Term Insurance Plans – 20 different policies compared with charts !

Which is the best term insurance plan in India ? Which Insurance company has the best claim settlement Ratio? Should you buy online or offline plans ? These are some of the questions which comes in the mind of every insurance buyer! .

So are you looking for Term Insurance comparison at one place ? Do you have all the sufficient information to decide which is the best term plan you can buy? Today I will show you all the data like riders, maximum/minimum tenure, max age till when these plans covers a person and data on the premium, Claim settlement Ratio at one place! .

Best Term Insurance plans in India – A comparison List

There are many term insurance plans in India, but all of them have different premiums and features which confuses a prospective customer to choose the best term plan for him. Below is a table which shows most of the policies name along with their premiums. But before that, make sure you fully understand what is a term insurance plan ? Better read the 9 most asked questions about Term Insurance before you move ahead.

| Company Name | Policy Name | Mode | Riders Available | Premium (1 crore SA) |

| Aegon Religare | iTerm | Online | Yes | 7,300 |

| Bharti Axa | e-Protect | Online | No | 7,300 |

| Aviva | i-Life | Online | No | 7,368 |

| HDFC Life | Click2Protect | Online | No | 10600 |

| Kotak | e-Preffered | Online | No | 10825 |

| Edelweiss Tokio | Life Protection Plan | Online | Yes | 11,500 |

| Metlife | Met-Protect | Online | No | 11,600 |

| ING Vyasa | My Term Insurance | Offline | NA | 11,891 |

| ICICI Prudential | i-Care | Online | Yes | 13000 |

| DLF Pramerica | U-Protect | Online | Yes | 13,400 |

| SBI life | Smart Shield | Offline | Yes | 16,798 |

| Bajaj Allianz | iSecure | Online | Yes | 18400 |

| Max NewYork | Platinum Protect | Offline | Yes | 23,500 |

| IDBI Fedral | Termassurance | Online | No | 25,350 |

| LIC | Amulya Jeevan | Offline | No | 33,600 |

| Future Generali | Smart Life | Online | No | NA |

| Birla Sun Life | Protector Plus | Offline | Yes | NA |

| Tata Aig | Maha Raksha | NA | NA | NA |

| Reliance | Term Insurance | Offline | NA | NA |

| Canara HSBC | Life Pure | NA | NA | NA |

| India First | AnyTime Plan | Online | NA | NA |

| Sahara Life Insurance | Kavach | NA | NA | NA |

| Star-Union Dai-ichi | Term Plan | NA | NA | NA |

Note : The premiums above are for 30 yrs old non-smoking male, and 30 yrs policy tenure. The premium quoted is for Rs 1 crore sum assured and does not include service tax. The premiums displayed were taken from respective life insurance companies websites and should be treated as indicative premiums.

Brief overview of Riders

Most of the term plans also allow riders along with their plans. Riders are nothing but additional benefits which you can take by paying some extra premium. Lets see some of the riders and what they mean. A term insurance plan might be offering some of the riders mentioned below.

AD (Accidental Death) : The policy pays you additional sum assured in case the death happens due to an accident . Note that even if you don’t take this rider, the sum assured is always paid on death, whether accidental or not !.

CI (Critical Illness) : This rider gives you a lump sum amount if you are diagnosed with an illness which is mentioned in the policy . Generally all the major illnesses are covered in Critical Illness cover.

DR (Accidental Disability Rider) : This rider covers you for disability and pays you Sum assured in 10 installments per year incase you becomes temporary or permanent disabled person.

WP (Waiver of Premium) : This rider makes sure that incase you are not able to pay future premium due to disability or income loss, the future premiums are waived off , but your policy is still in force like always !

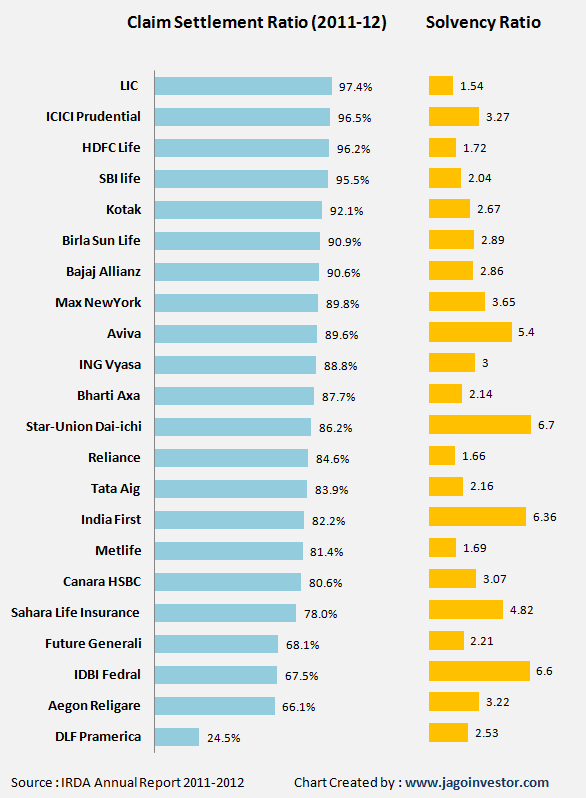

Claim settlement Ratio of Life Insurance Companies

While deciding on a term insurance plan, the biggest point which a person concentrates is the Claim settlement ratio (read this comment) . Claim Settlement ratio of a company tells you that how many policies were settled by paying back the claims in case of death. However note that these numbers are not for pure term plans, but for any kind of policies.

Solvency Ratio of a Life Insurance Company

Another small things to look in a life insurance company is Solvency Ratio. It indicates how solvent a company is, or how prepared it is to meet unforeseen exigencies. It is the extra capital that an insurance company is required to hold to meet all the claims which arise . In other words , Solvency margin refers to the excess amount of asset the insurance company has to maintain over its liabilities. Basically, it is the amount the insurer has to stash away in order to pay the claims during emergency. IRDA requires the insurance companies to maintain a particular level of solvency margin for their smooth functioning

Below is the Table and a Chart showing Claim Settlement Ratio and Solvency Ratio of all the insurance insurance company in India. The data is taken from 2011-2012 IRDA annual Report.

| Company Name | Claim Settlement Ratio (2011-12) | Solvency Ratio |

| LIC | 97.4% | 1.54 |

| ICICI Prudential | 96.5% | 3.27 |

| HDFC Life | 96.2% | 1.72 |

| SBI life | 95.5% | 2.04 |

| Kotak | 92.1% | 2.67 |

| Birla Sun Life | 90.9% | 2.89 |

| Bajaj Allianz | 90.6% | 2.86 |

| Max NewYork | 89.8% | 3.65 |

| Aviva | 89.6% | 5.4 |

| ING Vyasa | 88.8% | 3 |

| Bharti Axa | 87.7% | 2.14 |

| Star-Union Dai-ichi | 86.2% | 6.7 |

| Reliance | 84.6% | 1.66 |

| Tata Aig | 83.9% | 2.16 |

| India First | 82.2% | 6.36 |

| Metlife | 81.4% | 1.69 |

| Canara HSBC | 80.6% | 3.07 |

| Sahara Life Insurance | 78.0% | 4.82 |

| Future Generali | 68.1% | 2.21 |

| IDBI Fedral | 67.5% | 6.6 |

| Aegon Religare | 66.1% | 3.22 |

| DLF Pramerica | 24.5% | 2.53 |

| Edelweiss Tokio | 100% (Just 1 policy) | NA |

Term Insurance – Online vs Offline

With online term insurance plans coming in market, two things has happened. First, Customers have really got excited seeing very low premiums which insure them at throw away prices, however low premiums does not appear on the top wish list of customers and what everyone needs is very high claim settlement ratio and excellent customer service. This is where online term policies have disappointed customers, there has been huge disappointment from ICICI iCare and Aegon Religare iTerm Plan in terms of customer service. There have been cases where customers bought an online policy and after that, they had horrifying experiences starting from increase of premium once they bought it, No-response from the company for long duration and Long & frustrating delays in medical tests. This is what pisses off customers most and they get a feel that If situation is bad at the time of buying the policy, then what will be the response when their families for claim settlement .

Another important point which comes to a persons mind is Are private Insurance companies safe ? and what is the claim settlement ratio of the company. From last year IRDA report, we came to know that Aegon Religare did not settle even a single claim out of total 7-8 claims they got . However, this years IRDA report (2009-2010) shows that its better at 48% settlement ratio for Aegon Religare, but Life Insurance is not a maths exam where 90-91% marks will make people happy. We all need 100% or 99% at least !. Because most of the companies are very new, the trust factor is missing from public. Note that not everyone who bought term insurance policies had bad experience, there are many buyers who got very good response and good customer service, but it was a smaller section .

So if you a kind of buyer who understand Insurance very well and how things work in this area and you also have trust in online term plans then you can go for online plans. But if you are not comfortable with it, then you should try the old way of buying insurance through an agent. However it would cost more than online plan, which many are comfortable with! .

If you concentrate on the claim settlement and trust factor then the only option is LIC of India Term Insurance (Jeevan Amulya). However if you are fine with the pvt Insurance, but still want the best features, I personally see Kotak-preferred Plan as a good option. The premium for Kotak-preferred is the lowest in the offline term plans and this plan has good riders along with other good options.

Term insurance plan from LIC is obviously the best option if you do not believe in the pvt companies and insist on high claim ratio, but premium for LIC term policy is too high . So I think you can consider a mix of the LIC term insurance and any one from Pvt insurer. Soon you will also see LIC online term plan

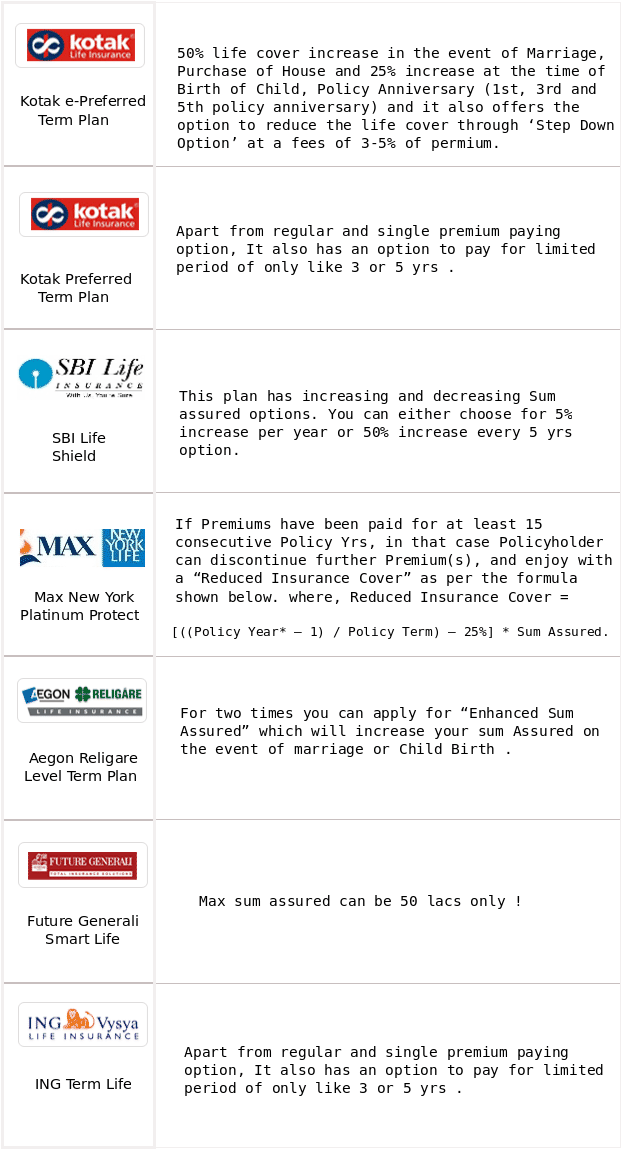

Special Features in Some Term Insurance Policies

There are some policies with very different set of features. Lets have a look at some of the those. These features can help you further in your decision.

Which online term plan do you have currently and incase you planning to have one, which one those the above will you buy ? Will it be LIC Term Insurance or some one else and why ? Also share, If you need any other factor before choosing the term plan ?

December 23, 2010

December 23, 2010

I want to buy best term plan in which included both death benefit (natural and accidental) and also cover parmenant total disability benefits. Pl. give guidance.

Hi Divyesh Kuntar

I can see that you are thinking of buying a term plan. ALl you need to do is leave your details at http://jagoinvestor.dev.diginnovators.site/pro

Our team will get in touch with you

Manish

I have taken Icici Icare plan and paying for the past 3 years – Rs 40 Lakhs. I missed paying 1 year premium, Now i wish to increase the sum insured to 1 cr. I would like to know , which is better.

i)continue the same plan with penalities and increase amount in same plan

ii)continue the same plan with penalities and take another insurance from different company for the difference amount

iii)Completely move to a different plan for the full amount.

Please help

I would suggest you continue with the same plan

Thank you . Should i increase the sum assured in same plan or go to another company for the difference amount. If later, please suggest a better plan.

Well, its more of a choice question rather than right or wrong thing . You might want to take a new plan now as the premiums have come down a lot. I would be happy to have my team call you and guide you in choosing the best option right now with lowest option.

Just fill in this http://www.jagoinvestor.com/pro#schedule-call (No charges)

Manish

I am 39.I am on the process of buying ICICI I protect smart term insurance of50 lakh SA and for a term of 36 years..through ICICI bank as I am a bank customer..But they waived the medical test..and are on the verge of issuing the policy..I insisted the verifying party from ICICI Pru for meditation,but they declined…I am fearful, doubtful on any future claim success…Kindly suggest or advise…

@ siddharthamohanty I bought an aegon life insurance 7 years ago when they were pretty new.. look at them today! They offer the most lowest premium with the highest sum assured and with best features..their claim radio has also improved drastically and is competitive with other companies. I’m so impressed with their performance that I have become a part of their online team. You should see what benefits your term plan offers rather than just going with it because it’s your personal bank.

Can you share a bit about “I have become a part of their online team” , how did that happen ?

Dear Manish, when you buy riders with HDFC Click2protect plus term insurance, does the rider premium increases after some years or it remains the same throughout the life of policy?

Being an expert in the industry, I would like to clarify the following

point with you :-

I have taken a term policy from Max Life recently for Rs.50 Lakhs.

My diabetic history was disclosed in the proposal. Though the

medical reports were normal, life insurance company charged me

50% extra premium based on my health declaration.

I have 4 personal accident policies and 2 mediclaim policies in my

name which I mentioned on my proposal form. How ever, I forgot

to give the details of 2 term polices which were lapsed in 2013.

Actually, those term polices were taken in 2012 but I discontinued

them due to the over charging of premium (on my health ground).

And I don’t have those policy details also. So I could not give the

details of those policies on proposal form.

Also I didn’t mentioned in the proposal form that I had been charged

with extra premium by other insurance companies earlier. However,

details of all current (existing) policies were given on the proposal.

In your expertise, should I ignore my new term policy and go for a

new term insurance plan to avoid any complications due to

concealment of fact and insurability.? Will my nominee face any

problem in case of a claim, since I didn’t mentioned the details of

expired policies.? Will this issue be treated as a very serious offense

even after paying the premium for 3 years.?

Please revert.

Regards,

Mathew K

Muscat

I dont think you have concealed anything here. Generally you need to give your active insurance policy details. If your term plans have already expired or if you discarded them, then its ok ! . just continue this

Hi Sir, Based on low premium, claim settlement ration, solvency ratio I am planning to buy Max Life Term Plan.

1. Please let me know is it good company ? Shall I go ahead.

2. In future if Max Life merges with HDFC, will it be a disadvantage for Max Life policy holders ?

Hi Vikram

There is no issue and already MAX is now merged with HDFC. HDFC is a good company and we have dedicated team at HDFC helping us. Just fill up this form if you need my team to have a call scheduled

http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Hi Manish,

I follow your blog and also like your writing style which I feel even small kids can understand.

Im 36, looking for 1 crore term plan till my 70 years.

Im looking for moderate premium(not high) with good claim settlement ratio & solvency ratio.

After some ground work, I have arrived at final these 4 – MaxLife, PNB MetLife, Kotak & Aviva.

I am confused which one to select among these.

Kindly suggest me any one out of these 4 companies.

Also let me know if any flaws you find in these companies.

Thanks in advance.

regards,

Deepak. K

You can look at any option actually, if you are providing all correct details . Why dont you try HDFC , its one of the best in the market and we recommend that one. We have actually met their team and they have setup a separate team to handle our readers.

Why dont you just leave your details and we will setup a call for you with them. Check them out atleast and then decide.

However even other companies like Aviva or Maxlife are good . Now Maxlife is anyways going to be merged with HDFC http://economictimes.indiatimes.com/markets/stocks/news/merger-with-max-life-to-facilitate-automatic-listing-of-hdfc-life/articleshow/52795023.cms

Leave your details here – http://jagoinvestor.dev.diginnovators.site/solutions/buy-health-insurance-policy

Manish

Thanks for your quick response Manish. HDFC is bit costly 17k+ where as all these are 12k to 13k hence, i did not consider HDFC.

Ok , if thats the case, then better settle through other insurers. We can still connect you to our trusted partner who will help you on selecting the best option among these. Let us know if you want us to connect you ? You get various companies options and pick one of them . The truster partner also gives support if there is any issue with the company at the time of medicals and other things .

Manish

Thanks Manish, I need some time. I will get back to you soon.

Hi, I have online term plan from Aegon. As you mentioned, I also faced issues with Aegon customer care like unable to get customer care no., frequent disconnect even if connected to customer care no, no reply to email.. etc. (which is more frustrating . If this is the case now, in case of unfortunate, what is guarantee that they will support dependent..claim settlement ratio clearly indicating the same)

Query:

Insurance portability: is it also applicable for term plan? if yes, please share more details. I would prefer to shift to other provider, probably LIC.

There is nothing like term plan portability right now !

HI,

I am looking for ismart term plan from ICICI & LIC E term plan coverage of 25 lakhs. my age is 26. LIC covers 35 & ICICI 40 yrs. Premium both are 5200 per year. which policy you are suggesting me. which i can trust without any risk in claims & better service.

Hi Surya

I can see that you are thinking of buying a term plan. ALl you need to do is leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Our team will get in touch with you

Manish

Hi,

What are the disadvantages of icici I cure smart protect term insurance plan?

Does riders are required as add on for term insurance plan. If so, minimum how many add ons must available.

There is no requirement for addon’s to be added in term plan, its purely optional.

Hi Manish,

I want to buy 1 crore term insurance plan. After My research I have 2 option, But I am confuse could you help me

1) Max life insurance:- 1 crore + 40000 p.m. for 10 years for my family all this benefit they provide in 15,ooo p.a.

2) Hdfc:- 1crore insurance they provide in 13200 p.a.

Should I go with Max Life Insurance . Their claim settlement ratio also good last 5 years(Between 91% to 96%).

What about company?

So is HDFC claim settlement very good.

I suggest go with HDFC

Hi Manish,

Thanks for sharing details, I have read your book from where I got to know about Term insurance Plan.

I need a suggestion here-

after doing some study , i am considering HDFC or ICICI , but now i am confused which one to go for..

background: I am 28, don’t have any life insurance, but my employer has some good polices – like paying upto 60K to 1 lakh per month in case anything happens to me. But since i cannot be dependent on my employer all the time as I might need to change job in future and that time i might be 30+, so i thought to better go for term insurance..

Kindly recommend which one shall i consider.

Regards,

Upasana

Yes, you can take up a seperate term plan. We suggest you go for a HDFC term plan . We have a special tie up for that, just fill you details here – http://jagoinvestor.dev.diginnovators.site/services/life-insurance

I need to buy INR 50,00,000/- term plan with Permenent Accidental Dissability rider. I searched on Policy Bazar & found PNB metlife & HDFC life options only. Kindly inform me which is the better among these two?

My basic details, Male, 30 years (09/11/1985), No tobacco nor alcohol. I am looking for 30years term duration.

Also kindly inform if any other is recommended. Thank you in advance for your help.

Hi Pankaj

HDFC life is one good option. We anyways recommend that to all our clients.

If you want, we can connect you to HDFC with whom we have special tie up for our Jagoinvestor readers.

Manish

Hi Manish,

I am planning to buy HDFC I protect and LIC E term policies. Do I need to inform them individually ? If I miss to mentioned previous term policy details , will it cause any issues when actual claim settlement time. Kindly confirm.

Regards,

Ravi

Reason, I choose is that one is Semi GOVT and other one Private.. I have plan for take 1 cr. So split into 2 term policies. If any insurer rejct claim other can approve. Just for safer side.. Is that good choice?

YEs, you need to inform each of them about the policies which you are buying in parallel. Mention all insurance policy taken in past, else it might be an issue at the time of claims !

Hi Manish,

I am male, non smoker 34 years old , want a Term plan. I searched, Edelweiss Tokio giving 2 Cr term plan for 46 years (upto my 80 years) with Totally and Permanently Disable (TPD) of 1 Cr upto my 70 years at Rs. 30K. But its claim ration is very low (between 55-60%). Is it good term plan or suggest me other maximum long term plan with TPD at low premium.

You can always go with any term plan now – read this

Hello Sir,

My annual income is 9 lakh and I am 31 years old. I am looking for Term Policy for 1 crore for tenure 34 years. I am bit confused for final finalization among 3 online policy

1) HDFC Click 2 Protect

2) Kotak e Term

2) Aviva I Term

If go for claim settlement ration then HDFC, if i go for solvency ration then Kotak. I f i go for premium then Aviva.

Request your guidance to choose among it.

Hi Sam

You dont have to worry on all this now . Check http://jagoinvestor.dev.diginnovators.site/2015/12/no-claim-rejection-in-life-insurance-policy-after-3-yrs.html

ALso , we have special tie up with HDFC on term plans. Do let us know if you want us to connect you with them?

Manish

I have a query regarding cover provided by term insurance outside india. When I checked with icici ismart term plan, they said if you stay outside for more than 6 months then it will not cover. Then I checked with sbi eshield term plan they said that this it is universal term plan and it will provide cover even outside india without any condition. but i didn’t find this details anywhere mentioned in their policy document or brochure of sbi eshield term plan.

when I asked this thing to sbi eshield they said you cannot find this details online when you take the policy then in the policy bond paper everything will be mentioned there.

I am an Indian resident but my concern is what when I travel outside for more than 1 or 2 yrs . Does policy cover this type of things ?.

Could you help me about this.

Hi Binod

When you take the policy it asks if you have plans to go out of india, you will have to mention YES for that, it might happen that it increases your premium.

Manish

Thanks manish for quick response. But how do i know before taking the policy that they are going to cover 6months or 1 yrs ?

Hi,

My annual income is 10 lakh and I am 34 years old, I am eligible for 20 times of my annual income which is 2 crore. I want your advice on should I buy 2 crore policy from one company or should buy 1 crore each from two different companies. Please suggest.

You can buy it from a single company. Now a days 1-2 crores is not a big cover. We have special tie up with HDFC for term insurance, if you are interested , please fill in http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Dear Manish

I’m 38 year old ,and want to buy term plan,

Kindly suggest me suitable online and off line term plan of 1 cr for non smoking catagory .

Though i’m late , but better late then never.

Kindly help.

Regrds,

Vijay

Hi Vijay

We suggest HDFC term plan . You can get it online. We have special tie up with HDFC from our end. Please fill up form below to get our help on this

http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Hi,

I am NRI now and getting salary in USA.In term insurance,they are asking for Salary right, So should i give my USA salary converted into INR ? or i should give my Old Indian salary which i was getting while i was india ?

Why i am asking this is : In USA salary – if you convert it will be 30 lak + , So we can get Extra sum assured right ? But later on after 2 years if i come back to india,my salary will be less…

So how the sum assured will be taken care ?

Kindly show your current salary status.

You will have to give your current salary only . Give your US salary !