Review of Portfolio management softwares in India – MProfit, Perfios, Intuit

Which Portfolio Management Softwares do you use ? Some of the Portfolio Management Softwares in India are MProfit, Perfios, Intuit and Investplus and we will see a detailed review of these portfolio trackers in detail. Portfolio Management & monitoring is an important part of managing a good financial life and if your financial life has different components like Real Estate, Loans, Life Insurance Policies, Mutual funds, stocks and ULIP’s. You can also track your portfolio using Excel and there are lot of templates also, but it can be a tedious task to monitor which part of your financial life is doing well and how much worth do you have at each level using an excel template for Portfolio management. Hence, you can use portfolio management software which suits your needs. There are tons of Free portfolio management softwares which you can start with

![]()

There are many paid as well as free portfolio trackers available in the market which you can use to track and manage your financial data. I really recommend using one of these so that you have all the data at one place and you don’t need to struggle every time to find out your own information. Once we put all the information at one place, we get a clearer and a complete picture, which we don’t get otherwise… We are amazed to see our clients find out that they are worth so much or worth so less once we start discussing with them their financial life data.

Some important features of Portfolio management softwares

Now we will discuss some of the most important aspects of portfolio management softwares in India . These points are top level concerns of customers.

Data Security of Portfolio Management Softwares

A very big concern which most of the people have is where will their financial data be (example) ? Will it be on their local computer or will it is at third-party server and this becomes a big blocking point for them to go for those products which stores their data at their end itself. Here I am not talking about the login & password, but the actual numbers of their financial details. A lot of people don’t want their info to reside on other servers. I personally don’t buy that argument, but that’s a big concern for a lot of people. In a survey done by JagoInvestor last month, the number one concern which people had was data security, ahead of pricing and features.

Regarding the security of login credentials, with the advancement in technology and strong security advancements, it has become virtually 99.999% secure if not 100%. A lot of solutions also give an option for users to link their bank accounts, credit card and other online accounts by providing the passwords. A lot of people do not know how it works internally…

An online money manager will work well only if you provide online access to banking accounts for a one-time setup. This raises security concerns, but here is how it works. The login username and password for individual online banking accounts is used to retrieve read-only data. The ‘transaction password’ for online banking should be different from the ‘login password’ for greater security. You don’t have to reveal your ‘transaction password’. Customers do not have to give any personally identifiable information, making the process safer. Moreover, the account is completely anonymous and requires only a username and password. All the banking accounts are linked to provide consolidated data. In the consolidation process, vendors will have access to your financial records on a read-only basis, but privacy policies of these entities should prevent abuse of information. – source : moneylife

Features provided

I was surprised to see that in our survey, most of the people voted for high features and less on simple features. I personally thought that most of the people will love to have something which provides them less, but rich data. But actually people look for lot of features giving them number of reports and graphs. It’s very important for someone using the software getting more analysis and suggestions on what one should do in their financial life rather than just getting some plain info which they would have done on their own. Most of the software providers give good analysis along with different type of reports and charts which you can download in excel formats.

Easy to use

It’s extremely important that the softwares are easy to use because no one would put a lot of time to feed the data at the start and on ongoing basis. A lot of players provide statement upload facility where you can just upload your Bank Statement, Credit card statement or other demat statements and the software will put out the information and feed it automatically, thus reducing your work. Some softwares like Perfios allow you to link your accounts with them so that they can pull your information and feed it themselves (read only).

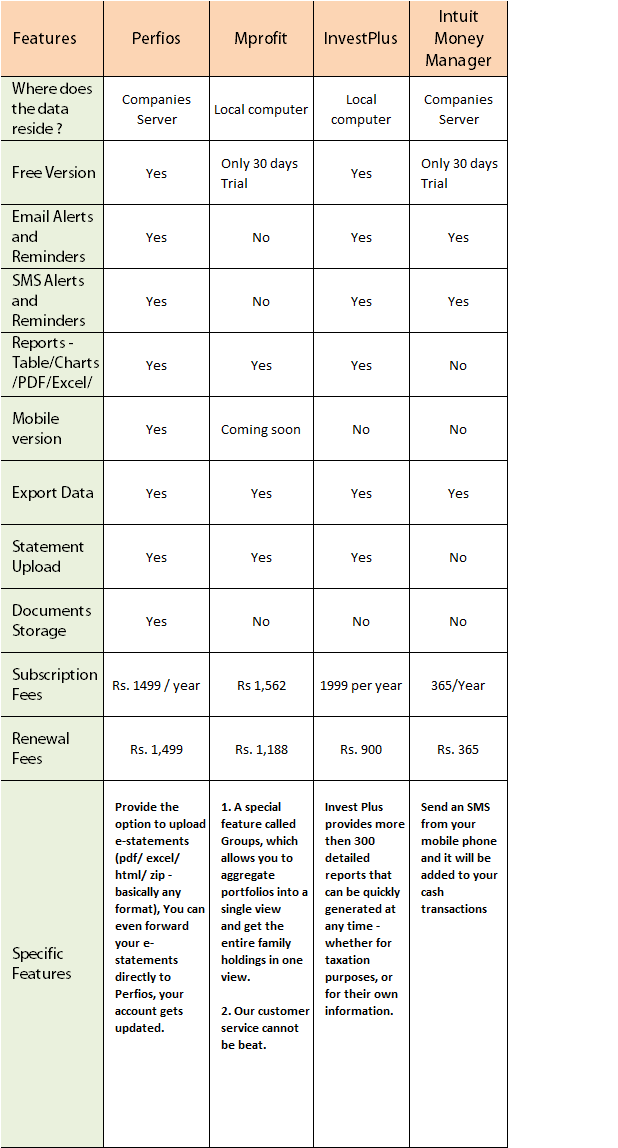

Below is a comparison of 4 major Portfolio management software’s in India market and used by thousands of people (you can read their reviews on their website). They are Perfios, mProfit, Investplus and Intuit MoneyManager

Look at the above video done by me and Manish Jain from Mprofit .

Free and Trial versions

I would say you should take advantage of Free and Trial versions of softwares, Like Mprofit gives away a full functional 30 days trial, where as Perfios and Investplus have free versions which are good enough. If you don’t want to use any software, you can manage your finances at very basic level in an excel sheet, but you will have keep updating the values etc from time to time as the situation changes, which is not the case with softwares, as they auto-update the values.

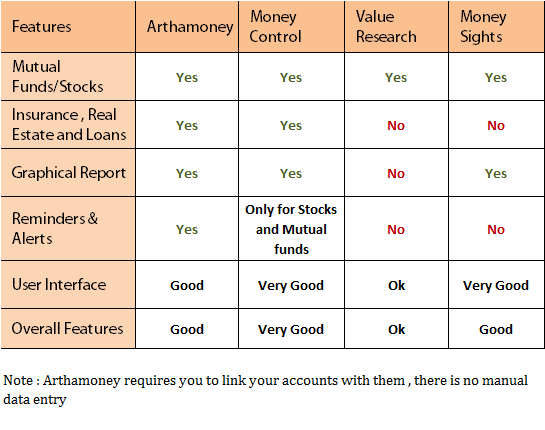

Free tools for Portfolio management

A lot of people don’t go for advanced tools and use free tools available in market which does a good enough job. Tools like money-control tracker and Valueresearchonline tracker are used by lacs of people to track their mutual funds and stock holdings. But they do not give you all the functionalities which fully fledged software’s give to you. Below is the chart explaining Arthamoney, Moneycontrol , Valueresearch and Moneysights portfolio trackers. I hope liked this review of Portfolio management softwares !

I would say you should definitely try out some softwares which provide a free version and also explore the free options, there is lot they provide free of cost and all you need is to put your data there. Some other tools which you can use are rediff money (only for stocks and mutual funds, but I like the UI), myirisplus, yodlee and rupeex.com. Please share what more do you look from these softwares and what do you think about the value you get out of these management softwares?

6 Free Portfolio Management Software Licence from Perfios

Update 12 Aug : The 6 winners are selected and this giveaway is not valid now

Perfios is willing to give away 6 free Platinum licences to Jagoinvestor readers for the first year (worth 1499). The first 10 commentators who share this article on their Facebook profile will get those licences (just cc manish at jagoinvestor dot com) (to share it on Facebook, just “like” this article below and put your comment in the box which opens).

August 10, 2011

August 10, 2011

hi,

its a great article.

do u plan to update this article with the new softwares available in the market, grandfathering & supporting various asset classes (bonds, equities, insurance, fd’s etc) with their corporate actions?

YEs its a pending task, will do it .. but not sure when because there are so many things on my todo list!

Hi Manish,

I have tried MProfit free version for stocks, MFs, FDs and bullion. But I found that it only gives an accounting average price of your stocks. Say I buy 100 shares of X at 100 and process goes to 200, so I free up my investment by selling 50. Now my actual average is 0 but MProfit still shows it to be 100 since that’s accounting average. Any software which can give me both?

I have no idea on that.

How would you rate the new breed of softwares/ facilities given by Economic times, or Google finance or Yahoo. agreed that they all have your data at their mercy and some people may not be comfortable doing it.

Hi Dilip Kulkarni

I have not checked it myself !

Queries asked to hdfc customer care around Aditya Birla Money myuniverse integration with HDFC, as it has only a single password, though some transactions are OTP protected.

1. Do they have a formal tie-up with you?

2. Is the integration with them reviewed by HDFC security teams?

3. Is it safe to use my login credentials on their site?

4. Will they have only read-only access to my account?

Response:

We request you to use our Net Banking website for the safer transaction

Myuniverse customer care mentions they do store the login credentials encrypted on their US servers.

Any thoughts?

Any thoughts

I think you can go ahead with them . It totally depends on your personal comfort level with these things ..

If i do not want to track the value of my portfolio,but just want to do accounts of my family by uploading contract notes of angel broking …. Which will be the right software for me.

I am a portfolio advisor and handle HNI clients .

I think MProfit is a good choice , they have a advisor version also

[…] Portfolio manangement softwares Review – Mprofit … – Which Portfolio Management Softwares do you use ? Some of the Portfolio Management Softwares in India are MProfit, Perfios, Intuit and Investplus and we will …… […]

Excellent review,

I have decided to purchase Mprofit Software. I searched on their site for pricing details, but it was not available there. If you are aware about the price list of their 3 version of softwares please give me one reply and help. Enthusiastically waiting for your reply. thank you.

Its not here .. Contact them on their website !

Thanks for the review. Working in a large financial institution I am paranoid about how the financial data can be misused.

Case 1: Online upload by providing credentials

By providing credentials to a third party software the users may be potentially exposing themselves to a great risk with no legal options, when the terms of use of banks and other institutions clearly state that passwords and PIN’s should not be disclosed to anyone.

Example,

http://www.icicibank.com/online-safe-banking/internet-password.html

“ICICI Bank is NOT liable for any loss arising from your sharing of your user IDs, passwords, cards, card numbers or PINs with anyone, nor from their consequent unauthorized use.”

Does the software instutions have any agreement with the financial institution regarding exchange of data in a secure way and who assumes the fallout case in case of data loss?.

Case 2 – Offline upload of statements

Even the statement uploads the following “personally identifiable” data like name, address, telephone, PAN, Folio numbers, bank account numbers, credit card numbers. .etc can be extracted and stored in remote database. Even if they give all the claims about using all industry certifications we as ousiders do now know or cannot verify what level of internal data protection processes or mechanisms are used within the company. Even large companies experience data theft and loss. In other countries there are rules like HIPPA, DPA, PCI DSS, but here there is none and in case of data loss nothing can be done.

Any person armed with this information can target the users or their family with spear phishing, and get all the remaining information to swindle your hard earned money. Heck a lot of the information is even available online – you just look at electoral roll which is publicly available to get your name, address, family and date of birth. You may be divulging a lot of information in your facebook or twitter accounts. Just think in a telephonic call with the bank what information they require to authenticate you and how much of that is freely available online. In case of PMS software you may be exposing your entire financial information in one shot.

Solution: I recommend masking (replace characters with a logic of your own) all the personally identifiable information in statements before uploading to these software. I have verifired this works in perfios.

For Protected PDF statements, you need to decrypt it, edit it and then use the same. Excel statements are more easy to mask.

Thanks for sharing this information !

I have tested Perfios, it still needs enhancements. They have not built the logic correctly for the bonds program.

Thanks for sharing your review !

I am very pleased with your detailed article and insight.

I recently found one more portfolio application which is rich in feature and performance is also good, you can study this also and compare it with others.

http://www.askkuber.com/Portfolio/Home

Parvesh

Thanks for sharing that

Very useful article, Manish.

I started using mprofit and it had helped me a lot in managing my finances.Thanks again

ashish

Thanks for sharing that !

Hello Manish,

Any software that tracks Gold & Silver prices online along with Stocks & Mf”s? I mean Gold & Silver physical prices not ETF’s.

Hello Manish

This is a great article and a step in the right direction for people to learn to manage their finances. I am curious if anyone has had any experience in tracking bonds traded on NSE/BSE e.g. lets say I had bought NHAI bonds in 2011 and now I want to see their present value on the exchange. I find that most software only allow stock values to be tracked. I have not seen any software so far which allows this to be done. Any inputs appreciated

Not aware of this .. Let me check with Manish Jain of Mprofit . he might know this .. hold on ..

Hello,

We currently don’t track these bonds in real-time. Our MProfit users enter the transaction under Bonds, then manually up date the price from time to time.

We are planning to offering a delayed price feed for these instruments but can’t really give a timeline for when it will be implemented.

Hello Manish Chauhan and Manish Jain Thank you for your response clarifying the bond holdings. Can you please give info on where one can get the latest value of tax free bonds e.g. NHAI as mentioned in the earlier query. Thanks

One of the best resources on the web is located at:

https://www.edelweiss.in/Debt/default.aspx

Dear Manish,

Thank you for guiding us on the available software. Indeed very helpful. Can you suggest a tool that can support multiple currencies? I am trying my hands on Quicken Premier 2013 and it serves the purpose. However, it doesn’t differentiate between USD and INR when you connect your Indian bank account. Also, the investment part does not download the stock prices. In the end, I have to do everything manual when it comes to Indian bank account and investment.

Thank you for sharing your thoughts in anticipation.

Try Yodlee

Thank you Karthik. I will try my hands on it. Will give my view once I am done.

You should try http://www.myuniverse.co.in which offers both usability as well as personal finance management.

MyUniverse is a unique solution which offers its customers an opportunity to manage their scattered finances through an integrated online money management platform. The unique platform enables customers to aggregate their bank accounts, investments including gold and real estate, credit cards, loans, incomes, expenses in a highly secure environment. The platform gives customers a single window view into their financial universe thereby helping them evaluate their actual net worth and provides advice on money management.

Thanks for sharing that .. are you from Aditya birla company ?

I tried the free version of perfios. it has integration channels to obtain your investment information with most of the banks / insurane firms etc. which is a real food feature. That way it is useful. but the GUI was not very good. It could have have been made simpler on while and black. it looks decorative like an entertainment site.

Yes.. agree to that 🙂

Thanks for putting up this.. I migrated to intuit with moneycontrol sometime ago. Now that they have asked to download our data since from 28-Feb they’d close the service. But they’d continue with ICICI.

Have felt some accounts that dont have linkage (Ex. LIC now… ) makes it difficult since we get used to uto syncing rest.

Find Perfios linking more sites than intuit that I used.

Its good to see Perfios can be totally free.. May give it a tray soon before 28 Feb!

Thanks.

Yea .. just have a look at it , there is a free version of it and pretty good one !

Hi Manish,

Thanks for the information on above topic.

I have just started with the financial planning and was desperately looking for some tool like this.

Tried Arthamoney and Perfios, but Perfios is much better.

In Arthamoney we have to update the accounts detail or some of the information manually, we even unable to upload the statements directly from pdf.

Thanks currently using Perfios free version.

-Abhinav

Good to hear that .. Perfios basic free version is good enough !

Dear Manish,

Its nice article on portfolio manager. Is it safe to link accounts with podtfolio manager sites such as arthamoney

Its about your trust, better do it with more famous companies!

Kindly suggest more famous companies. Thanks.

I am not aware of more .. you can ask here http://jagoinvestor.dev.diginnovators.site/forum

Dear Manish,

Its nice article on portfolio manager. Is it safe to link accounts with podtfolio manager sites such as arthamoney.com