What could trigger the next financial crisis?

There are many areas which we talk about regarding financial awareness, however there are things which a retail investor is never aware about and that’s “International finance”. It’s equally important to understand what is happening at national and international level which can hugely impact a common man. With financial markets becoming increasingly complacent about the recurrence of a crisis, we believe it is relevant to explain a couple of areas of concern which could trigger the next round of the crisis.

Greece – Europe’s Achilles Heel

Source : DNA

Source : DNA

What’s Going on in International markets

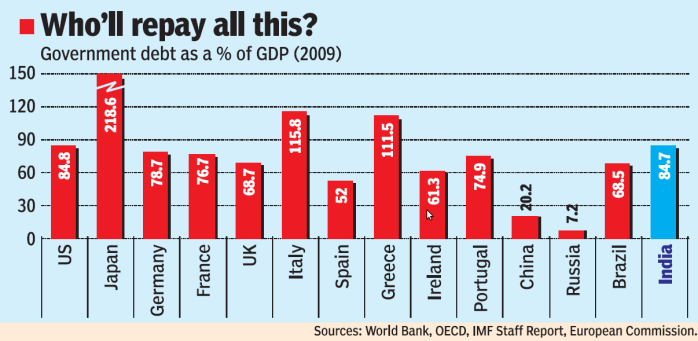

In the last few weeks, Greece has taken the centre stage in the financial markets. Within the next two months, Greece has to pay back the maturing bonds [to investors across the world] and finance its budget deficit. The country needs to borrow around $40 billion from the international market. With 10 year Greek Government bond interest rates of around 7% (more than 3% to 4% higher than 10 year U.S. Treasury or German Government Bonds), this has led to fresh worries over a potential default by the Greek government. What has added to the problem over the last two days is a rapid withdrawal of deposits from Greek banks by individuals in the country. Unless, Greece agrees to the terms set forth in the rescue package put together by European Union and IMF [to reduce government spending and increase taxes], it is difficult to get the support of this consortium to raise the $ 40 billion to stave off the crises. As you can see from the graph, Greece’s debt is over 111% of GDP. We believe the situation in Greece is getting grimmer day by day and could be a trigger for a crisis in other European nations – Portugal, Italy, Spain.

Read more on this through the following links :

- http://ow.ly/1wR0D (Retry opening this several times , if it does not show you article)

- http://ow.ly/1wPhw

The China Bubble

The fiscal stimulus initiated by China last year through bank lending to the tune of $ 1.2 trillion has led to potentially unstable conditions in their economy. According to well-known investor James Chanos with 60 percent of the country’s GDP relying on construction ‘China is on a treadmill to hell’. Marc Faber a long time optimist on China and well-known economist Kenneth Rogoff have also spoken of a China Bubble recently. With the Chinese government trying to enable a slowdown in real estate speculation via a recent tax on sale of homes when they have been owned for less than five years, one cannot rule a rapid decline in prices which would have a negative impact on economic growth.

Read more on this through the following links:

- http://ow.ly/1wPem

- http://ow.ly/1wPcN

Any one or combination of the two global factors identified above could trigger a mild to deep correction in the financial markets and slow down the world economy. Due to the strong financial linkages with the U.S. and the rest of the world, India will not be spared.

This is a Guest Column by Partha Iyengar – Founder and C.E.O and Srinivasa Sharan – Adviser, Investment Management – Accretus Solutions

Disclaimer : The article is for information purposes only and should not be construed as any recommendations. Accretus Solutions does not intend to solicit any business. Accretus Solutions do not take any responsibility of the losses that may arise out of actions taken based on the article. This article is not a substitute for developing an investment strategy or plan with a professional adviser. The views expressed in the article are that of the authors only.

April 10, 2010

April 10, 2010

[…] The single word for this phenomenon is ‘liquidity’. I am afraid you could get reliable statistics on real estate, since India lacks transparency[ be it in title deeds or transaction mechanisms] and we are yet to have real estate investment trust vehicles or REITS which would help track data and give a better picture. It should happen soon… (Link) […]

[…] there were news on Greece facing economic crisis which sent jitters all across the world . After Greece now its turn of Spain . S&P has […]

Guys,

Real estate prices are currently at a high premium but you can’t call it a bubble. They dont seem to be overvalued by 50-60 %. If that much correction happens rental return on residential property would become 8-9% currently btween 3-5%.

Also dont forget inflationary expectations….. I guess there can good deals avaliable in resale market if one can take the pain of looking for them.

Regards

Rahul

Rahul

Its not clear why do you think its not a bubble , can you explain in detail your reasoning ?

Manish

I agree with the other commentors. There will be a depression in 2012. This has been proved by the law of the economics which cannot be disobeyed. So we better start preparing ourselves. Thanks for the information though.

Thanks for your views .

Manish

This is in general on real estate investments; most of us make the mistake of thinking that owning a house property is an investment. Let us clear the clutter here once and for all. If I own one house property, it is my necessity and not an investment. Even if my property value sky rockets, will I sell it? If I sell it, where would I live? In a rented placc? In which case I need not have owned the property in the first place and could have lived in a rented place all along. So, owning one house for necessity is not an investment and do not even waste your time calculating the (notional) gains/losses on it. We financial planners classify such assets as personal assets and indicate it separately as such in the Net Worth Statement.

India, as a developing economy has provided many opportunities for select set of people. As many of you have amplified above, during a specific time period in specific places, real estate prices skyrocketted and few smart people made a killing.

If an ordinary person because of extra ordinary situation owns more than one house property and ignores owning financial assets, he or she is bound to suffer and would live as a king at the end of the dynasty – asset rich and cash poor. Only reverse mortgage could save such people which will transfer your wealth back to banks as interest payment.

Dear Manish

Many of our real estate investors ( speculators ) in the grossly overpriced Indian Real Estate ‘market’ ( If you can call a place where are customers are taken for a ride a ‘market’.. Better call it a circus) are going to rant like this this in the future.. Must watch.. hilarious

http://www.youtube.com/watch?v=bNmcf4Y3lGM&feature=related

Please read the book called ” Capitalism, The Unknown Ideal” by Ayn Rand.

In this book she clearly shows that all “Booms” and “Bust” of the market is caused by government intervention in the economy.

The present crisis was caused by

1.The US government strong-arming banks to lend to the poor in the name of ” Social Justice” and “American Dream”

2. Federal Reserve ( A government body ) kept the interest rates abnormally low post 9-11 to make americans take out loans and purchase goods.. This was deemed patriotic!!

3.Semi Government agencies like Freddie Mac and Fannie Mae which virtually insured the bad loans made by the banks

This recovery is a false recovery.. I was caused by Government intervention.. All major governments have ran up huge debts trying to “solve” the crisis created by them in the first place.. Governments do not create wealth like private enterprises.. They only tax wealth..

A major crash triggered by a major default of a major economy is coming.. Or a major hyperinflation is coming.. The question is when? The laws of economics are like the laws of physics.. They CANNOT be disobeyed.

Unless governments get out of the economy and restrict themselves to governing these booms and busts will always be there..

I suggest that readers read the following 2 books

1. CAPITALISM – AN UNKNOWN IDEAL– By Ayn Rand

2. ECONOMICS IN 1 LESSON – HENRY HAZLITT

drkhann

Thanks for such an insightful comment 🙂

Manish

Assumption is the mother of F*** U**. As @Rajandran already pointed out above no one can predict how the future will play out. Hardly anyone predicted sub-prime crisis and equally no one expected the markets to bounce back that quickly(you should have heard the doom and gloom predictions then). Predicting the trigger for the next financial crisis is in vogue now( kinda of fashionable)- from PIGS to China bubble to our huge fiscal deficit, but I doubt it will come when and from where everyone is expecting- could come in 2 years or 5 years or 10 years, who is to know.

Guardial,

the sub-prime crisis was predicted rightly by quite a number of economists and researchers..markets always tend to ignore it..

some of the economists/researchers who predicted the sub-prime crisis and the bank failures are David Rosenberg, Meredith Whitney, Nouriel Roubini , Stephen Roach etc.. The economists usually could see the crisis coming much earlier than others.. They predicted in early 2007 the bubble is bursting.. but it happened from Oct 2007 and our markets fell in January 2008..

The May 2006 crash of Asian markets was predicted accurately by Andy Xie – the economist from Morgan Stanley[ he is no longer with them now] predicted the crash of the equity market.

The recent upturn in April 09, was very well predicted by Jermey Grantham who was a long time bear. He was the first one to write that its time to buy the stocks.

Same goes with Anthony Bolton.

yes..you are right about the time frame..its difficult to predict..

but one thing is for sure, we are going to have many bubbles and bursts from now on..

We need to be prepared for the volatility and learn to deal with it..

Accordingly develop dynamic strategies to minimize the downside of our portfolios to reach our financial goals..

Partha

well explained with names of economists and examples , how do you read so much 🙂

Manish

I don’t agree with such type of super human experts who can predict markets – for 2 reasons:

1. One thing is common in these names either they predicted the top or they predicted bottom. So in any case investor can’t get benefits from these predictions.

2. The market can stay irrational longer than you can stay solvent.

Let’s hear few of the investment legends on this:

We’ve long felt that the only value of stock forecasters is to make fortune tellers look good – Warren Buffett

I never ask if the market is going to go up or down next month, I know that there is nobody that can tell me that. – Sir John Templeton

I don’t know anyone who’s ever got market timing right. In fact, I don’t know anyone who knows anyone who’s ever got it right. – John Bogle

There are two sorts of forecasters. Those who don’t know, and those that don’t know they don’t know. – John Kenneth Galbraith

If I have noticed anything over these 60 years on Wall Street, it is that people do not succeed in forecasting what`s going to happen to the stock market. – Benjamin Graham

It is absurd to think that the general public can ever make money out of market forecasts. – Benjamin Graham

Hemant,

Agreed, forecasting is the toughest domain for even the seasoned professionals..

But today, there are some of these specialists in economics/researchers who have attained credibility over a long period of time and the body of work they have published in well known and peer reviewed journals stands testimony to it.. the people I had mentioned.. have been following significant number of research notes, interviews etc for many number of years..

they have such deep insights.. i remember way back in 2004-05, stephen roach of morgan stanley [ chairman for asia] and chief economist at that time for the U.S. region for morgan stanley talking about the impending crisis due to the americans tendency to live on future cash flows [ that is borrowed money or negative net worth].. He had written for half a decade [before the crisis hit in late 2007]that the only way america can get out of the mess is start saving.. he was laughed off..

look at the scenario now..

the u.s. consumers have saved 6% as on date since crisis!

the citizens out there for the first time after 4 decades are in a mood to pay back loans and cut on their spending..

in fact, so much so, have you ever heard of urban middle class americans stitching the worn out shoes, living frugally and going to walmat? wal mart was always a place meant for lower middle class, poor and the asian immigrants!

the savvy asian immigrants are the biggest savers in america..

the advantage in u.s. is that they have got centuries of transparent data through which one can analyze and predict the future events..

the point is ‘ who wants to listen to them’.

nobody likes to listen to ‘dooms day’ stories..

every body wants goody goody stories..

unfortunately, reality is that in fnancial markets its better to be realistic and gaurded , because your hard earned money is at stake..

please read ‘ This time is different : Eight centuries of financial folly” by Kenneth Rogoff and Carmen Reinhart. It traces the history of how the governments, individuals reacted to crisis and what they did..

one other person you need to watch out is ‘Nicholas Nassim Taleb’..

I am sure you must have heard/read his books – fooled by randomness and ‘black swan’..

You will find some very interesting insights from these books, authors and economists..

We just need to open our minds and read and analyze..

India is no longer an island and investments are no longer strictly defined and adhered by ‘models’..

in short, the idea is to be aware of whats happening around and take advantage of the opportunities that come your way..

at the end of the day India is linked to financial markets across the world ..

Economically as well, we are not yet ‘de-coupled’..

All we say is, manage your portfolios actively in accordance to your financial goals and risk profile. period. be it you are a ultra hni or a retail investor.

Manish,

You are keep saying that the real estate is going to burst… I am not sure on what basis… In India, it looks like real estate is overvalued in metros & big cities… but, it mainly due to high demand (speculation also a factor for demand but large scale migration is the real reason) & less supply… also, you cant compare it with US… Becoz, lot of the black money involves in the market & most of common people invest their life savings in real estate… also, you dont have much lands unlike USA… home loan could be concern, but not sure whether that could cause a burst… Can you please explain why you are expecting it to burst in 2-3 yrs??

Hi Vinay,

This is a very valid question that why real estate prices will crash. You have said that demand is more and supply is less so the prics will remain firm. But there is a big illusion, make a logical conclusin. 1. Greenry (trees) is refresing and soothing.

2. Dense forests are green and have trees. So from 1. and 2. we can concluide logically that dense forests are refreshing and soothing. But we all know that is not the case. Similarly there is demand for houses but from whom ? The person who needs house is a lower middle class guy with income less than 30000 a month. after his expenses he is left with 10000 Rs as saving (This is exaggarated in this state of inflation). With this he can afford a loan of 10 lacs for 20 years from bank. Asuming 15% equity in home the max he can afford is a house worth 12 lacs. Now ask yourself two questions.

1. How many houses out of the supply you stated falls in this bracket.

2. How many persons (Demands) you know can afford an EMI of even 10000 Rs.

This is a fake demand and supply situation. Demand is for apples and supply is of oranges.

Secondly the projects. In NCR alone where I live there are 1.5 million units that are on sale and in next three years this will double. average price is 25-35lacs. Since many are funded projects, deal has to happen in “white money”. Definitely the one who will spend 25 lacs must be a taxpayer. At this time only less than 2 crore people pay income tax and many of them a have a home so WHO WILL BUY ?? these homes with fancy names.

Now take a look at some events that took place in recent times.

1. Unitech had to sell its land to pay off debt.

2. BPTP surrenders the plot of land it bought in auction at NOIDA with a penalty of 50 Cr Rs.

3. JP Associates sheds plans to build apartments in Noida and Gr Noida and sells plots from its land bank as it does not have money to build apartment and the ones alredt built are insold.

4. Parsvnath is on the verge to call off its Pride Asia project in Chandigarh as only 10 bookings were recieved in last 3 years and six of them are cancelled.

5. Three malls in Gurgaon have been converted into offices as there was no taker.

Now you decide if Unitech and JP are selling lands which was bought for building houses then there is something fishy in the market.

If you wonder why the prices are not coming down it is because of the following reasons.

1. Real estate is the best place for HNI and Mafia to hide their Black Money around the world. High price means better amount converted to White. These are cyclic trades that happens between a group escalating prices.

2. The broker community never let the deal happen in transparent manner. They will never let buyer meet seller and the real picture of market is hidden.

3. The land banks bought by builders are in the once remote area’s agriculture land at a throw away prices so they can hold back to it for quite sometimes.

4. If you look closely the biggest property dealer in your area must be some close relative to local MP, MLA etc. Every project has some partnership of politicians and this builder – politics nexus will try their best to keep prices upward ( e.g. you can not build your house in your farm but a builder can build a whole township. Or posting restrictions on land use thus ensuring short supply of land)

there are many reasons but you can not holdback for long. Ultimately every assset has to bow down to the principles of economics and that will happen with real estate as well. It is possible that the prices may not be halved because people will not sell at loss (Typical indian mentality) but even if they stand still for next three years that is a discount of 30% w.r.t. inflation. Just a way to look things. Imagine a rise in your income by 10% every year and the discount is almost 50% so get ready. I am not an economist & this is plain observation on my part so I would request fellow boarder to clear any misconception within it.

Pramod

Pramod

Amazing points from you 🙂 . good one .

Manish

Vinay

While Pramod has answered you , i will be very brief .

When something goes at a speed which is not inline with long term history , its bound to fail at some point . See Gold , in last 5 yrs , Gold is the top performer . this cant be always , its historically known to be a single digit earner .

Talk real estate . What is a 2 BHK flat , if you have to construct that single flat , how much will it cost , not more than 10 lac in any case . Take profits of 100% and it should not cost 20 lacs + . max 25 lacs . the same flats are selling at 50-55 lacs at some place . then they will be sold at 60 , then 80 … then ?

At some point , one finds there is no buyer . thats an ugly moment .

Manish

Manish & Promod,

Thanks guys for your time & response. I agree that the real estate may not have the same growth as it has been… But, will it going to burst? whether the current prices could go down… Even I am not sure whether Gold prices could go down from the current ranges… Similarly, real estate prices may not grow 30-40% year… but it may grow at less than that… My question is, whether that is going to have negative growth? when you say it is going to burst, do u mean negative growth/dip or slow growth?

Also, Promod, in your example, you are talking about lower middle class… but the real estate growth is due to upper middle class… as economy grows, there will be lot of movement to upper middle class, who also will be migrating to cities & so forth… Not only IT, other fields also giving better pay checks now… for a common man, building the home is the main ambition… so, they invest(or spend) most of their earnings in it? so, brokers will use this… In India, it is not very much exposed to any financial process or institute… That s y, I am still trying to understand, whether it is a weak bubble? if it bursts, how?

Real estate too would correct when financial crisis happens..

All the more so in India, since lot of high net worth investors move by rotation their surplus cash from equity to real estate and vice versa.

Ravi

yeah .. you are right . look at Partha’s comment on this .

manish

Hey Manish,

This type of articles are very scary for the common people like us. However it is eye opener for all.

Krishna

I feel its better to be aware of things like these rather than not understanding whats going on .

Manish

Great post Manish.

As for the overall economy, initially i thought the recovery was fake. But it seems to be real. We are seeing a lot of hiring, salary hikes etc. The company results across various sectors has been very good. I am in a dilemma whether to put money in direct equity/MF since we are at a peak since the last crash. To me it looks like the chances of going up is more than going down.

As for real estate, i still think its highly overvalued. But i am wondering why people still buy it. Many think buying it is some sort of an achievement. ( even if they buy with 85% loan). Its very difficult to change the Indian mindset. Last week i had a heated argument with my in-laws :-). They want me to buy something. But i said i would never ever buy flat/apartment and will buy only independent house if am convinced from all aspects. Currently i am living happily in a rented house in a very posh location where u get everyting within 200 meters. If i were to buy that, it would cost crores of money and the rent that i am paying is peanuts compared to that.

What could trigger next crisis? I dont know. But from what i know, there are a lot of people in india with huge debt. We are seeing increased NPA in bank balance sheets. Who knows, india could well be the next one.

Tejas

You have raised a very sensitive and important issue . I would say you are on the exact right path . the argument with your inlaws can be a seperate issue as they are thinking of protecting their daughter future with you . I am sure they no other reason . So that part is acceptable , however your decision is correct.

We are slowly building a big real estate bubble and in coming years the situation would be very ugly .

Manish

Hey Manish,

Any idea of the time frasme for the real estate bubble?

Thanks

Hitesh

Hitesh

You are asking a wrong question . No one can know that .. Personal opinions doesnt matter much , I expect it to be in next 2-3 yrs .

Manish

Hi Manish,

Was surprised to see this post in your financial planning blog.

This game of predictions goes on an on on all news channels, where they keep talking about market levels and what happens in BRICS, PIGS and other animals. TREND IS YOUR FRIEND is their take on the markets. Everyday there are some Charts or Stats thrown at you to reiterate that they know the markets better than you do.

Inspite of the PIGS, BRICS, The HYPED UNION BUDGET, (the list never ends), the Index has given 18% Annual Return in the last 30 years.

If you have a timeframe for your goals and with a conservative approach you allocate your assets with enough diversification you should get the desired returns, and in the end achieve your goals.

News are for Short Term Traders and not INVESTORS. Investors dont need to worry about any CRISIS.

Happy Investing !

Regards,

Abhishek Gupta

hey in the article and the subsequent discussion you have focused on Greece.. But at the same time I can see that govt’s debt as a % of GDP in Japan is more than 200%.. This is very high as compared to Greece..

We have been also hearing about Chinese bubble..

Can someone throw some light on Japanese economy..?

Pavan

Japan is another mess : http://www.economist.com/displaystory.cfm?story_id=15867844

Manish

the japanese debt though very high, it is internal..

that is its mostly owned by its citizens..

if you notice, even India has high levels of fiscal deficit, but again its almost owned by its citizens/domestic institutions..

hence the worry is lesser..

but in the medium run it needs to be controlled or else it could lead to slow down in growth..

If you look at Japan, when the real estate bubble burst in late 80s, they printed money to bring the economy back to normal.

they are yet to do so..

Latest research brought out in the form of book by Kenneth Rogoff and Carmen Reinhart on ‘This time its different : Eight centuries of financial folly” is a fabulous book to read and study.. It traces the bubbles for the last eight centuries and concludes that fiscal stimulus [by printing money] to revive growth just doesn’t work..

Now all governments have been doing that post financial crisis..

We will know the effects of it pretty soon..

It may take some years though for the bubbles to burst..

Abhishek

I agree , Investors can always find the investments opportunities and invest . The news is only for people who are concerned about short term .

Manish

Abhishek,

things have changed post lehman crisis..

we can no longer afford to stick to ‘buy and hold’ strategy..

but that doesn’t mean that you would need to trade or book profits/losses often..

what it means is that one needs to do tactical allocation [ by buying during dips, rebalancing the portfolio and also sector or sub asset class rotation] actively..

Do you know, during the 10 year period of investment 1999-2009 in U.S. the investors who followed the ‘buy and hold’ strategy got negative returns..

closer home, our country too on a 10 year basis recorded negative returns!

have a look at the proprietary research done by us:

http://blog.accretus.in/market-chronicle/india-market-chronicle/

you will get the picture..

you should read the latest book by Mohammed El Erian of PIMCO ‘ when markets collide’.

the buy and hold strategy was based on the modern portfolio theory which stressed that the asset allocation determines 91% of the portfolio performance.

going forward we believe that tactical allocation and security selection also plays an important role.

there was a recent research conducted by Ibbotson[ yale university”s professor of finance and and his colleagues] that corroborates our views and they found out asset allocation alone does not dictate the portfolio performance. Importance should be given to market timing and security selection as well..

abnormal negative retuns for a long period of time can have an impact on the life stage goals of investors.

In the U.S. for eg, most of the investors who were to retire soon, have to postpone their retirement [leave alone finding jobs, thats the next question] by a longer time period due to negative returns earned in their retirement pension plans..

While, I agree that in general there is no need to panic and get carried away by the noise in the market, it is helpful to watch out for signs of crisis to review and steer our portfolios to minimize the downside.

The key to this is ‘financial planning’. Once you have your short,medium and long term goals sorted out, you know where your money is being invested and accordingly you would invest in the right securities.

After wards, all you need to is monitor your portfolio in regular intervals and do the re-balancing of your asset classes and sub asset classes once in a while.

Finally, as I said earlier, Indian markets are highly correlated with U.S. and other emerging markets. It will take many years for us to de-couple from the developed markets.

Interesting Content from Elliotwave

Why Economic Forecasts Often Fail?

Linear thinking often utterly misses the mark in financial forecasting.

Let’s begin with a paradox — the one constant in our society is dramatic change. This is the main reason why projecting present conditions into the future often fails.

“If someone had asked you in 1972 to project the future of China, would anyone have said, in a single generation, they will be more productive than the United States and be a highly capitalist country?

“Project the U.S. space program in 1969, in fact many people did — there are plenty of papers you can read from 1969 to 1970 saying, well, it’s obvious at this pace we’ll both have colonies on the Moon very soon and we’ll have men on Mars…

“One could just as well ask someone to project, say, the Roman stock market in 100 A.D. I doubt if you’d have found anyone who said, well, it’s essentially going to go to zero.”

— Robert Prechter at the London School of Economics, lecture “Toward a New Science of Social Prediction.”

Examples of linear thinking may be well-known like the ones above, or may happen in our individual spheres. Mom sees Johnny eating animal crackers Monday, Tuesday, and Wednesday. The box is now empty. She buys more — but the box remains unopened for days. Johnny wants a break from animal crackers. It’s an elementary example, but a demonstration of linear thinking nonetheless.

The socially awkward classmate you knew in high school is now the boss of the former class president who was dubbed “most likely to succeed.” Projections for both of their futures would have widely missed the mark.

SUVs are selling like snow cones on an August afternoon in Luckenbach, Texas… “let’s make more,” says Detroit. “Dramatic change” takes over in the form of sky high gas prices — and SUV sales sink.

When it comes to your money, pay attention to the pitfalls of linear thinking. The markets of today may not resemble the markets of tomorrow. Keep in mind the concept of dramatic change. This cannot be over-emphasized and bears repeating: Major change is not an occasional occurrence throughout history; paradoxically, it’s the only constant. Even with the benefit of reviewing the above examples, it can be difficult to imagine, ahead of time, a future which is strikingly different than the present. But you must leave your mind open to such a possibility — nay, probability.

Rajendran

thanks for the valuable insight

Manish

financial crisis may come and go

but the real estate prices will remain the same in India, if not go higher up since there is an increasing demand for housing and an ever decreasing land available

the middle class will suffer once more due to lesser salaries but higher taxes and increased expenditure due to higher prices of essential commodities.

Lakshmi

No , it will go down in coming years , real estate moves in cycles , we have just seen a big upmove , a little exaggerated one .

Manish

Lakshmi/Manish,

I can give an empirical example.

in 1990 a 2 BHK flat in Malleswaram area in Bangalore cost approximately 20 Lakhs. Last month, Mantri developers anounced a project in Malleswaram where a 3 BHK flat would cost approximately 1.5 Crores. So what is the growth we are seeing here? It is approximately 10% PA. If you add another 2% towards rental income, it will be approximately 12%. What about depreciation and maintenance expenses and taxes paid?

Even here I doubt very much if there are any buyers for the property built in 1990 at 1.5 Crores.

This is what happens in case of any asset if you hold it for sufficiently longer period. The returns tend towards the long term average. There are always exceptions which can not be the guideline for all investors. Also, there are circumstances such as a govt. agency allotting the property with heavy discount to market price which tend to exaggerate the returns.

Generally, lack of volatality is mis-construed as better returns. What about liquidity? Real assets tend to be high ill-liquid. Try owning 10 properties instead of 10 stocks and see what happens.

Narendra/Lakshmi/Manish,

I agree with Narendra on the long term returns in the real estate market..

Its about 12% compounded annual growth rate..

typically rental yields would give you about max 6% returns..

one of the barometers to check whether we are in a real estate bubble zone is if rental yields cross 6% of capital value of the property in a year across a city or an area..

also..when it comes to real estate cycles, its been a seven year cycle..

for eg. in bangalore..the realty markets fell in 1995-96 and it took 2003-2004 to recover..the next 4 years was a bull run, partly because realty markets generally tend to have high correlation with equity markets also there was a sudden demand for apartments, commercial complexes and retail malls..

The younger generation cashed out and got their sudden money..

Manish..you are right..in terms of the current scenario…we are yet to see a big correction in the realty markets after 1996..

But one of the emerging trends is also ‘shorter cycles’ across asset classes..

therefore, for all that we know we will have many boom and bust cycles.

the more an appreciation, the more correction would set in..

classic case : whitefield: during the peak the prices for branded apartments were quoting at 4500-5000 levels per sq feet..

but in 2008-09 correction, it fell to as low as 2800-3000 levels. of course, these were possible if one had full cash to pay..

hope this puts into perspective our real estate market..

Partha

I accept every bit . i have done some study on real estate returns in India and overall the returns in last 10 yrs converges to 15% max . see: http://jagoinvestor.dev.diginnovators.site/2009/12/returns-of-real-estate-in-india.html

I think if the best times in real estate gave 15% return, then one should not expect more than 10% in general scenario . over long term its not something for investments, its something to save in .

Manish

Narendra

I agree

This is what i call the mirage of big numbers , if a person buy a flat in 30 lacs today and in 10 yrs if its value is 1 crore , they will feel that they have made 70 lacs in 10 yrs , thats 7 lacs per annum , they will not see that they have got just 13% return , which is not a big deal if you see a long run of 10 yrs in country like India and have 13% return , thats the kind of return which some of the debt oriented funds like Tata Young and UTI mahila Unit scheme has given .

Investors have to look beyond absolute numbers and dig deep into CAGR numbers and also consider that is the opportunity cost .

Manish

Hey,

I never thought like that.

Excellent point Manish.

Thanks

Hitesh

Dooms day predictions are there all the time.

In my opinion, if you are less than 50 years old, these recessions and financial crises are opportunities of life time. Any one following Buffet’s actions during the last crisis?

If you are > 50 years, there is some thing known as asset allocation you should follow..

As regards real estate, investing in a new property is easy. Try selling an old property and see what happens then..There are plenty and asset rich and cash poor people because they choose real estate as sole mode of investing..

Crises come and go. There is no alternative to asset allocation.

How can we benefit from Asset allocation???

Thanks

Hitesh

@hitesh

Asset Allocation

http://jagoinvestor.dev.diginnovators.site/2009/07/power-of-asset-allocation-and-portfolio.html

http://jagoinvestor.dev.diginnovators.site/2009/04/asset-allocation-presentation.html

http://jagoinvestor.dev.diginnovators.site/2008/04/what-is-diversified-portfolio-and-how.html

@Hemant – good show

@hitesh – asset classes that are not related with each other (-ve correlation) perform differently when economic situations change. To achieve ‘portfolio diversification’, you should own different asset classes in different proportions (not putting all eggs in one basket).

Asset allocation is mainly practiced as ‘risk reduction’ strategy than ‘returns enhancing’ one.

Thanks Hemant and Narendra

Your comment about: “Asset allocation is mainly practiced as ‘risk reduction’ strategy than ‘returns enhancing’ one.” is not completely accurate. Asset allocation has been shown to reduce volatility in portfolios and also increase overall return (so risk reduction and return increase)

JSR

I think Narendra meant that primary reason for asset allocation is “risk reduction” and secondry is “return enhancement” .

I too think same, not denying that it help in “return enhancement”

Manish

JSR/Manish

My aim when I do asset allocation would be reducing the risk (volatality). I do not aim to ‘enhance’ the returns by doing asset allocation, in which case I can as well stay (100% weightage) in that asset class that gives me highest return.

The moment you reduce your allocation towards high return (and high risk) asset in a portfolio, you will not get the entire return that asset can provide. All risk management strategies come with the caveat of sacrificing the returns to reduce risk (volatality).

Follow this link for more about asset allocation:

http://www.investopedia.com/articles/03/032603.asp

If you mean ‘enhancing the returns’ as in ‘reducing volatality there by cutting down the possibility of catastrophic losses’, I would agree with you.

BTW, do you have any study that shows asset allocation actually increases the return of a portfolio (let us say in a buy and hold strategy)? Would be very interesting to see that. Is there a way to have the cake and eat it too..

Narendra

Even I dont think that just asset allocation can enhance the returns of a portfolio , however I did a small study to show that asset allocation coupled with portfolio rebalancing can increase the over all returns , ie: mix of equity + debt can perform better than pure equity or pure debt if rebalanced properly at : http://jagoinvestor.dev.diginnovators.site/2009/07/power-of-asset-allocation-and-portfolio.html

However this is very known fact 🙂

Manish

Manish,

I am going through your work (lot of them..)

Shall post my observations in due course..

Thanks , Would love you have a guest post from you . It would help readers to get more insights on topics your are expert on . let me know

Manish

Some time soon. I am too lazy some times especially in this heat and dust..

Hi Manish,

I don’t think real state can see dip..Even in last crsis it stood firm & house prices didn’t decreased.

China & US finanical war can also have effect on world economy in future.But let see when this happen.

If dollar goes down then many secotrs can go down.

Regards

Yogesh

Yogesh

I would say the real slowdown in real estate has not come yet . The last one was a small one , which recovered along with stock market recovery . Real estate will not go against “mean reversion” universal rule in long run .

Manish

Even after stock markett reaching its level fron where it dipped heavily real estate stocks are still at half of that value..why is it so?

All FIIs and HNI knows its the banks money which is sailing them but once a bigger crises is around government itself will need the savings money.Bank wont be allowd to save this big fish like unitech dlf etc

Sohil

WHy should real estate come back to same point if markets at back at their earliar levels , are they not different things ?

Manish

Interesting article. The next financial crisis may hit the world sooner than most people think!

Nirvana

Yes . Most of the people are not aware of whats going on internationally and they are more bothered/concerned about whats happening in country . Most of the investors dont inter link things . Once the crisis happens , it can fall apart equity markets . I am not sure about real estate , but i am confident that even that does not have strong roots .

Manish

Agreed most people are showing feel good…but nothing has changed..

House prices are here at 2007 top level and they say correction happened but within 2000 to 2007 price increased 700% and correction only 15-20%(e.g 100 became 700 and corrected to 540 and now back to 700 in 1 year this is not is called correction even gold before 1980 was giving hardly any returns than why should real estate be at this level)

After greece now even bulgaria admitted its in mess …So no doubt euro will get hit so a secondary currency after dollar weakens…Which means dollar will strengthen but since USA is on printing spree china and japan not happy with it as this will lead to future mess of their past security saving bonds invested there

Just sit on cash on invest in gold presently

If want o invest in stock catch the big fish like hero honda who can survive tough time…And than invest once the market makes a big dip…

I think China and India are both going to burst soon . China may lead first , but India is coming second for sure .. Real estate is now a musical chair game , the one who has it at last moment is gone !!

Manish

Manish,

Real estate too would correct when financial crisis happens..

All the more so in India, since lot of high net worth investors move by rotation their surplus cash from equity to real estate and vice versa.

Partha

Is this “lots of high net worth” people significantly enough in numbers and their quantum is so big ? Please enlighten

Manish

Manish,

the answer is yes.. all the more so in Mumbai and Delhi..

For eg, during the period of Nov 2007-January 2008, large number of high net worth investors got carried away by the bull market assuming that they could make quick returns by booking profits when the sensex moves to 25,000.

A large sum of the monies allocated for real estate investments[ in parts or full] by these investors were moved to stock markets and commodity markets. When the markets crashed immediately, which they did not expect, they were struck. The couldn’t pull out the monies, due to losses.

The real estate market which was also on a bull run till then, found the buyers who had shown interest earlier [some of them made advance payments], specifically in premium apartments, backing out.

Hence the Mumbai markets went through a period of correction [though the cycle was shorter] and picked up again gradually when the markets started its rally since April 09..

In fact, some of the developers too speculate [through leverage as well] in the stock markets and move it back to their business.. As usual timing is very difficult and that’s why one of the problems faced in the last two years by real estate markets is ‘cash’..

Which means not completing projects in time!

The single word for this phenomenon is ‘liquidity’.

I am afraid you could get reliable statistics on real estate, since India lacks transparency[ be it in title deeds or transaction mechanisms] and we are yet to have real estate investment trust vehicles or REITS which would help track data and give a better picture..

It should happen soon…

Partha

Amazing insights here . I am afraid when will a day come when common public will have this kind of information available to them . They just dont have no idea on how things work at broader level . Even this is new to me 🙂 .. thanks to you .

manish

Hi Manish,

Nice article as always…

But as i m a financial novice, i would like to know how does this affect india…

Everyone says recession/slowdown affects everything, what i dont understand is how can we be prepared for it. and what should we do to gain from it (or minimise losses).

Sorry if this question doesnt make sense..

Thanks

Hitesh

Hitesh

Its directly impacts . Our barometer is stock markets , which will be the one one where a stong sell off will start because there will be concerns all around the world , FII have lot of money in markets , they will pull out , most of the company stocks will plunge ,all mutual funds , ULIP’s will be impacted . There will be panic everywhere , like what happened in 2008 .

Manish

ok thanks.

But i thought 2008 was a good year for investors with long term goals in the sense that the all big blue chip shares etc were avalaible at rock bottom price (like a clearance sale).

Thanks

Hitesh

Hi Hitesh,

would add to your observation on buying stocks during downturns..

it would be great for long term investors to do it..

buy blue chip stocks when markets have crashed and sell when the markets have topped..

but Greed and fear dominate the markets..

so..when the market falls..people expect it would fall further..so they wait..

when the market moves up..people expect it would move further up and they don’t want to miss the opportunity..

actually, in both instances.. they should do the opposite..

thats why people like Warren Buffet are considered one of the best investors. Like he says ‘ Be greedy when others fear and be fearful when others are greedy’

On your first question-

How does this global situation affect India?

Today, all countries are financially inter connected..

we are global..thanks to technology and internet..

at the touch of a button you can move of billions of dollars across any markets.. be it for buying or selling..

this does really impact..

apart from that.. the most crucial one is..

the U.S. consumers are the biggest driving factors for the world economy..

they contribute 17% to the world economy..

If they don’t consume, how are producing nations going to benefit?

that includes India as well..even though our exports are only 12% of gdp..

but what affects us a lot is , we are heavily dependent on foreign inflows which drives our stock markets and there fore the economy..

stock markets acts as a barometer to the economy’s well being..

the foreign inflows are basically portfolio flows – that is for short term investment.. if the foreign flows are of long term in nature which are otherwise called foreign direct investment or FDI.. it stays put for long time.. because the monies are invested in manufacturing, agriculture or servicing sectors..

our FDI is improving..but its got a long way to go..

the other alternative is that the domestic institutions and domestic savings by individuals should invest more into the equity market..

then we wouldn’t see outflows every now and then when some crisis happens some where..

we as Indians invest just 5% of our total savings into equity/equity funds..

To sum it up, more domestic savings channeled into the domestic equity marketby resident indians can reduce the dependency on the foreign portfolio flows.

hope this clarifies ..

Thanks Partha.

That really cleared a lot of my doubts.

Hitesh

GOOD ONE,VERY INFORMATIVE

PIGS have power to take whole world in mess:

Pigs – last year it was through Swine Flu & now

PIGS (that’s Portugal, Ireland, Greece, and Spain) – this year through Debt FLU.

God save world from PIGS. 🙁

Nice playback is this PIGS..

The importance of these economies are exaggerated. They are small & not so important in the global pecking order (may be Spain is). Their ability to create and consume is puny compared to BRICS. They may knee jerk for few days but not more than that.. Look at the data here:

GDP (PPP 2009 estimate – Source CIA World Fact Book)

BRICS

Brazil – $2.025 trillion

Russia – $2.116 trillion

China $8.789 trillion

India $3.56 trillion

PIGS

Portugal $233.4 billion

Ireland $176.9 billion

Greece $341 billion

Spain $1.368 trillion

These countries are low on productivity, high on social security and are not colonial powers any more (no more enrichment through pludering and looting). Look at the fate of Greece who held the Olympics in 2004 and are bankrupt now. So the market will take care of them.

It is China that holds the key for the next recession..

@Narendra

PIGS are economies grossly misbalanced in terms of high debt matched with low prospects of economic growth and productivity. Infact, their crisis has now snowballed into one for the euro zone challenging the Euro’s competence to global currencies. If Dubai seemed to be hazarding the economic stability in the Emirates, the PIGS are far more capable of ruining the Euro zone.

Donate: Save Greece

Fund raising for Greece ? Interesting 😉

Target: £100,000,000.00

Raised so far: £420.66

Manish

European governments offered debt- plagued Greece a rescue package worth as much as 45 billion euros ($61 billion) at below-market interest rates in a bid to stem its fiscal crisis and restore confidence in the euro.

Hemant

Ye to hona hi tha 🙂 . If this happens to India , which asian country will come to rescue ? China ? 🙂

Manish

haha.. this is the craziest thing i have heard in recent times 🙂