customer/s for PPF Account/s which are applied for and operated through ICICI Bank Internet Banking Services. However, the Customer shall be able to view his/her transactions through his/her statement of accounts available online on the Website. In the event, i Customer wishes to have a passbook for the PPF Account applied for through ICICI Bank Internet Banking Services, he/she shall be required to put in a written request for the same at the designated base branch where PPF Account is/has been opened as per ICICI Bank’s policy / process/Primary Terms.

However, if you mostly do all the transactions online, the Passbook point is not that big thing to reject the idea of opening PPF account in ICICI bank.

Conclusion

PPF account was always opened at SBI bank or Post Office by maximum people and ICICI bank is the new player in this field. Only time will tell about their services and how they handle this PPF service. However overall for netsavvy investors who already have a ICICI bank account, seems like its a good option and which can be acted upon faster. Now you need to take your decision. Let us know if you will open a PPF account in ICICI bank or not ?

December 4, 2012

December 4, 2012

Hi,

Can I open a PPF account linked to my salary account?

I went to ICICI bank, and they told to open a linked account for PPF. Is it really required?

No , its not mandatory , open it only if you need it

Hi Can the guardian of my child’s minor account be changed? I have been pursuing this query with ICICI Bank since the last 1 month. I am still awaiting confirmation of the rules.

Please can you advise.

I am not sure on this . At the account opening time you mention it and I believe it can be changed only in extreme cases .

One more point in ICICI, if I have a savings account with ICICI, then I can open a PPF account for myself, but if I want to open an PPF account for my daughter (2 years old), they say its not possible to open an PPF account for her and link it to my account.

Instead I should first open a Kitty / Minor account in ICICI and only then I can open a PPF account for my daughter.

Not sure if this is same for other banks as well.

Regards,

Senthil

Well there is no rule like that, but it might be just a sales pitch . But I think what they say is a good idea anyways ! .. Whats stopping you to not open an account for her..

[…] minor children and invest Rs 1 lac in all the Public Provident Fund accounts (Here are articles on opening PPF account with ICICI Bank and with SBI Bank). You don’t get income tax exemption under 80C for more than total Rs 1 lac, […]

Hi,

I have a PPF A/C with SBI. I think you are require to visit the branch only once for your documentation. Rest you can carry the the entire transation by Netbanking . There is no problem as of now. I can even take the PDF print out and submit it for IT Return.

Everyone should have a PPF A/c as it gives you 100% exemption under Section 80C of IT Act.

Correct !

I am listing here why you should not open a PPF A/C in ICICI if you have an SBI A/C.

1. In SBI it is avalaible in almost every branch but in ICICI it is available in only few branches. For Delhi NCR it is only there in Cannaught Place Branch.

2. It is one hour work or more in SBI but in ICICI it will take almost 15 days (No Idea about branches which have themselve PPF A/C facility)

3. you will get a passbook in SBI but you won’t get the same in ICICI

4. you can add PPF as an beneficiary A/C in SBI and set the repeat transfer option. But you can’t do the same for ICICI. In ICICI you can add only Saving Bank A/C not PPF A/C.

5. you can generage statement online in SBI, you can generate the same in case of ICICI as well but it will be of no use as it will not mention the type of A/C

6. you can get statement on your passbook in SBI, you can get the same in case of ICICI as well but again it will be of no use as it will not mention the type of A/C

7. SBI PPF Statement mention your address, Bank Branch, Type of Account, interest rate etc. But ICICI PPF will have only A/C number and no Branch detail, no Type of A/C and no Address, no Interest rate. Moreover not in PDF Format.

7. In case of death of A/C holder passbook can be found at home so nominee can apply for withdrawal. But for ICICI no one would remeber if A/C holder doesn’t remind it time and again to family members

8. Even if you get passbook after applying to ICICI bank, in the passbook it is not mentioned anywhere that this passbook is of PPF Account.

Very soon I would be writing a blog with pictures on my website curiouslogic.in.

Thanks for sharing all those points

my age 30yrs i’m planning to open PPF account ist this right time to me open PPF account ? if yes plz tel me in which bank i have to be opened. i have s/b a/c in vijiya bank, sbi bank and idbi bank. now a day i dont like sbi bank becouse its fully crowded if i want to deposit or withdrew money i want to wait 1 hr in a line. so ist vijiya bank is good to open ppf account. plz help me i this

thank you

You can open it in any bank . but if you open in SBI bank , you can use internet banking to transfer money in PPF

Hi Manish,

IDBI Bank is also providing online PPF facility like SBI, ICICI.

Thanks for sharing that Francis !

if i have ppf account with icici bank, and i will make online transfer to ppf account from hdfc bank or any bank other than icici, do they apply charges for transfer to ppf account?. I am asking this question because if i transfer money online from sbi to hdfc (or any bank other than sbi) via third party transfer they will apply 2.5% charges for each transaction.

Isnt 2.5% charges very high for banking conveninece. If this charge is true, i will instead issue a cheque if time is on my side.

I think its very specific to ICICI , you need to get clarity from them only

To open a PPF account, i downloaded the forms from ICICI and went to Ghole road branch in Pune. Instead of accepting the forms, they said that they have better option than PPF which is RIS. They said PPF pays 8.7% whereas they will pay 8.7+2% extra and that too guaranteed. I accepted the offer thinking this is something new. They asked me to confirm my details on some number which they dialed from my phone and which i happily did. Later i got SMS from ICICI prudential that i have bought ICICI suraksha life insurance policy from them. I was so surprised. No where did they tell that they are selling me life insurance policy.

I checked the net and downloaded sample policy document from icici pru. No where have they mentioned that they will pay an assured 8.7+2%. What they mentioned is assured 5%.

My application is now showing Policy issued and waiting to be dispatched.

I know i have a free look period to cancel but dont know if it going to cause trouble in getting my premium back.

I need some kind of legal action against ICICI so they dont misuse the PPF option they have and dont cheat any other customer.

Please advise

Well u should get the policy cancelled immediately. There will be a small charge on the premium, but when cancelling that the policy was mis-sold to u, and make a huge noise like complaining to insurance obudsman, and like wise. They will return your money back,and also reprimand the employee hopefully. BUT DO NOT keep quiet else, hundreds like u will be made bakras, while these crooks eat the commission.

After several followups, they gave me my policy documents which i returned to ICICI bank immediately to cancel under free-look period.

The terms of the policy was totally different from what ICICI told me. The iciciprudential site shows me the status is “free-look cancellation”. It is 2 weeks and still they have not refunded my premium.

The banker has stopped lifting my phone also. I registered my grievance at ICICI, registered a complaint to IRDA and also sent a mail to insurance obudsman for the fraud they are doing

Not sure when they will return my 2 lacs.

Finally got my money back with some deduction.

Guys be careful with this PPF option. They are misusing this option to bring in customers and then they sell them insurance policies by giving false information

Thanks for sharing that !

Hi Manish,

How do I open a PPF account under my child’s name with ICICI?

You need to mention your Child name as main applicant and your self as guardian , I guess your child account has to be present in ICICI in that case, but you need to get clarity on this from ICICI bank only.

The other sites are fine in office..even videos also..

only facing problem with jagoinvestor..almost need to wait for 4 or 5 min to read/scroll the site..

getting stuck for few minutes..

Even now ?

Hi,

It is taking too much of time for loading the site.

Are you trying anything to improve it?

Thanks

Prasad

Hi Prasad

I guess we have already improved the site a lot . Are you seeing the speed issue many times a day ? Or was it just this instance ?

yes it is not just once in a day..

I am facing this problem all the time …it is taking too much of time to open any topic…

It is fine with 3G airtel connection at home..but in office..facing this problem all the time..

Are you still facing it ?

ICICI – For those who are having relocating jobs and know the power of internet banking.

SBI -For those who are settled in one citi and place.

I trust SBI coz its largest PSU but i hate the services because its really irritate you… visiting base branch again and again is the biggest headach……. transfer of account takes 6 months time……. however with ICICI life is cool and comfortable… i never visited my ICICI base branch.

by Anupam

——

I have decided to open PPF account online. I have both SBI and ICICI Saving accounts. I was in confusion whether to go for SBI or ICICI.

The first thing that comes into my mind is “Jagoinvestor” to check that -:).

I read this artical and all the reviews..

Based on the point given by anupam, I have decided to Open it with ICICI.

SBI is also very good, but it is really irritating to visit the base branch for many things, HOw can we go to native and visit base branch whenever it is necessary..

in this case ICICI is very conveient, we need not vistit base branch, we can do anything from any branch mostly.

Really I am fed up with address change, net banking activation etc with SBI. Rest everything is good, but visting base branch is really a big problem.

Once again thanx to Jagoinvestor..

on the other day…It helped me to take the “Term paln from HDFC” .

I was about to go for money back policies etc with the influence of LIC agents (many are relatives or friends)…but jagoinvestor helped me to plan it correclty..

like going for Term plan..which gives lump sum of money to family if some thing hapens..I took it 70 lakh for just 9k per year..it is really good..

which helped me to invest the other amount in things like PPF etc..

Really thanx a lot..

-:)

I am more relaxed and happy by all your reviews/suggestions..

thank you..

Thanks for sharing your review about these banks !

Hi Manish,

What is the right time to transfer PPF account from Post Office to SBI / ICICI? Is it more suited to do during the beginning of the year (April) or anytime of the year is good?

My concern is that, will the account transfer impact the interest calculation.

Srinath

YOu can transfer it exactly after you get the interest. That would be better

Hi,

Can Anyone let me know how can i avail the auto debit feature of PPF a/c online. my payment is not getting deducted automatically . And while opening ppf nothing as such was informed.

thanks in advance to rply.

Were you able to link your PPF to your bank account online or not !

Hi Manish,

I lives in Gwalior, even I went to ICICI(I didn’t know about that there are some designated branch for PPF), and representative misguided me, he told me that I can open an ppf account and i have to deposit 20k check for privilege, 10k for normal, 0% for women acc but 2K of RD will be there, i told him many times that i just want ppf account but still said a same thing, and got confuse, things got clear from your article thanx for that, I am thinking to open ppf in SBI now. 🙂 ! All the services is going to be same right ? I also want everything should be done through Internet and fast, transfer and all and that is also possible through SBI aswell ? and then what is the point to choose ICICI ??? Is there any ?

hi all,

I opened my ppf last april, 2013 with sbi. i went to the branch only once to open it. it came linked with my sb a/c. now i m transfering as when i lyk, no big deal.. sbi has one of the best netbanking facility .. with advance technoogy, u dont need to bother abt poor human services..

thanks for sharing your experience 🙂

Can i have PPF account in ICIC without any saving account??

Pls tell me the schedules of PPF..

I think you cant . you need to have it linked with icici saving bank account

Hi,

I have opened my PPF account with ICICI.

Please let me know, how to link it online?

I cannot see it in My accounts.

Thanks in Advance.

It can be linked online only when your PPF is with ICICI and your saving bank account is also with ICICI

Hi

Some one told me that If I open PPF account and link with my ICICI bank account then I dont need to worry for maintaining monthly balance and it will consider as zero balance account with all feature and facilities.

Same I have checked with Vasai Branch and they inform me the same and told need to start with atleast 500 Rs PPF PM.

please reply.

I am not clear on this . If branch has told you this, then it would be correct