What are the important elements of setting your financial goals?

One of the most important part of financial planning is setting financial goals. The first step involved is to know where you want to go ?

If you have no goals set , then you will be randomly investing and as your goals in life comes along the way, you fulfill them. It can happen many times that you are not prepared and some important goals is near by, however you didn’t give much thought to it from many years or months and at the end you have to take decisions in hurry, which you don’t want to take.

By setting your financial goals in advance you can get a good idea of what lies in future and start preparation for it (Goal of financial planning)

What is goal setting ?

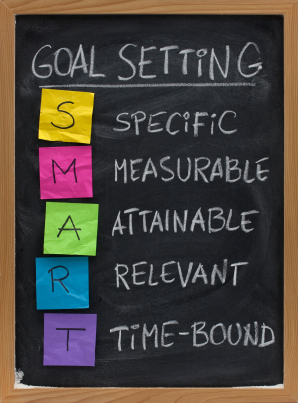

Goal setting is a process of defining your goals in Life. There are many important and intuitive characteristics of any goal, which makes it SMART . Lets see what those 5 important element of goal setting is .

Specific : Your goals should be specific and not a very general one, It should contain detailed information and should not leave a room for further questions.5 “I want to buy a house” is a very general goal , however “I want to buy a 3 BHK Flat in Karvenagar area in Pune costing around 35 lacs within next 5 yrs” is a more specific goal which gives a clear picture to you . Look at returns from Real Estate in India

Measurable : Your goals should be measurable in terms of “How many” or “How much”. It should not happen that you have a rough idea of the goal. Many people I talk with; say “I want to buy a big house”. It’s a great thing to dream for a big house, but at some point in life you will actually decide the actual size and how many rooms and what will be the area.

Not having a clear view means no idea of how much it will cost and then you can’t save for it properly. “I want to buy a 4 BHK house in 5 yrs” will mean you can exactly find out how much you need to save per month so that you can achieve the goal with higher accuracy, you should be able to track your goal.

That means goal being measurable .

Achievable : This mainly means that your goals should be achievable given your current situation. When financial planners start working with some client, one of the major issues is targeting unrealistic goals in life. Just because you are hiring a financial planner does not mean that he is a magician and will somehow create a strategy for you .

If you are saving Rs 20,000/ month , dont target “3 BHK House in 5 years without loan” as one of the goal because it’s not possible given your current situation. If you put a lot of unattainable goals, the first thing is you will not be able to define how you can achieve them in the first hand.

Relevent : What will happen, if you always wanted to become IAS officer, whereas your goal is “To crack CAT exam” ?

If this happens , you will start with some enthusiasm in start but at some point, it would be tough to sustain the enthusiasm and energy, because that’s not you really wish to and even if you some day achieve that goal which you planned, it would not make sense because it’s not aligned with your life objectives.

This is very much true for financial goals also. You have to make sure your goals are very much what you wish in life .

Lets see some of my personal goals in life .

a) As I like to travel a lot so I would like to generate enough money in next 15-20 yrs , so that I can travel to different countries every 6 months .

b) I would like to build a Farm Land by year 2035, where I can personally do “Vegetable Agriculture”. (I personally have experience of growing things like corn, potato, tomato, carrots, radish, peanuts, cabbage, cauliflower, chana, almost all green vegetables, pulses, peas , onion , garlic) . Yes I have done it in UP at my hometown as a hobby. Do you know hybrid tomato seeds can cost upto Rs 75,000/KG 🙂 so we bought 1 gm 😉 .

c) I would not like to save much for my child marriage, as I would like to encourage them for love marriage and settle things with a simple ceremony , that’s all . I dont believe in lavish marriges anyways .

d) I have no long-term goals of buying house, I would rather like to live in rent for long and build a corpus in pure equity + debt . If things changes and one day I feel real estate is something which should really be part of my portfolio, I will change my mind .

vegSeriously, do you want to buy that 55 lacs flat which is ‘almost’ out of city and commands a rental yield of not even 3% ? Do you ?

Timely : Imagine your goal is like “I would like to buy car of 5 lacs”, Fine ! . Now what do you do ? Do you save 5,000 per month or 20,000 and for how long , It’s important to set a time line so that you have a clear idea of how much does it take to achieve some goal. You can calculate the investment needed for that (See how to calculate) .

Example of Goal setting

Very simple way of doing this is to categorize your goals in Short Term , Mid Term and Long Term and each of them will have “High Priority” and “Low Priority” . This way you have a clear idea of what is important and first preference in all the time frame , For example .

- “I want to buy a Car worth 6 lacs in next 5 yrs, which can accommodate around 5-6 people” can be a High priority , Mid Term goal , where as

- “I would like to take a 2 weeks vacation in Kerela with my family worth 50k , can be a Low priority, Mid term goal .

Let us see the full example of Goal settings

|

|

High Priority

|

Low Priority

|

| Short Term (<3

yrs)

|

|

|

| Mid Term (3-6

yrs)

|

|

|

| Long Term (7+

yrs)

|

|

|

You might want to look at subra’s post on Financial Resolution , it gives a good idea of how you should start and stick to financial goals .

Importance of Goal Setting with an Example

Even though it looks nonsense, you need to understand its importance and its impact. Financial Planning is all about achieving goals in the best possible manner by considering your current situation. If you do not have a goal set with some target amount and target date, then you don’t have a clear idea of reaching there.

Imagine a goal of “Child Education” which costs Rs 10 lacs in today’s value. If your target date is after 25 yrs, then considering a 10% education inflation (historically it stands at 10%), the target amount will be 1.08 crores { 10 X (1 + 10% ) ^ 25 }. Now lets take 3 scenarios with return assumption of 12% per annum .

1) You plan for it and start saving for next 25 yrs

In this case , you will have to save Rs 5,710 per month for next 25 yrs . So you can start an SIP today and consistently start investing for this goal . If you get 12% over long-term , and you do not deviate from your goal and consistently invest with discipline , you can reach the target .

2) You plan for it and save more in the starting years

In this case , lets assume you can save more money in the starting 10 yrs and then do leave your money to grow for next 15 yrs , then you just need to save 7,800 per month for next 10 yrs and then leave the money to grow for next 15 yrs .

3) You do not plan for it and start saving at later point

Incase you do not plan for it and lose the starting years of your earning life and once your child is 9-10 yrs old (suppose you lose 10 yrs) and then you start thinking about the higher education , then to meet the same goal you need to save 21,500 per month for next 15 yrs .

Learning

The most important learning we should take from this article is that planning for a goal gives a direction and enables us to start thinking in that direction. We spread out the effort of achieving that goal in different stages, rather than struggling at the end when that goal is near .

Comments , share your thoughts on setting financial goals , what are the problems in real life which does not encourage us for setting the goals in this manner , Is it realistic ?

May 19, 2010

May 19, 2010

The process of setting financial goals is an interesting one Manish.

At the beginning, you need to dream a bit to become aware of the possibilities.

Later on, you’ll narrow your goals and make them S.M.A.R.T.. specific, measurable, attainable, relevant and time-bound.

For more ideas on how to articulate financial goals read this article:

http://www.mdrmoney.com/setting-achieveable-money-goals-interview-transcript

Manish your articles remind me of my very first exposure to pornography. i read your article one month back … first one for me and i m hooked, now i have read almost entire archive of jagoinvester

god bless you

sanjay

Sanjay

Haha .. thats a hilarious comment 🙂 . Keep it up !

Manish

Hi,

I want open PPF and NPS account

Pls. advice first whether the decision is right?

If right how to open with procedure

Thanks

two options are good. But to how much it is useful to you, its very important to know your age(if you are comfortable).

If you are young investor, i thnk your priority should be to invest in PPF and rest of the amount in a balanced mutual Fund through SIP.

Even after this if you still have ceratin lumpsum amount then to achieve short – term goal you can consider 1-2 yrs FD( bcz still FDs are giving 9-10 % return.

Thnks.

yes Financial goals helps are necassary.You explained it in simple and nice way.setting goal is right to achieve financial success.

Nandakishore

thanks 🙂

I totally agree with the SMART goal concept, and also breaking down your goals into short term VS long term goal planning. However the one element that much often over looked with respect to goal setting is the element of faith and belief either in yourself or in God that you will achieve what you set out to achieve.

Irrespective of one’s spiritual or belief views-you have to harness the faith and belief in yourself and in God to move foward. If you can believe it you can achieve it. Conversely, if you don’t believe you will-more likely than not you won’t.

Best-

Wayne

wayne

Agree with you , Its faith only which makes sure you dont take bad decisions in tough times and dont deviate from your goals .

Manish

Hi Manish,

Great Article..really opened my eyes on “Goal Setting”.

Thanks for sharing this information.

-Saira

Saira

Great to hear that 🙂 . What are your loan term goals ?

Manish

Hi Manish,

You have explained the basics of financial planning in an excellent way. Keep it up 🙂

-Srinivas

manish

posting it here although this may not be the correct place for it:

by the way some regulatory changes in ULIPS from IRDA

http://www.moneycontrol.com/news/cnbc-tv18-comments/irda-to-rectify-flawsulips_459494.html

please start a news wire on ur column so that any new info can be accomodated and spread around

dr kishan

We have news site now

http://news.jagoinvestor.com/

dear manish

a very grass root level article indeed. its really necessary to plan out our lives with respect to needs and requirements. Its the destination which decides the route, isn’t it.

wanted to ask u for a long time. people always quote “retirement corpus” or “children corpus” and such things, right? is there a difference in the strategy for saving for different goals? what i understand by basic logic is that whatever the goal the strategy for investment will be same for different goals except for the time factor- short term goals requiring investments in Debt and long term investments requiring equity based savings. is there any other difference? i may take a child benefit plan or a retirement benefit plan or a ULIP, all are based on insurance(or annuity) + a equity-debt combo package, right? then why so many different schemes etc.

u always discourage Unit linked investment plans as they are costly and always are pro-MFs. thus what i understand is whatever the long term goal i make, the ingredients for the strategy of investment remains the same, isn’t it?

am i correct or is there something i’m missing?. why the different names for the same strategy is it just market gimmicks by companies or anything else

@Hemant

welcome back. i was missing your comments for some time. redaing comments from regular readers is always a pleasure. especially from intelligent and clever people like u

@Pramod

nice suggestion by u on the issue of reverse mortgage. although i understand it but i am eager to hear from manish about it in his easy going, detailed and exemplyfying language.

@Free Financial Calculators

the annual income, although decides of the class of visitors helping the content planning, does not necessarily decide the saving capacity which depends on other factors like no. of dependants, liabilities etc. wouldn’t it be nice to include the factor of capacity to save also in the voting system. anyway i have voted. lets see what the results display.

dr kishan

dr kishan

dr kishan,

Sound idea of target amt, a well diversified portfolio, starting early and some knowledge of expected inflation should be good enough for any goal. Retirement and child edu. basically can have the same types of debt +mf products with need to shift from direct equity to debt as the goal approaches. To me that sums up most of financial planning as long as each step is taken in an informed way.

Reg. the poll this will gives us all, esp. Manish some idead about the purchasing power of his visitors. That is purchasing power to afford a certified financial planner!

Financial planners to me are like greeting card companies who made valentines day into a big deal and jewelers who made Ahskya Triti into a big deal for their own benefit.

If you earn a lot of money then who cares if you are informed or not. Just get a CFP to do the job. If you are not so rich and cannot afford a CFP then to this section of the community financial planning should not be made to look like rocket science which is how most CFPs market it.

Very important points, i have been following this and am happy with what I have been able to achieve, so far. The very important use of this for me is that it gives me a purpose and focus – i dont get distracted.

However, i have realized that since these plans are longtem quite a few things change, meanwhile. Such as:

– your goals may not be right ones any more

– your earning potential can change and hence what you can do

i believe these goals can change and revisiting them in several years (not sooner) and validating them again with your family might be important.

Praveen

correct , plan must be reviews per year otherwise they might become off track soon . Do you think common public has time and motivation for this ?

Manish

Great Article Manish. The kind that has made jagoinvestor what it is today. Also its an article that is relevant to everyone irrespective of ones salary. Speaking of which: May I request that you conduct a poll on the annual income of your visitors. This may help for planning content.

Pattu

Thanks 🙂 . I have added the poll in blog to get the data . It was a great idea .

Manish

Manish Ji

A fantastic article. Only I find you are one person giving concrete reason to avoid to purchase flat and following the herd. I was in same dilemma. What to do? How to do? Even some people suggests me to take personal loan to make the downpayment. A home should be purchased any how. I am much more relaxed. I can now concentrate to build retirement corpus, fund for child education steadily.

I can invest 10000 p.m. I am splitting these in 5 separate category, 2000 each. HDFC top 200, Religare tax plan, IDFC premier equity plan A (which covers mid cap sector), Birla sun life MIP savings (conservative fund), 1500 to PPF at every month.

My LTA and Bonus amount will take care about building emergency fund and down payment for purchasing flat.

Please advise.

Yours faithfully,

S.Das

S.Das

Make sure you invest more in tax saving funds , as you can build long term wealth through it with lock in . Why Religare Tax plan ? There are better one’s i Guess .

Manish

Manish Ji

I got the name of fund from Outlook India fund review form there website. That is why i am taking your suggestion. What should be the best ELSS?

Whether my investment is going in right direction?

Yours faithfully,

S,Das

Unless we know about the risk appetite , it cant be said .

Manish

Manish Ji

My risk appetite is moderate.

Best regards

S.Das

You can consider Canara robeco equity tax saver, HDFC tax saver, Sundaram Tax saver, these are some of the best among ELSS category

Shrinivas Ji

Thanks for the suggestion.

Best regards

S.Das

Hi Manish,

Renting the house in short term is OK, but in the long term its always advisable to have your own house.

Avs

Reason ? In which situaiton ? Is it always recommended ? Can you show any calculation which shows that it makes sense to buy house in long term ?

manish

@Jagoinvestor:

In my area (Mumbai Suburb), property rates are increasing by the rate of 15-25% over last two years and 10-12% historically. So, I believe my house maintains it’s real value. Additionally, people feel lazy/unmotivated for savings but are more conscious for their EMIs. Finally, it keeps one free from all the hussles of a rented house.

Three good reasons to have your own house 🙂

Sunny

What is the price appreciation in last 10-20 yrs ? It might have given 20-25% in last 2 yrs , but that kind of return over long term is not expected .

You have talked about hassles of rented house , but there are hassles in bought house too . I feed rented has many advantages too .

Manish

Hi Manish,

My thoughts are:

I think owing a house is good in most situations except that if you cant afford it.

The most important reason is being security. Besides paying higher rent every year throughout the life, i cant imagine anyone staying in rented house throught life just because other investment options gives better returns.

Hi Manish,

It was a really good article. Learned a lot from it.

But even i dont agree wid the thought of living in a rented house and investing the money somewhere else. I think, one should own atleast one property where one can live. There are lot of hassels involved in a rented house like 1)changing the house as per landlord’s wish.2) Getting change your addresses all over and paying for that. 3) Getting new identity proofs (wid changed addresses) 4) you cant make any changes/improvements in a rented house to make it better. 5) N if landlord also stays within dat property (like groundfloor/upper floor) then there are many other hassels involved.

I think one should have atleast one house where he can live. Purchasing another house just for investment can be thinked again.

regards

Tarun

Tarun

Thats right . I dont disagree with that, The major point here was from investments point of view .

manish

Excellent article guru …

my ponit is that ..

if i want to achieve short term goal (2-2.5)year … like, buy a car around 4-5 lacs.

how to plan 4 it …

Raj

as its a short term goal , you do not want to invest in equity because of high risk associated with it , so better use debt oriented funds or RD’s only .

Manish

manish ,

so plz suggest debt oriented funds for short term ….

raj 🙂

Look at my article on debt oriented funds

Manish

It is right that all should have some clear goals yet the biggest problem for human psyche is that We can not, very often, differenciate between the goals and desires. Goals must be based upon needs first and luxeries later. Many young couples have only one kid and still their goal is to buy a 3/4 BHK flat becuase their peers have done so or they desire to own a bigger flat. Now that is absolutely not required. I have seen people who want to buy a sports car in Delhi. Why ? Its speed is 280 km/h dude ohhh what a feeling !!!!!!!!! My question is where do you find a road (and permission, its illegal) to drive a car at such speed in Delhi. Still people classify them as goal. But as Subra says ” I dont have any right to question a client whose goal is to buy a flat for his girlfriend (not his wife)” Its a personal affair.

BTW, Do you think its a better idea to Build a house for first 20 years and then use it for retirement through “reverse mortgage” rather that saving for house and retirement seperately. Why dont you come with an article on the subject of Reverse Mortgage to let people be aware of it !!!! -:p

Pramod

Good idea . I will write something on reverse mortgage soon .

manish

Very Nice Article Manish.

Its touches the basic roots of the problem wherean individual can make difference to his/her Financial Planning.

Jitendra

Thanks 🙂 . What are your suggestions on how to motivate people to plan for goals in the start itself ?

Manish

Hi Manish…..

damn good article about goal setting.

The article inspired me to set my IMP goals rite away ( i mean RETIREMENT corpus and CHILD EDUCATION corpus). Can you tell me how much roughly i need with inflation in Year 2032 for retirement AND how much with inflation for Child Higher Education in 2025 ??

Secondly, how i can achieve the corpus ? How much i need to invest today monthly and allocation ?? And which are the best investment instruments i can go for ?? (SIP and PPF ???) Pls advice.

Ajay

Thanks , glad to hear that, You should take 6-7% as inflation for retirement and 10% for education . Once you have the target amount you can use the formula’s to compute how much you need monthly, its nothing but reverse engeering the SIP formula.

Manish

sorry manish. taking 6-7% as inflation rate is fooling oneself.inflation has been galloping worldwide -dont look at useless CPI and WPI numbers.look at the things you need: healthcare and housing are going thru the roof.education is roughly up 20-30% per year for decent schools.with RTE and other bogus ideas,it will further go up.

it is better to plan with a very pessimistic view of inflation.it is always going to surprise on the higher side.that is what central banks and govts are geared to behave.

@ Praveen

“Shant gadhadhari bheem shant”

If we are talking about 2-3 Years you are absolutely right. But when we are talking about financial planning we are talking about 20-60 years (depending on the client’s goal). We can safely assume 6-7% of general inflation & 10% of inflation for education/medical. In retirement its important that what kind of income/expense replacement we are doing.

Financial Planning also handles “Lifestyle Risk”. Over pessimism will kill your present & over optimism will kill your future.

hemant,

there is no real scientific or real world basis for assuming ‘6-7%’ over the long term.it may have been the case when dollar/rupee was linked to gold. i am not sure you have considered regime change in the monetary system. all that equity growth could easily be wiped out with a black swan event. ofcourse,you might know as they teach in CFP, we are all prone to anchoring bias.somehow some central banker decided in india that 6 is a nice number and we are all anchored to it.

look at your parents inflation index and your own.every person should have his own index based on experience.not on thumb rule

@ Praveen

I follow Keep it Simple Stupid, I don’t know what you follow.

People try too hard to get the best and in doing so, they actually makes a mess and then blames the same on other factors.

If someone is going down the wrong road, he doesn’t need motivation to speed him up. What he needs is education to turn him around. I think this is what Manish is doing.

@ Praveen

30% inflation means prices get doubled every three years. So, the funny part is, if you assume a 30% inflation, the equity portfolio will also hesitate to accomodate you, that means the only place for you to invest your money is on highly speculative penny stocks /chit funds. or you have to start microfinance institution.

@Hemant: The article was really nice. I do have planned for everything except our health costs. I don’t believe in insurance etc. Can you comeup with an a rough amount I need to set aside for health costs( I am 25, will marry next year, parents have their own health plans)

Praveen

Why does 6-8% inflation is not a realistic number ? I once calculated the simple average of inflation for last 30 yrs and it came to 6.5% .

Considering India is on path to become developed nation in coming year , the inflation and interest rates both are set to go down in range of 3-4% atleast in next 20-40 yrs which we are targeting .

What number is a good estimate as per your analysis ? please share

manish,

not sure how you calculated the inflation numbers from? from cpi or wpi?. i dont think they are reflection of reality.

i looked at gold prices. in 1979 it was around 1000 per 10g,today it is around 18000. gives around 10.5 percent annualized.

my ideology is be prepared for the worst.one can always hope that our political masters will allow the continued liberalization of the economy.thats just a hope,imo.

gold is a good indicator of inflation since it is “true” money.the funny paper we see today is just something that started in 1971.so the fiat money system isnt even worth 2 generations life time yet.

sunil,when i went to B-School 10 years back, the cost of an MBA in IIM was less than 1 lac.today it is 10 times over i think.thats an inflation of 25% annualized.

imagine when govt ever decides to free up petrol prices.

we are moving from a subsidied culture to true rates.price jumps are inevitable. also,more than equities or any kind of investment,the best investment you can do is INVEST IN YOURSELF.if my salary was able to double every 3 years and go up 15 times in the last 13 years,i have done well for myself.so focus on that as well.

@All Readers

Let’s Compare 1980 & 2010(30 years) prices for different items:

Item……1980….2010….Rate

Gold…….1452….18000..8.75%

CII……….100……632……6.56%

Petrol…….5.22…..50.55…7.91%

IIM-A….6000…13,70,000…19.84%

SENSEX…120….16445……..17.82%

FD………..100…..1436…9.65%

Endo……..100…..661……6.5%

In this period App. returns of Endowment 6.5% & FD 9.65%(3-5Years SBI)

Hemant

What is the source of the data ?

Manish

RBI, BSE & various other sources.

if death happen ,,,,,,,,,,,,,,,what will be the irr ???????????????????????????????????????????????????????????????????????????????????for his family

m

Thats interesting , the IRR would be very high in that case . It can range from 1000% – 10000% , depending on when a person dies , But which family would be interested in that kind of IRR at the cost of someone’s death ?

Manish

good heads up.

lets back it up with market uncertainty, which distracts and demotivates people. Not realizing that this unevenness is neutralized with healthy returns inthe long run. Refer Manish’s old articles please. 🙂

though am unmarried, given current social context and new kids considering and treating their parents nothing more than ATM machines, I do feel unless there is a critical issue, except kids education till graduation, one should not plan for his future financial needs .

P.S. this is a personal viewpoint on a friends forum . No offense intended to any one.

Aditya

So what you are saying is one should not be considering his retirement planning today itself and other goals except Child education , That can make sense but I would like to hear WHY ? In which situation can that be help ful ?

Manish

Manish,

my points.

1.Please do consider retirement plan , yes one must. Are you a conscious investor, who can bear moderate risk? yes- 80 CC with minor investments takes care of it well .

2.I am discounting kids support beyond their graduation, let them own it themselves post that.

corollary- unfortunate scenarios of poor mental or physical health of kids needs to be planned and cared for. And again here, your term insurance planning and 80cc investments help if done prudently.

Excellent article Manish

About the point that Aditya made on supporting kids beyond a certain point, I would infact want my son to apply for (higher) education loan.

Though I have started saving/investing for my 9 month old son’s

higher education which will be put to use in case of any eventualities

such as unavailability of loan due to whatever reason. Procuring

a loan and repaying it in the initial years of his salaried life, will also

inculcate discipline though I will encourage him to invest a part of his salary in equity as well right from the beginning. And guess what happens to the corpus that I would have built for his higher education? I will transfer the mutual funds/stocks to him at

an appropriate time so he can build upon it thus giving

him compounded returns over a period of say 60 years

by the time he approaches his retirement.

Avi

I also support your point of supporting your kids education and nothing beyond that point . However arent you overdoing when you say you will help him with his retirement plan too ?

Manish

Manish

I think of it like this – In anycase I will be leaving behind some assets for my son to the best of my ability (Unless he turns out to be a naalaayaak in which case everything gets donated to a trust or something and he works at the local paan ka galla for the rest of his life 🙂

A part of what I leave behind for him would be the higher education corpus which I was saving for him in anycase

but once he takes up a job, the financial instruments (MF/Stocks etc) get transferred to his name – he can either thank his bapu

for doing the good deed and build upon to it till his retirement on his own to get compounded returns effectively over 60 yrs or blow it all away on senseless expenditure. I hope to raise my son

to be sensible enough to build upon it for a secure future. Apart from this I am ofcourse going to ensure he understands that he will be investing atleast 30-40% of his salary etc etc – the whole financial planning drill

Avi

Yup

I get your point now .

Manish

Manish,

You touched the basic issue – there used to be one liner in the employment office which I recite even today – Unless you know which port you are sailing, no wind is favourable. A documented SMART goal setting is not only the begining but the essence to live the life. I think if the people at the bottom of the pyramid consider goal setting as one of their goal (and abide by it…), they in all probability can invert the pyramid.

A thought provoking article considering 3% of people holding 97% of the wealth (till the last count came…)

Naresh

yea , unless people start planning the road ahead will always be rough and not smooth , Goal setting is nothing but making the rough path ahead very smooth to walk in 🙂 .

I didnt understand your 3% and 97% part ? What does that mean ?

Manish

Manish,

It is evaluated that 3% of people hold 97% Assets/Wealth of this world and ironically only these 3% knows what they really want. It is an old case study and I do believe that still valid….

Naresh

ahh ok , got it , its same as 80:20 rule 🙂 . Should be still valid and till the end of eternity 🙂

Manish

A very good article indeed!

I’ve just started in the past year, lets see how things materialize.

Thanks for the very good post.

Regards

Kavita

Kavita

Good to hear that you have atleast started, Starting is the biggest reason why things are done in life . So you are already much ahead of everyone .

Being a lady and involved in finances , I congratulate you and would like to hear your views on goals settings , do you think ladies can be better at setting goals in financial planning ? Do you think male counterparts do not have better understanding of expected things in long run ? Your views ?

Manish