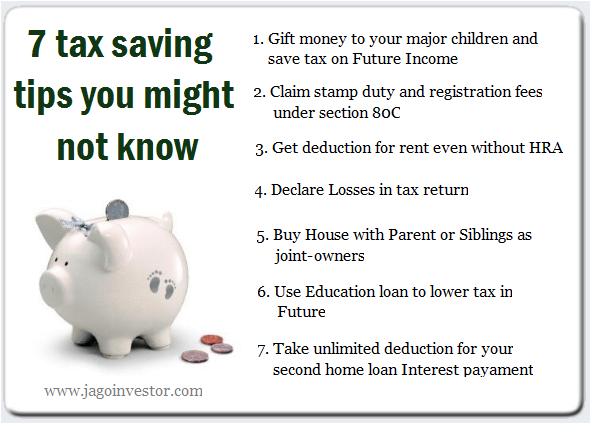

A video on 7 Income Tax saving tips you might not know

Are you bored of regular income tax-saving tips? Are you looking for some tips which are different, kinda unique and not very well known?

If yes, then you’re reading the right article, mate! I will share some tips which would help you in the area of income tax saving. Some of these tips will help you in this, current year and some, at some later point. But helpful at some level, they will be:). Below is a video on this topic where I explain those 7 tips.

In case you don’t want to watch the video, you can just skip it and move forward to read the tips in the text. Let’s look at them. If you are reading this article on email, you can watch the video on Youtube here

7 income tax-saving tips

1. Gift money to your major children and Save tax on Future Income

Imagine this, you have Rs 25 lacs. Logically you put this in a fixed deposit or invest in some other financial product through which you get an interest at 8%. You will get Rs 2 lacs as interest which will be added to your income and you pay tax on this income. Not good!

Now what? How do we save tax on these 2 lacs? As per income-tax laws, you can gift any amount of money to your major children without attracting gift-tax and as their money will become theirs any income arising out of it would be treated as their income, not yours. In case their income is below the limits, there won’t be any tax.

However, there can be times, where you might not feel too comfortable gifting away large amounts of money to your major children, in which case, there is another option of giving them loans. And guess what? you can make interest-free loans to your major children as per the law.

Please note that doing exactly the same thing with your spouse is not possible. Any income you transfer to your spouse which generates any income will be treated as your income only. However, if you are going to be married in some months and you have some big amount of cash, you can gift her right away, as a gift given to prospective wives would become hers lawfully.

I hope you liked this first point on income tax-saving tips

2. Claim stamp duty and registration fees in 80C

Many people dont know this, but the Stamp duty and the registration fees of the documents for the house can be claimed as deduction under section 80C in the year of purchase of the house. An important point to note here is that you should be in possession of the house if you want to claim these deductions.

So in case of under-construction properties, you lose out on claiming this deduction. As per the income tax

The stamp duty, registration fee and other expenses incurred for the purpose of transfer shall also be covered.

Payment towards the cost of house property, however, will not include, admission fee or cost of share or initial deposit or the cost of any addition or alteration to, or, renovation or repair of the house property which is carried out after the issue of the completion certificate by competent authority, or after the occupation of the house by the assessee or after it has been let out.

Payments towards any expenditure in respect of which the deduction is allowable under the provisions of section 24 of the Income-tax Act will also not be included in payments towards the cost of purchase or construction of a house property.

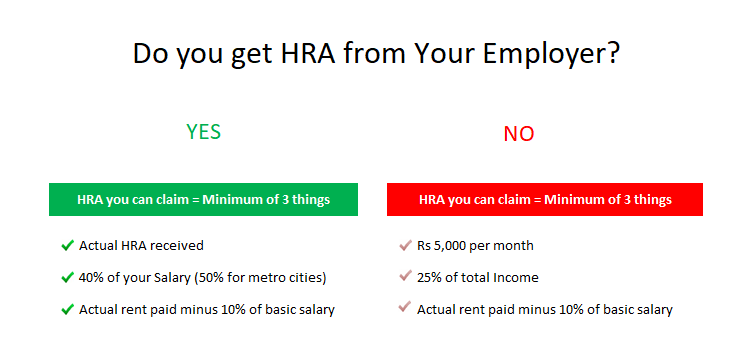

3. Get deduction for rent even without HRA

All the salaried class people get HRA from their companies, and hence they claim deductions on that. However, what if you are a self-employed professional or working for a company that does not provide you HRA benefits? Can you still claim HRA? Yes! But with some caveats.

Under Section 80GG, you can claim a deduction of the rent paid even if you don’t get HRA. However, not many people are aware of this deduction. If you are not being paid any HRA or don’t have any housing benefits from the employer. You can claim least of following 3 things as HRA

a) Rent paid less 10% of total income

b) or Rs 2,000 a month;

c) or 25% of total income.

Note that your spouse or minor child should not own any house with the city limit if you want to claim this benefit, You will have to submit a form called 10-BA that you are paying rent and not receiving HRA.

Bonus tip : If you are staying with your parents, you can pay them rent. If they don’t have significant income, it would mean you save tax on rent paid and even your parents income does not cross the tax limits, which is a win-win situation.

4. Declare your losses in a tax return to save tax in future

A lot of people do not show their losses in shares, mutual funds, gold ETFs, real-estate in their tax returns. This is a big mistake, as you lose an opportunity to save tax in future years. You can set-off your losses against profits in the current year as well as in the future too.

For example: Assume you had sold your real-estate property and made a profit of 10 lacs after indexation. You will have to pay a tax of Rs 2 lacs @20%. However suppose in the same year you have also made a loss of Rs 4 lacs in stocks, you can set-off this loss with your 10 lacs profit and just pay tax on Rs 6 lacs, which comes at 1.2 lacs only. That’s a cool 80k in savings!

Also if you have only losses this year and no profits, you can show this loss in your tax returns and carry forward and set-off this loss against any future profits for the next 8 yrs. For more details read this article.

5. Buy House with Parent or Siblings as joint-owners

Yes, if you thought only spouse can be co-owner in the real-estate property to claim the tax deductions, you don’t know the whole story.

You can have your spouse/parent/siblings as co-owner and all the co-owners can claims the tax deductions of 1 lacs for principal and 1.5 lacs for interest part. So if you take a housing loan with your siblings as co-owner of property and co-Borrower of loan, the loan amount interest and principle paid will be available for tax exemption in the ratio of your loan amount.

So if you are still a bachelor or a single who wants to buy a house, consider asking your brother, sister or parents to become the co-owner so that both of you can get tax benefits and reduce your tax outgo.

The only problem, in this case, is that loan-sanctioning companies are very stringent in giving loans to siblings, as there are higher chances of you parting your ways with them later in case of any family issues, however, in case of a spouse it happens lesser.

Bonus Tip : The co-owner who falls in the higher tax bracket should hold a higher proportion of home loan to make sure that the tax benefits are maximised.

6. Use education loan to lower tax for your Children in Future

So what, if you have all the money to pay for your children’s education fees? It would be wise to opt for an education loan in the name of your children’s name as you can claim the full interest paid on education loan under section 80E. Note that it’s only is available if you are a parent or a legal guardian .

You can’t claim a deduction for your spouse education loan 🙂

The other thing is that you can take an education loan on your children’s name so that after some years when they pay off their loans, they can claim the deductions themselves. Apart from this, they’d be more responsible and this education loan payment from their pocket will make sure that they don’t spend too much money in the wrong places and you can use your money today somewhere else!

7. Take unlimited deductions for your second home loan interest payment

This one is the last tax-saving tips we will discuss here. If you have already bought a first home where you are living right now and want to buy another house, the good news is that you can claim full interest paid for the EMIs of the second house. As per tax laws, you can claim full deductions for the amount paid as interest on the loan for the second house.

For the first house you can claim up to 1.5 lacs in interest, however for your second house you can claim the full amount of interest without any upper limit. Read some tips on buying real-estate

Which of the above income tax saving tips were new for you? Please comment.

January 11, 2011

January 11, 2011

Hello,

Nice Articles!!

I have a question, I want to gift the some money for saving my income tax, as per your article I can gift my money to major children. I want to know, except that whom I can give the gift and how much amount I can claim under this section in tds return?

The gift is given out of “post tax income” . So you cant save this year tax by gifting. Only the future income on the amount will be not taxed in your hand

Dear sir your articles are very very useful thanks for that’

i have a question

my brother has a hotel in uttarakhand with air condition.

we also provide food to customers.

WHAT ARE THE TAXES WE MUST COLLECT?

What is the VAT rate in uttarakhand on food and beverage ?

Hi BHAGAT SINGH

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

Hello Manish,

I have two homes – A & B. A is given for Rent and B is currently under construction. I stay at a rented apartment for being convenient to my work location. I’ve taken loan for both the homes. While I claim the tax benefits for loan on ‘A’ along with the HRA benefits on the Rented apartment, can I claim the tax benefits for the 2nd home ‘B’. Please advise. Thanks.

No, because you cant get the tax benefits unless you have possession !

l want to invest 4.5lac in POMIS .pls reply me how much tax will be deducted from my interest

This money which you will invest is out of POST TAX income. You cant save any tax just because you are investing in POMIS

Manish – i have a question. Assume the wife gets HRA and the husband does not get HRA (Self employed). If they live on rent, can the wife claim HRA exemption proportionate to the share of her rent payment And can the husband claim rent deduction under section 80GG for the share of his rent payment?

Please advise.

I am not very clear on that. Its more of a CA related topic.

Manish

I bought fully constructed apartment in FY12-13 but did not claim stamp duty/registration fees due to ignorance of this provision. Am I allowed to this now FY-15-16/AY16-17?

Regards

Rajeev

No, its only allowed in the year when you paid it !

Hi,

I have taken home loan in Nov 2014 and paying EMI since Jan 2015. I registered the flat last month. I have not occupied it yet. I am currently living in a rented house. In the company prepared Form 16, the rent component is present. Can I also claim the home loan interest paid so far in this Fy 2015-16 tax returns?

Biswajit

Unless you dont have possession , you cant claim the interest part !

Dear Manish

Thanks for the info, especially the ‘Take unlimited deductions for your second home loan interest payment’ one.

I live in Pune and have a house in my native (a village) which is owned by me and my parents live there. For this house, I pay around Rs. 200000/- interest on it’s home loan. In this case, is this amount eligible for deduction for tax from my income? I am in 30% tax bracket.

Thanks,

Shashank

Yes, you can reduce this much from your income. Upto 2.5 lacs limit is there !

Manish, it is indeed very informative article. However regarding point 4 in your example, I suppose it has to be a short term capital loss on shares and not long term capital loss for setting off to be applicable. Correct me if I am wrong.

Thanks.

Yea I think you are correct

Hi

I want to know whether I will get the entire amount of Super annuation fund on retirement.

No, you can’t withdraw the entire amount. Generally it is 1/3 (you can check with your employer or fund for exact condition), while rest needs to be used to purchase an annuity that will offer you a pension subsequently.

No , some part will be for pension

Hi Manish,

My query is, currently I own a house (in my name) and have given it out for rent and the loan is also cleared. Hence since I fall under the higher tax bracket of 30%, if I transfer/gift deed this house to my wife, who is a home maker, and no other income earner, then for the rent earned, will the tax bracket be the minimal, as thehouse will be in her name. Pls provide your views.

Thanking You

Umesh

Yes, thats correct. You can do that

Hi Manish,

I am in 30% tax bucket. Can I give interest-free loan to my non-earning wife which she can then invest in FD (without Clubbing of income for me)? If yes, what documentation(s) and/or declaration(s) do I need for this loan? If it can not be interest-free, what is the MINIMUM interest rate I need to charge?

Giving no-interest loan is same as just giving the money . Its just a trick . You cant food IT department like this. Its better to talk to a CA on this .

I see.Thanks, Manish.

i have a house on my name which i have given on rent. Can i collect the rent on by wife’s name to avoid adding the same in my taxable amount and save on income tax.

That will not help , Even if you take on her name, its still going to be counted on your name because house is on your name only.

I invest in agriculture but the land is on my father name? Can i claim losses ?

No

IF A WOMEN ONE WHO TAKES TUITIONS TO CHILDREN AT HOME WANT TO SHOW SOME INCOME ON HER PART AND STILL DO NOT WANT TO PAY THE TAX. HOW CAN SHE DO SO???

If she is earning less than the taxable limit of 2.5 lacs a year, she anyways dont have to pay any tax

Dear sir,

Please do help me in my last income tax-calculation issue. I retired on 31 jan 2015,so It was shown in form 16 ( by my employer, AIRINDIA),that my tax on regular income is Rs2.5 lac and deducted. An additional tax on my retirement benefits is shown to Rs2.2lacs and deducted..which I could not avoid as it was deducted at source.Thus I paid Rs4.7lacs.

In fact It is paining me that after all, it was my life long retirement benefit on which my income was calculated as additional income as if and deducted.

I request you that can you show any loss of income in this current year submission or any other way of tax saving possibility.

Regards KARRI RAMARAO, Ph:09493976988., [email protected],

Hi RAMARAO

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

I have a joint house loan ( me & My wife).

In first year of loan I gave 2 lac of principal & 3.5 lac as interest.

Since it is a joint loan, we defined as 50 % each.

Scenario here is that my house is in Bangalore Rural area and It is far from office, I am planning to take rented house near my office. And I may not get any rent income also from my house.

My question here is :-

1- Can I mention my house as Let out and define minimum rent income as above 3 K (Without any proof) & avail HRA ( Both Me & my wife) ?

2- Is it possible only one person avails the benefit and defines interest more than 200000 ?

1. Yes

2. Yes

Hi I have a demat account on my wife names and she is a House wife. I made 2 lac loss this year in delivery add intraday trade. can I claim this loss against my income of this year?

No you cant

Amazing article, Manish Ji!

Please help me in solving below queries on point #1 and #5

1. Gift money to your “major” children.

What do you mean by major children? My daughter is 3 year old she has savings account in SBI. Can I transfer money in her account as gift?

Example: My take home is Rs1,20,000. I transfer 60k in her account then only 60k will be taxable income, is it? If not please quote an example so that readers can understand it correct.

2. Me and my brother bought a house. We took joint loan of 38 lakh. Flat is on both names.

We have been paying equal EMIs i.e. 19k by me and 19k by my brother every month. But I hae always been in larger tax bracket. Is it possible that I can claim more benefit than him, because he has already deposited in PPF, kids fees, LIC etc so he taking home loan benefit is useless for him.

Also , we are planning to buy another flat. That flat will again on both names, loan also will given to both? Can we exmpt 100% rebate. Example: Loan will be of 28lakh. I will 14k he will pay 14k. So we both will get benefit of 3.36 L(28*12) or we will get 50-50 benefit i.e. 1.68L(14*12).

3. How point #5 and Section 26 are different/same?

1. Major = above 18 yrs

2. Not possible

Your seven TAX saving tips are awesome….Hats off

Glad to know that ShrigopalMalani ..