Which is the best bank for Home Loan ?

Taking a Home loan is a big task in itself and one of the biggest financial decisions. A home loan is the longest debt in our life. At times 10-20 yrs, which makes demands a long term commitment. Each month you have to pay your EMI, sometimes you have to prepay some part of home loan, sometimes you need some documents and visit the bank. There are numerous things to be done during taking the home loan and after taking the home loan, hence you should be very clear that which is the best bank for Home Loan. Without much confusion, it’s very clear that everyone wants to go with the bank which makes your life easy at the time of taking a home loan and even after that. So the biggest question on everyone’s mind is “Which is the best bank for a Home loan?”

First thing first, you have to be very very clear that their cant is a single bank or loan institution which is perfect for everything and you will never face any issue with them. Also, there is no “best bank for Home Loan” which has always worked for everyone to date. But overall we can always pick some banks which have been better than others on different parameters. You can say that on a high level “Bank A” is better than “Bank B” and this is based on many loan takers’ experience over the years. So now in this article, we will try to understand the difference between different banks and how they differ with each other. We will also see a survey result done with the vast community of this blog and which bank they choose collectively as the best bank for a home loan.

Public Companies vs Pvt Companies

While researching on this topic, the first thing which came to my mind was “all banks are the same, everyone has a bad experience will all kinds of banks, whether PSU or private”. But we have to understand that while some people can have a bad experience with some banks, there are a positive experiences too and we have to see things from a very high level and not judge a bank just based on a handful of bad experiences. The first confusion which comes to any loan taker mind is “PSU bank or private bank?” and based on the experience here is the conclusion.

PSU Banks are good post-loan but not friendly at the time of taking the loan

Private banks are very fast and friendly at the time of disbursing the home loan, they will treat you like a king up-till the loan is disbursed, but once every formality is complete and your home loan is sanctioned, you are a trash to them! As they are extremely aggressive in the marketing of home loans, a lot of people fall for it, Private companies presentation and the way they approach you is good but only till you are not a home loan customer. A lot of times private companies make things easy for you and also bend some rules for home loans. the number of documents they need also is less compared to a PSU bank.

On the other hand, PSU banks are not that great at the start of home loan , their rules are very strict and stringent and they still operate in the “sarkari” style, however, once your loan process is complete and things start, their afterlife is much easier compared to private banks. The overall handling is much professional and as per the process. In short, they don’t suck your blood every now and then as private companies do.

Private banks are first to raise the interest rates

On the interest rates increase and reduction side, its seen that private companies are first to raise the interest rates after the rate increase from the RBI side, but private banks hide somewhere when there is a time for reducing the interest rates. However, PSU banks are more transparent on this front and much less annoying than Private banks. Also private banks arbitrarily increase the pre-payment charges ( like from 2% to 3%) the conversion fees are also charged heavily if you want to move down to lower interest rates.

Also the changes of fraud at employees level in Private bank is much higher than PSU Banks. I can’t say that PSU banks are not into the bad game, but it’s much much higher in Private banks because of sales pressure and targets. There has been cases of forced selling of home insurance and also cross selling of ULIP’s and other financial products along with the home loan

Which is the best bank for Home loan in India?

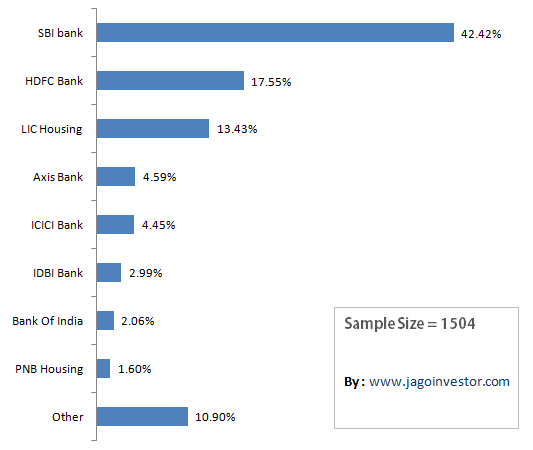

Now there are millions of people who have taken home loan and there are various parameters on which a bank can be ranked like Processing time for a home loan, Transparency in whole process, Attitude towards the customer, Interest rates and pre-payment charges, online tracking of your home loan after disbursement. But there is no ranking of banks on all these parameters. However still you can rank a bank overall as good or bad in total. I ran a survey on this blog and got around 1504 participants to vote for the best bank for home loans and based on that we can judge which banks are more preferable and more trusted. Here are the results.

Best Bank for Home Loan in India (Survey Results)

A good place to look for all the home loan related data (Click here)

Top 5 banks for Home Loan at the moment

If you see the survey above, you can clearly see that the top 5 banks for a home loan are SBI, HDFC, LIC Housing, Axis Bank and ICICI Bank and these 5 banks comprise 83% votes. While a big reason for this can be that these are big banks having a wide reach and has more customers and hence the results are a little biased. But at least you can see that out of 1504 people on this blog, 83% of them have a home loan from these 5 big banks, in which SBI tops the list.

1. SBI Bank

Based on the survey and overall reading’s done over the net and comments section of this blog. SBI bank seems to be the best bank for Home Loan. While SBI Bank still carries the hangover of Sarkari culture and they are strict in the overall process, which means you will have to run all over the bank and many times to get things done, but once the whole process is complete, maybe you will have a smooth experience overall. Things will be easy post home loan process if you need anythings from bank compared to other banks. For those who want to know why SBI is preferred, follow this thread

2. HDFC Bank

Overall HDFC bank seems to be have mixed reviews. Some people had a great experience and some had a very bad experience. HDFC Bank is overall recognized as the bank for the home loan itself. But overall the experience was very very mixed.

3. LIC Housing Finance

LIC housing finance seems to be a decent option after SBI. While they are not that great as SBI, still they seem to be a good choice after HDFC and ICICI bank. LIC Housing Finance has lesser documentation requirements, but one has to run around for smaller details. LIC seems to offer better rates and also giving the option to fix the interest rate for 5 years. One thing which many people do not know is that LIC reduces the interest rates for home loan for its customers having any insurance/investment policy with LIC by at least 0.25 %, but only if Sum assured of all policies collectively is more than 15,00,000 and all policies should be under the name of the loan applicant.

4. ICICI Bank

ICICI Bank seems to be very very fast and too friendly at the time of loan processing, but once the loan is done, life seems to be hell for most of the people. They are not very supportive most of the times and one gets too frustrated with their attitude. Overall their interest rates are also very high.

5. Axis Bank

Axis Bank is another good option as a big bank. One good thing about Axis bank is that they have NIL charges for any pre-payment. It’s a big surprise that Axis bank was more preferred than ICICI bank overall in the survey. While Axis Bank has few good options, there was one recent case from axis bank which I had highlighted on this blog on how they forced sell a life insurance policy along with home loan, While this was a negative thing from Axis Bank, we have to understand that good and bad experience are part of all the banks.

So what is the final answer ?

While there are positive and negative experiences from different banks, the clear answer coming out of different comments from readers and survey is that if one has to choose just one name, SBI bank is the best bank for home loans. We have seen most of the votes going to SBI Bank and all the pointers are suggesting that its the right choice.

Which bank do you have home loan with and what was your experience overall from start till the end. Can you share it in for others benefit?

May 21, 2012

May 21, 2012

Hello Sir,

Thanks for your article. I have taken home loan of Rs. 37L from IDBI bank in last year. Current ROI is 9.6%. However now, I need top up loan But IDBI rejected saying property valuation is not meeting the criteria. LICHFL has offered me Home + Top up @9.5. Transfer would take at least Rs. 17000/-says’ LIC personnel.

Should I transfer home loan to LIC? Please advice as none of my friend or acquaintances have taken loan from LICHFL yet and I really need topup.

Thanks,

Akshay

Hello Sir,

I have option from HDFC HFL (9.4%), PNB HFL (9.55%) and PSU banks ranging rate from 9.65%-9.75%. Out of all which option I should opt. Please guide as I am very confused due to interest rate and loan provider past history.

Thanks.

Hi Manish,

Currently i am paying 9.7% and for new loans only bank is offering at 9.4%. Can a bank give different interest to customers for home loan? I gave a letter to the bank. But no response. my loan’s remaining principle and tenure is 27L and 18years. can i switch to some other bank.

Please suggest.

Thanks.

Dear sir, I m planning for a home loan.plz tell me from which should I loan axis or HDFC? Reply on [email protected]

Dear Mr.Manish,

I liked your comments but I have certain doubts regarding hoam loan. It would be nice if you could opine.

Should i take a loan from HDFC or PNB Housing finance—

1)HDFC charges a mortgage of 0.5% of the loan amount (Andhra Pradesh govt norms)(Eg: 40,000for a 80lakh loan) BUT PNB housing doesnt charge the 0.5% and not even later ones the agreement is done and amount disbursed ,so I straight away save that 40,000

2) HDFC rate of interest 9.4% floating and PNB 9.45% floating (They are willing to give it for 9.45 from their actual rate of 9.55%) and they(PNB) say that the discount remains till the loan tenure

3) Changes of rate of interest is more with PNB 0.25% but Rs.2000+ ST with HDFC

What the PNB people are telling me that even though the difference in EMI is Rs.250 per month between the two and Rs.3000per year still its Rs.30,000 in ten years time and the initial money saved of Rs.40,000 to start with if we calculate the interest then its a big money.

4) Nil processing fees for both

I am confused. Because normally HDFC and SBI are the first banks to change the interest rate be it up or down. If we do a cost benefit analysis which one is beneficial , whether HDFC or PNB housing finance?

I am old by the HDFC people that there are major service elements and benefits with HDFC and the loan against property at a lower ROI for existing customers at a later date if in future loan is required.

KINDLY OPINE

Can you please ask your query briefly.

We get too many comments and hence cant answer such a long queries due to less man power

Manish

[…] Best Bank for Home Loan – SBI , HDFC , … – … the best bank for home … atleast can you recommend the best banks … Plz suggest which is a good bank to take loan and who can support me with … […]

Hi Manish,

I follow Jagoinvestor site for many of my concerns and Thanks for sharing yours information with us.

Best bank home loan article looks to be quite old, could you please share the current recommended banks ( nationalized and private) for an home loan. I heard that SBI takes long time in processing and they are restrict and reject loan if the property is having deviations from the plan . Pls recommend your options.

That would mean doing a fresh long survey 🙂 . Not a easy task as of now !

Manish- I know survey is huge effort, atleast can you recommend the best banks today for home loan. Thanks in advance

I am actually not aware of it . My personal experience is with HDFC and I am very happy with it !

Hi Manish,

I read your articles often. Jagoinvestor is the first place I think of for any questions regarding investments. Thanks for providing information to many of us.

This time I am checking your portal for information on how to put a check to the ‘harassment’ of housing loan providers. I have mine with LICHFL. I have some thoughts or feedback which I would like to share with you. Not sure if any others have felt these as issues ever.

a) They lack the system of communicating customers about a change in interest rate which obviously impacts the outstanding loan repayment schedule. I call this as irresponsibility. (my ROI was changed from 10.25 to 11.7 and no communication sent. I realized it very late.

When I visited the so called head office in Hyderabad(Madhapur, krishe saphire) I got a response that ‘we might have posted those letters, and that might have got missed somewhere’. When I asked about why you cannot email such communications, I got a response from the same branch manager that I can write feedback on their portal and she cannot do anything about it.

Is there a way to get LICHFL top management hear this feedback about their poor (and intentional) communication and ill treatment of customers? I did write to the email addresses mentioned, but never got a response.

b) Their customer portal never allows a complaint successfully posted. I tried it multiple times, while I sent email to the mail ids provided in the portal in April and have not seen a response till now.

c) They have an offer of reducing loan Rate of interest by paying 1145 /- + taxes extra. This was again not communicated. Is this done by all firms? What does prevailing laws say about this way of increasing and reducing after some payment?

d) I made a part payment through Cheque in May and I did not receive any communication again about the impact of that pre payment to the tenure. I visited a nearby branch today and they suggested I visit head branch to get this info and that they dont have access to these details. Strangely, same branch collected my pre-payment cheque!!

It feels as if their attitude is “you BORROWED and so you deserve this kind of empathy from us.” did you hear any such concerns from anyone?

I am willing to fight to get these corrected. I just dont know how to do that or if someone already doing that. I suspect this is the case with other similar firms?

This is lengthy, apologies. I am trying to reach you and ok if this is not shown on the website.

Regards

You should first complain to bank in this and reach out to banking ombudsman using this platform https://secweb.rbi.org.in/BO/precompltindex.htm

I have taken a loan from Lichfl and suffering..it looks like new customers don’t get the advantage of rate cut by rbi. For everything you need to go to their branch personally. Nobody attends the phone and this is the condition of Fort branch in Mumbai..sorry state

This seems to be old review. . .I just spoke to ICICI guy, he quoted lowest interest rate in market for balance tranfer @9.45% and 9.55% for top up amount. No prepayment charges after 1st EMI and no hidden charges ? Can you help me should i move from SBI to ICICI as I need top up loan and SBI wont give me till Dec 2016 as my other top up is working since Dec 2015.

Hi Vijay

I suggest you explore more options here – http://jagoinvestor.dev.diginnovators.site/solutions/apply-home-loan-transfer

Hi Sanjay Prasad,

have u bought the flat in secunderabad?

https://jagahuntblog.wordpress.com/2016/05/21/how-to-pay-off-home-loan-soon/

Hi,

We approached SBI with the required documents.

All our documents regarding the builder and seller was accepted by SBI,but they rejected one agreement called Tri party assignment agreement,made between builder seller and buyer,they said either builder should sell us the flat directly or the flat should get solely registered in the sellers name.

Since SBI confirmed all other papers are clear except for this agreement they said to approach other banks like icici.

and once registration is done and property is solely in our name they said they can transfer loan from icici to sbi.

Kindly advice if this kind of assignment agreement is usual,and wont create any trouble after its registered in our name solely.

Also which bank is better icici,hdfc,or axis interms of customer service/behavior after loan is disbursed etc.

Regards,

Shilpa

This looks good. Each bank has their own process and they are right if they want to follow this. Better apply for loan with ICICI and then transfer it later !

I am salaried person having all documents to process for Home loan with SBI /HDFC .

The property which i am looking also approved by both banks .

Rate of interest for both banks same . ( HDFC expected reduce to 9.4 %)

Process charges for SBI is ~ 15 K more than HDFC ( one time)

In long run which bank is better for Home loan .

Hi Bhavin

SBI / HDFC are top rated organisations for loans. I think you should check your options here

http://jagoinvestor.dev.diginnovators.site/solutions/apply-home-loan

Hi Manish,

This is Sanjay. I am working in PSU. I am 31, married and having one-year old baby. I am planning to purchase a 10-year old triple bed room flat in Secunderabad which is presently financed by Axis bank. The deal settled for 21 Lacs. I am very much confused about Home Loan. Some banks (Canara) are calculating eligibility based on Gross Income which is around 51K offering full loan (but has processing fee) whereas some banks (SBI, Axis) calculating eligibility based on my “take home pay” which is 33K and offering lesser than expected without processing fee. I do not have any existing loans with banks. I have internal loans taken within our company for which deduction is around 6000. I have pending EMIs and Credit Card bill not more than 10K which can be cleared in 2-3 months. My CIBIL score is 795 as per SBH enquiry. Our PSU is having MoU with Union Bank which is offering 9.65% without processing fee. SBI and few PSU bank staff is so reluctant to give clear information.

I would like to know,

What is the exact procedure banks (especially PSU banks) should follow to calculate eligibility.?

Which bank/housing fin. should I opt.? Being a PSU employee myself, I prefer PSU bank. Is it a good decision to go with UBI as we have MoU or Axis Bank as the original documents and loan of the present owner is with them.?

How long should be the tenure period (15, 20, 25, 30 yrs.)? What critiria should I follow to decide the tenure period for Tax saving etc.?

Is it worth to buy a 10-year old flat or shall I go for new flat or independent house.? Some people telling me that there won’t be much resale value for a 10-year old flat in future.

Please give me suggestions. This is first purchase.

Thank you.

There is no standard defined process. How does it matter to you? Take it from the bank from where you are getting the loan you require . You can opt for a 20 yrs old loan or 15 yrs if possible, but surely not a 30 yrs old !

You can go for a 10 yrs flat/villa if its in good condition. I cant comment much on that!

Thanks for the info Manish.

I am concerned about procedure because I feel that PSU banks should be transparent, shouldn’t they.? And, there is a difference between the interest rates and obviously any one prefer to go for the one which has lowest interest for loans and highest interest for deposits.

All the institutions (private or PSU) should be transparent. You should check each bank and see which one is offering the lowest rate to you

Need help for home loan on resale flat

You can apply for it here – http://jagoinvestor.dev.diginnovators.site/solutions/apply-home-loan

Manish

Hi manish,

I have running loan from LIC for which 2 years lockin period is finishing in next two months. My problem is I need another 7-8 Lac loan for builders demand of registration, VAT and others. Now LIC wont give me repair top-up loan so for that i need to transfer my loan to another bank. Plz suggest which is a good bank to take loan and who can support me with this extra demand. Another thing to my surprise is that LIC floating rate after lockin would be around 11 whereas currently rates are much lesser around 9.5. LIC guys told me that they follow LHPLR which is always higher and doesnt change easily like base rates.Plz help to understand this issue of difference in rates.

You cant always get the extra loan. May be you are not eligible for any further loan , thats why you are not getting it !

Hi Manish ,thanks for 2 very good books on investment from you.

i have one query and if you can help me, I m planing to buy plot for around 8 lacks. I already have home loan of 20L from sbi , how about getting a topup loan and invest in land, is it good option to use topup loan , as i already have home loan.

can u please suggest. ? I can afford topup loan along with home loan.

regards,

kns

Yes, I think its a good idea, better to take top up loan which will give you loan at lowest interest possible !

Hi

I like your information which you share with us , I also read this similar tutorial from another platform I think from this post user’s can more details about :

http://jagoinvestor.dev.diginnovators.site/2012/05/best-bank-home-loan-india.html

We are looking for a pre-approved home loan and are confused between Canfin Home Loans Ltd which sponsorship of Canara Bank & Axis Banks. . And Can Fin Intrest Rate stat 9.95% to 11.25% & Axis Start at 9.5% to 9.65% Can you please let us know according to you which bank would be better for a home loan considering all the parameters?

Hi Manish,

We are looking for a pre-approved home loan and are confused between Canfin Home Loans Ltd which sponsorship of Canara Bank & Axis Banks. . And Can Fin Intrest Rate stat 9.95% to 11.25% & Axis Start at 9.5% to 9.65% Can you please let us know according to you which bank would be better for a home loan considering all the parameters?

An my salary account is Axis banl only kindly confirm which is best?

I think we will not be able to comment on that

Hi Manish,

Thanks for the post, It was very intuitive.

I am looking to purchase an apartment on second sale, which is 3 years old.Currently the owner has a loan running in LIC for 21.5 lakhs. I am confused on whether to transfer the loan to my name in LIC itself or taking an loan amount of 20 lakhs in SBI. Please help me on this.

Thanks,

Lokesh

I suggest taking up a topup loan for your requirement from the same lender

Hi Manish,

We are looking for a pre-approved home loan and are confused between HDFC & Axis Banks. HDFC is providing ROI as 9.50% (Base rate=9.30% + Markup = 0.20%) whereas Axis too as 9.50% (Base Rate=9.50% + fixed mark up of 0%). The processing fees for HDFC is around 10K, whereas for Axis it’s around 5K. Rest of the charges remain same.. Can you please let us know according to you which bank would be better for a home loan considering all the parameters?

Hi Dhans

I am not sure if there is a straight answer to that. HDFC is pretty known in home loans, so I would go with that option !

Thanks for the suggestion Manish.

Hi Manish,

I want to know which one is the best option for Home Loan i.e. Axis Bank or DHFL

I am a salaried person & need to get the loan proceed as soon as possible at the lowest interest rate & processing fee.

-Bhuwan

I would choose Axis ..