How RBI rate hike impacts your financial life ?

Few days back, there were some changes announced in repo rate and saving bank account interest rates by RBI. Do you want to know how you as an investor would get impacted with the recent changes done in interest rates by RBI? I have seen that a common man always ignores this kind of news because it looks too complicated to him or he can’t understand how his life will be affected by such fluctuations. In this article, I will touch two most important changes that were recently disclosed by RBI and show you in simple manner how it’s directly related to a common man. Note that this article is limited in its scope by looking at the two changes from the point of view of its direct impact on a common man.

Let me quickly go through two main changes which RBI recently changed and explain to you how it impacts common man. Note that this article is limited in its scope of looking at these two changes only from a viewpoint of how a common man is affected directly.

1. Increase in Repo Rate by 0.5% (6.75% to 7.25%)

Repo rate is a rate at which Bank borrows money from RBI, which was increased by 0.5% by RBI and is at 7.25% right now. So now what are the effects of it on a common man? Let’s understand this concept. Banks offer loans like Home loans and Auto loans to someone at an interest rate which is directly proportional to Repo rate (interest rate for common man = repo rate + X %). Now change in repo rate has a direct impact in the interest rates offered to customers for loans by the same or by more magnitude.

Now with the increase of 0.5% in repo rate, this increase will directly be passed to a common man (in case of floating interest rates). In fact some banks like IDBI bank and Yes Bank have already increased their interest rate for loan takers. In fact, Chanda Kochar (Managing Director of ICICI Bank) has already said that this repo rate increase can increase the interest rates for end consumers in the range of 0.5% – 1.0%. So if your interest rate for home loan or Auto loan was 10% p.a, it will now increase to 10.50% at least. This has direct impact on the EMI which you pay for your house.

Let’s see the calculations. If you had bought a house worth 30 lacs @10% interest, 15 yrs tenure, then the EMI would be Rs 32,238. With an increase of 0.5% in interest (10.5%), your EMI will rise to Rs 33,162. That’s an increase of Rs 924 on every EMI. However if the interest rates rise by 1%, in that case your EMI will increase by Rs. 1,860 (calculate yourself). Now imagine if you took the loan at the time of low-interest rates and over the years the interest rates keep rising every quarter, your EMI can shoot up so much that it would make your cash flow very uncomfortable. For example, just last year in Mar 2010, the repo rate was 5%, and then RBI increased it up to 7.25% today. This means there was a 2.25% increase in the last 14 months. You can understand the impact of this on EMI rise over the last 1 yr!

Hence, now you understood how change in repo rate directly impacts a common man, because that change in repo rate is passed on to common man and his EMI’s are affected in the case, the person has opted for floating interest rate option while taking the loan.

2. Increase of saving bank interest from 3.5% to 4% .

The second change which RBI has done is to increase the saving bank interest rate. Till now it was 3.50% which was set long back, many years ago and was never revised. But finally with this year’s credit policy, RBI increases it to 4%. Now you must be thinking how does this impact common man? It’s a good thing for account holders.

Well, in a way it’s a good thing that a person will get higher interest rate on his cash lying in the saving bank account, but let’s see how it impacts a bank. A bank that was paying 3.50% interest on the money will now have to pay 4% interest. That means now, it would directly impact Bank’s profitability. Suddenly a bank which was able to add up that 0.5% interest in its profits has to pay it to customers and that would hit their margins. Bank’s profits will come down by that much amount. This is not a good thing for the bank. That’s a simple reason why you should have expected a big fall in banking stocks and that’s exactly what has happened on the day when this news came in that saving account interest has been raised.

Banking and automobile stocks anchored the broad-based selling. While the hike in saving rates is expected to hit the net income margins of the banks; muted sales numbers in April, high fuel prices, and likely rise in auto loan, diminishing outlook for automobile space.

Among banking stocks, Bank of India, PNB, SBI and Yes Bank tumbled 6.47 per cent, 5.07 per cent, 4.03 per cent and 4.03 per cent, respectively. ICICI Bank and HDFC Bank dropped 2.76 per cent and 2.40 per cent.

Note that around 22% of the money in banking system lies in normal savings bank account and that’s approximately 10 lakhs crore in all the banks. Taking a hit of 0.5% on that kind of money is Rs 5,000 crore. That’s a direct impact of the bank margin of profits. The worst affected will be those banks where saving account ratio (the amount of money lying in bank accounts vs. total money with bank in all forms) is very high. Clearly banks like ICICI bank, SBI bank, Punjab National and HDFC banks are the names I can think because their saving bank deposits stand in range of 30-35%, much higher than the average of 20% across all other banks.

Now how does this impact the common man? Again this move of increasing the interest rates for saving bank is going to affect banks profitability and banks are going to pass this burden to those people who take loans from them, which means those who only put money in bank will stand to gain and the people who took loan will be losing out.

S Raman, chairman and managing director of Canara Bank, said, “There was a need to increase savings bank rate. It will lead of cost of funds going up but how much will it affect the margins of banks will depend on the extent of pass through of these rate hikes to consumers in terms of lending rates. Lending rates can go up by 50-75 basis points.”

Conclusion

Repo rate fluctuations which come from Banks in the form of increased interest rate for loans will directly impact common man. Knowing this can help an investor in many ways. The biggest benefit a person can from such fluctuations is if he time’s his decisions based on where the interest rates are inclined towards.

Let me know what do you think about this rate hike in repo rate and how is it going to impact your life?

May 5, 2011

May 5, 2011

Very good article,cld u pl tell me,what happens to stock market when CRR or Repo Rate is decreased or increased or not changed?

Depending on the situation , the markets will move .. its not mandatory that with increase or decrease of CRR or Repo rate there is same effect on markets every time !

hello sir,

i want to know the impact of increasing and decreasing of Repo and Reverse Repo rate.

Check this http://jagoinvestor.dev.diginnovators.site/2008/10/crr-and-repo-rate-how-they-help_30.html

Thanks, Manish for such a simple explanation.

Dear,

Good explanation about Repo Rate.

But I what to ask you,

In home loan there is two types of interest rate 1) fixed interest rate for some period 2) faxable interest rate

Now my question is 1) what is better option to take home loan fixed or faxable?

2) What is common charges bank charge to customer in home loan process & EMI ?

1. There can be an answer to this .. Its your choice which one you want to go for depending on your outlook !

hello sir…..

fine explanation…

sir i have few doubts on the ‘ increase of bank rate after a long time,

can u give a perfact explanation on the impact of increase in bank rate on the commen man and market…???

y this time the Rbi dont used the repo and reverse repo rates as his tools??

Chanchal

Bank rate and Repo rate are same !

What will be the impact if r.b.i decreases bank rate by 1%

Arupa

What are you refferign to bank rate ? Its clearly mentiond in this article that what will be the impact , where are you confused ?

Manish

Dear Manish,

Can you please explain the term Cash Reserve Ratio (CRR)?

Kumar

Read it here : http://jagoinvestor.dev.diginnovators.site/2008/10/crr-and-repo-rate-how-they-help_30.html

Manish

Thanks Manish for nice explanation. But still I don’t understand onething. Obviously RBI gives loan to banks for which it charges some interest called repo rate. But what is reverse repo rate? Is it that RBI takes loan from banks and pays interest?

KUmar

Kind of .. its not that RBI takes loan from banks , but Banks deposit thier money with RBI and they get interest on it from RBI which is called Reverse repo rate

Manish

test

Due to increse in RAPO rate my EMIs of home loan incresed to 1%. I would like o know is it posssible to keep the EMI same as previous and increse in tenure of my hoam loan even in increse in RAPO rate?

Dinesh

Yes, thats exactly what a bank does untill the new tenure goes beyond a logical point .

Manish

hi Manish Great article quite easy to understand……….

I wud lyk to ask something different wat are the effect of these rise in interest rates by RBI on the currency rate.

I mean will Rupee appreciate against dollar or will it Depreciate?

Piyush

I dont have much idea on that . better to ask on our forum : http://jagoinvestor.dev.diginnovators.site/forum/

hi,

I am Srinivas i have home loan amount 19,80000 in DEC 2010 from Dewan housing finance during that time the interest rate was 9.50 for 20years & EMI is 17,802.when there is an increase in interest rate to 10.75 till 2040 & EMI is 17,802 again increase in interest rate to 11.50 and EMI is 18,397 till 2049. and again after today’s increase in RPO either my EMI or tenure will increase have to wait and see.as per the bank at present i am paying 85,01244 till 2049 for 19,80000 taken from them.

Can anyone suggest me regarding my increase in tenure from 20 years to 39 years is it ok ???? if required i will send the EMI details through mail.Pls help

Srini

thats perfectly ok ,. With increase in rates , either EMI or tenure increase .. if tenure increases , it increases madly . The only one thing I can suggest is start prepaying your loan as and when you get a chance , If you get a lumpsum , or you get some moeny from somewhere every month . make sure you prepay that loan , read : http://jagoinvestor.dev.diginnovators.site/2011/04/loan-amortization-emi.html

You can play away with the EMI calculator we have : http://jagoinvestor.dev.diginnovators.site/calculators/html/emi-calculator-advanced.html

Manish

Thanks a lot

First of all I must admit that I am the most ignorant soul on earth about investment-economics-market-accountancy etc; perhaps not worth to continue this chain.

However, in one link http://www.bankrateinfo.com/2011/04/possible-hike-in-fixed-deposit-fd-and.html I found the following remark: –

“Friday, April 22, 2011

Possible hike in Fixed Deposit (FD) and Home Loan Interest Rates

Wall Street bank Goldman Sachs has predicted that Reserve Bank of India (RBI) will hike interest rate by 50 basis points. It will affect all the interest rates from fixed deposit rates to home loan rates…”

That is why I think.

Subir

Ok , I am personally aware of only bank loan rates being affected . not very sure of how it will work for bank FD’s

Manish

Can anybody state in unambiguous terms if hike in repo rate due to July 26 rbi monitory policy will hike bank’s (particularly hdfc bank) fd rate?

If yes, what %age may it increase?

Subir

Your question is not clear

Manish

Hi Manish,

I am really sorry!

I wanted to mean this: –

On 26 July RBI’s monitory policy is likely to raise repo rate. Now can anybody please state in unambiguous terms how this possible hike in repo rate will affect bank’s (particularly hdfc bank) fixed deposit interest rate?

Subir

It wont impact interest rates of fixe deposits , why do you think it will

Manish

hii Manish its too impressive about you to share such a useful knowledge with us

as i am new to this finance world and recently completed MBA in finance gathering knowledge as much as i can from these type of articles and i am really thankful to you for the information you have given its too appreciable

keep it up…

Arohi

Thanks .. keep reading

Manish

Hi Manish,

I was planning to pick up a home loan for 22.5 Lacs from SBI @ 10.25% (what they told me). As I can figure, it’ll go to (ballpark) 11%. Great, I’ll be broke as usual. BUT – when the rates go down, does it really affect my money positively? will I pay less? or should I forget the house and invest in onions?

Regs,

Sri

Sridutt

It affects positively when interest rates go down , but not very soon and not as much as it hurts you while going up . Banks are not that fast in reducing the rates compared to how fast they are in increasing it .

Manish

Yes. I mistakenly understand that it depends on CRR.

Dear Mr. Manish,

I discussed with bank manager regarding the rate of interest hike, he told the rate of interest changed depends on not CRR, by only their bank’s Advanced rate (SBAR – State bank’s advanced rate).

my housing loan sanction letter shows interest rate is -1.5% (minus 1.5%) of SBAR and present SBAR is 14%.

Bank does not considered my request on interest rate changes, and they told SBI chairman said his latest interview, that if loan customers get an better interest rate from other bank, they can transfer the loan without any penalty charges and also prepayment options without penalty charges. but the order copy is not come to bank yet.

Sampath

Yes , I never said that it depends on CRR .

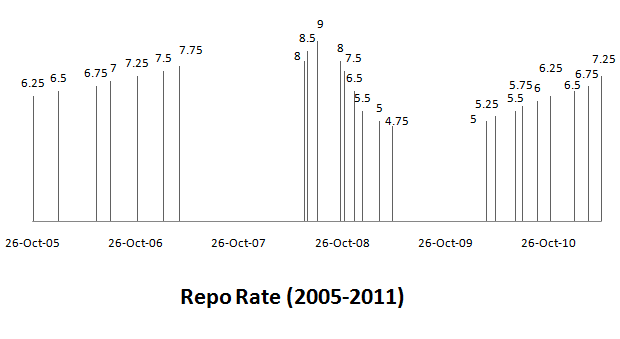

History of Repo Rates in India

25-Jul-2006 7.00

30-Oct-2006 7.25

31-Jan-2007 7.50

30-Mar-2007 7.75

12-Jun-2008 8.00 RBI circular dated 11/6/2008

25-Jun-2008 8.50 RBI circular dated 24/06/2008

30-Jul-2008 9.00 RBI circular dated 29/07/2008

20-Oct-2008 8.00 RBI circular dated 20/10/2008

3-Nov-2008 7.50 RBI circular dated 3/11/2008

8-Dec-2008 6.50 RBI circular dated 6/12/2008

5-Jan-2009 5.50 RBI circular dated 2/01/2009

5-March-2009 5.00 RBI circular dated 4/03/2009

21-April-2009 4.75 RBI circular dated 21/04/2009

19-March-2010 5.00 RBI circular dated 19/03/2010

20-Apr-2010 5.25 RBI circular dated 20/04/2010

02-July-2010 5.50 RBI circular dated 02/07/2010

27-July-2010 5.75 RBI circular dated 27/07/2010

16-Sept-2010 6.00 RBI circular dated 16/09/2010

02-Nov-2010 6.25 RBI circular dated 02/11/2010

25-January-2011 6.50 RBI circular dated 25/01/2011

17-March-2011 6.75 RBI circular dated 17/03/2011

03-May-2011 7.25 RBI circular dated 03/05/2011

Thanks for ur immediate reply manish.

when i buy HL on 25-07-2006, Bank REPO Rate is 7.00, and gradually it is increasing up to 9.00 and now it is 7.25. how it is possible my loan interest rate 12.25% from 9.25%.

is bank have rights to increase any rates without matching the REPO Rate.

Dear Manish,

I entered SBI for housing loan (5.1L) on 25-07-2006 with interest rate of 9.25% floating basis. But now my account shows 12.25% interest, due to RBI rate hike. I have the doubts on the following and i need your advice:

(1) is the interest rate is correct, because when i bought the loan RBI CRR rate is 7% and after increasing and decreasing the rates , now the CRR is 7.25. how my interest rate increases 12.25% from 9.25%

(2) some other banks (idbi bank) ready to offer me for 10% floating basis, if i transfer the loan from SBI.

expecting your reply sir.

Sampath

The bank interest rates are mainly influenced by the REPO RATE and not CRR . Also you should first try to negotiate with your bank about the interst , else you can then shift to other bank , make sure you look at the penality charges to be paid for this .

Manish