Making sense of the market through Sensex at MRP

In the previous article, we looked at Stocks@MRP and how a stock can have a price tag. Moving further, we now discuss how the concept of Stocks@MRP has been extended even to the benchmark index :

Sensex . Also there is an example of one stock each considerably above and below its MRP. The inherent volatility in the stock markets makes stock investing to be perceived, by many, as a gamble. However, the Stocks@MRP can help us get a very good idea about the worth of a stock.

Once we know the MRP of a stock, we should buy it at a 50% discount to its MRP and sell it if goes considerably above its MRP. Then, how does Sensex@MRP come into the picture? And why do we need to find out the worth of the benchmark index as well?

Going back to History

Let’s jump back a bit in time. It’s December 2007. The Sensex is close to 20,000. The media is going gaga over the Indian economy and the movement of Sensex (up by 55% in just 9 months) and is saying that the next stop is 30,000. Everybody is eager to jump onto the bandwagon.

Fortunately, you have been a part of the rally since the beginning and have seen a considerable rise in your holdings. So, what do you do? Do you sell off and book your profits? Or do you wait? After all everyone is saying that this is just the beginning.

You wouldn’t want to look like a fool selling too early and missing out on the further upside, would you? You stay in and within a few months, you regret your decision.

The market crashes (falls by 50% in 1 year), your stocks tumble and a large portion of your wealth is wiped away. All your companies are still doing well, they are still fundamentally strong. Yet, you have suffered because of the market’s over reaction to the sub-prime crisis.

You may have not lost your capital, if you bought your stocks at a discount to the MRP, but your profits have definitely vanished!

Sensex@MRP concept

Warren Buffett, one of the greatest investors in the world has said, “Be fearful when others are greedy and be greedy when others are fearful”. But to do this, you need to be aware when the others are being greedy and when the others are fearful. And this is the quest that exactly led us to finding Sensex@MRP.

The market represented by Sensex is known over react, to both positive and negative news. Be it national or international politics, capital inflows or outflows and favorable or unfavorable monsoon forecasts; the Sensex fluctuates widely because of these.

Even though Sensex is comprised of just 30 stocks, chances are that if these big names get hit, a majority of the other stocks also get clobbered. This thought led us to the logical extension of finding Sensex@MRP so as to enable investors to enter stocks at bargain levels and help them exit when things start getting over-exuberant!

The Sensex companies are some of the biggest and most well known names in the country. They are amongst the favourites amongst the institutional investors and hence are highly liquid. One can then expect these stocks and as a result the Sensex to trade close to the fair value i.e. MRP.

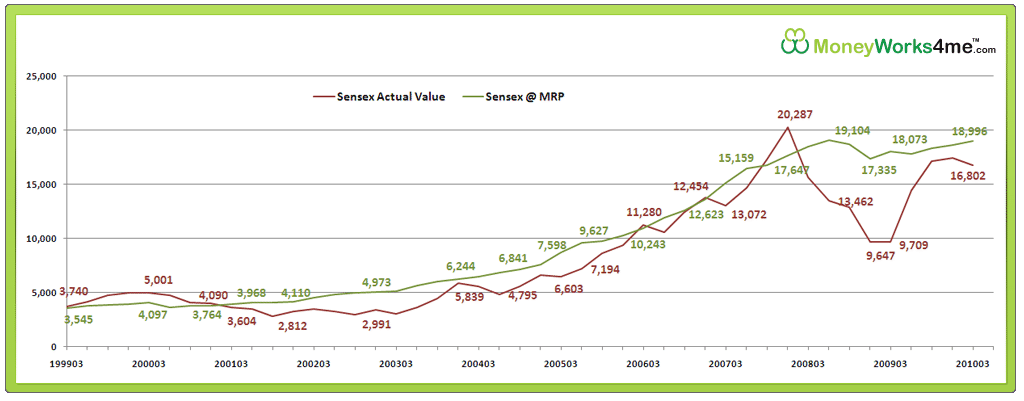

However this has seldom been the case. On quite a few occasions, the market has become irrationally exuberant or highly depressed. Knowing these phases of the market can help you become better investors. The graph below gives you a comparison of Sensex@MRP values plotted against actual Sensex values for a period of 10 years beginning March 1999.

Click on the graph below to have a look.

Movement in Sensex along with its MRP

- March 1999 to December 2000 saw Sensex quoting consistently above its MRP. Many of us will remember this time as the Technology boom. During this time Sensex was trading at a multiple of 30 times earnings. As the Sensex was clearly above Sensex@MRP, this was a good time to ‘Sell’. As expected a correction took place and within a year, Sensex was trading 15% below Sensex@MRP.

- June 2000 to March 2003, saw the Sensex trading at around 30% discount to its MRP. The earnings for the Sensex companies were stagnant during this period but clearly the market was undervaluing them. In hindsight, this was a good period to enter the market.

- Post 2003, earnings of the companies entered a high growth phase and this continued till March 2008. This is evident from Sensex@MRP which increased from 6000 levels in 2003 to 19000 levels in March 2008. But the market seems to have over reacted during this phase with the Sensex crossing the Sensex@MRP in September 2007 and December 2007. Infact December 2007 saw an over valuation of as much as 15% – a clear sign to Sell and get out.

- As the sub-prime crisis and the fears of a global meltdown spread, Sensex crashed and reached 9000 levels in December 2008 and March 2009. What is interesting to note here is the fact that earnings of the Sensex companies had not suffered much. Sensex@MRP, which is driven primarily by earnings, was in the 17000 levels. Thus the market was without a doubt over-reacting and Sensex was quoting at almost 50% discount to Sensex@MRP. This was the buying opportunity of a lifetime.

- Within a couple of quarters, Sensex zoomed up and traded close to its MRP. Considering March 2010 quarter results, Sensex@MRP comes out to 18,996. This means currently Sensex is just about 4% below its MRP. Thus, Sensex is close to its fair value and as investors we need to tread with caution. Quite a few stocks are creating 52 weeks highs and it is difficult to find value picks at the current moment. Infact, some stocks are currently trading well above their MRP and one can consider selling them.

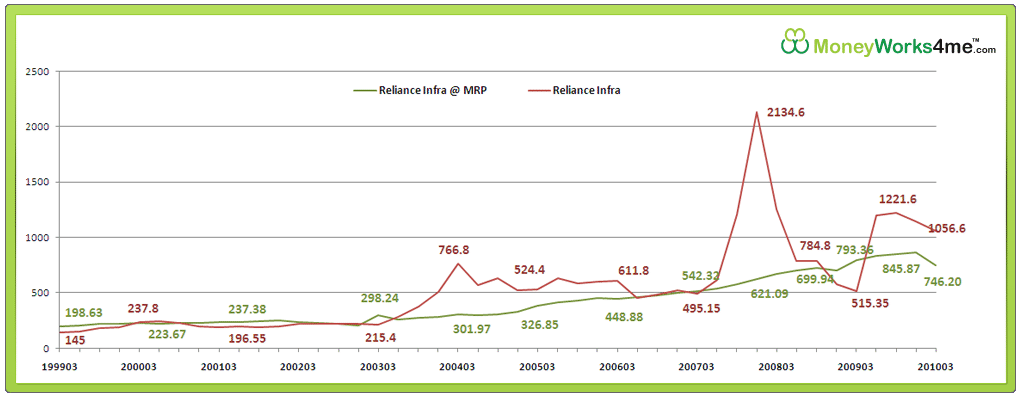

Reliance Infrastructure Example

An example of a company quoting considerably above its MRP is Reliance Infrastructure. In 1999, Reliance Infra was quoting at a discount of 20%. It crossed the MRP in year 2000 and remained close to MRP till 2003 inspite of an inconsistent financial performance. Its earnings infact witnessed a drop in 2002 and 2003.

The company’s performance improved post 2003 and the price zoomed above its MRP. In 2004, the stock was quoting as much as 150% above its MRP. This seemed like a sell signal but the stock rose further to unimaginable levels in 2007. In two quarters i.e. from June 2007 to December 2007, the stock more than tripled.

The irrational exuberance of the market was visible as the stock quoted at a PE multiple of 50 at Rs. 2130. The price crashed soon and in March 2009, the stock was quoting at a 35% discount to its MRP. Again, the prices corrected and the stock is currently trading 50% above its MRP of Rs.746.

However, even with the market at 18,000, there are a few stocks which offer good value. Let’s take a look at a Sensex company which is currently quoting at a discount to its MRP.

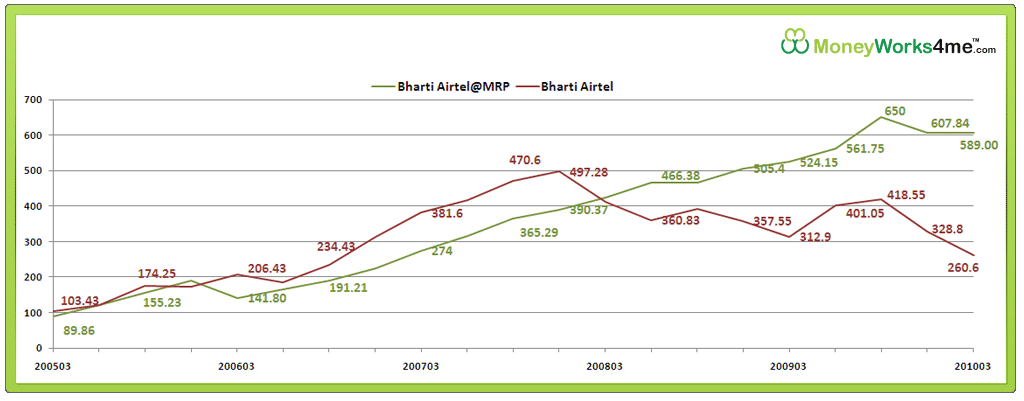

Bharti Airtel Example

Bharti Airtel currently at Rs. 327 is quoting at a discount of 44% to its MRP of Rs. 589. Click on the graph below to take a look at Bharti’s historical valuations. Except for the initial years, Bharti has always traded above its MRP.

Leadership in the telecom industry coupled with high growth in the mobile market, helped the company record great earnings growth over the years. However, since March 2006 as competition intensified, the premium commanded by Bharti has decreased especially after Reliance Communication’s entry.

Further, the telecom sector has been seeing all sorts of problems including an intense price war, detrimental policies and very recently audacious 3G and broadband license bids. To add to this, Bharti also completed the acquisition of Zain Telecom which led to questions being raised about its financial position.

All this led to Bharti tumble to levels seen in March 2009. However, over the last few weeks, Bharti has picked up quite a bit. Bharti’s MRP works out to Rs. 589 considering an earnings growth rate of 18% which is substantially lower than its past growth rates thus making it a value pick.

So, the rule of buying at a discount to MRP (ideally 50%) and selling above MRP would ensure good returns. Once the stock crosses the MRP, the probability of a correction increases. There is however always the chance of error. There is a possibility of the stock running considerably above the MRP as seen in the case of Reliance Infra.

You may miss out on the upside fuelled mostly by sentiments rather than earnings. But provided you buy the stock at a 50% discount, you would already be sitting on handsome, riskfree returns and hence would rather let this risky upside pass!

August 17, 2010

August 17, 2010

Just answer one question mrp guy.if you are so good in predicting share movement why are you spending your time on lesser mortal souls.WHY NOT INVEST ON YOUR OWN AND EARN MONEY LIKE RAKESH

Sensex in now well above MRP! What next ? Are these MRP’s calculated Quarterly based on earnings ?

Chirag,

Yes, we calculate the Sensex@MRP on a quarterly basis as soon as the Sensex companies announce their results. As you rightly pointed out, Sensex has crossed well above its MRP. We suggest that you should be on the look out to book profits in stocks which have crossed their MRP. You can read more about our thoughts on what you should do here.

http://bit.ly/b8ZmtZ

Thanks.

Questions: How can we find company which is fundamentally strong?

Thanks

Vijay,

To find a fundamentally strong company, you should look for 3 most important things

1) Strong Financial track record

2) A competitive advantage (a sustainable moat)

3) Trustworthy Management.

You can read more about how you can go about doing this here : http://bit.ly/aHBGTC

Hope this answers your questions. Do let us know, if you have any other queries.

Thank You.

Thank you,

But from which sources we get the MRP of our desired stock.

Vijay

Thanks

Vijay,

Here is an article which tells you how to calculate the MRP of a stock. http://bit.ly/b24Pv9

Thank You.

All is fine, But can anybody tell me what is MRP?

Vijay

MRP is max amount you should pay for it .

Manish

Vijay,

The MRP of a stock gives you an idea of the intrinsic worth of the stock. The concept based on the fact that, while in the short term, stocks might be affected due to news, sentiments, FII movements etc., over the long term, the market will invariably reflect a stock’s intrinsic value based on its earnings. As sensible investors, we would be well served if we bought stocks at a considerable discount (ideally 50%) to their MRP and sold off stocks if they are priced considerably above their MRP.

thank you Nikhil

you too manish

manish, plz do write a blog on taxation on trading like intraday, f&o, delivery based etc

Sure. will try to do that

The concept looks great nikhil and can be useful in taking buy side of dicision whether for stock or for index and provides good margin of safety if one is buying a stock at considerable discount to its MRP but the most important decision to be made is on sell side. When to sell a stock ? Emotion of greed takes a firm grip which does not allow investor to book profit and come out of profitable investment decision. I agree there is no tool to control one’s emotions of fear, greed and hope but MRP concept may not give clear indication of sell as if market is bullish about a particular sector or growth prospects are good for a company it might possible that market will not mind paying considerable higher price above MRP and in that case stock can consistently trade above MRP level for a longer period of time. e.g. Bharti Airtel from 2006 to 2008.

Thanks a lot Darshil. Yes, the MRP concept definitely allows you to take a very good buy decision. However what MRP can also help us at is take timely sell decisions, provided we don’t let greed take the best of us. It is quite possible that a stock may go above its MRP and remain above it for some time; sometimes a stock can even move grossly over its MRP like in the case of Reliance Infra.

Once the price of stock crosses its MRP, it is the first signal that the stock price is moving into the realm of irrationality. The thing to do then is to keep a watch out on company specific or industry specific factors. If there are reasons to doubt that the growth may slow down or a correction may take place one would be better off selling the stock. Also, one thing that can be done is to sell the stocks in slabs. So, when the Stock is say 10-15% above MRP, you can sell part of your holding, if it goes 10% further up, sell another part of the holding. And if the stockis grossly above the MRP, say 40-50%, one would be best advised to sell off the entire holding. Remember, provided you have bought the stock at a discount, you would already be sitting on more than handsome profits. Trying to guess when the peak will occur and wishing to sell your entire holding at that point would be like trying to time the market and will invariably fail.

Excellent article nikhil,

I completely agree on buying at 50% of MRP and am doing it same with bharti airtel since last one year. Am in no hurry because i know in coming years (3-4yrs) company will grow like anything.

Now just an suggestion, you need to put in bold letters in your post that target audience is only long term buyers (3-4yrs). Traders and speculator can give a miss..:)

Cheers

Marshal

Marshal,

Thanks a lot for the appreciation. Bharti Airtel definitely seems to be a great investment for the long term.

Will keep the point of the disclaimer in mind for the next time. 🙂

Cheers.

Nice concept 🙂 I would like to see similar graph for the Nifty also in stockshastra blog…..

Jagadees,

Thanks a lot for the appreciation. We have got good feedback about the concept from many people. Also, many people have also asked for a Nifty@MRP. We are currently working on it and it will be out in some days.

How to calculate the MRP of stock ?

Mitesh,

The MRP of a stock depends on the earnings capacity of the company in addition to other factors. You can find the detailed methodology of calculating the MRP of the stock here : http://stockshastra.moneyworks4me.com/learn/presenting-to-you-sensexmrp/

The article gives you detailed information about the methodology followed for calculating MRP.

Praveen:

The concept of MRP is based on Value investing principles and as you rightly said, is calculated considering certain parameters/factors. You are spot on in saying that it is the market which decides where the stock must be. So, it might be the case that the market does not realise the value in a particular stock and its price does not increase.

So, the first and most important step here is to find a company which is fundamentally strong and has a competitive advantage which will help it to remain a winner in the future. The importance of this cannot be stressed enough. Once you find such a company, then comes in the concept of MRP. You wait for this stock to be at a discount to its MRP and then buy it. The chances of the market not realizing value when its due are definitely very low for a fundamentally strong company.

Still if it happens, what do you do? Once you invest in a company, does that mean you just wait for it to cross MRP? No, definitely not. You need to periodically review your investments and see if there has been any substantial change in the situation that led you to buying the stock in the first place. If yes, you need to recalculate the MRP and accordingly take your next step : buy/hold/sell. The MRP is not a static value. It is based on the fundamentals of the company and hence will change if these change. This is what we practice at MoneyWorks4me.

May be this MRP is calculated based on a number of factors in company’s balance sheet, pe/pb/pv ratios or whatever those. May be this looks like some ‘value investing’ priciple (buy the stock at some bottom price with margin of safety). But the factor people (like me)look is ‘when to buy & when to sell’. what if I buy the stock at 50% of the MRP and the stock doesn’t cross the MRP for 4 years??? May be the market didn’t realised the value of stock or some other factor holding the stock down which didn’t included in calculating this MRP!!!

MRP is decided by you, but its the MARKET which decides where the stock must be(below or above MRP).. There is no need for market to act on MRP decided by you 🙂

(No intention to offend anyone, but these are just my thoughts)

and finally what investors(or traders or spectulators like me 🙂 ) want is when this will happen(when to buy & sell & time-span). If time-span is too long then the returns will diminish.

Ex: As shown with your MRP concept Bharit Airtel is quoting below its MRP from past two years.. What we want is ‘If I buy now, whats the time it will take to cross the MRP’. No body will tell this., only one will will show us this i.e ‘Mr.MARKET’