Financial Planning Survey in India

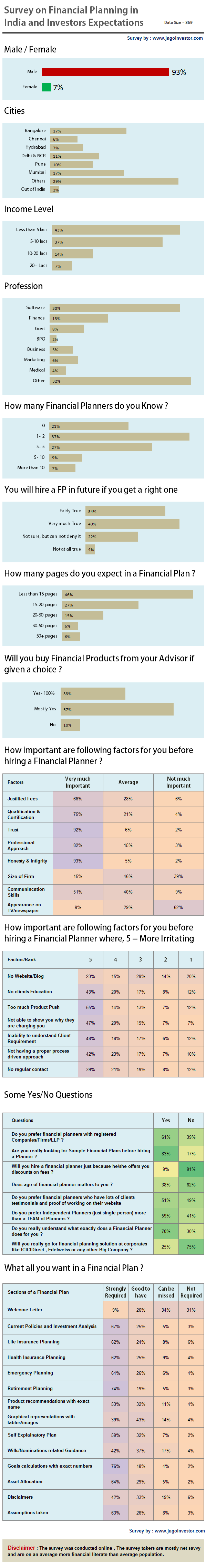

Jagoinvestor recently conducted a online Financial Planning Survey in India and what a common man expects out of the financial plan and a financial planner. I will list down some key observations, some learning based on survey results and finally compilation of the survey in a decent pictorial graph. Note that the survey was also published by Mint Newspaper. Here are the survey results:

Key Observations

- Total 869 people participated in Survey

- 93% respondents were Male, 7% female

- Trust Factor and Honest/Integrity was highest on rating. 92% said that the trust factor is extremely important, 93% said honesty and Integrity is extremely important.

- Mumbai and Bangalore had highest number of respondents with 17% each Chennai and Hyderabad was lowest in Metro category, NRIs were 2% of overall survey

- 21% respondents were having income of more than 10 lacs

- Top 3 professions were Software (30%) and Finance (13%) and Govt (8%) . The smallest was BPO

- Only 15% people said that Size of the Financial Planning firm is “very much important” to them

- Only 9% people said that “appearing on TV/newspaper” matters to them , 62% clearly said that its “Not much Important” .

- 83% people said that they expect or look for Sample Financial Plans before hiring a financial planner.

- 85% people said that they expect clean financial plan with tables/graphs into it.

- 91% people said that Discounts of Fees does not work if they dont see any value in them .

- 75% people said they will not go for any financial planning with corporates like ICICI Direct, Edelweiss or such firms.

- 90% people said that they will buy products from their financial planner only – if its a CHOICE, only 10% said they will not.

- About 58% people know less than 2 planners in India by their name, 21% know no one!

- 68% people feel that Financial Planning would have improved their financial life if they had taken it 5 yrs ago

- 74% people are very clear that they will hire a planner sometime in future if they get a RIGHT one .

- 73% people expect less than 20 pages in their financial plan , Only 12% said they would be happy to see more than 30 pages

- Most of the people do not want the welcome message and those stories in their financial plans

- In More than 10+ lacs income category , 42% people were from Software jobs

- In more than 10+ lacs income category from Bangalore , 74% were from Software and from Mumbai it was just 14% in Software , 48% Others

- 68% of Govt jobs holders were from Non-metro cities and 60% among them had less than 5 lacs income per year

Learnings for Financial Planners/Advisors out of Survey

1. Different Cities have their target markets

Each city is different from other. A Planner in Bangalore should mostly be targeting Software professionals (62%) rather than Doctors (1%), compared to some one in Delhi which had only 20% in software

2. Have a Dummy Sample Financial Plan for prospects , but make it beautiful

There is no doubt that prospects wants to know what they can expect from planners when it comes to that PDF which has things written to it, I know that one PDF is not Financial plan and it does not matter, still thats one tool to impress the prospect and show them what value one will get out of it .

3. Make your plans more attractive , clean and with tables/graphs

Its a clear indication that clients are not looking for 100% pure wordings in the plan, they expect some kind of tables or graphical representation in the plan. But make sure its only at places where it adds value or is required.

4. Don’t worry if you are not on TV or Newspaper

Being on TV/Newspaper is really a great way of increase a financial planner visibility, but only a handful of prospects will prefer a planner coming on TV than some one who is not . Coming on TV is good, but its not the business secret or the top most thing you should be looking for. 56% of survey takers said Appearning on TV/Newspaper is Not much important factor and only 37% said it was complementary , just 9% said that they would like to have some one who appears on TV shows or writes in Newspapers . However its very much clear that these factors increase visibility and helps a planner to increase trust .

5. Trim your Financial Plans to the point and short

A very big number said that they would like it to be less than 20 pages . Hardly few clients will read each and every page in great detail , for most of them what matters is the “solution” and how things look like . The maximum a plan should be of 25-30 page . More than 30 pages is some not expected from most of the clients.

6. Investors are afraid of Big Corporates companies For Financial Planning

Thanks to all the bad treatment all these years , big corporates firms (banking etc) , people are really not very much keen to go to them for financial planning . People seem to be more interested in pure financial planning firms or individuals .

7. Dont push for products – Clients will anyways buy it from you

I know most of the planners have experienced it already. 90% of the survey takers said that they are almost sure that they will buy the financial products from the planner/advisor only and will not go anywhere else . However a planner has to keep 2 things in mind. a) This point is true only if a client is satisfied with your work and is a happy client . b) At no point you should be pushing products to them or give them any feel that you are there just to sell them products (Too much product push is one of the biggest turn off) , hence just do what you should be doing and almost all the clients will buy the products from you, unless there is some other strong reason not to buy

What do investors think about this Financial Planning Survey in India ?

As a reader of this blog and someone who might be one of the investor, what do you think about this survey and the results ! . Do you agree with it . Do you want to point out something and talk about it ? Jagoinvestor also provides financial planning , you can look at our services page here

July 6, 2012

July 6, 2012

can you suggest good (honest) Financial planners in Bangalore. Whom ever i met are finally targetting to sell products.

Very Interesting Insight Manish.

Few important Analysis:

1.TRUST forms the major part of the clients decision.

2. Bangalore has elicited a lot of interest in Financial Planning.

3. It is not so much the number of pages in the Financial Plan, but the content and how you are able to connect with the client beyond just numbers.

Yes .. agree with all the 3 points you have put .. The Trust is the only thing because of which we are able to get our clients without even meeting them face to face 🙂 .

How much fees is the market rate for a Financial Planner who services a software engineer with 60k as monthly salary and has a surplus amount of around 15k per month.

The charges can range from 10k to 50k .

Hi Manish 🙂

Great work! I was just googling on financial planning stuff & that’s how landed to this page. Your survey is indeed very informative. Hope this creates the necessary awareness for the masses making them realize why FP is very much needed; and must be done by them on a “DO IT NOW” basis. They must also realize that FP is a pre-condition to deciding on Insurance (S.A.), setting of Financial Goals and scoring them too!This survey would also guide planners, as to what people are expecting out of them – advisory or selling or both 🙂 Hoping for the best!

Regards,

Rahul Shethiya

Thanks for appreciation Rahul !

Hi Manish

It was a really helpful survey for investors, and financial planners alike. I think its good to see the glass half full…and in this case, 74% of readers who were surveyed that they will look at hiring a financial planner if he/she finds the right one. So, the future of financial advisory is bright. Also, there was good amount of learning in terms of no. of pages an investor wants (max. 20 pages) and the fact that investors are not resistant towards buying products from the advisor.

however, the awareness is concentrated in select cities and it has to percolate to Tier 2 cities as well.

overall a very helpful survey.

good to hear you liked it 🙂

Hi Manish,

Great work. Most importantly, it complemented my decision of pursuing CFP.

Good.. which city are you practicing in ?

Dear Sir: What is the job of FP. Asset allocation ? Investing in Debt MFs or Equity MFs on behalf of the client? Trying to achieve goals of his client? I have burnt my fingers twice. I invested a big sum for my retirement in 2008. Instead if a SIP, I was made to put money in lump sum. Even today, after four years, I am incurring a minor loss. Later, I realised that those were the times when distributors of MFs were getting commission upfront. So in his greed to earn all the commission in one go, my FP advised to put in the money in one go. Also since the FP is also working on assumptions, there is no surety that his assumptions will be right. What if the market does not perform for the next three years.

I think FPs should be like doctors and true professionals – not sending their patients for unnecessary blood tests. But in today’s world, can you trust anybody.

Sanjiv

That will happen to you if you go for those planners who also sell your financial products . Why dont you hire some one who just advices what to do and not sell anything , so that he does not earn anything from where you put the money at all .

I was also in search of a professional financial planner , who have sensible approach to the whole task . I am lucky that I could came in contact with Jago investor team . I can vouch that this is the best education in personal Finance , I have got from them . I only wished that I could have got them much eariler in life .

Now I am not only able to improve my financial life , but also provide useful tips in my circle of friends & relatives

Thanks for appreciation Sandeep !

Hey Manish…

Once again excellent information….

Thanks..

Thanks Sachin !

[…] Investor, which is perhaps the best Indian personal finance blog, did a survey on what people wanted from a financial planner, and I thought the results were quite interesting, and worth sharing […]

Dear Manish,

Is Financial Planning is how to get maximum return out of investments (after considering risk level and adequate insurance) OR proper utilisation of money?

My doubt is what is the minimum income one should have to go for Financial Planner? If Financial Planners are advising how much loan Client can (Ex:EMIs-Not morethan 30% of Income) take based on Income client is earning, Planner should have also an Idea how much Income Client should have to bear Planner Fees. How can a Financial Planner can charge 10000/- for the Client whose monthly income is 10000PM. I think two ways to deal this issue. One, FP should charge as fixed percentage on Clients Income OR Second, he should not accept the clients whose income is below 1.5 Lak PA (For Example). That means he should tell (in his Ads),-‘only for those whose income is above 1.5 Lakh PA”

Is my view correct? Any alternatives!

Thank You

R Siva Prasad

Siva

More than Income , I must say what is the surplus he is left with each month , because a person with 50k salary might not be having anything at the end of the month and some one earning 25k can have 10k left . So its mainly what is left at the end of the month ,I thikn anyone with more than 10k or 20% of his income can be an eligible candidate !

I think Financial Planning is managing one’s finances to meet his/her life goals.

Financial Planning is not about getting max return, it is essentially goal-based planning–in simple terms –how much money you need, at what point of time and how much money you can invest from today onwards and the risk you are willing to take in order to get the expected return — I know this sounds confusing, that is why you need a financial planner to guide you . A good financial planner will draw up a plan based on your fund requirements after understanding your risk profile.

Very informative survey Manish.

I’m surprised that only 7% of the respondents were female though. Why do you think that is?

Manshu

I was not surprised by that number, when the number of readers itself will be 7% or 10% , obviously the survey will also reflect that, how many female readers does your blog or mine have ? I dont think more that 10% of total .

Also this survey was purely at my blog , so my blog demographics will apply 🙂

Manish

REALLY SIR FINANCIAL PLANNING HAS BECOME VERY IMPORTANT BECAUSE IT IS NOT TAUGHT IN COMPANIES TODAY AND AS THE NATURE OF WORK IS ROUND THE CLOCK ,WHERE IS THE TIME FOR INVESTMENT PLANNING.

Yea true .. thanks for your views , but what is the conclusion of your statement at the end ?

It is very much benefical for every one to plan for good life

And how does that happen ?

Dear Manish

I have became fan of your writing skills and knowledge about financial products. Most of the time I am reading your archived posts. This survey is really helpful but I wont be needing any financial advisor since there is so much useful data on ur website itself.

Thanks for your appreciation !

DEAR MANISH SIR,

VERY BENEFICIAL SURVEY REPORT IT REALLY HELP FOR INVESTORS

REGARDS

SRISHTI

welcome !

Was surprised to see Chennai have such a least number!!

Looks like lot of awareness is required in FP.

Yes .. the best markets seem to be Mumbai , Bangalore and now PUne also !

Dear Manish,

An useful insight for both the clients and FP’s. As you rightly pointed out clients are more interested in solutions and justifications for that solutions. Clients are not keen on Product name and company. The way in which FP’s understanding of client is very important. If possible please share some sample financial planning PDF’s

I think clients are interested in financial products names and categories !

Hi Manish,

Detailed worked out plan.Nice for FP Professionals as well as customers.

I had been one of the participant in this survey and was happy to see that most of my anwsers go with the majority of people….:)

Anyways keep up the good work and wish you all the best …..

Thanks for taking that survey Suhas !

Dear Manish,

A very very informative survey report published which should be of great help to investors as well as planners.

Regards,

Hitesh

Thanks Hitesh !