How Chit Funds Works

What are Chit funds and how do Chit funds work ? There are lots of chit funds in india like shriram chit funds , margadarsi chit funds and I would like to show you how chit funds exactly work and what are pros and cons in Chit funds. Over the past many years there has been large scale frauds and scams done by large chit fund companies. However, a lot of people do not understand the working and wonder how chit fund works.

What are Chit Funds & How they work !

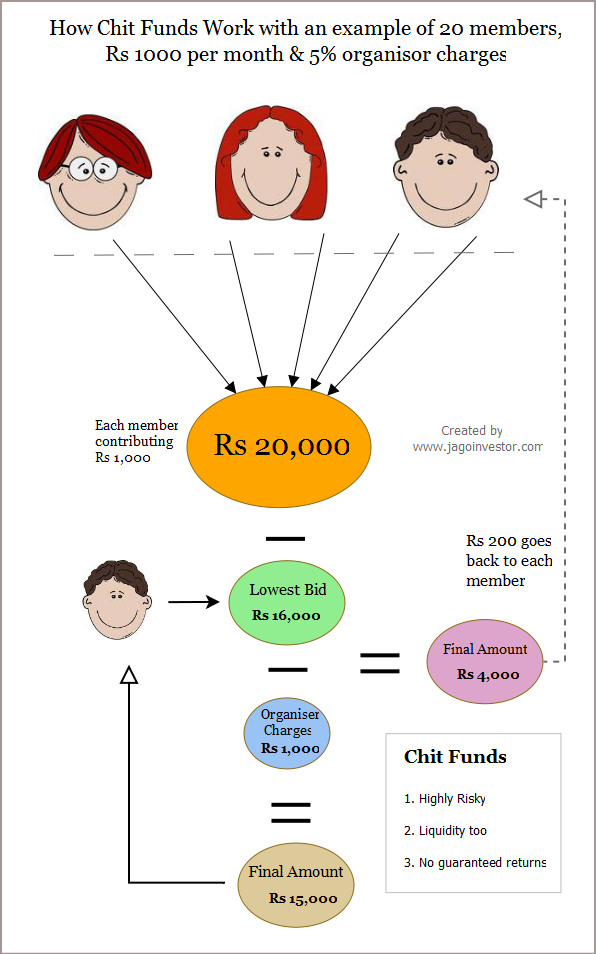

Let’s say there are 20 people who come together and form a group. Each one will contribute Rs 1,000 per month and this will continue for next 20 months (equal to number of people in the group). In this group there will be one organiser, who will take the pain of fixing the meetings, collecting money from each other and then doing other procedures.

So each month all these 20 people will meet on a particular day and deposit Rs 1,000 each. That will make a total of Rs 20,000 every month. Now there will be a bid on who will take this money. Naturally there will be few people who are in need of big amount because of some reason like some big expenses, liquidity crunch, business problem, Beti ki Shaadi etc etc … Out of all the people who are in need of money, someone will bid the lowest amount, depending on how desperate he is for this money. The person who bids for lowest amount wins. Suppose out of total 3 people who bid for 18,000, 17,000 and Rs 16,000, the one who bids the lowest will win. In this case it’s the person who has bid Rs 16,000.

There will also be “organiser charges” which are around 5% (standard) of the total amount, so in this case its 5% of Rs 20,000 , which is Rs 1,000. So out of the total 16,000 which this winner was going to get, Rs 1,000 will be deducted and the winner will get only Rs 15,000, Rs 1,000 will be organiser charges and Rs 4,000 is the profit, which will be shared by each and every member (all 20 people), it comes out to be Rs 200 per person, and it will be given back to all 20 members. So here you can see that the main winner took a big loss because of his desperate need of getting the money and others benefitted by it. So each person actually paid just 800, not 1,000 in this case (they got 200 back). Note that when a person takes the money after bidding, he can’t bid from next time, only 19 people will be eligible for bidding.

Now next month the same thing happens and suppose the best bid was Rs 18,000 , then winner will get 17,000 (after deducting the organiser fees) and the rest 2,000 will be divided back to people (Rs 100 each) . So each person is paying effectively Rs 900. This way each month all the people contribute the money, someone takes the money by bidding lowest, organiser gets his charges and the rest money is divided back to members. You will realise that the person who takes the money at the end will get all the money except organiser fee, as there is no one else to bid now. So the person will get around Rs 19,000 in the end, if you try to find out the returns which he got out of the whole deal, it will depend on two things, how much lower bids were each month and the fees paid to organiser, if bids and charges are very low, then a person will make more money at the cost of other situations.

So this is pretty much how a chit fund works, there are various versions of chit funds and how they work , but the idea was to communicate the basic model and how it works.

Trusted and untrusted Chit Funds & Some experience

A big question which is in every one mind is “Should I invest in Chit funds?“. Chit funds are not some investment products in which someone invests! By design you can see that it’s only a support structure for needy people who are unsure of their cash flows or some big expenses coming on the way. It’s only for those who can’t get loans from banks or some lender. In which case chit funds provide that structure where one can take the benefit of it. But beware! Whenever someone says “Chit funds”, the only thing which comes to the remind is “Fraud”, “Scam” and “Something Fishy” and its true to great extent as there many chit fund companies which come in market and run with the money. The only condition where I feel one can go for it is if all the participants of the chit fund are known to each other properly and there is high level of trust between them. For example, you can do it with your colleagues at office whom you trust and are friends with for long. But if you dont have liquidity issue and can get loan from a bank, then I dont see any need of doing this.

Good experience

In smaller cities, you can see your father, grandfather and even many housewives form these groups with friends with whom they are from last many years. A lot of people on this blog might have experienced how their father used these networks to get huge cash at the time of need. One of the readers Jagadees shared his experience with me on mail

The great advantage for the village people would be availability of immediate funds in the times urgent need. My father would say that he met all his life obligations like his sister’s marriage, his marriage expenses, my grandpa’s medical emergencies, our education expenses were met solely through this type of monthly chit fund investment.

Bad experience

Greed has no limit. What was created for help to each other under a trusted network is now converted as a business and many people have started opening Chit fund shops where they become the main organiser and pocket the organiser fee. Investors have started looking at these chit fund companies from investments point of view and in greed of high returns, they invest their hard earned money with these chit fund companies and at times there are frauds and scams. Chit fund companies are regulated in most of the states by Central Chit Funds act,1982 and they come under the purview of state governements. RBI has no role in regulating them. But still you know how easy it is to do frauds and scams in India (don’t forget commonwealth & 2G and 3G and 4G scams, wah ! I am futuristic). Let me share with you a horrible experience how an old man lost his 40 yrs of earning in chit fund

My father-in-law when he retired, without telling any of us he put all his money in a chit fund. nobody knows how much & in which chit fund he deposited. That was the time when a series of chit funds went bust in chennai. Pity the chit fund in which he deposited also went bust. he had a mild heart attack. The pain he underwent other than the heart attack was terrible. He was in an ordinary job & after 40 years of hard work he had earned that money.

More than the loss of the money, it’s the shame, foolishness and the iyalaamai to take any action by us, the government kills.we supported him, but he wanted to be independent even after retirement. that objective was defeated by his shear foolishness. none of us ever asked him anything about it. but every day he must have been repenting for that . (via)

Easy & MicroFinance Tool

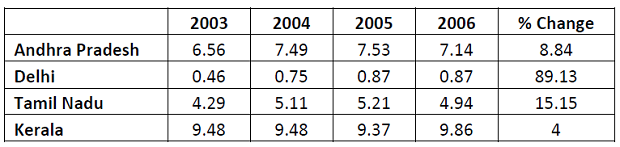

Can you believe that as high as 5-10% families are associated with chit funds in South India ? For example – The share of households participating in Chit Funds increased by 9% in Andhra Pradesh, 89% in Delhi, 15% in Tamil Nadu and 4% in Kerala between 2003 and 2006. You can see below graph that shows Kerala having 9%+ penetration in Chit funds which means 1 out of every 10 family is in some chit fund.

Source : IFMR research

As per a report from IFMR on Chit Funds , most of the people in smaller places are attracted to chit funds, because of easy availability of easy credit and simplicity of chit funds. In small places banks are not much interested in lending to poor people and poor people see chit funds as perfect way of getting a loan, though at a high cost. So you can also look at them as microfinance tools. All of south India and Delhi is deeply flooded with chit fund companies (thousands of them) and its reach is much above what you are thinking right now.

Should you invest ?

Overall, chit funds are not recommended unless it’s a person group formed by friends and relatives whom you trust a lot. I don’t think one should put money with chit funds which are not among their social circle. It might make sense for people in smaller cities to look up to them. As the last note, these chit funds are not investment vehicles where you park your hard earned money, So please avoid them unless you want to exactly take that kind of risk.

Please share your personal experiences about chit funds , I am sure all the readers who are from smaller places , they have seen it and for sure there father or grandfather had used chit funds at some point of time to fund a financial goal 🙂 .

July 7, 2011

July 7, 2011

The chit funds (amendment)Act 2019 does not bring any good to the subscribers. Now it became a gold mine for the foreman.

Before the amendment as per section 16 only in the presence of two subscribers the draw (find out the prized subscriber)can be conducted. After amendment, presence can be had through video conferencing.

In the case of ‘lot ‘the foreman can select a person he likes. Because no subscriber is present in person.

Thanks for sharing that information

I AM FAN F CHIT FUND

Thanks for your comment BHARATH

Hi manish,

I want to invest 10K a month. Is joining a chit fund company advisable? or shall i opt for RD? I dont have liquidity crunch.

If your CHIT FUND is trusted enough and you want to be a little explorative, you can go with it !

Sir, suppose there were no bids on the entire tenure of the chit period.What is the benefit each individual is getting ??

Hi Kiran,

That is theory only. Let us take an example to illustrate it. In the above case

20 persons —> 20 months —> 1000/- per month per person = 20,000 /-

Prize Money after the min acceptable bid (Foreman Commission) = 19,000/-

If I am there in the group, if no one bids, I will be happy to take the 19K in the very 1st month and pay 20K in remaining 20 months. I might be saving at close to 24% APR considering the Time Value of Money (TVM).

Looking at me, a friend like you might think, he will also use the opportunity and take the whole 19K in the next month. Even if 2 more people start to think like you and me, then we have a competition for bidding. There you go…

So, Chit Funds are essentially an opportunity funds. You will be able to earn more from Chit Funds, if you are alert, participating and reinvest with a good opportunity cost (Which is very much possible even if you reinvest in traditional savings instrument).

I am not clear on that !

Interesting thoughts Manish. I will be addressing some of the points you have raised as part of this discussion in my upcoming blog.

At an outset, I feel the time has come to see Chit funds from a complete different angle.

Sure !

Hi,

I’m an NRI with not so substantial monthly savings every month and hence being a Keralite where chit funds are a household name , I too subscribed to one 40 months back. I’d subscribed KSFE’s chit fund and last month I accepted a cheque for 10 lacs which was put into my NRE FD account. KSFE is the acronym for Kerala State Financial Enterprises and is a public sector non-banking financial company based in Thrissur city, Kerala, India.It started functioning on November 6, 1969, with Thrissur city as its headquarters.[2] It started with a capital of Rs 2,00,000, 45 employees and 10 branches. It has now 500 branches and seven Regional Offices at Thiruvananthapuram, Kollam, Kottayam, Ernakulam, Thrissur, Kozhikode and Kannur.[3] KSFE is a Miscellaneous Non-Banking Financial Company (MNBFC) and is fully owned by the Government of Kerala. KSFE is the only chitty Company owned by the Government in the whole of India.

I believe chit funds can be a safe investment which will give slightly better return than RD’s/FD’s. But then one has to make sure it is fulfilled through reliable financial institutions.

Thanks for your comment Kumar

i’m a prized bidder of 40,000 chit. i’ve already paid the 20 months installements and the future laibility is 25,000/-. Can i claim the 50% amount and the rest once i provide security to the company.

Hi anil

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Sir, my wife subscribed to her friend’s chit scheme. The total members were 20. Every one had to pay Rs5000/- per month. My wife took the chit amount in the 2nd month and she rcvd 96,000/-.Thereafter she was asked to pay 6,000/- every month, when she did. This month is the 20th month. Till now my wife has not rcvd any interests or whatsoever. When asked to d organiser he said this is not a bidding chit scheme. So I have 2 issues here which I am hoping u will help me sort out.1) should I pay d last installment which is this month? 2) do u think I am entitled to any interest(if any) for all these months? Please help sir.

Thanks & Regards,

Neeraj. V

PS: I am a Sailor and can’t ask the organiser in person about all this as I am sailing right now.

Hi Neeraj

Note that Chit funds are not that much regulated and most of the times they are run in a close group. So legally you are not entitled for the interest as such. Dont compare it with a bank FD or something.

The organizer is correct, when you withdraw from the chit, you have to pay 1000 more… so you ended up paying 6000. You will not get any interest. As this type of chit fund is called ‘Fixed chit fund’ as it is predecided – what amount you will get in which month.

Hi,

How to start chit fund for ten members for ten people. sum assured: 1Lakh.

Sorry, it was typo mistake. for ten members for ten months. 10,000 X 10 (1,00,000)

Hi Naresh

Thanks for asking your question. However we do not have answer to your question.

Manish

sir,i recently subscribed to a chit run by cooperative bank. first chit went for rs 30000. Bank deducted minimum 7500 as foremen commission and distributed rs 750 for each member as dividend to 30 members. In set of agreement they have mentioned as 5 percent where as deducted rs 7500/- as minimum foremen commission. Bank also intends to deduct service tax on members dividend. is it fair. please advise.

Hi babanna

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Read the below link to see HOW the KSFE ( Kerala State Financial Enterprises ) operates

http://scam-ksfe.blogspot.ae/

Here is an android app to track you chit fund investment.. It’s easy and hassle free

https://play.google.com/store/apps/details?id=com.trachit

Hi,

I m a house wife, at the time I was in job I put a surity for my colleague. For marriage I resigned my job..now I m getting alerts that the guy is not paying money for months and they r asking us to pay..that guy also resigned from the job and no one knows where he is staying now..and he z in upscan..now I m not understanding what I have to do now n my husband doesn’t know about diz issue..I m also unable to pay r face the issue as me also not getting any income now..please tell us the solution

You dont need to pay for it now. Just tell them you have no income

please see the best example of how a government run chitty company works

http://scam-ksfe.blogspot.ae/

KSFE is a Kerala state run non banking financial entity …the criminals robs the general public and being so called government employees they are all well protected …No action by government as politicians also get a share of money funnelled out by the scammers …

Now this particular company is coming under the minister of finance Sri KM Mani ..who is well respected for ….please watch the news channels

For novice users like me this is very good info.

Thanks ramana reddy

thanks for your answer.broke others trust is a offence.

I have a doubt about chits law please clear it. A person start a chit in her home of total amount 5000(20 members,250 rs per month) without registration.She not give the money properly.She misbehave with the members and use their money for her personal needs.If members became angry for it she say to their that she will ready to give her paid amout,and forced that members to quit from it . Is it allowed our law?I think its a offence right?

If its not registered, then the person is not bound by any law. Its about the trust with the other person

Hi Manish,

I am subscribed to one Chit Fund, but its only among my colleagues (who can’t run away since its everyone’s permanent job and no transfers).

The returns come around 15-17% for me if I don’t bid and get the amount in the last month. Here are the details.

I pay 6000 every month and at the end of 23 months, i got back 165000. That gives me 17% returns (calculated using jago investor SIP returns calculator). So in my case I think its worth it. What do you think?

Regards,

Naveen

Yes it is worth it more .. The returns are around 19% .. continue it !

Hello Manish,

Question – are organised Chit funds safe? For example, Shriram Chits? What about defaults. If the contributers start defaulting in their contributions, then what is the recourse?

All chit funds are always risky compared to banks . Thats the reason the returns you get from them is also high .

So I would say that do not put a big amount which will give you heart attack if you loose it 🙂 .

Hi Manish

Thanks for the useful information. i would like to know how to judge when to lift the chit and which month chit is profitable. i know it depends up on the bid amounts.

however in an ideal scenario. when there is no much competition.

Eg: the chit amount is 2lk and 20 members. 20 months.. which are the ideal months to lift the chit.. and if there is any competition for bidding. how to decide till what amount we can keep bidding on which month.. how to calculate the profitability every month to bid for the chit. request help me to understand this calucullations.

Regards

Rajesh

Hi Rajesh

There is no fixed formula for this, I suggest you open a question here http://www.jagoinvestor.com/forum

Hai Manish,

In order to avoid cheating companies from Chit Funds, the government must give permission to BANKS to conduct chit funds business.Now banks are prohibited under the Chit Funds Act 1982.People can trust them.If banks come to this field fraud people cannot flourish there.Before 1982.banks were conducting chit business in India.

I think that will be really tough . CHIT Funds are not banking related products !