What are different sectors in stock market

Which one among Reality sector and Banking sector has given more returns in last 5 yrs and 10 yrs with lump sum and SIP way of investing ? Have you ever tried to find out which sectors among indian indices are doing well and which are not ? In this data-oriented article will take you into the world of different sectoral indexes on Nifty, like Bank Nifty , CNX IT , CNX Pharma , NCX FMCG and some more like those . We will see their performances compared with each other with graphs. Note that I have also taken NIFTY as one of the index to compare it with a broader index even though it’s not a sector specific .

Which sectors ?

In this study you will come to know about lump sum and SIP performance of various sectors for 5 yrs and 10 yrs time frame. I have taken the raw data from NSE website and done all the number crunching and graphing to come out with charts which shows you how money has grown in various sectors . I have taken 6 sectors ( Nifty , Bank Nifty , Energy , Pharma , FMCG) for 10 yrs time frame and 8 sectors for 5 yrs time frame (6 mentioned earlier + Reality + Infra ) . We will see the results of 4 different scenarios and will see major learnings from those .

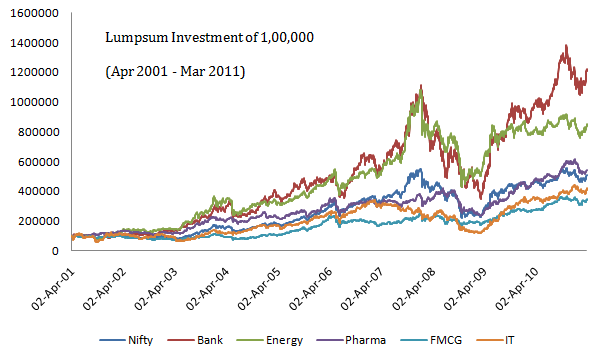

10 yrs performance [Lumpsum Investment]

The chart below shows the sectoral performance + Nifty for a lump sum investment of Rs 1 lac in last 10 yrs .

Observations

- Bank Nifty was the clear out performer among all giving a 12x return in just 10 yrs . That’s very good return . Energy sector came second and FMCG and IT sector gave the least returns out of all .

- Bank Nifty has given 3x return after the crash of 2008-09 . Look at the big spike upwards . Till the crash Energy sector was performing same to same as Bank Nifty , but after the crash, performance of Energy sector deteriorated and it didn’t match up with Bank Nifty.

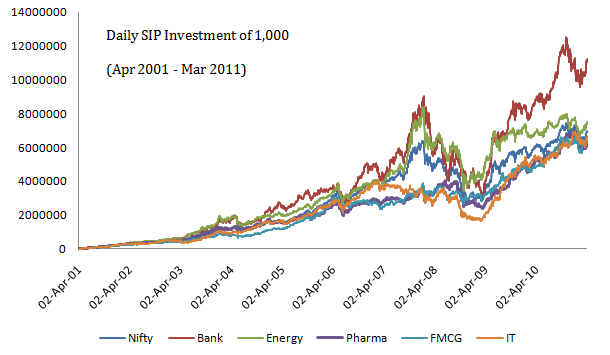

10 yrs performance [Daily SIP Investment]

The chart below shows the sectoral performance + Nifty for a daily SIP investment of Rs 1,000 in last 10 yrs .

Observations

- The most insight full thing you can see here is that all the sectors other than Bank Nifty has given very close return if one had done SIP regularly . This shows both, the power and weakness of SIP . You can get more returns out of bad sector and less return from the strong sector .

- IT sector performed very badly after the crash , but in the recent bull run , it has performed very well and gave superior upside .

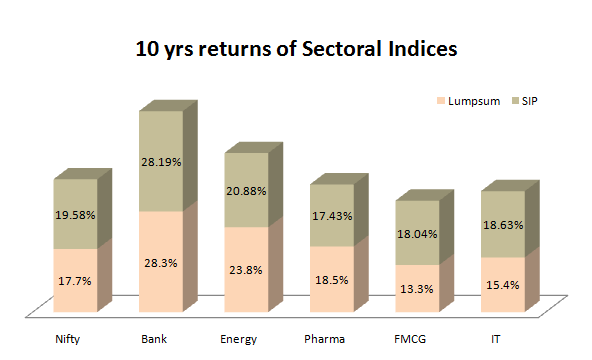

10 yrs CAGR returns for lump sum and SIP investments

The following chart gives you CAGR return of last 10 yrs for both lump sum and SIP . Note that the values are approx only .

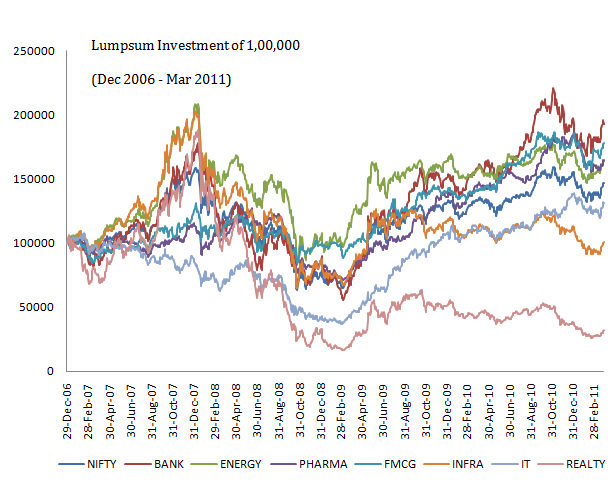

5 yrs performance [Lumpsum Investment]

Now we will look at 5 yrs performance of various indices . The chart below shows the sectoral performance + Nifty for a lump sum investment of Rs 1 lac in last 5 yrs .

Observations

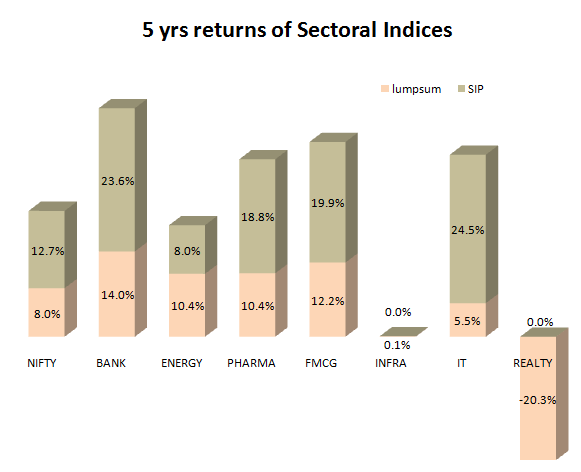

- Bank Nifty still leads the pack , the other sectors too performed good and are marginally poor . Nifty , Pharma and Energy come next best .

- Reality sector was one of the best performers till 2007 , but then its performance went down and its gave a very high negative return on CAGR basis . When other indices gave above 10% returns on average, Reality index averaged -20% CAGR return .

- Energy index has not made much movement in last 2 yrs from 2009 – 2011 , whereas Bank Nifty has doubled .

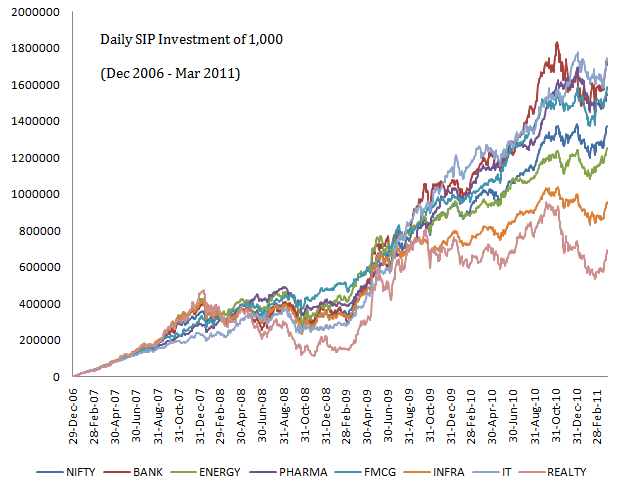

5 yrs performance [Daily SIP Investment]

Observations

- On 5 yrs SIP basis , IT sector has clearly outperformed other sectors and it was very consistent in that . Bank Nifty comes second.

- Reality and Infra sector has performed badly and given close to ZERO return in last 5 yrs .

5 yrs CAGR returns for lump sum and SIP investments

The following chart gives you CAGR return of last 5 yrs for both lump sum and SIP . Note that the values are approx only .

Please share what other information were looking from an article like this . Share your comments about the article .

How did you like the information ?

May 16, 2011

May 16, 2011

Manish,

I can see that you have added the print functionality to print the post. Is is possible to make the comments available along with the post while printing. Many a times the comments are very valuable.

indeed very good article..

do you have any good banking MF(s)..that one can add in portfolio (via SIP) for a horizon of 5yrs+?

Hi Manish,

It’s no doubt a good analysis but see there are some things which needs to be stated as disclaimer..:)

Looking at the graph, it looks like SIP is better (in general) to lump sum investing for both periods but the fact remains that at what stage the mkt was 5 or 10 yrs back. If the period coincides with the bull height or bear low, that will obviously affect the results in big way…for Ex if some one has invested in Jan 2008, what do you think his portfolio will break even? Similarly, if some one invested in Jan 2009, he must be laughing his all his way to bank…so this all boils down to your general knowledge of time you get in…now looking at SIP, I guess this is just another way of saying that see I don’t have a dime of knowledge and interest to look at the graphs and I also don’t that a shit. I also believe that whatever time I’m getting in is the right time…!!! 🙂 So, essentially what I’m saying is— let’s not conclude anything of these charts and nos—these are all loser’s game—winner will anyways make money both ways–whether mkt is rising/falling…similarly, whatever sector you take, SIP can’t beat lumpsum investment starting Jan 2009 and whatever sector you take, lumpsum investmen can’t beat SIP starting Jan 2008….!!!

Rgds,

G.K.

but how constantly can you time the market?

Hi manish..

As always..doing g8 job here.

Here i like to confirm that ” Is SIP work particular in time frame or any time u start SIP, and got return after 5, 10,15, 20 yrs 12% +….

looking ur view on SIP – Any time invest.

Mitesh

Mayank

Yea , I also expect Banking to do better, however what I feel is some one with high risk appetite, they can invest in emerging banks like Kotak , Axis and Laxmi vilas

Manish

In the future, I expect Banking space to do well. Pharma may also do well for conservative investors

Thanks

Mutual funds normally give better return than Nifty or Sensex index

Antony

Its true for India . But in US its tough to bear index for many funds

Manish

Hi Manish,

As usual very nice article.

As per my view, a portfolio should have a small (5-10%) exposer to sector fund.

But its very difficult for a layman to judge which sector is going to beat the index.

So an Investor can bet on fund managers favorite sector.

For Example – If you check some top rated diversified fund, you will find

the maximum (15-30%) fund allocation is towards Financial Services sector for most of the funds.

So an Investor can Allocate some % towards these sectors depends on his risk appetite.

I personally applied this technique .

Sidharth

For now financial services is high on allocation , because it looks promising, it was reality some years back and IT 10 yrs back . So it changes over time .

Manish

Sidharth,

I think one need not take the trouble to go for sectoral funds if he does not know well about it i.e. you must be ahead of the tide to get the real benefit. There is a major issue in the formula suggested by you.

As per you one should have 5-10% exposure in sectoral fund & then he should choose the top sector from the holding of a good diversified fund. Now top sector in a MF accounts for around 15- 25% of the portfolio. If one buy that fund then he automatically gets the required 5-10% exposure to the sector. So what is the fun of increasing one more fund to your portfolio.

Keep it simple. I always prefer a GO ANYWHERE FUND. Dont restrict fund manager to large cap, midcap or sector themes etc. A good diversified fund will go to anywhere and keep your options open. Look at HDFC Equity, or Fidelity Equity or DSP oppertunities, you need only one fund like these to take bets on entire market.

P.S. – HDFC (which I feel is one of the best fund houses) did not have a single sectoral fund to offer till 2007 & even today they have only one- infra fund. The two biggest and best performing funds belong to them is a testimony that one can do with one good diversified fund.

Pramod

Good point . So now we can ask a different questions – “Can we invest in just one fund and not more for our portfolio ?”

Manish

I do not believe in “keeping all the eggs in the same nest”, however I agree going with “go anywhere funds”. The reason being you should not be over-invested in one fund house or one fund manager, as these are variables. A star fund manager from HDFC today can leave and join some other AMC taking away that extra edge he had all this while.

More so fund houses go up and down as their DNA changes; take SBI as an example. Few years back it was a leader of the pack, but lately it just has below avg funds. Most of its star performers have left and their best funds are sulking.

Deepesh

I meant investing in one diversified fund , I think you thought I am talking about “sectoral fund” . I know its still keeping your money with same nest , but its a very high level , one can always review it over years and take decisions for changing it

Manish

Manish – I meant diversified fund only. Once should not park all their assets in one fund or in one fund house. And I agree, the yearly review process is very important.

What is your take on “go anywhere funds” like HDFC Equity? You have always advocated its more focused sibling Top 200 or DSP Top 100; over time these “unrestricted” funds have beaten any focused ones. Is it just comfort factor or something else?

Deepesh

HDFC Equity is again a great fund . Its managed by the same fund manager of HDFC Top 200 , but its a bit less aggressive than HDFC Top 200 .

Over time these funds will mostly beat any sectoral fund ,but there are short time frames when sectoral funds give extra exceptional returns . so i would say its a common man fund

Manish

Promod,

I am agree with your views.

My views are suitable only for those who can take some extra risk to get extra return then index, but don’t have idea about the promising sector.

There is no fun in following what others doing. “The road will never be the same”

I too agree that Diversified funds are the best for common investor.

Deepesh,

Agree with you that one should not keep all his eggs in one basket. But then to be with one good fella is better than being with many crooks. Anyhow I meant to say that while constructing portfolio one can replace two or three focused funds with one Good diversified fund. It will save the clutter & monitoring. I meant that in ideal world one Go anywhere fund will serve the purpose of a portfolio (BTW What is a MF – A portfolio, isn’t it). One can go with three to max five funds for diversification.

Your other point is very valid that to follow today’s star can be dangerous but that’s why you should first choose fund house & then fund. If you see HDFC, Fidelity, DSP, Franklin and to some extent Sundaram are all process oriented fund houses which dont depend on individuals too much (see how many Managers have changed for HDFC Tax Saver). Interestingly their core team is intact for over a decade. SBI and later JM was a one man show of Mr. Sabharwal but same can not be said for HDFC.

Crux is choose good fund from a good fund house and let Fund Manager decide how much to invest in which sector or Market cap.

When you are not driving yourself then dont prompt the driver; you must have faith in either the driver or the God. If you dont trust either then it’s better to get off 🙂 So research, invest, & enjoy with annual monitoring of course.

I had invested in diversified equity (HDFC Top-200) and Pharma sectoral fund (Reliance Pharma). Although both gave good returns, diversified equity returns were better.

The diversified funds normally chose top 3 companies in any sector thereby limiting the risk. Where as Sector specific companies might go with 10-15 companies of the same sector. Any bad news like FDI aproval rejection among the 15 companies would reflect in the sector fund performance. It is to say one bad apple could spoil the entire lot.

Krish

yes , thats the reason one should not take a call on a sector unless he/she does not know what he is doing.

Manish

Nice analysis manish

Praveen

Thanks , can you share your learnings out of the post ?

Hi friends,

I think pharma will be next sector to watch out. Moneyworks4me.com has done extensive research on pharma and they suggested the same. For last few years Reliance pharma & franklink pharma have performed well. Banking & pharma has a good future as both the sector will grow with the economy.

Jayesh

May be you want to explain here why is pharma a good bet over long term in India from now onwards ?

manish

Jayesh,

If you see the history then there are evidence that Pharma and FMCG are consistant sectors because the macro economic factors dont affect their performance significantly. One does not stop washing cloths or shaving or getting treatment because of economic slowdown.

My point here is ” Is it pharma that has done well over the last couple of years or other sectors have done badly”. I mean on relative basis pharma is good but what about on absolute scale. We can say that a sector is going to have a significant growth if the growth rate has increased in the recent past or is expected to increase in future. If you say that Pharma has grown at 15% over last 5 years and it will grow @ 25-30% in next five then it is always exciting & you can share your views about why it will happen however if it is going to remain at 15% but others will be at 10% then it’s not “exciting” though good. In that case we say it is a defensive sector not growth sector.

Thats what I feel pharma is – A defensive bet for all seasons.

Pramod

Do you really wanted to say its “just good” if it gives 15% return ? I think 15% on absolute level is also great 🙂

Manish

Hi Manish

A comprehensive information with lots of number crunching. Good one. As additional information you can add some best performing sectoral funds/ETFs and their returns in each category. Key take away for me: one myth is busted. In subramoney.com, the blogger mentioned that it is always better to invest lumpsum in sectoral funds than sips. But the numbers proves that it is not always the case. (I am not going to hold the blogger for this. He mentioned that point from his personal experience).

Personally i dont like to invest in sectoral funds as i dont have special knowledge about the sector which is going to outperform in the next 10 years or so. Now banking and IT sectoral fund seems to be rage. But if we see the most of the top diversified equity fund, financial services occupies the top slot with allocation ranges between 20-30%. Hence my viewpoint is if a sector performs well and holds long term prospect, it will automatically finds fund managers attention and hence investors does not need any specific sector in their portfolio. But going forward i dont see banking and IT sector fund raking same kind of spectacular returns as past decade.

Regards

Jagadees

Jagadees

Subra mentioned that you should do lumpsum in sectoral funds because doing SIP in sectoral funds is like doing SIP in a bunch of stocks in same sector and it sector goes through a bad time ,then its tough to recover from it soon , where as its not the case with diversified funds ,

So even though in the example above SIP has given good returns over lumpsum in some time frame , one can not take it as a rule now . So I also think its better to invest lumpsum only . Because its assumed that you understand the sector and have some view on it , else it does not make sense to buy sectoral funds .

Subra was correct .

Manish

Hi Manish Excellent blog as usual. :-). U r taking lots efforts on this. I think for this FY Banking and Pharma sector will go superb. But I am worry Auto and Infrastructure. what do u think Manish?

Parag

I am not very sure on sectors , I do not do sectoral research btw 🙂 .

May be you want to share will all why Pharma looks great to you in coming yrs ?

Manish

Wow, man… you put in lots of effort to give us all this information! Kudos!

BTW… why did you take the example of Rs 1000 SIP invested daily? For the aam aadmi, it would not really be possible to invest 30k a month (unless the standards for aam aadmi have changed!)

R

Thanks . Example of 1,000 as daily SIP was just to see the money growth , you can see the same exmaple as 1000 , 100 or 10 or 1 lac , the growth will be in similar manner , The data which I had was for daily . It was a big task to extract exactly monthly data from it , so i went with daily SIP , it would not make much difference .

Manish

Manish, I have a doubt..Whenever i fill SIP form, the bank takes my money during every month from my account..But Is it possible to do for every day?? if it so, then will it include sunday too?? Because i am planning to do daily SIP of Rs.200 – Rs.300 in good funds. Is it worthful or not…please clarify me..

TS Ashok

Why do you want to do Daily SIP ? I took example of daily SIP only because I had daily data and it was too much of work to seperate out the monthly NAV .

Daily SIP should not have any advantage over monthly SIP from return/risk point of view

Read more :

Manish

Hi,

You can do daily SIP with many fund houses. For example UTI has the daily SIP scheme where u are requested to put a large amount of money into a liquid fund and do a daily transfer from there. SIP happens only on market days and not on Sundays or saturdays. But , there are many case studies to show that daily SIP returns and monthly SIP returns will almost be the same for some time period of 3-4 years. A goodle search for comparison shoudl yield some links to case studies.

Kiran

thats called STP and doing it on daily basis is too much I suppose !

thanks manish.

very useful insights.

also you can work on rolling returns of the identified sectors.

i have a graph in my site on the rolling returns of the sensex.

http://www.vsfinancialadvisors.co.in/stock-investments/sensex-rolling-returns-what-is-the-chance-of-losing-your-money/

Nice , do you have something for sectoral indices too ?

Manish

Manish,

Great work, excellent analysis. Quite a comprehensive research.

I too don’t invest in sector funds, like to diversify.

Rakesh

Rakesh

thanks . why dont you want to invest in sectoral funds ? Dont you think some particular sector can be very promising in future ?

Manish

Manish,

I did invest in DSP Tiger few years back. I monitored its performance for over a year and its returns were much less than other equity diversified funds, So i switched it to DSP Top 100.

I think infrastructure sector could be promising in the future.

Rakesh

Rakesh

Yea DSPBR TIGER has lost its shine from last some years . Good move to shift !

Manish

Thanks Manish for the good number crunching. During the market fall around junly 2009 I had started SIP in DSBR TIGER which is a reality and infra sectorial fund. In Nov 2010 I found that it has not giving me good return as both the sectors are not performing. So I switched to DSBR Equity. As the old saying that past performance is not indication what one can get in future for the market. Then my question is what is the utility of looking at the 10 years or 5 years return from a sector.

Many

“Past performance is not a indication of future” , but past performance is still some data and it can be used in some analysis . Your comment on DSPBR TIGER was a short term one like 2 yrs , you cant have much cycles to say anything .

Also the article gives you good and bad points of sectors ,you can see the volatility and the quantam of profits , you can also see how sectoral funds over a long term can be quite skewed , for example see Reality and IT , despite a good enough 5 yrs term , both have returned close to 0% , this is the risk with sectoral funds as they depend on one sector , where some good or bad thing continues for long .

Manish

Manish,

Once again very good article. You have spent a lot of time in researching the data and given us the readers all the info required before investing in a sectoral fund.

I personally feel an individual investor should not invest in sectoral fund. The main purpose of Equity MF investing is to give your money to a professional to manage. If I invest in sectoral fund I narrow his mandate and as a result the risk increases.

Also, in sectoral fund timing to get in and get out is very important as they go up and down based on the relative bullish and bearish nature of the industry in relation to the broader market. I have invested in sectoral fund notably in IT fund( I work in IT and thus thought I am an expert in that subject!!) but found the return was lower than the diversified funds.

However, if one is willing to take a risk he can go for 5-10% allocation in sectoral fund. And Banking looks to be the sector to be in at the moment as India’s banking is still has a long way to go.

Ujjwal

Ujjwal

Yea . I also think like that . However I personally feel if some on has a view on a sector and wants to invest in lots of companies , he can take a bet on the sectoral fund . Its high risk high return game 🙂

Which IT fund have you invested in ? Is it a long term winner ?

Manish

Manish,

I had invested in Templeton Infotech for many years and I also invested in DSPML Technology fund. I redeemed them about 18 months back and gone back to diversified funds.

Ujjwal

Ujjwal

Ok , I hope you will get much better returns now 🙂

Manish

That’s quite comprehensive and I can guess the effort you put in to summarize this.

Good job manish, keep it up.

Jayaprakash

Thanks for appreciation . What is the one learning you have taken from this article ? Do you believe in sectoral investing ?

Manish

I do believe in sectoral investing only for banking and pharma sector