What is Reverse Mortgage ?

What is Reverse Mortgage ?

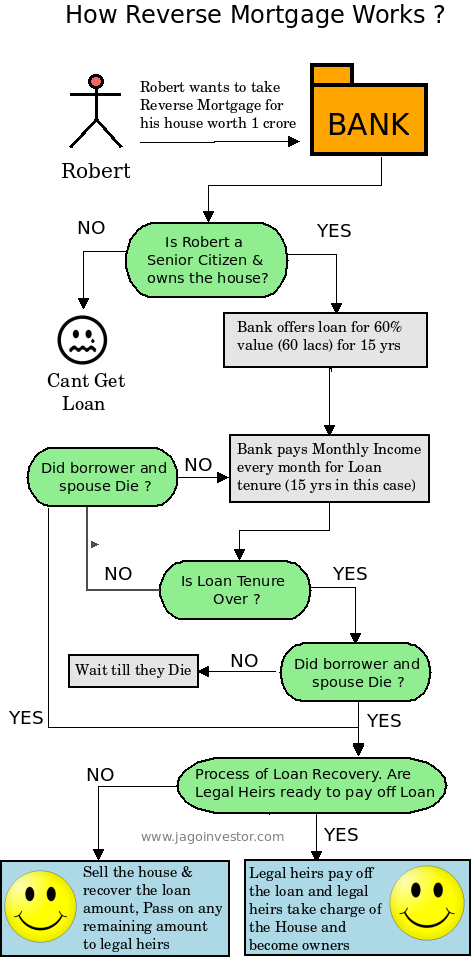

Simple! Reverse Mortgage is the exact opposite of a Home Loan. Anyone, who has a fully owned House can get a loan. The way, this works, is that his loan money will be divided in chunks (EMI’s) over many years and given to him every month. This can easily act as Monthly income. At the end of the loan tenure, the Bank stops paying the monthly income. If one of the spouses dies, the other can still continue living in the house. If both die, the bank gives their heirs two options – settle the overall outstanding loan and retain the house or, the bank will sell the house, use the proceeds to settle the outstanding loan and give the rest to the heirs. For people who don’t know – “Mortgage” means “Loan” 🙂

How is the loan paid ?

With a reverse home mortgage, no payments are made during the life of the borrower(s). Which means the loan has to be paid only after both the borrower and spouse die. Since no payments are made during the term of the reverse home mortgage loan, the loan balance rises over time. In most areas, where the appreciation is good, the value of the home grows at a much faster rate than the loan balance. Therefore, the remaining equity continues to grow.

When both, the borrower and spouse pass away, the ownership of the home is then passed to the estate or directed by a living will or will to the beneficiaries. The beneficiaries now own the home and have to sell the home or pay off the loan. If the home is sold, the reverse home mortgage lender is paid off and the beneficiaries keep the remains. Read about Real Estate returns over last 10 yrs .

Example :

Mr Ajay is around 62 yrs old, and his wife is 60 yrs old, they live and own a house in Karvenagar, Pune which is worth Rs 1 crore now . They have a daughter and son who are their legal heirs (50:50) . The old aged Ajay and his wife do not have a monthly income source, so they decide to go in for a Reverse Mortgage loan. The Bank is ready to loan upto 60 lacs to them, which means they will be paid Rs 35k per month for next 15 yrs (just an example.)

Now, they start getting monthly income of 35k per month for next 15 yrs, & they continue to live in the same home. After this point, their children support them financially and then Ajay dies at age 79. After this, his wife still continues to live in the house. Sadly she too, passes away at age 85. By this time the total loan outstanding becomes Rs 1.1 crores (It was 60 lacs at the end of 15 yrs, but after that, it starts growing.)

Now the loan has to be paid off. The son and daughter does not have money to pay to the bank, so the bank decides to sell off the property. At that time, the price of the house is Rs. 3 crores. The bank sells the house and get total 3 crores, out of which 1.1 crores is taken by the bank and rest is paid to legal heirs, which they split amongst themselves. Look at EMI Calculator

Which Banks Offer Reverse Mortgage ?

- National Housing Bank (NHB)

- Dewan Housing Finance Limited (DHFL)

- State Bank of India (SBI)

- Punjab National Bank (PNB)

- Indian Bank

- Central Bank of India

- LlC Housing Finance

- Andhra Bank

- Corporation Bank

- Canara Bank.

Tip from Hemant : “Star Union Dai-ichi offers annuity cover with reverse mortgage . When a person approaches the bank for a reverse mortgage loan on house property, the bank, after assessing the value of the property and sanctioning the loan, will approach the insurer and buy an annuity plan for the borrower. The annuity will be passed on to the borrower’s account on a monthly, quarterly or annual basis. The installments will depend on the purchase price, age and whether the insured person opts for a lower or higher lifetime annuity. “

Important Points in Reverse Mortgage

- Reverse Mortgage is available to Senior Citizens only. Any house owner over 60 years of age is eligible for a reverse mortgage. If wife is a co-applicant, she should be above 58.

- The maximum loan is up to 60 per cent of the value of the residential property subject to maximum of Rs 50 Lacs.

- The maximum period of property mortgage is 15 years with a bank or a HFC (housing finance company.) Minimum tenure will be 10 years. Some banks like Punjab National Bank offer RML for 20 years also.

- The borrower can opt for monthly, quarterly, annual or lump sum payments at any point, as per his discretion.

- The revaluation of the property has to be undertaken by the bank or HFC once every 5 years.

- The amount received through reverse mortgage is considered as loan and not income; hence the same will not attract any tax liability. How to do last moment Tax Planning ?

- Reverse mortgage rates will vary according to market conditions depending on the wheather borrower has choosen Fixed or Floating interest rate.

- Processing fee for the loan would be between 0.15 per cent and 1.50 per cent of the loan amount.

- One can prepay the loan along with the interest any time during the loan tenure. Typically, there is no pre-payment penalty.

How do I apply for Reverse Mortgage?

- Decide to pledge your house for reverse mortgage.

- Go to the branch of the bank, who you have a banking relationship with, and provides Reverse Mortgage

- Fill up the necessary form, the bank offers for reverse mortgage

- You need to furnish your personal and financial details like: the property, your legal heirs, and so on.

- Proof of ownership; you will also need to furnish property papers and a proof that the house that you are pledging is your residence.

When to consider taking Reverse Mortgage ?

Even though Reverse Mortgage seems like a nice idea, it should not be the primary tool to fund one’s retirement expenses. It shouldn’t be used to fund the shortfall in the retirement income if any. A valid reason can be – if one does not have any legal heirs or leaving money to/for them after death, is not high priority. There are many old people who have assets of high worth, but they do not have a proper, steady stream of income. One can use reverse mortgage in that case. In India, Reverse mortgage isn’t very popular yet, because of bad/negligible marketing and our mentality, where we dont take loan on our most valuable and most emotional asset “Home” 🙂 Another reason could also be that there are old / aged people who own 100% of home and are living alone with spouse are few & far between. These products might become very popular in coming decades .

Comments? What do you feel about Reverse Mortgage Products? Do you think it’ll become more popular & successful in the coming decades?

June 6, 2010

June 6, 2010

The best article I found on RML. Thank you!

A few questions:

1) If I’m still earning after retirement and take this facility to have more income, I can invest the surplus in some funds, stocks or in my loan OD account. Is that permitted?

2) In above case, does the total income become taxable considering this surplus?

3) Assuming 35k per month for 5 years, if I decide to prepay at that time, how much approximately I will need to pay to get it back, considering an interest of 12%?

Many thanks,

Sanjay

Yes, you will be liable to pay the taxes if its above the limit

Nice article with a self-explanatory flow chart. Just asking whether this loan (or interest accrued each year) is eligible for income tax benefit as negative income from house property?

No, its not eligible for tax benefits

Thanks Manish.

Very Nice Flow chart, Thank you very much for make it understandable in simple language and example

Thanks for your comment shyam

hi my father is 67 year old he is a retd. central govenment employee,i have plot of 1000sq feet. in Bihar .Is he is aplicable for taking RML.he have 1 daughter and one son(married).but he not depend on his father .will he get the RML OR Home Loan (against property)

Hi sanosh prasad

I am not clear on what is your question. Please repeat it with more clarity

Manish

Hi sanosh prasad

I am not clear on what is your question. Please repeat it with more clarity

ManishHi sanosh prasad

I am not clear on what is your question. Please repeat it with more clarity

Manish

My 86 year old Mom is owning the house/flat in CHS at Mumbai, which has been contracted with a Builder for redevelopment. Most probably the house will be vacated in near future and all the members will be asked to shift to the rented houses/alternative accommodation. Though the rent is due from the builder, it will not be sufficient for renting out a comfortable stay in Mumbai itself along with household/emergency expenses. Thus requiring supplemented income source such as annuity . The redevelopment and reconstruction of a new building/flat is likely to take say 5 years. Under the situation, is RML for a duration of 5-10 years possible with an option to sell the house once ready after 5 years? Further is it possible to apply and get RML during reconstruction period if so required? To add more, most of the properties in Mumbai are now more than 30 years old and are going in for Redevelopment. Will such properties be eligible for RML?

NO , RM is not an option in this case

“One can prepay the loan along with the interest any time during the loan tenure. Typically, there is no pre-payment penalty.”

Please recheck this in your article. There is a prepayment penalty of 2% imposed by some banks if the loan is taken over by another bank/FI.

It’s very informative and useful information, liked very much. Thanks

Thanks for your comment Sunit

I intent to avail RML from Central Bank of India. I have two sons and one daughter all are married and staying independently. I do not get any pension as I worked in Private Sector. My children although caring, have their own financial liabilities like education of their children, repayment of housing loan etc. So, I do not wish to be a burden on them financially. My query is : Whether I will have to obtain their concurrence for availing RML. Also, explain role of Star Union annuity with example. I am 73 and owns a flat in Pune constructed 3 yrs. back with a present market value of Rs.1.25 cr. Your early reply shall be appreciated.

Hi DR.V.V.BARVE

Actually this is a very new thing and we dont have knowledge till this level . I think the best thing you can do is get clarity from the bank itself !

Sir,

My father is retired person at the age of 58. and less pension is coming, No other income also coming. and we have 1500 sq ft property any provision for taking Reverse Mortgage Loan at the age of 58 age.

Yes, you can apply for it .. See what the bank says !

Banks says. first borrower should be 60 years, not less that 60 age its not possible to give Reverse Mortgage Loan,

Then you cant get it . Is your father not above 60 yrs old ?

Hi Manish,

In case of divorce maintenance case if court order recovery ( payment to wife)

Whethet Banks consider such order and sanctioned Reverse Mortgage loan .

Also to avoid court order if smart husband transfer his property in tthe name of spouse (second marriage).

Age and other criteria qualifying.

I am not very sure on this .

Hi Manish,

The article that you have posted is really useful. Thanks a lot.

I am a senior citizen aged about 63 years. I have a doubt regarding Reverse Mortgage. I own a Vacant Site and not a residential property. Can I get Reverse Mortgage Loan on that?

No Chandra

Its not possible on plot

Hi manish,

Plz suggest me which is the better option to stop my brother from selling the house owned by my mom.

1.Reverse Mortagage loan

2. Home loan

I want to pay the amount to my brother and own the house which is emotionally attached to us. My mom got this house from my father after his death. It is the self acquired property of my dad. My mom registered a will , this house passes to my brother after her demise. But my brother wants money now itself and is forcing my mom to register the house in his name so that he can sell it immediately.

My mom is unhappy with this and asked me to buy it. I don’t have enough money to buy it now. She can’t give it to me as my brother is fighting for it. I am only daughter,married and iam a govt. employee.

So, plz suggest me what should I do?

1. Shall I ask my mom to take RML and pay the money to him(I can pay the extra money if bank restricts the lump some money not to exceed 15lakhs)

Or

2.Shall I take home loan,purchase it from my mom and pay the money to my brother?

Hi Manish,

Confused about the repayment of the loan. Let’s take an example, The value of the house is 15,00,000 and bank grants 90% loan of the value. Considering, 10.50% interest rate, the EMI comes to 3,110 for 15 years loan.

Real Question starts now. Bank revalues the home after 5 years and considering growth rate of 15% p.a. the value of the house comes to 30,17,000. Now what will happen? Will the EMI increase and by what amount and HOW?

If couple dies after 5 years and their child wants to buy the house back from the bank, what amount does he need to pay at that time?

Looking forward to the solution….

Nothing will change on reevaluation . The only amount needs to be paid is the main AMOUNT which was taken as loan

I am not sure whether what you say it is correct. Please check the link and find the word revaluation.

http://www.indianbank.in/loans.php?by=8&ty=1

Hi Harshil

In that seems like some new changes have come . I had written this article long back, at that time I didnt come across anything on reevaluation !

Manish

Hi manish,

My father applied for reverse mortagage in 2009 and closed the loan in 2013 from SBI Chennai. Bank people suggested not to close the loan account, so it will be easy & quick to reprocess if same loan is availed in future (bank will keep the documents). Now,my father for an urgent need has applied again for loan but after making him run for 3-4 times from branch to central processing center, his application was rejected stating that his exisiting loan should be closed before reapplying. Now, we’re worried and not sure how long it will take since we would need to close the existing loan account, get back the documents, get EC updated, reapply, reevaluation etc. Do you have any idea how to reapply this loan more than once. Also, they gave 20 lakhs first time now they’re saying my father will be eligible for 15 lakhs only..I don’t understand this as well..so, age factor also plays role in reverse mortgage loan?

Definatly, age factor will matter, then the age of building must have increased now compared to first time .. all these things matter.

True that the whole process will take time now . You cant do much other than follow the actual procedure ! . Its always a good idea to keep 3-4 months buffer time !

I assume there may be periodical inspections/visit made by the bank, once in a year.

I dont want to be technically/legally wrong. I can go and stay for a month in a year at home to technically/legally be correct that I have not moved out of my home.

Sir,

I plan to apply to a bank for a reverse mortgage loan. I have a home

in Mumbai. My son stays & work in Pune. I stay with my son in Pune.

However, I dont want to get money for monthly expenses from him. My

home in Mumbai is closed. I read a clause that I need to be residing

in the house that I mortgage. I also read that if it is not my

“permanent home” the loan may be recalled. I think it is a restrictive

clause. However, will I be denied a loan

because of my not staying in my home in Mumbai ?

Thanks and Regards,

Rajesh Patel.

It might happen , however you can always be there till the loan processes and then later you can move out . How about an arrangement with your son to buy the house from you and pay you pension on that ?

Manish

Hi Manish,

The concept is very well narrated.

Thansk

Dear Manish Hi!

Sorry for replying late.Actually the house at where we are staying presently is a purchased one.If i get issued a free holding certificate for it now, can it help me to prove that the house is owned just now or from the date of its purchase ie after yr 2000?I dont want my parents to lose this house of dreams of theirs and as i ‘m unable earn well for now.As I suffered huge losses in my business.Its improving but i had to change my channels of retail business in to a multi-retailing one.

What at best can be done presently to improve on our finanacial gains?

As we as a family , had thought to rebuild the house and furnish it two more floors ie 1st and 2nd so that it will help my parents income to grow at old age and since there is a lumpsum expenditure on medical expenses in old age.What do u suggest?

I hope you not getting me the other way round.ppl have misunderstood me here in the last round also thinking me to be incoherent of my parents’s problems.Pls help.

With best wishes,

Devashish Pattanayak.

NOt sure , but lets discuss it over forum now – http://www.jagoinvestor.com/forum/ . MOre and more people can give their ideas there !

MR MAHESH,

NEED YOUR ADVICE. OUR HOUSE GOING FOR REDEVELOPMENT IN FEW YEARS. WE NEED TO PAY SOMEONE SOME AMOUNT. SO THINKING OF GOING FOR REVERSE MORTGAGE. DOES THE INTEREST AMOUNTS TO BE TOO HIGH AFTER A PARTICULAR PERIOD. IS SELLING AND PAYING THE LOAN IS ALWAYS BETTER THAN GOING FOR REVERSE MORTGAGE ?

If its going for redevelopment then how will it help to go for reverse mortgage .. ?

Good article Manish… Yes as ur 1st word,Its really simple to understand to every one and i thinnk it is useful to the parents who are suffering for money when thier children are not supporting.

Yes . i agree !