Worst 5 yr period in Stock markets – Are you happy with your Investments ?

Most of the people are worried about their Mutual funds, ULIPs and direct stocks returns. In the last 5 yrs, Stock Markets have been so bad that literally no mutual fund has given a good return in last 3-5 yrs , except few. I recently saw a reader asking this question

I have been going through SIP returns for last 5 years of some best recommended mutual funds and found that the returns were less than the Bank FD rates or at par… What is the use of investing in risky mutual funds if they cannot deliver returns better than Bank FDs in long run… I suppose they are high risk low return investments… please enlighten..

Your investment return is function of underlying Asset Class

A very simple, but not an easy thing is to digest that it’s not the investment product, which is doing bad, but the underlying asset class. Take the same example of mutual funds, ULIP or Index Funds. Its not the “fund”, but the stocks which they are invested in, that are doing badly. Stock markets in India have seen one of their worst 5 year periods (2007 – 2012). In my book “Jagoinvestor”, there’s one chapter on equity and debt, where I take last 30 yrs of history and show how in the long term, equity has given good returns and as the tenure increases, the returns get stabler and better .

So because stock markets have given bad results in the near term, its natural that the investment product which uses those stocks will also give similarly bad returns. So your fund might have just done its job of picking stocks as per their mandate, but the underlying stocks have done so badly that the mutual funds really can’t do anything here. What really you need to look at, is if the mutual funds have beaten its benchmark or not . If not, that’s when the issue is with the fund.

When did you exactly buy matters?

Yes, the last 5 years returns have been really bad!. No investor would be happy with these returns. However, did you notice that your opinion will be strongly biased, based on the tenure you have been holding the stocks or mutual funds? Some one who had bought near the peak of 2007, will surely say – “Stock market is the worst investments, never believe someone who says they are good.” A person who had bought stocks in 2002 and had sold in 2007 , would say – “Stock markets are great” and someone who bought in 2002 and is still holding would also say – “Overall they are good. Ups and downs are always there.”

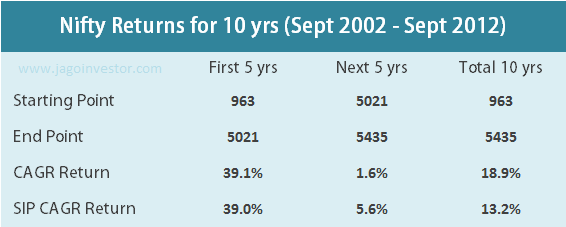

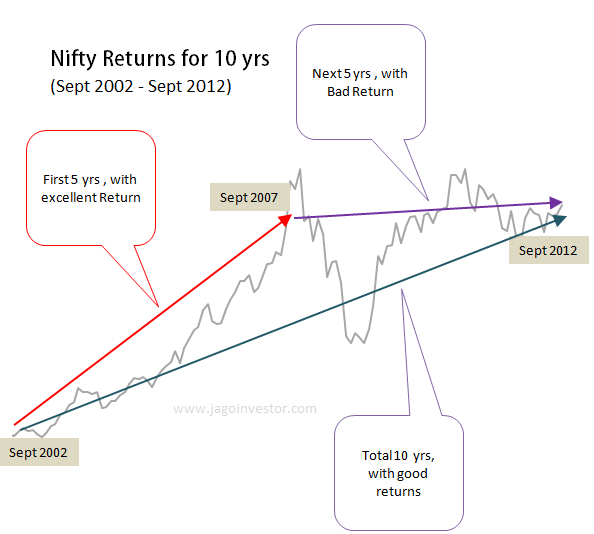

Let me show you some numbers. I took past 10 years of monthly NIFTY data starting from Sept 2002 to Sept 2012. Then I divided it into two halves, so there is the first 5 years (Sept 2002 – Sept 2007) and the next 5 years (Sept 2007 – Sept 2012) . Here are the results of the returns based on the Index values.

First 5 yrs

You will see that the first 5 yrs were a really golden period, which gave close to 35-40% for lump sum as well as SIP investments. Someone who had been invested in this period would know how amazing the returns were.

Next 5 yrs

If you have been lying in this group, you must be complaining and surely your investments have not done well. You are disappointed and you have lost your wealth. But sadly it’s only because you are in this group.

Total 10 yrs

If you see the returns in this period ,you will see that the lump sum returns are 19% and even SIP return have been around 13% , which is a respectable rate of return. Most of the returns were eaten up due to the last 5 years, but even with those 5 years counted, the returns are good enough. At least better than PPF or FD returns and that too tax free .

Stock Markets vs your Investments Return

“Equity gives good returns in long term” is a statement which is nothing but a probability linked statement , It means “most likely, equity will give good returns in long term” It’s purely a function of time and your consistency in investing. While 5 years can be seen as a long term tenure, there can still be 5 years tenures where the returns are not that good and you might get bad or negative returns. Also note that it’s not your investment product, but the underlying asset is behaving wrong. So rather than complain about the fund, better complain about the stock markets .

What was your biggest take away from this article ?

September 20, 2012

September 20, 2012

A good article for understanding, unfortunately last few years were bad and still not that great as it was in 2002-2008, I had invested in MF in 2004 and got good returns when I withdrew in 2007 (just before the crash, thanks to some personal requirement of money). I feel a combo investing through SIP in MF and also through RD / PPF shall balance the whole investment rather than going just a single way in either of these.

Thanks for sharing your views on this topic Ashish

manish,

very handy collection of information. thanks for that! can you tell me what graphing tool you use to analyse data like PE, support and resistance numbers?

Is use Excel 🙂

yes of course, 😛 there is always a simple solution

These have in fact been the worst 5 years in stock market exactly when I started investing back in 2007/08. The first shocker coming in the form of Satyam …

I have been investing in 2 MFs which I started in 2010 but still I havent seen a green till now on my investments.. but anyways, I am looking at long term so I am not worrying much..

Yea.. past 2 yrs have not been that good , better target long term

Statistics are like bikinis. What they reveal is suggestive, but what they conceal is vital. ~Aaron Levenstein

This is a great article reiterating the fact that equities is for the long term. But how would next 5 or 10 years pan out? We can look in past for story behind the numbers. Why was period 2002-2007 great but 2007-2012 bad? Was the reason for rise in 2002-2007 because of the money being pumped by FIIs (Foreign Institutional investors)? What if we take away that period 2002-2007?

In our article Ups and Downs of Sensex we have tried to show the rise of sensex from 1000 to 21000 fall to 8000 and then again rise from 8000 to 21000.

Thanks for your views !

I am one of those who started in the second 5 year period and took a severe beating as expected, lost almost 85%. I do not do any more trading now, its completely stopped. I do not have much regrets for those losses because I chose the equity blindly without doing any homework…Nice article this one is, clearing some doubts on equities..

Thanks to hear your experience on this matter !

Manish,

I started reading your articles only from yesterday but to be honest they are quite good. Thanks a lot.

I too started investing in equity at late 2008, without much preparation and lost in quite a few stocks. Started SIP and continue to hold for long and now its good 2 digit profit. Stopped direct trading and is continuing SIP.

nice .. thanks for sharing your experience Sujith !

an exelent site and supper article with the added flavour of comments.

does anyone thinks or looks at all this a little differently, i.e. to say ” baghwan ne jis ko jitna dena hai de detta hai, na kum na ziada”.

taxes on FDs, compounding in PPF, bull & bear markets, wrong and right advises, technical analysis, fundamental analysis or combining the two, diversification verses concentration( ofcourse on good analysis of balance sheets, cashflow data and what not) etc etc only helps to achive our share already earmarked by THE BHAGWAN !!!!!

does any body agree at least partialy ???????

thanks

Good way of looking at things

sir,

i was in search of good and sincere advise on ( personal finance) money since 2006. i could not find one till recently when i came across your site.

i am happy to share it with my nears and dears.

how much any of us gains depends on our karmas (luck).

our happiness depends on our efforts and you contributes to the crux of our life i.e. THE HAPPINESS QUOTIONENT.

thanks

with respect and lv

sandhu

Thanks for your appreciation !

[…] good returns in long term” but how long is long term – 5 years, 10 years. Jagoinvestor Worst 5 yr period in Stock markets – Are you happy with your Investments ? shows for Nifty (results are similar for Sensex) So is timing in the market important? Nifty 10 […]

Hi

I think irrespective of you investing in stocks or mutual funds , tracking your investments and switching from laggards as and when required is very significant.Also investors should look to book some profits when there is sudden big upside and control their greed.

I still believe investing in equity diversified funds such as HDFC Equity , UTI Opportunities , IDFC Premier Equity , HDFC Top 200 , ICICI Pru Discovery is a great way to make wealth over a long time frame – atleast if you are looking for goals 10-15 years away.Stay invested and continue your SIP.

Hi Salil

I agree one should book profits if there is substantial gain. But what if you are aiming for long term investment. You just want the money to grow, once you book the profits.. what you do with the money.. it will simply go as expenses.. part by part or all at a time…. Am I wrong in this or you have better idea? Thanks

Thanks for your views Salil !

Hi Manish,

You have taken 2002 as the starting point, a point at which the stock market was it’s lowest and 2007 as intermediate point, a point at which the stock market was at it’s highest. Naturally it will give a high CAGR. How many of us would invest at the lowest level and getout at the highest level ? I think less than 0.01%.

This is the marketting trick used by MF’s to showcase the good returns by taking a point which is convenient for them (where the NAV was lowest) and a point in time where the NAV was highest, and projecting that it’s doing well. We should not buy into this.

I had not taken 2002 , It happened to be 2002 , because I took last 10 yrs data , as last 5 yrs are bad and 5 yrs before that was good

In statistics there is a concept of moving average. The 3 year, 5 year and 10 year window is to be applied over a moving period. Then you can arrive at better conclusion.

Yes .. i agree ..

The base year for the Sensex was 1979 when its value was 100. Annualized return since 1979 is 12.5% . SIP return is 15.4%

Historically equities in most countries have returned about 4-5% above inflation. Bonds have returned about 1% above inflation. Real estate has mostly matched inflation.

As usual, it was an excellent articulation of the data.

I would feel rather than typifying 5 yrs or 10 yrs as a long term, it would be actually a good strategy to actively follow the markets & economy and then decide long or short term period on individual basis. It would be bad to remain passive and blindly invest for 5 or 10 years with an implied assumption that “Equity gives good returns in long term” to later find out that the returns didn’t meet the expectations (like starting to invest around Sept 2007 period) and then as you rightly pointed out with people telling “Stock market is the worst investments, never believe someone who says they are good.”

Bhautik

You can always be active and try to do it , but the point is how do you guarantee that it will work , just like you can guarantee that it will not work in being passive . Its finally your call

Thanks for your views on this topic

Tks Manish, Good one. Apart from 19% return in 10 yrs, equities would have also given dividend avg yield 2% for most good companies. Bank FDs are easiest and safest but net return after taxes is not always great especially for the ones who’re in high tax bracket. After paying 30% taxes net yield of a 9% FD will be only 6.3%, whereas long-term equity returns are tax-free. Therefore, taxes and dividend income can also bring a lot of difference.

Direct investment in equity or even through mutual fund does require regular analysis and some changes from time to time. If one cannot allocate sufficient time or stick to principles chances of good returns in long-run are minimal, in short-term anything is possible. For such people Bank FDs or conservative MFs are good options.

Another interesting point I note in your article – last 5 yrs CAGR rtrns are only 1.6%. If this trend continues for another 2-3 years new investors will completely avoid equity while experienced will argue it’s the best time since it cannot get any more bad. Going by above chart in order to return a 19% CAGR or even 15% between 2007-2017 next 5 yrs will have to do a lot of catching up.

Thats the points . It needs a good deep understanding of how equity works in real . A person should be understanding that just because equity has given 0% return in 5 yrs or may be 4% net in 7 yrs , thats one of the rarest event in equity and happens ! .. If a guy knows this and accepts this, he only will be able to benefit from equity . Equity is more of a mind game rather than just a plain vanila investments avenue . Thats the reason its not everyone;s cup of tea !

Good article Manish. I think “long time” is 10 years+ where even if we can get inflation beating returns by just 2-3%, it can give descent corpus via power of compounding. What more, the corpus even if partially withdrawn continues to get compounded with increasing time.

Yes .. 10+ yrs a good number . How ever rather than putting a number to long term , the statement “higher the term, higher is the probability that you will make better and consistent returns” is more accurate.

Manish – I tend to differ here. I have been a SIP investor for the past 7 years and have never stopped my SIP in the last 7 years. I have got a decent return and i am extremely happy with my investments in the last 7 years. I think you need to have perseverance and guts to stay in the markets during its roller coaster ride to get good returns in the long run. I am giving below some of my real returns in the last 6 years for people to know that mutual funds really work if you are serious about wealth creation.

fund year annualized return

HDFC Equity 2006 18.35

HDFC Equity 2007 14.44

HDFC Equity 2008 10.12

HDFC Equity 2009 16.49

HDFC Equity 2010 22.72

HDFC Equity 2011 0.85

HDFC Equity 2012 -0.10

HDFC Prudence 2006 16.52

HDFC Prudence 2007 15.60

HDFC Prudence 2008 12.74

HDFC Prudence 2009 18.03

HDFC Prudence 2010 24.89

HDFC Prudence 2011 6.50

HDFC Prudence 2012 8.33

thanks

Vinod

Thanks for sharing that vinod , but I think you are agreeing with me and not differing 🙂

The biggest problem has been faced by people who are in their 30’s, we have all lost the compounding effect for the most important period of our lives to this downturn, I feel this loss will be extremely difficult to recover from, if you add the fact that , this is the period when the salary increments were also very low.

Personally the confidence about taking heavy risk in earlier working years has been lost by me I have become a More debt -equity balance person due to this……

Never will i allocate more than 40-50& to equity.

yes Siddhant

thats true .. the early part is lost and now it will not come ,that could have made a big impact in your returns , but now its lost !

During first 5 years (2002-07), RMs, Brokers & Agents were pitching with illustrations of more than >20% returns projections in MFs, ULIPs and so on. I am glad that last 5 years taught everyone lesson that assuming linear growth is unrealistic.

However I see a new trend still. Earlier 5 yrs was in equity investing was considered as Long Term by most of them. Now this is stretched to 10 yrs. Who knows we may talk about 15 yrs as LT should the equity returns be bad in next 5 yrs & overall past 10 yrs.

Coming to the returns story, 20% ROR was taken as guaranteed in the worst case scenario of markets. Today everyone preach that equity investor should jump in joy if one gets returns around early double digits (12%). We see lot of moderation in recent times. In any case in developed world, you would see few people talking RoRs in double digits and most of them seem to talk about single digit RoRs.

As a NRI, I have converted significant portion of USD savings when the INR was around 40. We saw some articles then in the news papers that it could touch 33. If I talk in USD terms, I am hit with poor returns of Indian equity market in last 5 years plus currency devaluation of around 25%. Don’t think I would ever be in the green in USD terms.

Given many variables in today’s global enviornment, these days am wary of all the investment anlysis, principles and advises.

5 yrs was never a long term in equity . When its said that 5 yrs is long term , all it means is that there are “higher chances” that you will get good returns . I would say it was not a right thing to take it literally, because if you almost take it as a 100% guarantee thing , then every one will just put their money in equity only .

Longer the term , higher the chances of good returns , there is no guarantee ! ever .

Manish

I like the analysis detailed out in this article.

My feeling is that the investor must also set an expectation for themselves and say anytime my investment in the market(stocks/MF) goes up beyond my expectation(12-15% max ; be realistic here 30-40% may possibly not happen again),I will realize the gains.

Thinking about this, the group of people who stayed invested for 10 years would have benefited much more had they realized their gains and (39% CAGR for first 5 years) and reinvested(5.6% CAGR for the next 5 years) as against the 13.2% CAGR for staying invested the whole(10 years) and not realizing the gains(being lazy by not redeeming or just imagining investments are going northwards only!!).

Let me know your opinions.

Yea its a good strategy .. But my recommenation for a common investor is to not look at it from even 5 yrs point of view.. just keep on investing in mutual funds for 15-20 yrs tenure !

What i wanted to express was the need to set up a realistic expectation of the gain you expect from Equity(irrespective of the time frame of 5 yrs) say 12% CAGR; and when the fund has given a profit% of 14%CAGR, then exit the 2%, invest in bank fd/debt instruments and keep the 12% invested for the next rally/switch to a different MF etc. A thing I learnt, is that gains are going to sway, based on the market conditions and the profits would continue to remain in paper if its not booked.

I got it, but this can be done by someone who really wants to be very active in markets , not all can do this

Unfortunately what is you said is true.

However, if one wants to create wealth, one needs to be active with his investments. Passive management maynot give sustained long term returns.

May be .. its always may be .. its all about the quality of decisions .. if sommeone is active , he may still take wrong decision 🙂

True.

An active person can do mistakes and loose. My point is, there are no passive investments which can help create wealth.

Hi Manish….. A comment off the discussion topic….. Can you please post a topic on goal based investing? I want more specifics on withdrawal plan. For example if I have a financial goal to be achieved 15 years down the line. I started SIP for that goal with a 80:20 equity to debt ratio. Assume that the asset allocation of 80:20 will be maintained all the years as per the growth of each asset class. How and when should I start changing this ratio to get skewed more towards debt as I reach the goal? The motive of changing the asset allocation ratio is to minimize the loss at the time of final withdrawal as equity is volatile and unpredictable…. like… 60:40 in 13th year, 40:60 in 14th year, 20:80 in 15th year or whatever…. I don’t see many topics anywhere which discusses on a goal based withdrawal plan. Everywhere there is guidance on how to start investing but rarely I see a topic on how to exit safely from a goal based investment.

In the meantime, I did not see anything grow like real estate (housing plots) at least in my external money driven state, Kerala…. saw them growing with not less than 25% CAGR for the past five years and don’t see like it slowing down any time!!!!

I would say that for any goal, before 2 yrs , the money should be withdrawn totally and put into a debt option like FD or a debt mutual fund. That withdrawal can be done in parts like each month in 1 yrs !

Interesting post and thoughts.

As was highlighted, there was a boom period during first 5 years and almost a flat period subsequently.

However one should not assume bounty from market as one’s diligence. I know many who, though invested before 2006, got good (notional) returns till 2008, could not decide and left investments as they were and got nearly normal returns when they liquidated them subsequently. Thus, starting in a boom period may not gaurantee that becomes wealthy.

One needs to understand concept of reasonable return as a first step. Then one progresses cautiously from one step to a better one, understanding the intricacies there by improving his returns.

However, it is a problem in our system that these steps are not taught/learned in a proper fashion. Thus, mostly one gets exposed to investment after one gets a job, when he has little or no interest to learn step by step. Thus he approaches these so called experts and follow their prescriptions. Some times these prescriptions go well. One thinks that it is the greatness of the expert or more ludicrously, his own. As he does not know the real issues, if the bets fail one approaches the next expert and the story repeats.

One way out, can be financial education to children. It is a pity that children are not made a part of financial decision making and investments in their homes. Teenagers can be made to handle financial transactions on their own and can be shown the theoretical concepts of compound interest and risk have much relevance in real life.

As for the adults, it is never too late to learn. I understood few concepts of personal finance after 15 years of my working life, that too by chance.

Thus, with some understanding, matching one’s income and expenditure and planning, one can build one’s wealth continuously. If one grows his wealth continuously, even at a lower pace, he can amass considerable wealth in his working life.

Thats a very very good comment , What you have laid down is step by step process to get better return from your investments . I like it . Will make a post on this .

>>> “Equity gives good returns in long term”

Don’t you think timing matters significantly!!! If you would have got out of the market (wait I meant equities and invest in bond funds) late 2010 or early 2011 you could potentially be gaining even in bear market, Isn’t it!!!

In essence, can we know this ahead of time or as and when it is happening!!! The answer is YES, all we need to know is where to look for it.

Not everyone can read balance sheet/income statements. But few rules and basic understanding can provide equally good returns… HOW!!!!

1. Understand market timing – NOT implying IF we can do it but rather YES WE CAN DO IT. By using breadth indicators which NO ONE TALKS about cause NO one wants others to know this. Also the data is not easily available in VISUAL FORM

2. Find right patterns on stock with simple fundamental analysis could provide good returns.

I have mentioned this over n over and also demonstrating it in the blog/site…

Yes you are corrrect, what ever is mentioned in the article is for a common man who does not want to invest his time in market movements and wants to do passive investments like SIP in mutual funds.

hi manish,

nice piece of work put together..

but my only question is… How long is long.. 5 years you have put together. with less return now consider time period of

1992 to 2002 same senario of low return.. again how long is long.. must be aware of great depresion markets didnt gave return from 1929 to 1956.. more than 25 years of low return.. again how long is long?????

totally agree

You never can put a number like that, there cant be any X year after which you will get good returns , Its all about the probability . Higher the tenure, higher than chances of good returns ,read the 3rd chapter on my book .

xactly manish, thats what i am trying to convey. totally agree with u.. its all about probability.. 99% in your favour means 1% is also against you..

YES