Endowment Effect affects your financial decisions

Do you know that you are holding some of the bad financial products in your portfolio? Also you are not clearing some of this mess because of a very well-known behavioural concept called “Endowment Effect”. Did you know that this same behavioural concept is used by the sellers to make more sales! I will talk about that also.

Endowment Effect

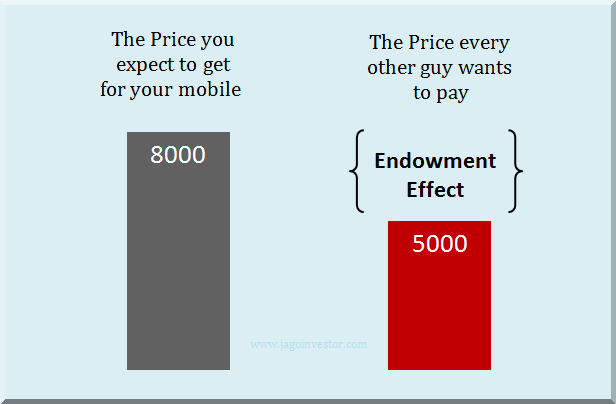

Endowment Effect theory is a well-known concept in the world of Behavioural Finance. Endowment Effect says that we tend to value thing more just because we own it. However we don’t value things more in pricing terms if we don’t own it. Endowment Effect also says that we tend to love what we have already and if someday we need to change it, it’s not easy for us. We resist it a lot. So final one line conclusion is “If I own it, it’s good and it’s valuable and if I don’t own it, I am not sure, maybe it’s not worth!” . You can see this in all aspects of your life. Check with any couple, who has the cutest child in the world? Check with any employee who loves his organisation; ask him which is the best company to work for ? Ask any murderer’s parents, if they really think their son/daughter is involved in crime and you can hear, “No it’s not possible, their son/daughter is innocent”. So the point endowment effect puts is, what is ours is clean, good and worth something. This is what happens with most of the people , if not all .

To explain it other simple words; How much money do you expect for your mobile phone, if you wanted to sell it? And then think how much money would you like to pay to someone if you wanted to buy it? In most of the cases, one wants a higher price when he wants to sell and wants to get the same thing for lower price. There is nothing wrong in this as we all are human and we will think from money point of view. But take the underlying learning from here. If a person has something, he treats it very special and does not think rationally at times and it affects him a lot in his financial life. A lot of people don’t want to admit that what they have is ordinary and just like others. Let me take each area of financial life and show you how it’s applicable there.

Example of Endowment Effect with Stocks

You might be able to relate to this. The stocks you own are always worth and they have potential to go up, that’s what you think. If market goes up, you feel that your stock has potential to go further up and if markets go down, you say – “huh!, this is temporary, they don’t understand how strong fundamentals are for this stock, I will wait”.

In 99% cases its nothing but endowment effect, just because you have it, you start feeling special about it, but the other guy from some distance can clearly see what an idiot you have been so far! And incase you didn’t hold that stock, it might happen that you would have not recommended it to someone else, you could see things clearly only if you don’t own it. (read my experience) Even in mutual funds, if some of your friend asks you which funds he should go for, most of the people will recommend mutual funds which they already hold. For them just because they have bought some XYZ mutual fund, it’s one of the best (that’s why they bought).

We get comfortable & repulsive to change

Another big thing which happens to us is that once we buy something or own something, we start being very comfortable with it and find all the reasons of why it’s good for us and why it’s not worth changing it. Look at your job portfolio, its same!. (read another beautiful concept called Mental Accounting).

How Trial & Money back guarantees make use of Endowment Effect

So now you will relate to Trial & Money back guarantees. Once we bring something on Trail or buy product on money back guarantee; almost never one’s returns back as they have tasted it, felt it, owned it and now they believe that they need it. I have never seen anyone returning some product which was on money guarantee! The sellers understand the power of endowment effect and hence use it to their advantage. In his book called “Stocks to Riches”, Parag Parikh talks about an incident relating to this.

Raju : Mom, See what I have got !, The latest Stereo system . It will fit perfectly in our drawing-room. Wait till I play it , you will love the sound.

Mom : Raju, where did you get the money to pay for such an expensive item ?

Raju : Its on a 15 day trial basis , The shop round the corner allows you to use the goods before you buy it . Since college is closed for 2 weeks , I thought I will listen to music for some days .

Mom : Are you sure they will take it without any fuss ?

Raju : Off course Mom , dont worry , see here is the card . It says that they will take it back , No questions Asked !, if refunded with 15 days trial period.

Mom : Thats great , Handle it carefully . They may not take it back if it’s misused.

Raju : Dont worry , I will be careful .

After 14 days…

Mom : Raju , dont forget that trial period ends tomorrow, We will really miss this stereo , we had so fun listening to music .

Raj : Did you notice how exactly this fits our decor and space . I really love its sound . We wanted it from so long , Lets keep it only , and make the payment , anyways we needed it .

Mom : Yea , I think we should keep it , the price is also justifiable and within our budget and we really needed on for long and the best part is we got to use it without paying :

Did you see how Raju and his Mom got comfortable with the stereo? A seller knew that out of 10 times, 5-6 times people will get starting loving what they start using and accept it as part of their life. Not a big price to pay for 15 day trial!

Conclusion

One should think about his financial products from other’s eye also and should be open to accept that it’s time to find alternatives and change it. Don’t just concentrate on those points which makes you believe that what you own is best, also see the bad side. Let me know if you realise that you have seen this endowment effect in your life ?

July 15, 2011

July 15, 2011

Hi Manish ,

Thanq very much , wonderful article 🙂

hey nice article…didn’t know it was called the endowment effect…thanks for letting us know and improving our vocab in the process 🙂

Hi Manish,

Very Excellent Article. I felt my endowment effect of mine as follows..

1. I purchased a flat for Rs.31 Lakhs. I am planning to settle in my life after 10 years. apart form my savings & investment, i am willing to sell the flat with in 10 years for Rs.1 crore(!!!).

2. I am in telecom field for the last 8 years& i am earing well. I know that this profile will not be suitable after 5 years due to competition and low tariffs(we belong to indian customers only). I planned to change my job profile to professor. But many people as sticking with their job profile even after their field got down..

Anyway , after became the jagoinvestor fan, i surrendered many useless policies. But my friends are kidding me without knowing the fact(endowment effect)..

TS Ashok

Good to see your positive expectations from real estate in coming 10 yrs . I hope you have covered your self with term plan now after surrendering the useless policies .

Manish

Hi ALL,

Forget everything and this effects , buy a piece of land or Property any where in India this the most efficient financial planning in emerging economy like INDIA.

As India tends to grow another 20-25 years with average rate of 8 % , property will never let you down. (Which may be not in the investments like Stocks or Equity MF’s ). {Except in World War III}

Vinay

Thanks for your views .. I would like to hear others comment on this .

Manish

Dear Manish ,Excellent article as usual. Because of this effect people tend to hold stuff with them even if they don’t require it like e.g. old vehicles,books,furniture etc. I would like to share my experince about this. We have old Bajaj Scooter which my father has stopped using around 4 years back but he hasn’t sold it, reason? he felt he is getting too less money for it. He could have sold it 4 years back even for say for Rs.5000 & could have invested that money in say mutual fund or gold coin; but now that scooter can be sold only as scrap.

In the same way I have seen in homes of my friends,relatives that they have so much stuff which they don’t use but they are reluctant to sell it because they expect much more price for it.I feel that is locked money whatever small amount that may be.This creates another problem of Clutter (this is another but interesting subject).If we sell the old things which we never use we can declutter our homes,get the extra space for our use & can get some money which we can invest.

Swapnil

very good points . I agree with you that people dont look at time cost , if they get 5,000 today , its bad , if they get 6,000 after 4 yrs , it good 🙂 . What a waste !

Manish

If some one has spare money in saving account then i think these plans r not ver ybad …as they are giving 6% returns for 20-25 yrs which is good.No product gives guranteee for such a long time and as per me it increases deversity in ur profile.Even FDs are only for 5-6 yrs maxi..so time period doesn’t have any value ?

Yogesh

I am not sure how much it would add to have products with 6% return for long term. And you never know how much you can make in next 20 yrs from equity products . what if its 12% ?

Manish

Hi Manish,

Very Rightly written.

In personal finance the guarantee is has the highest impact on such behaviour.Attach this to any product and you will see maximum application.I have met so many clients who although have a junk portfolio but still want to continue it because it guarantee them something.

That’s why we as Financial Consultants has to do a lot of hard work in educating people.Hopefully, many are realizing.

But a nice analogy you have written.

Jitendra

Yea .. we also face this with our clients ,but we make sure we convince them in getting rid of it , When you show them those unconfortable situation, It will work out .

Manish

Hi Jitendra,

There is one more reason for people sticking on to junk portfolio other than guarantee which is explained in behavioral finance as ” Sunk Cost Fallacy” Even if clients know that they have taken an insurance plan with higher charges still they will be willing to continue paying premiums.

These video links give an idea about Sunk Cost Fallacy in business, investment and day to day life.

http://youtu.be/xGKTXxxeKeQ

A good article on sunk cost fallacy and ULIP

http://capitalmind.in/2010/06/ulip-exits-and-the-sunk-cost-fallacy/

Hi Manish

Firtstly thanks to your wonderful blog (and many wonderful bloggers like subra, vinaya and direndra/ value research…) and Srikanth of fundsindia (though it took almost 5 months to activate it with no fault of theirs) which pushed me back to restart SIP “TODAY” (happened to be in your action month too 🙂 ) which i neglected because of low returns for a couple of years. I hope i will not stop it anymore now.

The endowment effect i want to share with you is – for the past 4 years i wanted to buy a plot for a house my home town. It was quoting roughly 1.5 lakh per cent at that time and i felt is too high, so thought will wait for a correction and expected to have enough cash savings in a year time rather than going for any loan. Each year i go on vacation WITH CONVICTION THAT EVEN A 10% OVER LAST QUOTE is a justifiable rate i was asked last time. But to my dismay i find it will be minimum 50% above the quote i got previously. so the same assumptions as before continued and by the next visit the same result of minimum 50% over last time.

2 months back when i went the quote i had was 4.5 lakh per cent and i had to return back empty handed as usual. Right now i am finding ways to convince myself that this is a fair price so that by next time i go i will be ready for a minimum of 5.0 lakh per cent is good for me though during these years i have convinced myself of reducingthe area requirement by almost 50%..:(. Hope one day my dream will come true after the much anticipated real estate correctin comes in… I feel this “endowment effect” is much more in the real estate than in stocks though i too have burnt my hand in it and learning the things hard way.

Once again thanks for the wonderful blog.

Shinu

Shinu

Yea .. Endowment effect in real estate is very much there , and its too heavy in that 🙂 . The first reason is because the amount involved is very hugh compared to stocks .

Thanks for sharing your experience with all of us .

Manish

nice article!!

and i will restrict my comment to financial product only –

one should do the necessary due diligence before buying the financial product/service and what maybe best for you may not be apt for someone else and vice versa…. but yes one should be open to accept that it’s time to find alternatives and change if what you have bought is not working for you.

Deepika

And thats what most of the people dont do ! . They are not ready to accept it that they have bought junk and they need to get rid of it ?

Did you ever see endowment effect coming in your life ?

Manish