Can your assets support your for next 30 yrs ? Download this Calculator and Find Out !

If you have Rs 50 lacs with you and you want to generate some consistent income for next many years, how many years you can generate income? Think about it! Put some very high level calculations in your mind and try to come up with some numbers! . Will it be able to generate a lac of monthly income for next 10 years or not? Will it be able to generate Rs 30,000 of inflation adjusted income every year for next 30 years or not? Will it be able to generate Rs 30,000 of income increasing at 5% each year for next 100 years or not?

Still wondering ?

Lets discuss a very basic problem which many people face in financial life. A lot of people at times have a big lump sum amount like 20 lacs, 50 lacs or say a crore! Now they want to know how much income can be generated using that big amount which can be used by their family. This can happen in many situations like following

1. When a person wants to make sure that he wants some kind of passive income out of a big chunk of money

2. A person might have got retired and now he wants to create a pension for himself using the big amount of money he/she has saved

3. A person wants to leave his job and because of uncertain future , he wants to utilize a big sum to generate a certain cash flow in future

4. You might want to find out how much of life insurance you should take so that your family can start getting monthly income by making a fixed deposit out of the money.

So lets take case of Rs 50 lacs ?

Coming back to our example – Let’s talk about Rs 50 lacs. How much monthly income can it generate? And for how many years? This will depend on three things.

- How much inflation you are considering

- How much return on the investment you are considering

- How much monthly income your want to generate per month

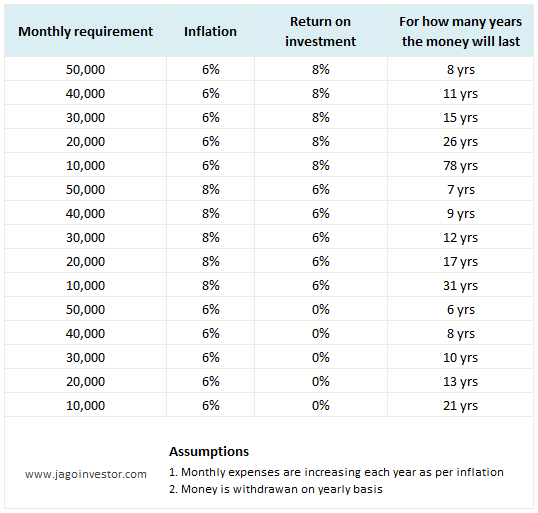

Here are some of the permutations and combinations assuming different values for Inflation , Return on investment and monthly expenses needed and a corpus of Rs 50 lacs in hand.

How to Calculate this ?

You can calculate this in many ways , but one of the ways you can do is by calculating it in excel sheet. We have this calculator on our upcoming Jagoinvestor Wealth Club product (our paid product) . You can download this calculator and play with different numbers and plan out for yourself. The calculator shows the answer along with the graph of the wealth and how it grows or shrinks over the years.

You can calculate this in many ways , but one of the ways you can do is by calculating it in excel sheet. We have this calculator on our upcoming Jagoinvestor Wealth Club product (our paid product) . You can download this calculator and play with different numbers and plan out for yourself. The calculator shows the answer along with the graph of the wealth and how it grows or shrinks over the years.

Was the calculator helpful for you? What other kind of tools you would like to have and to what level ? You can start using this calculator and see what is your net worth and how much monthly income can you generate at this moment if you leave your job and in case you are not able to bring money to home due to some issue.

September 24, 2012

September 24, 2012

Hi ! I am 28 years old bachelor living with my parents. We have got a corpus of 55 lakhs recently on sale of property. I have no job(active income), no own house, no insurance (any). Consider I will not do any job for your financial suggestions.

My Requirements and goals:

1. We need 20-25k per month for our living

2. My marriage within 2 years.

3. A 15-20 LAKH own house within 3-5 years.

4. I should have at least double my investment after 15-20 years

5. Retirement corpus.

My idea of planning: need expert opinion on this after reviewing:

1. 5 lakhs in bank account for first one year for monthly expenses and apply for IPO s for listing gains.

2. Park 40-45 lakhs in hybrid equity funds and opt for SWP of 35k after 12 months and SIP the remaining after monthly expenses into 1 mid cap and 1 small cap for long term say 7-10 years.

What I am missing here is how to choice various insurance like term and health for all members and an emergency fund. Will the term policy be applicable as we are not working ??? Also suggest me with a detailed restructuring of scenario. I am able to face medium risk and see that my Requirements are met. Or I would be happy to solve all with a different approach.

Awaiting your detailed reply

Dear Manishini, I know that I need term and health plans but what I am bothered more is that your comment and review on my planning. Also , how to allocate funds for buying insurances. Also, how to reach all my set up goals if I plan as detailed, would that suffice??? Kindly reply in detail

Hi Arjun

Thanks for asking your health insurance question. We will get on call with you and help you resolve your query. Please fill up your details at

http://jagoinvestor.dev.diginnovators.site/services/health-insurance

We will call you back

Manish

Dear Manish,

I have had invested in icici maximizer ulip whose maturity period is 10 years,l have completed 8 yrs of payment term and with current nav,fund value is 54 lacs.I wish to withdraw the policy and intend to have a secure income.How much income can be safely generated with mentioned amount?I am 38 years old now.Please advise,

Hi Rajnish

You can get a 35-40k income from that per month .

Manish

hi Manish,

thanks for your reply..yes i would like to know what all possible ways i can invest the money or allocate the money so that interest earned or generated money would be sufficient for my future post 7-8years..thanks again

We can build a mutual funds portfolio for you and get you invested. I will email you !

Manish

Hi Manish,

Thank you so much for responding. Unfortunately i didn’t get this sentence from your response which says ‘A 50L can give you 1 crore after a year and it can generate only around 20-30k per month with inflation linked to it.’

Are you trying to mean that after 8 years my money would grow to 1 crore and the interest I will get would be equivalent to 20-30k per month as on today’s value…

please clarify.

and also want to include since I have no big purchases to make like land/house/car/jwellery then please suggest me how can I invest the money in such a way so that I can travel around globe from the interest earned.

thanks in advance.

Hi sangeeta

50 lacs invested even in FD can give you 1 crore in 8 yrs . 1 crore can generate 80k per month , but that will be fixed for future (80k per month for years and years) . If you want a increasing interest which increased by inflation, then you will get 30k per month which can be increased in later years.

We can help you invest this money in such a way that it gives you monthly income . Let us know if you need our help in that !

Manish

Hi Manish,

I want to know if now I invest 50L in a bank FD for 8 years without withdrawing any money will that be a good idea to depend on that matured value after 8 years for the rest of my life upon interest. My age is now 30yrs.

Yes, you can do that and it will be enough, but only if your montly expenses are very low . A 50L can give you 1 crore after a year and it can generate only around 20-30k per month with inflation linked to it .

Manish

if some one have 5 lakh rupees to invest, can u help in suggesting where to invest except sharing and trading or mutual funds.

For how long ?

Dear Munish ji,

Please Answer it…….

if a person invests Rs, 2000 per month for twelve months in a jwellerry scheme & get Rs, 14000 on thirteenth month, so what % of interst is on investment of Rs. 12000 ,,which he invests in monthly installments he get ???

waiting for your soon reply With calculation

Thank you…

Maninder

You can use IRR for this , see it here http://jagoinvestor.dev.diginnovators.site/2009/08/what-is-irr-and-xirr-and-how-to.html

Just wanted to share this link for everyone’s benefit – http://www.mpfinancial.sites.acclipse.com/our_calculators. It has many free calculators similar to above. Also they arent password-protected, so those interested to know the logic/technical aspects of calculation can do so.

Thanks for sharing that Chaitanya !

Dear Manish,

This is an excellent tool. One aspect can be added to the calculator. Even one is retired, he may have some assets generating passive monthly income like MIS or rental income. If that aspect being captured in the calculation, the outcome will be more realistic

Thank you

Yea thats a good idea .. I will add that in future !

Awesome.Thanks for sharing the excel. Really helps!!!

Welcome Mahesh

Hi Manish,

Very cute calculator. I have shared this with a few friends at office and all are awed at this.

It would be good to get another similar calculator.

Say, my monthly expenses today is M. My age now is A. I expect to live till B. So, i would need Rs.M*12 for the next (B-A) years, inflation adjused every year.

So, we want a calculator to show what is the corpus amount i should have now, next 1 year and so on till B.

So inputs are M, A, B, Inflation, Returns% and output should be required corpus now, next 1 yr and so on till B.

This will give a picture of how much i should catch up before i call it quits for my work 🙂

Sure will be do that kind of calculator too .. infacts it already there in our upcoming Jagoinvestor Wealth Club !

Manish,

Can you please do a write up on the gold bhishi schemes run by most of the jewellers in India for e.g pay Rs.1000 per month for 12 months and get gold worth of Rs.13,000 in 13th month.

that means you will get a benefit of some 7-8% in a year .. what great about it !

Thanks you Manish for this wonderful arcticle which is eye opener. I tried various inputs in your calculator to get idea of planned retirement corpus. Now I am in even greater dilemna. I am 30 years old and married. My spouse is also employed. Confused whether to drop my plan of buying flat. I feel that its better to save the emi in some good mf sips and continue to stay in rented house, this will build my desired retirement corpus after 25 yrs. Please help

that you can do , but when you retire, do you prefer to roam around in rented places at old age ? Dont you think you would like to stay at some place which is fixed . What you can do is go for flat now , and in your retirement , sell it off and move to some smaller apartment or a city which is cheaper 🙂 .

Nice article. I have heard the inflation adjusted returns but practically ran the numbers first time through your calculator. Indeed an eye opening output. The cost inflation index of CII published by GoI in the range of 6-8% does not reflect the ground realiy. The working class with wife & kids has to cope up with rise in expenses towards Kids education (Eduflation), Vegetables & Fruits (Agflation), Medical care (Healthflation)and Transportation(Fuleflation).

While the government is keeping DA announcement as per the inflation, but it chose to turn the blind eye towards Fixed Deposit rates. Sometimes you get to see shocking announcements like inflation is up but the interest rates are down.

I do not think FD rates would ever be in the range of positive spread of 2-3% over inflation. The only way it seems to stretch the retirement corpus is by lowering the monthly expenses but one may have to be content with the inferior quality of life.

Yea .. thats the only option if you do not have much time left for retirement , else you can give one last push by taking risk with equities, minimum 10 yrs required for that .

This is a good template but as I understand to arrive at the figure you need the simple thumb rule is to multiply your yearly total expenses by 25 & you will get an amount which will last you through life (the famed 4% withdrawal rate Thumb rule). works excellent way for me

Thanks for that tip . But the point is maximum corpus means more security . Instead of 25 times, why not 50 times with 2% withdrawal rule ?

well @4% withdrawal rate the Corpus will not end for 30+ years this is assuming no addition to income, which is impossible, if you are looking at age of 30 as retirement &

if the retirement age is 60then you are covered upto 95 through this rule. which i believe to be an age greater than anybody is planning currently 🙂

Hmm yea .. thats a good idea ..

Great one as usual, Manish.

The bug pointed above reg “months” portion of the result is because the formula has INT(H18) to display “months”, it should instead be INT(H19).

Yes , I have fixed that , how did you figure it out ?

fine

I think calculator can be improved further, spending 50k per month from 50Lakh fd will last for 9 years not 8 years. Here are two calculations

a b c d e

Principle Expenditure Interest At year End

1 5000000 600000 376000 4776000

2 4776000 636000 356640 4496640

3 4496640 674160 332765 4155245

4 4155245 714610 303835 3744470

5 3744470 757486 269258 3256242

6 3256242 802935 228382 2681689

7 2681689 851111 180491 2011068

8 2011068 902178 124798 1233688

9 1233688 956309 60443 337822

337822 1013687 -13522 -689387

Interest Formula (B- C/2)*0.08

Principle Expenditure Interest At year End

1 5000000 600000 352000 4752000

2 4752000 636000 329280 4445280

3 4445280 674160 301690 4072810

4 4072810 714610 268656 3626856

5 3626856 757486 229550 3098919

6 3098919 802935 183679 2479663

7 2479663 851111 130284 1758835

8 1758835 902178 68533 925190

9 925190 956309 -2490 -33609

-33609 1013687 -83784 -1131080

Interest Formula (B-C)*0.08

Bhupesh

I dont think your assumption are same as calculators , the calculator assumes that the money will be withdrawn on yearly basis, so if one wants 50k per month ,he will withdraw 6 lacs in one shot . And then withdraw from it on monthly basis .

Then the remaining 44 lacs will be invested back and next year the expenses will increase by inflation . Do the calculations like this . And see the results !

Also as per the calcualtor the right answer is 8 yrs 10 months , which is close to 9 yrs only . There was a bug in earlier version of excel ,now its correct. download it again and check

Very useful calculator…good work again

Thanks Santanu

This is really an eye-opener! At the same time, I am really worried about my future as I had thought that I shall able to clear-off my Home Loan by the age of 40 and then next 10 years I will save for my retirement. In those 10 years, when I attend age of 50 years, even if I save Rs. 50lacs., this is less likely though, assuming Rate of return as 7% ( ROI will keep on decreasing over time), inflation at 6% and expenses per month Rs. 50000, the amount will last only for next 10 years i.e. till age of 60 only. If I would like to increase expenses per month, which is more likely, then the accumulated amount will not last till my age of 60 as well. This is really shocking. I think, I need to find out the ways so that I can accumulate at least triple the amount, Rs. 1.5 Cr, so that it will last for 30 years.

Looks like you have not read the first chapter of my book Jagoinvestor . better order it and read it , you will get more shock 🙂 , but it will be for your good only . http://www.flipkart.com/jago-investor-9380200415/p/itmd68wtdnghgyqz#read-reviews

Shock,

Saving will never make you rich, try investing.

Some simple suggestion, look if it helps you.

Suppose you are 40 now, you have 20 years for retirement.

Suppose you buy a plot worth 50 lacs with bank loan.

You can repay that loan for the next 20 years.

Now historically if you see the land appreciates much more than what you will pay as an interest.

Take a wild guess, it appreciates 10 times (conservatively), you have corpus of 5 Cr now…