How to plan for retirement and think about retirement in India

How will your retirement look like? Have you thought about anything on retirement planning ?

This is something, which you should spend some time on. Our parents and grand-parents might not have given much importance to their retirement, they might have just took it as it came to them, but can we also afford to do the same with our retirement? Would you like your retirement to take shape just like your parents?

Lets discuss it and take some food for thought from this article today. This is the 3rd and last article in the series called “Financial Planning and Social changes in India” . You can read other two parts here and here .

In our country, where a very small number (less than 10% of the workforce which is in the organised sector) has access to some social security like provident funds, but the rest – almost 90% of the workforce – has no social security, Retirement Planning is a major issue .

If you take care of your retirement planning, your future will probably be much better and in control than without doing anything. It has become extremely important to plan for one’s retirement and at least take a step towards it. I will list down some pointers which shows why retirement in future India will be much bigger and serious issue.

Look at all the points in totality and you will realize that planning for own’s retirement is not just an option but a necessity these days.

1. Increase in life expectancy in India

One of the major problem while doing retirement planning is to assume how long the retirement will last. This has a direct relation with life expectancy. As a country develops, its healthcare and overall life style level improves and life expectancy increases. You can see the life expectancy in India is moving up and up with each passing decade .

It was 49 yrs in year 1970 , increased to 64 yrs today in 2011 and is set to increase upto 73-76 yrs in 2040-50 (projections) .

Now this life expectancy of 76 yrs does not mean that everyone will die at age 76 , it’s an average . If you personally have a better life style , better health and better medicare access compared to a average Indian, chances are you will have a much more life expectancy which will cross 85-90 yrs .

Leave future, even today you can see more and more people living upto an age of 80-85 . So, you can safely assume that you will have to accumulate enough money which can last atleast 30-35 yrs after your retirement, else make sure you die with your money itself 🙂 .

Overall the conclusion is “Longer life in future will mean more money required in retirement compared to today. Simple !”

2. Increase in Dependency Ratio

Dependency ratio means the ratio of Old age population vs Young population. To calculate it, just take total population above Age 60 and divide it with population between 15 yrs – 60 yrs and you will get Dependency Ratio.

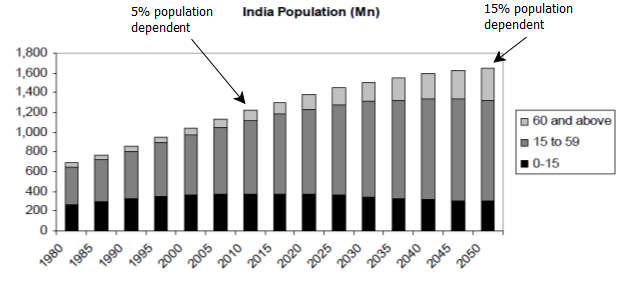

You will be surprised to know that right now in 2011 , the dependency ratio is around 5% in India, but in year 2050 this ratio will rise to 15% , which shows you that more and more people are going to be in the old age group compared to young population . See the chart below .

Source : here and here

This is not a small issue. More and more people will be shifting to this “retired” category in coming decades with more load on the working population.

At this current moment, we are one of the youngest country today with as high as 50% population below 25 yrs of age , but will this continue forever? With more population control measures at government and public level, these numbers are going to be different in future.

Hence the conclusion is “More and more people will come into retired category as percentage of population in coming future”.

3. Decline of joint family structure

If it was 1970 , you could have safely assumed that you will be probably spending your retirement with your grown up kids , playing with your grand children, but is it happening anymore in these changing times?

More and more people are moving in different parts of country in search of education, jobs and settling there compared to old times. Parents on the other hand dont choose to move most of the times as they feel connected to the same place where they have spend all their life and more than that , they have their social groups at those native places.

Very rarely I have seen that parents leave those places where they have spent 30-50 yrs of their life .

Bigger opportunities in life and a complex life style has resulted in smaller family size and its going down each decade. As per research reports of National Family Health Survey , Ministry of Health and Family Welfare (MOHFW), Government of India , average household size in the year 1992 was 5.7, which means each family had 5.7 members, this came down to 5.4 in 1998 and as per last reports of 2007 , average family size is 4.8.

Now imagine this, each family having approx 4.8 members , that’s today ! . Will it shrink further to 4.0 in coming decades , what do you think ? I think if it does not go down , it will definitely not go up ! . Thats my personal opinion .

This clearly shows that families size are shrinking on average. More and more parents these days are living in their home town where they raised their kids , but kids have moved to other places and settled elsewhere. By no means I am saying that not living together has resulted in less love or less harmony , NO !

All I want to say is people are living separately and “expecting” to live separately now a days. This will only rise , and not come down by the time you retire.

So the conclusion is “There are higher chances that you will be living separately and not with your kids , by choice or by society structure , unless you are living in smaller towns and villages.”

Change in perception about Retirement Planning

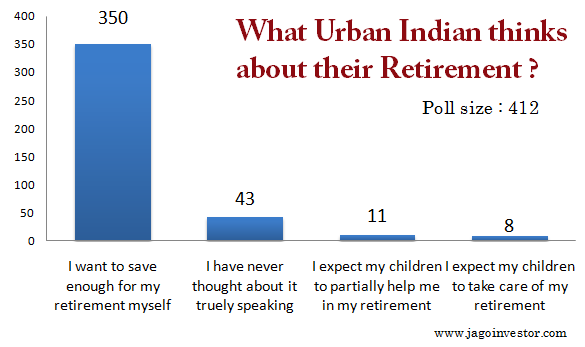

Now leave all the factors we talked above. Lets look at how people today feel about their retirement in coming years. I ran a poll on this topic which was taken by as high as 412 unique participants and you will be amazed to hear that as high as 83% said that they would like to be self-dependent and want to save all the money they would require in their retirement.

Around 10% said that this is the first time they are having any thoughts about their retirement after seeing the poll and just 7% people expect to be fully or partially dependent on their children for their retirement. Which shows us that as high as 93% readers on this blog who participated in the poll want to be self dependent and plan their retirement themselves.

Look at the poll results below .

Best Investment for your Retirement ?

Best Investment for your Retirement ?

So whats the best Investment you can do today which will make sure you live happily in retirement? If you thought that it’s some financial product or a strategy to make some extra bucks, you are wrong ! I am talking about your Health here.

Note that reaching destination is important, but after reaching the destination if you don’t feel joy and happiness and are not able to enjoy the fruits later, all the hard work you will put for reaching for destination will go waste.

You will be living for 25-30 yrs minimum in your retirement, Now if you have all the money , but no proper health at the end, you will not be able to eat what you want, you will not be able to roam around places , you will not be able to enjoy each moment of your life , what’s the use of all your hard-earned money in that case ?

I would say all your efforts will be waste. This is one serious point I want you to take home today. Think about it.

People who are neglecting their health and financial life today are living in illusion that future has a lot for them. Start working on your health today, do a daily SIP investment in your health through exercising in gym or working out in park or at least jogging. lumpsum investments in health does not work , It can only work in your financial life.

I want you to download this e-book called Food and Thought right now.

What do you think about retirement after 30-40 yrs ? I want to hear your action plan for your retirement in comments section. Do you think the points made for Retirement Planning by me makes sense ?

Write us your opinion in the comment section.

March 20, 2011

March 20, 2011

A very well written article. What you say is very much correct. I will retire within the next three years. I will live alone during retirement as I have two daughters who will live outside India. My wife has passed away. I own my house in Pune and have many friends there. I have lived outside India for 21 years in Jakarta. I will return to Pune after retirement and live in my house. It is certainly difficult to estimate how much money you need during retirement. If I follow my habits of exercising daily and not eating in restaurants, I hope to be in good health till age of 75 . The cost of medical treatment will certainly go up in future. I have saved good amount of money and also have bought real estate around Pune in form of land. I will sell the land if my money starts to run thin. I am planning to live on long term capital gains which are not taxed at present.

Thanks for sharing that Mr. Sanjeev

For the benefit of our readers and very young populations, would you like to contribute a written piece on “How life looks like around retirement in India” . If you can take out some time to write his for us, it would be great !

Manish

Great article on retirement plan. I would like to add some insight to this based on my personal experience. There are 5 simple steps you need to follow:

Step 1: Start early

Step 2: Prepare a plan

Step 3: Hire a financial planner

Step 4: Regular monitoring

Step 5: Do not touch corpus till Retirement

These are just the basic five steps to get a proper retirement benefit. The best solution is to ask for an investment planner to help you guide through post retirement investment plans. There are investment agencies like ‘Right Horizons’ which provide proper guidance to their clients so that they can live a tension free life post retirement.

Hi Shreya

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

VPF or PPF?…..this info will be helpful too….

That’s fine, but should you invest in VPF if you are already investing in another popular scheme — public provident fund? You have quite a few reasons why you should prefer VPF over PPF or at least in addition to PPF.

For one, whether you want the tax benefit or not, you cannot invest over Rs 1 lakh in PPF. In case of VPF, you can invest well over the Section 80C ceiling.

Two, you may not be a disciplined investor in PPF. Also, you will have to take the trouble to deposit the amount in your bank or post office. In case of VPF, your employer will do this for you. Three, interest rates on PPF, in recent years, have been lower than rates notified in EPF. Also, private-trust run EPFs may even manage a far higher rate.

Four, the clause to avail a loan based on your PPF is more restrictive compared to your EPF. Five, if you want to call it a day at your office, you can withdraw the entire sum (not taxable if you have worked for over five years). PPF is locked in for 15 years and allows only partial withdrawal.

This said, the biggest limitation with VPF is that it is available only to salaried individuals. Besides, most employers do not allow you to alter your contribution mid-year. You may reduce or increase it annually.

i had already thought of health after retirement before reading this artical. But what i did was that i decided to live & enjoy life as much as possible in present days. so when i was planning to buy a new car, i often thought that why should i buy a car in this young age when my father never bought a two wheel. so there comes this thought that one should enjoy life when his body is functioning properly. so i bought a new car.

more over in my company (Power Grid corporation) we have a post medical scheme for self & spouse. so no need to bother about medical expense after retirement.

so i wisely started contributing to my VPF account an amount of Rs. 5000 extra apart from my provident fund.

Once a wealthy foreigner was asked a question :- ” whom do u believe is the richest person in this world.”

“the richest person in the world is one whoes fives senses are working properly” came the Answer.

Jameel

thats a good thought , saving for tomm does not mean cutting for luxuries today . You can have your own way of thinking and all the things are right if you are able to convince yourself . If you think enjoying today and not saving for tomm will help you , you can do that way ! .. best of luck 🙂

Manish

Hi,

I think though you very well mention that SIPs can pave a good way towards retirement, however, one of the best sources of diversifying retirement funds is using the best debt options – Provident Fund. People tend to contribute in it year on year, without realising how it works and its importance.

Please let me know your views.

Yea .. in a way thats correct .. But there has to be a balance in equity and debt .. else only debt can be bad

Manish

I want to invest Rs. 10 lacs. I have horizon of 1 year and my age is 60. The money I got as my retirement benefits. Need regular income.

Rajat .. you can look at this article on generating income : http://jagoinvestor.dev.diginnovators.site/2011/11/10-income-generation-methods-india.html

Dear Sir ,

All you are here very knowledgeable , Retirement planning is the most important part of us when we do investment , but as the time pass we busy in life with more liabilities and short term goals became more focused , we start to ignore that .

I had done investment in Sip , PPF , NPS , Gold for my Retirement purpose .

Sip in Equities Fund ( includes Large cap , mid cap , small cap )

PPF to give my portfolio flavour of Debt part

Nps again 50 % equity 50 % Debt

Gold as safe gaurd and to full fill requirement at old age to give gift to my daughet in law or daughter or to my grand son .

As my earning will increase , my standard of living also increases , so with the time , the amount will increases to different instruments .

Retirement planning to be done in correct way might need exerptise , but i think if we start investing , in Mutual fund through Sip , that will automatically cover lot of Target corpus.

Ajay

Yes you are correct .. SIP in mutual funds is one of the best ways to accumulate for retirement

Manish

Hi,

The ebook which you have shared at the end of the article is really an eye opener. There are so many basics facts mentioned in that book which we all know but have really forgotten. Thank you so much for sharing such an informative book.

Vaibhav

Vaibhav

Welcome 🙂 . Share the ebook and article link with all your friends 🙂

Manish, I straight away agree with you, increasing the SIP amt will be little manual when done yoy. My thoughts are simple. I see SIP serves us in two ways.

1. It make us invest mom/qoq systematically and

2. Its takes advantage of mkt volatility.

Now mkt ll continue to fluctuate. Anyways i wont regret even if mkts are going up….however if mkts dip that little bit of increas in SIP will work great is n’t it?…..I feel things does not come easy….If the fund manager is taking 99% headache on managing the fund our head ache it just be patient and continue investing. Which all the SIP investors mostly do…what am i doing extra…Increase SIP amt every year 🙂 Its not easy, it needs conviction….so no pain no gain.

What do you say

NOTE: The post on Visualization is fabulous manish 😀

Charan

Yes , Increasing the SIP amount when markets tank would give a lot of momentum . I think it would beat the regular SIP , will have to do some number crunching for that 🙂

Manish

Yes Manish. It would beat SIP.

This technique is called Value Averaging Plan and has advantages over conventional SIP. One invests more when the market is down i.e. cheap.

Regards,

Sharad

But the question is it proved that in general it always beats SIP ? or it it only in few secenarios .. I am quite apprehensive that VIP is always better than SIP ! . Also if thats the case, then why are all companies still on SIP , why are they not coming with VIP facility in mutual funds !

Theoretically, VIP should outperform. Will see if I can work out some numbers to support the same.

However with VIP, things might get complex for the following:

1. It involves an element of timing the market

2. How much to invest at what point of Valuation requires sophisticated methodologies

Retail investors might not be able to appreciate the complexity, may be that’s why companies haven’t launched them.

I feel MFs especially thru SIP are good tools to accumulate retirement corpus. Which is now known universally. However i believe we have to increase the SIP amount by some % every year. This very site have a SIP calculator 1. Constan SIP calc and 2. Increasing SIP Calc. the latter will be something we all have to think about increasing SIP amount by some % every year. If some have not tried it i am sure it will make your eye brows raised!!!

Happy Investing!!!

Charan

Yes you are right , the only think is its little manual work to increase it every year by a fixed percentage , it looks good at paper . the practical situation is to increase your SIP whenever you start having a suplus , so some one who is doing a SIP of 10k can continue for some years and then directly increase it to 15k after 2-3 yrs .

What do you feel about it ?

Manish

Hi Manish, Wonderful post and the message is strongly conveyed!!! All our readers have discussed about finincial products and insurance covers…Health cover is a corrective measure to fix ill health, none of us want to fall sick just because we have insurance…Health cover is to cover unforeseen health problems however we can prevent many of them just by taking some preventive steps.

Here is what my preventive and corrective plans are

1. I ve already started to cycle to my office on alternate days( This was little tough initially but i pushed myself not i am fine) For others some thing else may work well…Say a morning jog, swim, take up their favourite sport.

For many or most of us GYM is the default preventive measure but being regular is a big question. Its works well for few may not for many….I ended up paying one year subscription fee at the time of joining and ended up going just for 2 months i am so bad i wont be surprised if there are many or most of our readers are like me lol

2. In addition to my company provided Health Cover, i am planning to take up additional cover on my own. Covering dependends makes more sense here.

It will be intresting to see what preventive measures our readers have taken which works well for them.

Thanks,

Charan.

Charan

Yea .. regarding Gym think i think you are in a better position , you atleast took action and started implementing , many dont even have it even in their wildest thoughts . Cycling to office is something really cool especially if your way to office is peaceful and not so trafficy .

Manish

@ Manish

Ideally it should be between 10-15% Depending upon time horizon and Risk profile of the individuals.

Agreed with Bharat, regarding inclusion of Gold and silver in one’s portfolio.

Euro zone – especially Greece, Ireland and Spain continued to experience burgeoning debt crisis. The U.S. economy too for the major part of the year suffered the pain of high unemployment rate, low economic growth rate and low consumer confidence; which eventually led to stimulus package being announced in the form of QEII, in an attempt to revive their (U.S.) economy. In India the political uncertainty caused due to several scams last year also led to the precious yellow metal becoming bolder (rose by 23%). Moreover, gold merchants also maintained elevated stock levels, as physical demand also remained robust due to several auspicious muhuraths during the year.

So it makes more sense to put your money in Golf and Silver, for long term, which should help you in achieving your retirement Goals.

Vishal

What percentage of portfolio can be allocated to gold + silver ?

Manish

Investment in Gold is good. Safe, Secure and liquid investment. Please find below the news in http://www.moneycontrol.com

The price of gold may hit USD 5,000 per ounce (Rs 74000/10 gram), nearly three times current levels, in three to four years, as demand from sovereign states, central banks and exchange-traded funds (ETFs) rises, the chairman of two Canadian gold mining companies said.

“Gold is used as insurance for bad governments,” Rob McEwen, chairman and chief executive of Minera Andes Inc and US Gold Corp, told Reuters on the sidelines of the Mines and Money conference in Hong Kong on Wednesday.

Gold is traditionally used as a hedging tool against inflation and economic uncertainty. The yellow metal has also been a favourite investor hedge against loose monetary policies in the wake of the global financial crisis.

McEwen said gold was in the middle of a super cycle that could end by 2015, adding that the length of the gold super cycle and the USD 5,000 forecast were based on historical gold prices and the ratio of the Dow stock index against gold since 1970.

McEwen founded Canada’s top gold miner Goldcorp Inc. He left the company in 2005, cashing in for a little over USD 200 million.

He said about 90% of his personal assets were in physical gold, adding the he owned a 31% stake in Minera and a 20% stake in US Gold, both headquartered in Toronto.

US Gold mines gold and silver in the United States and Mexico. Minera has a project in Argentina.

McEwen said he believed that countries such as China, Russia and India would buy gold as part of their foreign exchange reserves.

If China wanted the yuan to become an international reserve currency, the government may need to put 10% of its foreign exchange reserves in gold, he said.

The world’s second-biggest economy, China holds less than 2% of its 2.85 trillion foreign exchange reserves in gold, which have stayed at 33.89 million ounces since April 2009 according to official figures.

He said, however, that global gold production would continue to be limited by high costs and tighter regulatory controls.

Spot gold was steady at about USD 1,427 per ounce at 0630 GMT on Wednesday, within striking distance of its record USD 1,444.40 per ounce set on March 7.

Nick Holland, chief executive of the world’s fourth-largest listed gold miner Gold Fields Ltd, said on Tuesday that the gold could hit USD 1,500 and the industry was not making a huge amount of money at current prices.

Note: 1 troy ounce = 31.1 gram. USD 5000/ounce =Rs 74000/10 gram [(5000*46(Exchange rate))/3.1]

John

Thanks for the information 🙂

Manish

Manish,

Thanks for the nice article.

I am assuming most of your readers are very young and are working in IT / Finance industries. I am 45 and I work as a IT Manager and retirement planning is very close to my heart.

I’ll like your readers to consider the following

1. Do you think your industry will continue to grow at the current high rate in the next 25-30 years of your work life ?

2. Do you think they will be able to promote you in the same rate they have been doing your seniors. Consider this, a fresher who joins a big IT company today has got at least 1 Lac senior people in his organisation. Will he become even a Project Manager. Same question for the new trainee joining a ICICI Bank or HDFC Bank or Insurance Company. Do you think all of the Trainees in these industries will even be able to become Mid level Managers. My predictions is no. Please note I am not suggesting none of these people will be promoted. What I am saying is it will become tougher and the most important thing is there will be shakeout and many of the senior people will be shown the door.

3. Thus if you are 25-35 year old working in these kind of high growth industry you may target to attain financial freedom by 50 as I foresee many of us will lose our high paying job by age 50 as the companies will try to replace older high cost employees with younger cheaper employees or better still Indian Companies will outsource some of these jobs to even countries like Bangladesh , Nepal etc.

4. How many of us are upgrading our skills to keep pace with the market. How many of us think that we can join a new industry at mid level position.

Ujjwal

Ujjwal

This is a very valid point . We cant expect a increase in salary by 15-20% each year . It can happen once in a while or just few times in continuance . Here is a small article which talks about how real income has gone down in last 5 yrs : http://articles.economictimes.indiatimes.com/2011-03-11/news/28680348_1_consumer-inflation-salary-consumption-expenditure

Manish

Manish,

Yes, we all know that in the last 2 years most comapnies have used the recession to reduce the salary hikes. Specially for senior people where attrition is very low they are giving very little rise. Also, in my organisation I have seen that in the lst 5 years frehser salary has remained almost constant thus in real tersm the fresher salary has actually reduced.

Ujjwal

Very Nice and Thought Provocating article.

Keep up the good Work.

Sahil

Sahil

Thanks . keep reading !

Manish

I love the conclusion Manish!You are apt in saying that with out proper health, even we live longer, there is little use.

As said people will loose their health in earning money and then loose their most beloved money to earn/ restore their health.

Regards,

Ravi

Ravi

Yea .. Most of the people get lost in thier own world of office and life and forget a bigger picture

Manish

Hi, Manish

Recently I came to know about your blog through Google Search and it has become habbit to visit on alternate day to find new interesting article.

I have been reading a quite on Retirement Planning. Today I gained more knowledge through this article. I have kept aside 10k/month Mutual funds SIP for my retirement.

Regards

Dr Melhotra

Thats great to know , I suppose 10k per month should be a great amount to invest considering you have enough time in your hand 🙂 . So when can I c ome for some consultatin doctor 🙂 ?

And by the way , there is a new book in the market called “Wealth Prescription for Doctors” By PV Subramanyam , you need to read it !

Manish

Nice article as usual.

I have a tip for those persons who are not in organised sector and want to take a Medical Insurance. Bank of India in collaboration with National Insurance Corporation offers cheapest Mediclaim policy. Since they get group insurance benefits, their premiums are half of what you will pay when you go individually. NIC is Govt. Insurance company and hence I think they will be reasonable in settling claims. Please check with your local branch of BOI.

Sundar

Thats a good info 🙂 . I will check it out and try to make a post out of it

Manish

Yeah will eagerly wait for it :). I will be needing one soon.

Prasanna

but it wont come very soon , Let it come to you as surprise !

Check out the following website everything is given including proposal forms.

http://www.bankofindia.com/swasthy.aspx

Manish,

Please remember that Health Insurance is operated by criminal middlemen. I don’t know how much commission they get but most of them are working in these Insurance Companies and running broking business in the name of their relatives. If you approach them they will suggest to you only expensive plans. When my friend went on shopping spree for Medical Insurance and was about to get trapped by one of these employees, lucklily he was saved by another Junior Employee who (probably had tiff with his boss) and he told him to go to Bank of India.

Sundar

Thanks for that info , can you give some resource on this or it is based on your personal experience ?

Manish

Manish,

You will not get any published resources on this. When you hear personal stories the realities come to fore. That is why personal information is much more important. This is true for any financial product in any part of the World. There are much bigger criminals in US and Developed market. I don’t mind paying decent brokerage but not for brokers who have their personal interest than the interest of their clients.

Ok , I agree with you now .

there is also one group health insurance for the account holders( with payment of premium) of Indian Bank named ‘arogyaraksha’ from united india insurance co. ltd. it covers 6 persons including self,spouse, 2 children and parents , and si could be upto 5 lacs.

Bharat Shah

Thats great to know , I will compile the list of all the plans with banks and try to post it

manish

Hi,

Food and Thought book is very nice and meaningful. It is a very good gift for the entire world. YOU ARE A GIFT FOR ALL INDIANS..Keep going..

Ashok

Thanks for the comment . Good to know that you liked the ebook 🙂

Manish