What are Different ways of Buying Mutual Funds

There was a time, when mutual fund investing was limited to calling an agent and investing through him. He filled a form for you, and only bothered you for signatures; This was called as “convenient service.”. Things have changed now though. With entry loads abolished by SEBI and with so many technological advances, we have different ways of investing in mutual funds .This article explains the different ways of investing in mutual funds: through agents, AMC’s, demat, and web portals. Lets take a look-see…

Different ways of Investing in Mutual Funds

Through an Agent

This is the oldest and one of the most convenient ways of investing in mutual funds. You just call an agent and tell him you want to buy mutual funds. He comes right to your door, & fills in the various forms. All you need to do, is sign the forms. Since the abolition of entry loads, you now have to compensate the agent for his services, and pay him commission on the amount invested. Agents can charge anywhere from 1-2% of the amount to be invested. Make sure you don’t pay him more than 1%, which is a good enough amount of brokerage, for expediting the process (filling in forms, carrying them to the Mutual Fund offices, having them processed et al.) If he gives you sound advice on what mutual funds would suit you, and would help you achieve your financial goals, you could then, compensate him more. That makes sense. Be cautious though! Check the details of the form and what is filled. Ideally, you should fill the form.

You should go with this way of investing only if you want convenience and comfort takes more precedence. Click on this AMFI Agent Search Link to search for mutual funds agents in your city. You can submit the search with different parameters and get a list of all the agents with their name, address & phone numbers. There are many agents who are linked with many companies (like NJInvest or Prudent Advisory) who provide login facility, where you can login and see your mutual funds Performance anytime . Read : How many Mutual Funds you should have ?

Direct Investing through an AMC

You can now invest directly through an AMC (simply put – the Mutual Fund companies themselves.) There are many mutual funds who provide online facilities for investing. To do so though, you need to have a folio number, which you get only after investing in a particular mutual fund, which means that you have to go physically to the AMC office to invest for the first time. Next time onwards, you can invest in that mutual fund, online through their website. Using this method, makes sure that your entire amount, e.g. Rs 100/- gets invested and there are no charges here. The only hiccup, is the manual work involved at the start of the process; you have to take the pain of personally going to the office and then filling in the form. Sometimes, it’s a bit of a headache. If you want to invest in funds from four different AMC’s, then you have to go to all of them.

It would make sense to use this method, if the amount of investment is going to be large-ish and your tenure is long-term. In that case, using this way, will save you lot of money in commissions. Just imagine that if you invest 10,000 per month in mutual funds, then with a 1% commission structure, you save Rs 100 per month, which is Rs 3,600 for a 3 yr period. So 3,600 is what you lose when you go with an agent who charges a 1% commission . Note, that you do not require demat account for this .

Read : List of Best Equity Diversified Mutual Funds

Investing through a Demat Account

This is one of the most convenient methods of investing in mutual funds. If you have a demat account, you can browse through all the mutual funds on the site, and just with a few clicks of a mouse, you can invest in a fund of your choice. But then again, you have to pay commission here, since banks are also agents. Some charge a flat fee and some charge on percentage basis. For eg., ICICI Bank charges Rs 30 or 1.5% per SIP, whichever is lower and HDFC charges Rs 100 per quarter irrespective of the amount invested. The biggest advantage of buying and selling through a demat account, is that you control everything from one place. Some of the players in online mutual funds selling are :

- 5 paisa

- Geojit Securities

- HDFC Securities

- ICICI Direct

- India Bulls

- InvestSmart Online

- Investmentz.com

- Kotak Street

- Motilal Oswal

- Sharekhan

Investing through CAMS or Karvy

CAMS is the transaction processing company which services almost all the mutual funds in India. They process all the buying and sending the report etc to end customer . You can also invest directly through CAMS . All you have to do is Download the mutual fund form from the AMC website. Take a print out and fill the form . Then submit to your nearest CAMS or Karvy Investor centre along with copy of PAN card, SIP form(if needed) and cheque . For now , there is no way of investing online with them .

Here is the list of CAMS offices in different cities and Below is list of different AMC forms which you can download .

ABN AMRO Mutual Fund

AIG Global Investment Group Mutual Fund

Baroda Pioneer Mutual Fund

Benchmark Mutual Fund

Bharti AXA Mutual Fund

Birla Sun Life Mutual Fund

Canara Robeco Mutual Fund

DBS Chola Mutual Fund

DWS Mutual Fund

DSP Merrill Lynch Mutual Fund

Edelweiss Mutual Fund

Escorts Mutual Fund

Fidelity Mutual Fund

Franklin Templeton Mutual Fund

HDFC Mutual Fund

HSBC Mutual Fund

ICICI Prudential Mutual Fund

IDFC Mutual Fund

ING Mutual Fund

JM Financial Mutual Fund

JPMorgan Mutual Fund

Kotak Mahindra Mutual Fund

LIC Mutual Fund

Lotus India Mutual Fund

Mirae Asset Mutual Fund

Morgan Stanley Mutual Fund

PRINCIPAL Mutual Fund

Quantum Mutual Fund

Reliance Mutual Fund

SBI Mutual Fund

Sundaram BNP Paribas Mutual Fund

Tata Mutual Fund

Taurus Mutual Fund

UTI Mutual Fund

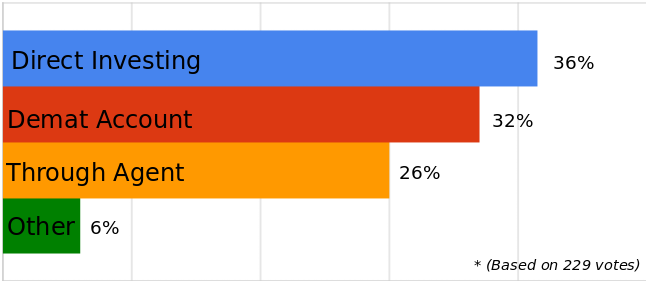

Break Down of How investors invest in Mutual funds [POLL RESULTS]

Here is a poll results

Note : This Poll is from the users of this blog only , so this result should not be generalised for whole country , Its just for the net savvy community.

Conclusion

Before choosing the way you want to invest in mutual funds , you should consider cost and convenience . If you are investing for long-term , you should definitely go through a way where there are less commissions or no commissions. Only exception can be through an advisor who gives you very sound advice and you are confident that paying him a commission would help you get a better knowledge and returns .

Comments please , how do you invest ? What are your experiences and learnings ? Is there any other way ? Any tips from your side ?

There was a time, when mutual fund investing was limited to calling an agent and investing through him. Things have changed now. With entry loads abolished by IRDA (please provide link or full-form) and with so many technological advances, we have different ways of investing in mutual funds.

April 7, 2010

April 7, 2010

does funsindia.com too charge commission?

the right question is “Does FundIndia also have commission based model” , because its not that they charge from you, but get it from AMC . There is a difference. The answer is YES

Not correct information regarding commission of mf agent, you said on Rs 10,000 agent will get Rs 3,600 means 36% then why everyone generally pitching insurance to every next customer. Why not Mf they are selling if commission is so high more than insurance products according to your article.

If you do not have complete information on any of the product and its commission please don’t mis guide anyone customer because so many customers will be reading your article and they are in thought that you are having sound knowledge and giving correct advice to layman.

Please stop mis guiding in name of jagoinvestor.

What has been written above is 3600 for 3 YEARS which amounts to 1% and not 36%.

Please read before commenting and mis-guiding other readers.

I have invested through a broker in a mutual fund and have a folio number. Can I use that folio number while opening account with the same mutual fund for satisfying KYC norms?

Yes you can

@Jagoinvestor,

Can you please give some good adviser name in Delhi NCR if you have for investing in MF funds/SIP.

Thanks

Anil

Hi Anil

Not sure of anyone in Delhi

Why dont you take our help in investing in mutual funds. We can help you on that. Contact me on support@jagoinvestor.com

very useful for any new invester.Thanks Manish

Thanks Sumit !

Very very useful and clear info! Just one point- these facebook etc icons make it very disturbing to read , why do they have to be over the part we are reading. Any way of getting rid of them?

Additional information: I am 30Y old and Single, the investment corpus is for retirement. I have been contributing 5K to PF, plan to do another 5K to PPF per month.

Kindly advise if the chosen fund are good to invest..

Hi Manish,

i have learned a bit of financial planning going through your blogs and books(16 personal principles & Financial planner in 10 steps). Thanks for education the naive investor like me and most cases we are ignorant of basic facts.

I would like to seek your advise on my investment for Mutual fund, planning to invest 10K per month for long term 10 – 15 years.

1. HDFC Top 200 Fund : Open Ended Growth Scheme – 4000 : chose this checking the past 10Y average returns and fund manager reputation.

2. HDFC MidCap Opportunities (G) –3000

3. ICICI Pru Value Discovery Fund (G) -3 000

I intend to do direct with fund house, also checking if i can go for direct option with CAMS/Karvy as they will provide option of consolidating the fund online..

You can go ahead with those options . They are good one’s

Manish

HI Manish..

After reading quite a lot of above blogs, thought you will be able to advice me.. I want to invest in mutual funds one large-cap/one mid-cap and hence contacted an agent.(got the ref from a colleague).. So this guy seems to be good, however he said the brokerage charges will be 1%. So I didnt understand that.. I will ask him again, but thought to discuss here once…

– is it that 1%full term of 5yrs span…

– again a friend of mine told me ” its 1% on entry and 0% on exit “…

very confused… if you can tell me a bit before i discuss with my agent.

Thanks Manish.

I think this 1% is the charge he will take from your for ADVICE . So everytime you invest Rs 10k , he will charge Rs 100 . But if his advice is sound and good one, its ok .. you can go with him . Better clarify with him about the charges

Manish

Hi Manish,

I want to start an SIP for building a corpus amount in long term.I am going to invest in mutual funds for the first time. Can you suggest some suitable mutual funds and also good brokers if possible (or should I invest directly through the online route) for doing this?

Thanks,

Varun

You can do direct investment with AMC , some good funds to start with are HDFC Prudence !

Thanks for the suggestion Manish! 🙂

Hi manish,

Very informative article.I’ve been following your blog for quite a long time and its excellent.Iam going to start investing in mf soon.But can you suggest me which is the safest and convenient(keeping in mind all the expences related to mf) ways to buy mf’s.Online portals or amc or brokers like sharekan??

Cost wise , direct AMC is good, but convenience wise , I would suggest FundsIndia !

Hello Everyone,

Thanks Manish for such a wonderful article, Since discussion started some where 2 years back I want everyone to put some light on present day options, after SEBI abolishing commissions on MF, to invest in MF keeping in mind ( brokerage,service tax, commission, trailing commission, convenience of buying at single window with one account through online mode.

OPTIONS INCLUDING

1.DeMat

2. AMC

3. CAMS

4.Web Portals like Fundsindia

5. HDFC Service Account

6 etc

But what suggestion you want out of this ?

Hi Manish,

Can you please tell the ways to go with direct option of MF buying online.

Want to start SIP’s without agent or broker.

Regards

Ritu

You will have to buy it through AMC for the first time . Visit AMC branches, or call them

Hi Manish,

Thanks for the informative article.

I would like to invest in SIP for a period of 10 years or so. Can you please provide me the best equity funds which I should look. I am planning to invest about 10K.

Regards,

Robin

You can start with HDFC Prudence

I am beginner .I want to invest through sip on-line in mutual fund. Can you guide me best way for investment.

go for HDFC Prudence

Thanks and Shabassh Manish Bhai for such an informative article…

Welcome

My Agent gave my fully rubbish ideas and erode all my money. I gave him Rs 1 lac to invest in stocks and now I have only 6000.Luckily I did some SIP’S but i want to change his agent code from there.Also I got a new SIP online of Reliance, but there also had to give his agent code.

So is there any possibility of removing his code

Which code are you talking about ? If your agent has helped you invest in stocks, then its just the first time brokerage that he earns .. There is no recurring thing ?

Which is better way SIP or STP for mutual fund investment?

Both are different things for different purpose . What is your requirement , I will tell you which one is better?

Can I have updated latest Entryload, Expense ratio table for various MFs.

First of all Thanks Manish, I was thinking to start investing in MFs but was not sure of various options. I thought demat account is the only option.

However, I have few queries:

1. FUNDSINDIA, CAMSONLINE, KARVY are safe web portals????

2. Is investment through SIP will require forms to be filled every month on these web portals??

Regards,

Ankur

Ankur

These portals are running from many years .. you can read about it on net and decide if you want go with them or not . I can not recommend with any guarantee , but many readers from this website have an account with fundsindia

You have to do the paper work just once