Are you sharing agents commission ? Its Illegal

“Discount kitna doge ! Mishra ji mujhe 35% de rahe hain ” , as per Rakesh ,this is exactly how a lot of customers ask their agents commission to be shared with them in Insurance or Mutual funds. Have you ever asked your agent how much discount he can give you on the premium? This happens a lot with LIC agents and other insurance and mutual fund agents. Many times, even agents offer discount or some gift in return, if you buy the policy or mutual funds through them. This practice is illegal and totally against the laws of Insurance Act and SEBI. The agent can even face cancellation of his license if he is found to share his commission. (Read about agents commission in Insurance)

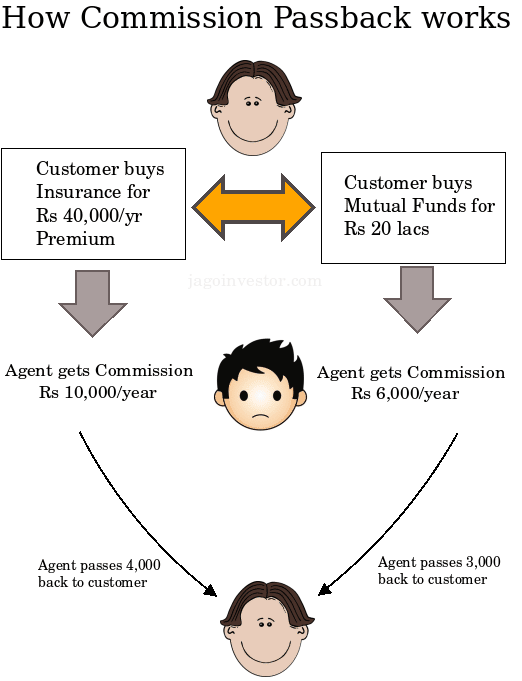

It kinda works like this. Suppose, an Insurance agent sells you a policy with a sum assured of Rs. 10 lacs, with a premium of about Rs. 50,000/- per year. An agent will make around 15,000 in commission for that year, out of which he might offer you a discount of Rs 5,000-10,000 for the first year or he offers you some gift! A lot of insurance agents do this to make sure they do not lose the business or get more and more business . In the same manner, if you have Rs. 30 lacs invested in mutual funds, your agent will get around Rs 10,000/- in trail commissions. It might happen that he can offer you 50% of that commission to make sure you stay with him .

Why you should stop asking share in Agents commission ?

Mutual funds : As per SEBI mandate, sharing the commissions received from AMC is illegal and should be avoided . Pass-backs, the practice of sharing a part of the distributors’ commission with the investor, have been made illegal under the code of conduct issued to distributors. “Intermediaries will not rebate commissions back to investors and avoid attracting clients through temptations of rebate/gifts etc” – As per a SEBI circular.

If a mutual fund agent shares his commission with others, it opens a big hole, not just for mis-selling, but also dilutes the whole industry atmosphere. There have been rampant cases, when an agent asks customers to leave their current agent and transfer their funds with them as a new agent (link) and they are ready to transfer a part of agent commission to them (the customers). For example, if a person has Rs 30 lacs invested in a mutual funds, an agent would get around Rs. 10,000/- as trail commission in a particular year. A lot of agents offer 5,000 (50%) back to the customers to attract them. A lot of agents pass back a part of commission and customers get into wrong & ill-suited mutual funds because of their greed!

Insurance : Other than the fact, that it’s illegal, you should not encourage or engage in sharing the agent commissions because, for one thing, it hampers your relationship with agent. Don’t forget that your agent will be the one to help in claim settlement when you are dead. If you snatch his share of commission today, it might leave him with a bitter taste in the mouth and not result in a healthy relationship. So please live and let live! The other important reason, you should avoid asking for agents commissions, is that it leads to mis-selling. If you ask for a share in commission, it will leave agents with less earnings and that would encourage them to sell more by any means, which in turn fuels mis-selling. So in a way the whole “asking commissions back” will hamper investors in the long run. What you sow is what you reap!

As per section 41 of the Insurance Act, “No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out OR renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.”

Real Life experience

As per Dhawal Sharma, a Delhi based agent shares his experience

I face this problem day in and day out and many a times have to miss out on prospective clients because they want “passback of commission“. This practice (Sorry to say, but started by LIC agents) is so much part of the Insurance selling culture that 99.9% of the public thinks that it is obligatory on the part of an agent to part with his commission. But even LIC agents were quite smart at that time as they use to pass back comission mostly on ENDOWMENT or MONEYBACK policies which generate hefty renewal commissions as well (Unlike ULIP) and reversely, would be of little or practically no use to the client in the long term. This practice is actually pound foolish , penny wise approach..

I know at least 100 people, regularly buying insurance for their entire family (father , mother, brother,uncle, aunty) for last so many years from SHARMA JI or OFFICE WALE CLERK who passback 20% commission, and if we make a thorough study of their Insurance portfolio, they are underinsured (No term plan), not properly equipped to handle retirement (their agent never knew that annuity fund is tax exempt only upto 1/3 amount), and no proper child planning (In many cases, child plans where child is life insurand and not father).

Violation of law using Multi-level marketing in Insurance Policies

For some years now, a new way of selling is evolving. It’s called MLM. Here a big agent sells a policy to some one and makes him a customer. Now, this customer also acts like an agent and starts adding new people in the network and sells them policies. This goes on to many levels, a person earns a part of commissions earned from every person under his personal network. This whole idea of multi-chain selling violates Insurance law and is illegal.

As per Section 41 of the Insurance Act, “A licensed agent, whether individual or corporate, can’t appoint a sub-agent and pass on a commission to another person or entity. Any passing of commission by an agent is construed as rebating and is prohibited under the Act.”

There are many companies operating in different part of our country like TLC Insurance (India) in Bangalore, RMP Infotec in Chennai, Golden Trust Financial Services in Kolkata and SecureLIFE out of New Delhi (read more here and here)

Responsible Investor = Health Industry

We as buyers, shape this whole industry based on how we act. Over the years, we expected and asked for share in agents commissions, without realising that it will one day work against us resulting in misselling. So please do not support it! A couple of hundreds or thousands is not going to make you rich or poor, but it sure dilutes the whole environment!

Have you ever experienced a situation where agent has tried to give back his commission? Do you think if everyone stops asking for any agents commission back, it can really have any impact?

November 30, 2010

November 30, 2010

What will happen if an agent get’s a commission from the premium deposited by a customer and if that customer decide’s to close his policy within the free look period.Commission is taken back from that agent or not?

Sumit

Agents get commission only after the free look commission has passed.

What happens if the same is reported to IRDA about sharing of commission ?

The agent will be disqualified and barred from his licence

Hi Manish,

I don’t like to take any insurance policy from a agent, and would rather prefer buying policy directly from the company.

Reason

1. Every penny invested in any insurance is hard earned and I would prefer utilizing that to improve my insurance but rather giving it to any agent.

2. Any policy suggested by agent would be something which would be in his own interest (keeping max commission in mind) rather keeping customers requirement in mind.

Please let me know if there is any such facility by LIC.

There are lots of term policies and ULIPS which you can buy online directly. but some policies which are of endowment plan or money back plan nature, they have to be bought through agents only

I totally agree with this article.Here in Hyderabad, customers ask me for 40-50% discount or else they move out.For lower premiums i have paid 100% for the 1st premium. I feel helpless as my D.O says its a business.And what do i get, 20-21% deducted commission and no bonus. And this is not enough, some customers expect that i should pay 50% of my every commission.This has been started by LIC & Lic agents and I’m stuck between them.

Shusheela

Hmm.. this is really a sad thing . If you are a commission based agent or some advisor who earns on that, you will really face issues like this

A few LIC agents are cheaters!

A LIC agent of Najafgarh branch, Delhi sells LIC policy giving 50% of his commission. One of my close relative got benefit, when I introduced the agent to him. When, I tried he gave me wrong policy and also not giving commission discount. Can I withdraw or change policy?

Thanks!

Hi All,

I Know a LIC agent who shares his 25% of full year first premium commission .I was able to save around 25k cause of this.

Hi Kumar,

To me your statement is “I Know a LIC agent who shares his 25% of full year first premium commission. Due to this I lost Rs 75k & next year I will loose more” 🙁

it is said that putting money in sectoral mutal funds should be avoided . but i have observed in last five years that pharma and banking sectoral mutual funds have outperformed all equity diversified funds . not only that any good diversified mutual funds constiture their portfolio taking a good number of banking and pharma funds . even in cases a portfolio might tilt towards these sectors by given a major chunk of the shares . so my opinion is why should not one be encouraged to put in an sip way his investments in banking and pharma sectors at large and to balance the act some fmcg sectors , instead of putting money in diversified equity funds . please throw ligh on my opinion si that i may save myself from becoming a bigoted holder of such opinion .

Simanchal

Its only discouraged for half-baked knowledgable people . peopel who dont have any idea of sectors . If you feel that you can catch a good sector and are confident about its movement in next few years ., then you can go for it .

Manish

I agree with your view & I have invested in banking & pharma sector And have received good returns. How ever continuous monitoring may be necessary as these sector funds are volatile & face ups and down.

to all,

I am working with Insurance industry for last seven years and I have grown a bitter experience. I just want to leave this Industry whenever I get a suitable alternative. It has become painful.

It has to be kept in mind that Clapping needs two hands, not one.

No doubt that this is one of the most Corrupt Industries, even more so after the new regulations came into force about the ULIP policies. Now an Endowment Plan is projected as a Short Time Investment Product with TAMPERED DOCUMENTS,(Pls remember that almost NOBODY is ready to stay invested for a longer period), and more stunningly Prospective Buyerss tend to proceed without doing Cross-checking, often these Manipulated Offers are topped up with Passbacks/Gifts. IT IS GREED and sudden loss of REASONING that these Offers are gleefully Accepted. Most of the Representatives go gaga with their Volumes of Business and income as well. The process goes on. Be a part of it or get Damned. The whole Industry has become like this.

On the other hand, whenever I went to a Prospective client, I have seen that their NEED can only be met if they themselves Design a Product/tool for them. They want Everything, ranging from Guaranteed Return which is significantly higher than the Fixed Instruments offered by the Govt to Short Term Plans; Tax Benefits, Liquidity(can be withdrawn at any point of time), Loan, Flexibility(?) to Gifts or Passbacks. Moreover they need Service availibility 24*7, otherwise there is a personal stiff.

So, can Representatives only be blamed? Or the Customers, for that matter, whose hard earned Money is at stake? Its Both.

The main motto of the Industry is nowhere near where it should be. It has become a source to earn some Quick as well as Hefty Money-buyers expect it and Corrupt Representatives get it (exceptions are exceptions only, they are not Rules).

A whole new Approach is needed, otherwise, God saves….

Manish,

Let me first congratulate you for educating investors. All articles are very informative & useful.

In fact after reading ” Understanding Different commissions on Mutual funds ” I discussed about sharing commission with my agent. He was reluctant so I changed agent to stop his trail and then redeemed /purchased MF in a phased manner.

During this portfolio make over I learnt that previous agent was misguiding me for getting more commission. Now my investments give a better return also. It is necessory for all investors to study before investing and now I am confident that no advice is required from agent.

My point is therefore simple. I am not taking commission from agent but giving him his share just for mentioning his ARN code and do not expect any service as everything can be done online. If this is not done both will loose and AMC is benefitted.

“So sharing is win win for both”

Vijay

Yea , in thay way atleast agent will get something 🙂

Manish

I select and invest in mutual funds through online websites and also monitor my portfolio to make changes. If I don’t mention name of agent in PPF or MF investment no one gets commission. Without doing any work if an agent earns just for adding his name what is the harm to him and why should he not share this with the investor.

The article is written to support agent’s side only. What about the investor without whom there would be no agents. I strongly support the idea of mutually sharing the benefits instead of both loosing.

Vijay

Its good to have sharing implemented , but its tough to find advisors and even customers having a right mindset like yours . I hope IRDA/SEBI soon changes it

Manish

There are a lot of LIC agents who offer this service, i was not aware this is illegal. But nobody is taking such action.

Bin

Yes .. regulators are not taking any actions on this

Manish

LIc agent are worst hit by the ritual” Pay Back”. A dedicated adviser will definitely not looking for those client who want share of cake from adviser. Like other profession they are also in market to earn . There should be healthy compition to Serve their client best not for Who “pay back” big ? Regulator need to take some serious steps.

Thanks for your comment Rashmi

Manish,

Fine, agents sharing commission is illegal.But lot of discussion and proposal has been taken place for making this practice legal.What do you feel??Legalizing commission sharing or pass back, as we call it, will make insurance industry more ethical.

Jitendra

The main intention of the post was to spread awareness , I feel if its made legal , It can be good move from competition point and sharing commissions with agents to win more clients . But at the end if its used with an intention of catching the clients just to make sure you can sell him unsuitable products , then it might be a good move .

I hope you agree with his thoughts . Overall it should be a win-win situation

Manish

unethical and illegal are not same always, these are (bit) different things. It is administration who decide illegal and legal. It is society which judge what is unethical or ethical. It may be illegal to buy/sell liquor in Gujarat but not else where in India. Similarly marrying in same Gotra may be unethical in one society but not in other society, while it legal to do so.

Bhupesh

in the same manner , sharing commision is illegal , but might not be unethical for many agents as well as customer who support it .

Manish

Yes, that’ what I meant. Things changes with time though.

5 years back, I went to post office; opened a NSC of 10k; and to my surprise the agent gave me 50 Rs back and told that I should go to her again for future investment.

Why should a common man refuse money if he is getting some? That too he is not asking for it. I think this will compensate all the bribes that we have to pay in government offices.

Anand

If you get it without asking , its not a issue ,but still its illegal for the giver !

Manish

I feel one good way to address the issues and concerns raised in this discussion is to apply the MRP model to financial products.

For a consumer product, the seller marks the maximum retail price (MRP) , and the retailers are free to sell it at any price below that (not above that). If you buy it in a swanky mall, you pay the MRP, while if you take the inconvenience of buying it in a dusty, crowded local market, you pay less. The cut that the retailer keeps depends on the convenience he offers, and it is quite transparent. The buyer is free to decide where to buy from based on how much convenience he wants.

Similarly, financial products should have an MRP and distributors should be free to advertise discounts based on their target clientele and value-add that they provide. Then, it is up to the buyer to decide who to buy from based on his comfort level. e.g. if I am financially savvy and don’t need much education, I can go to a bulk distributor and get the product at a discount. But, if I need more “servicing”, I go to a retailer and pay a higher commission for the services.

What’s the problem with doing this? This way we ensure that the financially savvy investors don’t subsidize the cost of education of the novice investors.

As for mis-selling, I think it is a fundamental mistake to take advice about a product from the seller of the product. Anybody can see a conflict of interest there. If you need advise, go to an independent financial advisor. This is common sense!!!

So, the agent’s commission essentially needs to cover his administrative and marketing expenses, just like sale of any other retail consumer product. I don’t see why the commission needs to be fixed by SEBI or the seller, it makes sense to cap it (through MRP), but not fix it.

Well said Sandesh, I agree with your argument, why it is not illegal for other goods sellers

There is a website which wants to enter the business of motor insurance.. By bringing in the insurance agent on a common platform.. In this case is the website iwner be considered as anagent themselves.. If so are there any loopholes or exception to evade being registered with the IRDA..?

Pratibha

Sharing of commissions between agents if fine , what is illegal is to share it with end consumer !

Manish

Hi Manish,

One year back I have taken LIC Term Insurance and got around 40% discount on first year insurance. yes it was term insurance with discoutn which is rare.

I met insurance agent at LIC office, and negotiated discount with him.

I did all research of deciding which term insurance I should take and doesn’t get in any trap of agent, as he tried to sell various other insurance ULIP, endowmnet, pension etc. but I persisted on Term Insurance only.

Earlier I had some other insurance with some known agents/relative they provided No or lesser discount for endowment policy. and No discount for Term Insurance. So I prefer directly go to LIC office and try to best possible deal:).

I just made sure that agent at LIC is genuine, which I confirmed with His name mentioned at LIC office agent list.

As we have so many commission agents, so they are fighting to get max customer, healthy compitation is good for customer. Alternatively either govt. should fixed no of agents or reduced the commission. Also customers should be more educated and doesn’t get trap in these so call Agents.

Vikas

Thanks for sharing your case . There have been discussion on this topic if its ethical or not , or will result in healthy competition among agents or not . What are your views on that ?

Manish

Hi Manish,

Although out of context to this topic, please check the link below (I find it quite interesting)

http://www.policywala.com/content.php/157-Return-on-ULIP

The best answer to this is with ” LIC ” . IT should stop hiring Agent and do their business directly from their branch.

Thanks for your comment rashmi

hi manish, i wanted to ask u something regarding my carrer… as nw i m studing in bba 2nd year n i m very much intrested in learning abot stock market, mutual funds..etc.. and also i m workin as a insurance agent for sekking knowledge and also for my pocket money.. i do invest in stock market and mutual funds throung sip but very small amount… in future i want to do mba in finance.. n i also heard abt d ncfm modules.. is it good for giving dat modules.?? does it make ane impact on my resume aftr my mba whn i apply for a job in mnc? how much impact does it make??? if it is good to give dat modules exam, den pls tell me wich wich shuld i give first n so on..?? or else tell me some other courses or certification dat i should i go for for makin my resume much powerful n get a well sound pay job… thank u.. pls reply m waitnin of ur rep eagerly…

salman

hi manish,.

great article with great pictorial example.

keep up the good work.

i never liked insurance or mutual funds,

so every now an than i have debate with anybody who supports it,

YOU HAD GIVEN ME ONE GREAT ARGUMENT for my future debates,

now i can shut them up in no time ;-).

i think whole mutual fund and insurance industry (private) is crooked.

i live by only one motto : THERE IS NO FREE LUNCH IN THIS WORLD.

Kalpen

Great! . I am confused if you are an agent or a consumer ?

Manish

Even if it is illegal but what is wrong if I get some money back from the agent.

As I took a term plan from LIC and the agent gave me some money as commission.. However he did try to sell other policy but I always denied..

So here in this case I won at the end.

MINESH – Let me narrate your story with an example..Lets say your age is 32 yeas and you have taken a SUM ASSURED of Rs 40 lakhs..For this, you have to pay Rs 16,766 for LIC’s AMULYA JEEVAN..But for same SUM ASSURED, you could have paid only Rs 6,340 for KOTAK’s PREFERRED TERM PLAN or even lesser if opted for ICICI PRUDENTIAL’s IPROTECT..But your LIC agent will never tell you that..

Now lets assume that you wanted only LIC for yourself..Then your agent should have told you about certain facts that LIC TERM PLAN did not offer you any RIDERS (ACCIDENTAL DEATH BENEFIT – PERMANENT DISABILITY RIDER – CRITICAL ILLNESS), which i am sure he did not..

And he passback some MONEY to you by pocketing rest of the money..Sorry MINESH, in the end your LIC AGENT won 🙁

dhawal sharma,

Excellent response and good analogy.

This is another problem that need to be fixed by IRDA. SEBI allows mutual fund agents to sell any mutual funds. why can’t IRDA do the same thing ?

Since LIC agents are not allowed to sell ICICI policies, he would not recommend those plans even if he knows they are good.

If IRDA allow this freedom and flexibility, then most of the mis-selling can be avoided. Customer would win in the end.

Raja

On the other hand , i feel why not allow insurance agents sell any company insurance ! . What will happen if its allowed ?

Manish

There is no clear reason why this is not allowed. Given reasons are far from satisfactory. I am clearly against this policy of “One agent – One insurance company”.

Reasons given are like this :

1) Insurance policies are long term products. Customer needs personal service; so the agent should stay with the company for long term.

2) Agent is sponsored by the Insurance company, to complete the exam and get certificate an agent has to complete certain hours of training, an insurance company “invest” its time and resources for the agent. And like to have hold on the agent for long time.

(1) This is hardly true. The same agent and company tells insurance buyers that they can surrender it after “x” years. So, where is the question of long term. If you look at the lapse rate published by insurance companies you will see hardly the policies are renewed after 3 years.

(2) Agents can be treated like employees. Companies invest time and resources to train even employees. If they can be let go, why they can’t let the insurance agent go.

I think IRDA should change its one OAOC policy in current environment. It doesn’t fit in current time. Agents should be released and made independent completely and should not have a label attached to one insurance company.

(1) Agents earning have come down. If they have to continue in the business they need the flexibility to recommend any insurance products they like.

(2) It will increase competition among the companies and they will design good products, fearing otherwise their products will not be recommended by any agents.

(3) Agents need not cut corner or compromise themselves in selling only what is manufactured by one insurance company. For example, if I know ICICI has good education plan compared to HDFC or Aviva, I should be given freedom to recommend this to my clients in their interest. Now most of the agents don’t do this right thing, because if they recommend another insurance company product, they are not paid commission. LIC agents still sell their Amulya Jeevan still knowing fully well it is not the cheapest term insurance.

(3) If mutual fund industry has no problem with this model, and we know it is working fine. What is special about insurance products ?

IRDA got several bugs to fix. This is not one on the top of the list. Further Agents themselves have not much say and not organized properly to fight for themselves. They don’t lobby hard to get these archaic regulations changed. IRDA listen to the insurance companies more than to the customers and distributors. It is another subject of blog.

Raja

I agree with you on this ! . As you said insurance agents should get liberty to sell any company insurance. I think this practice of One Agent one company is there becausse from the start LIC was in existence and there have been dedicated agents for pushing the products .

Manish

yes, every word is true

recently i told my branch manager (i work in a life insurance co. for a living ) that my earlier policyholders who are paying their annual premiums for the last 6 policy years (example= dream plan from birla sunlife ) are in a loss of 10 %, letus forget the profit.

u know what the shame less monkey said visit new customers, donot waste u time in being touch with old customers.

whenever a new ulip or any traditional policy is launched, these same persons like sales managers, relationship/unit managers and particularly so called trainers tells us to surrender earlier policy and take this CUSTOMER freindly very short term INVESTMENTS.

thanks

Minesh

Dhawal has replied to you already , he is correct, now here is my reply .

If a client thinks at this level in his financial life, he is already ruining his financial life, one should be deciding on financial products thinking about what value its providing in his financial life and not concentrate on these silly things that how much commissions can be get back etc, one does not buy insurance because he can get couple of thousands back ! .

Agents give back only when they are winner at the end, thats very logical , they are real winners , clients might just “FEEL” they are winner , however thats just psychological ! .

Manish

Manish,

This is one of the finest discussion I have ever witnessed. Many of the participants are amazingly knowledgible, passionate about the subject under discussion and so articulate about expressing their views! Especially Dhawal and Raja are simply outstanding(and so are you Manish!). There are very few occasions when I wouldn’t want to jump into a discussion and just stand on the sidelines and watch. But this is one! Almost all perspectives regarding this issue have been thrashed out so well by the participants. Great!!!!

shashank

Shashank

Great to know that. There are some really awesome readers who put their hearts out on comments , and if people like you also involve we can create some of the finest discussions on the personal finance area 🙂 and thats already happening with forum 🙂

Manish

sir,

if you ask for a pay back in agents commission then take it granted that u may never get any service from him.

SERVICE this is a widly used word.Right from receiving a policy bond from co. till maturity a timely advice is required in the age of technology also.

Any one having seen lic business may know , many policy holders make nominatin on parents name before their marriage,change of address/banks name must be recorded in co..

final point (do not laugh ) He will save you from other agents.

thanks for this service .

p. s in a recent incedent the nominee does not know his husbands investements including life insurance polices,great mental agony.

srinivasu

yes , i can relate to what you are saying 🙂 .

Manish